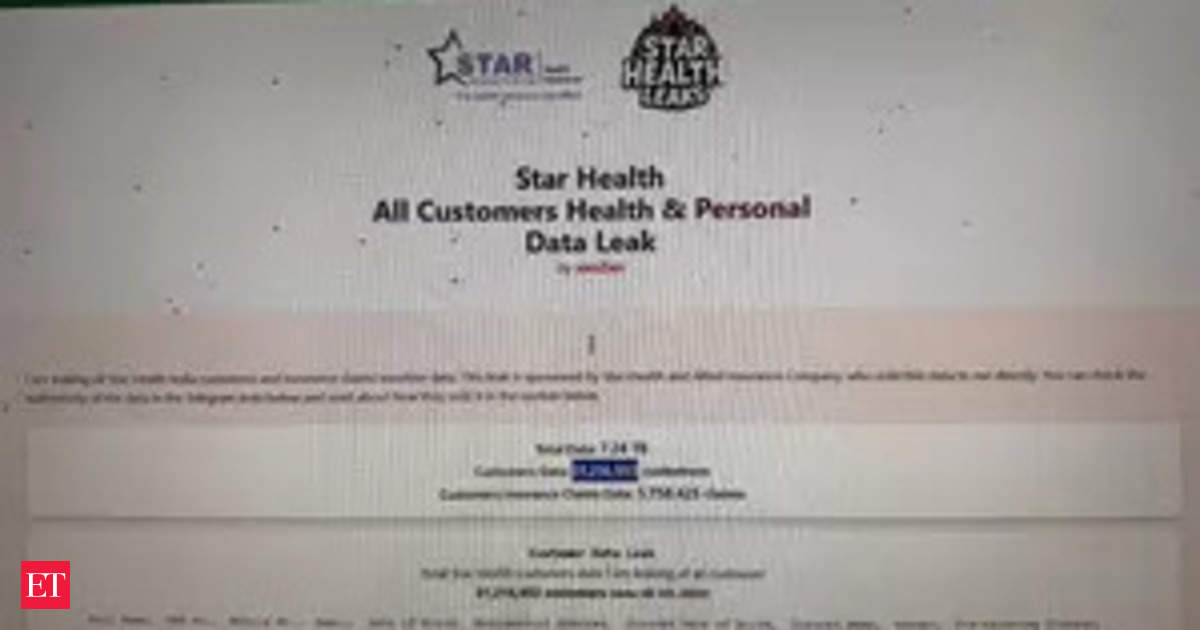

Over 31 million prospects’ delicate private info was allegedly bought to hackers, seen as probably the most extreme breaches within the insurance coverage business.

“Irdai sees this knowledge leak as a really critical concern,” an individual mentioned, including that different insurers would additionally have to overview their knowledge safety insurance policies. “As extra delicate knowledge flows into insurance coverage companies, there’s a want for stronger cybersecurity. The regulator desires to make sure that each insurer applies the very best safety measures, together with common audits and updates to safeguard knowledge.”

Irdai will watch for an audit report back to determine the gaps and concern directions. The regulator has requested Star Well being to extensively audit the corporate’s cybersecurity framework. The audit, led by an exterior agency, is predicted to determine management gaps and suggest compliance measures to stop future knowledge thefts.

The breach, linked to the corporate’s chief info safety officer (CISO) Amarjeet Khanuja, surfaced after a hacker going by the alias “xenZen” claimed Khanuja had bought the information and later tried to renegotiate for extra money in alternate for continued backdoor entry.