anyaberkut

A Quick Take On Fidelis Insurance Holdings Limited

Fidelis Insurance Holdings Limited (FIHL) has filed to raise $298 million for the company and for selling shareholders in an IPO of its common shares, according to an amended F-1/A registration statement.

The firm provides bespoke, specialty, and property reinsurance products.

FIHL has produced impressive revenue growth and profits.

Given a reasonable IPO pricing on a book value to share price multiple of approximately 1, my outlook on the IPO is a Buy at up to $17.50 per share.

Fidelis Overview

Bermuda-based Fidelis Insurance Holdings Limited was founded to generate returns across cyclical reinsurance environments.

Management is headed by parent company founder, Chairman, and CEO Richard Brindle (Fidelis MGU), who has been with the firm since its inception in 2015 and has more than 38 years in underwriting and held leading roles in Syndicates 488 and 2488 at Lloyd’s of London.

The company’s primary offerings include the following:

-

Bespoke insurance.

-

Specialty lines.

-

Property reinsurance.

As of March 31, 2023, Fidelis has booked fair market value investment of $1.94 billion from investors including Crestview Funds, CVC Falcon Holdings, Goldman Sachs, Pine Brook Feal, Platinum Ivy B 2018 RSC, SPFM Holdings and MGU HoldCo.

Fidelis – Client Acquisition

The firm wrote $3.0 billion in gross premiums in the year ended December 31, 2022, representing an annual compound growth rate of 46.0% since its inception in 2015.

Management believes the insurance industry is “primed for further value disaggregation, favoring specialist underwriters with access to clients and alternative sources of capital.”

General & Administrative expenses as a percentage of total revenue have fluctuated as revenues have increased, although the Q1 2023 figure was a function of one-time revenue recognition from a “Net gain on distribution of Fidelis MGU,” as the figures below indicate:

|

General & Administrative |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Three Mos. Ended March 31, 2023 |

0.8% |

|

2022 |

7.0% |

|

2021 |

6.3% |

(Source – SEC).

Fidelis’ Market & Competition

According to a 2023 market research report by Allied Market Research, the global market for specialty insurance was an estimated $104.7 billion in 2021 and is forecast to reach $279 billion by 2031.

This represents a forecast CAGR of 10.6% from 2022 to 2031.

The main drivers for this expected growth are increased integration of technology into specialty insurance solutions to better enable specialty insurers to quantify risks.

Also, the leading industries covered by specialty insurance services include healthcare, mortgage banking, non-profit protection and disaster products.

Major competitive or other industry participants include the following:

-

Arch.

-

Argo.

-

Aspen.

-

Markel.

-

W. R. Berkley.

-

Hiscox.

-

Beazley.

-

Lancashire.

-

Everest Re.

-

Axis Capital.

-

Renaissance Re.

-

Others.

The company also operates in the bespoke and property reinsurance markets.

Fidelis Insurance Holdings Limited Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing top line revenue, due in Q1 2023 to a one-time revenue recognition from a “Net gain on distribution of Fidelis MGU”.

-

Increasing income before taxes.

-

Sharply decreased cash flow from operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2023 |

$2,051,800,000 |

545.8% |

|

2022 |

$1,520,400,000 |

27.8% |

|

2021 |

$1,189,300,000 |

|

|

Income (Loss) Before Income Taxes |

||

|

Period |

Income (Loss) Before Income Taxes |

Operating Margin |

|

Three Mos. Ended March 31, 2023 |

$1,734,800,000 |

84.6% |

|

2022 |

$80,100,000 |

5.3% |

|

2021 |

$78,700,000 |

6.6% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Three Mos. Ended March 31, 2023 |

$1,755,500,000 |

85.6% |

|

2022 |

$52,600,000 |

2.6% |

|

2021 |

$68,300,000 |

3.3% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Three Mos. Ended March 31, 2023 |

$(101,700,000) |

|

|

2022 |

$742,900,000 |

|

|

2021 |

$367,700,000 |

|

|

(Glossary Of Terms). |

(Source – SEC).

As of March 31, 2023, Fidelis had $3.3 billion in cash, equivalents, securities and investments and $7.5 billion in total liabilities.

Free cash flow during the twelve months ending March 31, 2023, was $_ million.

Fidelis’ IPO Details

FIHL intends to sell 5.7 million shares of common stock, and selling shareholders will sell 11.3 million shares of common stock at a proposed midpoint price of $17.50 per share for gross proceeds of approximately $297.5 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $1.8 billion.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 14.59%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

We intend to use the net proceeds to us from this offering to make capital contributions to our insurance operating subsidiaries, which, together with other sources of liquidity, should enable us to take advantage of the ongoing rate hardening in the key markets in which we participate by writing more business under our planned strategy…

(Source – SEC).

Management’s presentation of the company roadshow is not available.

Leadership believes that any legal proceedings against the company would not have a material adverse effect on its business or financial condition.

Listed underwriters of the IPO are JPMorgan, Barclays, Jefferies and other investment banks.

Valuation Metrics For Fidelis

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$2,038,508,203 |

|

Enterprise Value |

$1,774,808,203 |

|

Price / Sales |

0.63 |

|

EV / Revenue |

0.55 |

|

EV / EBITDA |

0.99 |

|

Earnings Per Share |

$15.53 |

|

Operating Margin |

55.01% |

|

Net Margin |

56.80% |

|

Float To Outstanding Shares Ratio |

14.59% |

|

Proposed IPO Midpoint Price per Share |

$17.50 |

|

Net Free Cash Flow |

$541,400,000 |

|

Free Cash Flow Yield Per Share |

26.56% |

|

Debt / EBITDA Multiple |

0.25 |

|

CapEx Ratio |

38.86 |

|

Revenue Growth Rate |

545.83% |

|

(Glossary Of Terms). |

(Source – SEC).

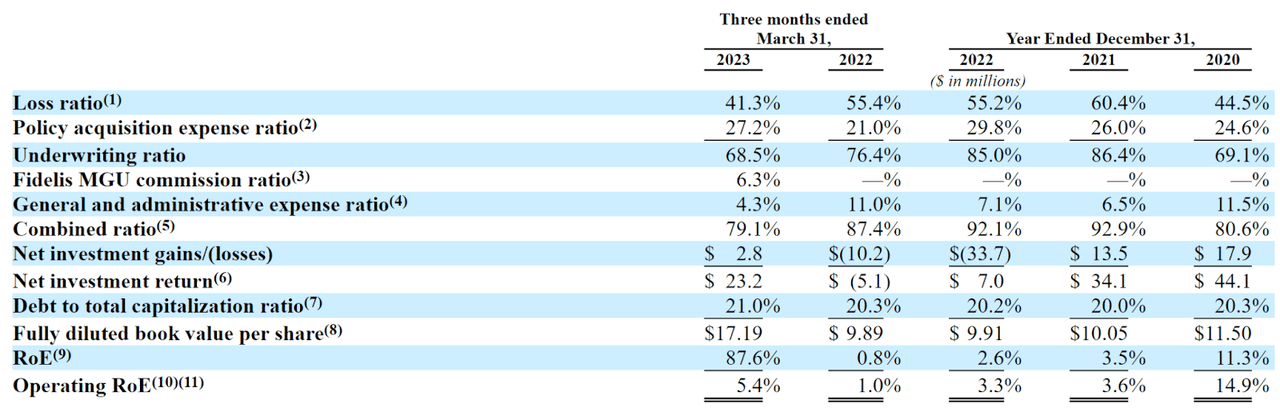

As a reference, the firm published a number of relevant metrics, shown in the table below:

Company Performance Metrics (SEC)

A general rule of thumb when valuing insurance companies is that a book value per share versus its share price of 1:1 is considered a fair valuation.

At the current proposed price of $17.50 per share, compared to the fully diluted book value of $17.19 per share, the IPO appears to be reasonably priced.

Commentary About Fidelis Insurance

FIHL is seeking U.S. public investment capital for its general corporate purposes.

The company’s financials have shown increasing top line revenue, growing income before taxes and a strong increase in cash flow from operations.

Free cash flow for the twelve months ending December 31, 2022, was $724.1 million.

General & Administrative expenses as a percentage of total revenue have risen as revenue has increased; its General & Administrative efficiency multiple was 3.1x in the calendar year 2022.

The firm currently plans to pay dividends at the Board of Directors’ discretion. The company has recently paid dividends to holders of the firm’s Series A Preference Security.

The market opportunity for providing specialty insurance products is large and expected to grow at a moderately fast rate of growth in the coming years, so the firm enjoys positive industry growth dynamics in its favor.

J.P. Morgan is the lead underwriter, and the five IPOs led by the firm over the last 12-month period have generated an average return of 24.6% since their IPO. This is an upper-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include a rising interest rate environment, which serves to increase the cost of capital and dampen asset valuations.

Also, the company separated in 2022 from parent firm MGU HoldCo and entered into a 10-year rolling Cooperation Agreement.

The main reason for the separation was to be able to attract more talent to the company. However, should this cooperation agreement not continue, FIHL may not be able to take advantage of its parent firm’s resources and market capabilities.

Given a reasonable IPO pricing with a book value to share price multiple of approximately 1, my outlook on the Fidelis Insurance Holdings Limited IPO is a Buy at up to $17.50 per share.

Expected IPO Pricing Date: June 28, 2023.