Bet_Noire

ETF Overview

The broader market has declined quite a bit since the beginning of 2022. Many stocks appear to be cheap relative to its cyclical high reached during the pandemic. However, is this really a good time to invest in the stock market aggressively?

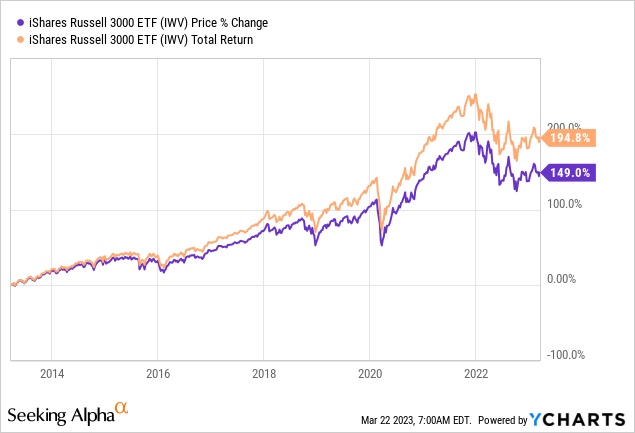

In this article, we will analyze iShares Russell 3000 ETF (NYSEARCA:IWV) and provide our insights and suggestions. IWV owns a portfolio of about 3,000 largest stocks in the U.S. Despite the drop last year, IWV’s valuation is still expensive. Given a lot of uncertainties in 2023 and a possible recession coming, we think it is better for investors to patiently wait for a better entry point.

YCharts

Fund Analysis

IWV has comparable performance to the S&P 500 index but is a better replica to the broader market

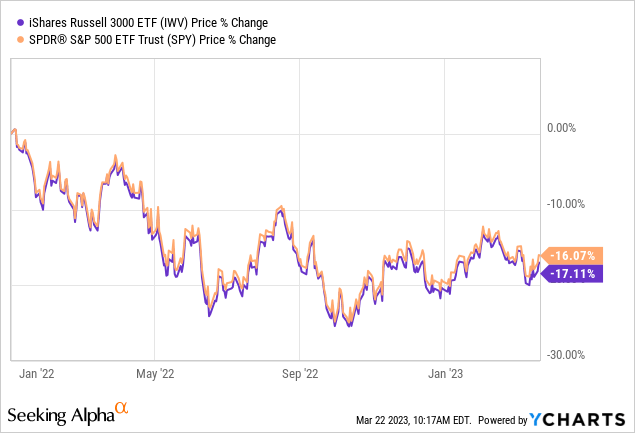

Last year was a challenging year for the broader stock market. IWV also suffered tremendous losses. As can be seen from the chart below, the fund has lost more than 17% of its fund price since the beginning of 2022. This was slightly more than the loss of 16.07% of the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index (SP500).

YCharts

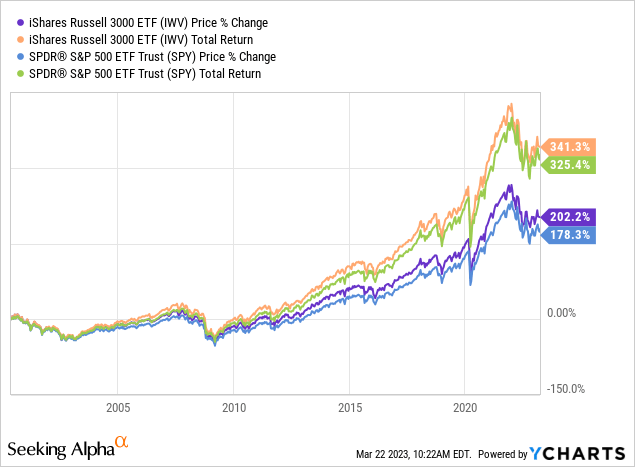

IWV’s performance in the long run is also comparable to SPY. Although its total return of 194.8% in the past 10 years was slightly inferior than SPY’s 211.2%, its total performance over 20 years was actually better than SPY. As can be seen from the chart below, IWV delivered a total return of 341.3% since its inception in May 2000. This was better than the return of 325.4% of the SPY in the same period. We think IWV is a better representation of the broader stock market than the S&P 500 index because IWV has a much more diversified portfolio of 3,000 stocks. On the other hand, the S&P 500 index only contains 500 large-cap stocks.

YCharts

IWV is still expensive based on the revised Buffett Indicator

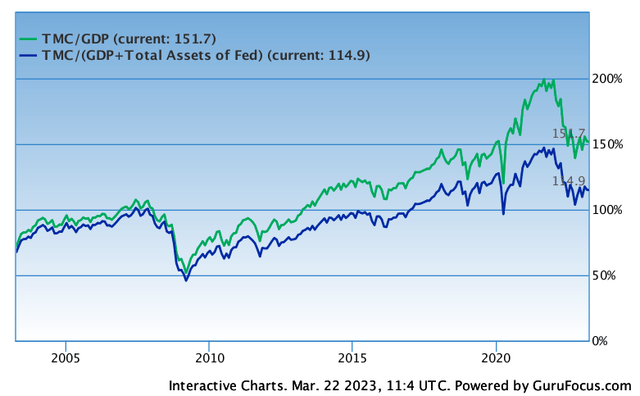

Given the dramatic decline in the broader market, many investors may think that it may be cheap enough to buy IWV now. However, this may not be the case based on the revised Buffett Indicator.

What exactly is the Buffett Indicator? In a Forbes interview in December 2001, investment guru Warren Buffett recommended using the ratio of total market capitalization to GDP to evaluate whether the broader stock market is overvalued or undervalued. According to Buffett, if the total market capitalization to GDP ratio is in the range between 75% and 90%, the market is fairly valued. If this ratio is above 90%, the stock market is overvalued. If this ratio is above 120%, the broad stock market is very expensive.

This method is a valid one, as IWV’s portfolio of 3,000 largest stocks in the U.S. stock market is a good representation of the overall U.S. economy. However, given that the Federal Reserve has significantly increased its balance sheet over the past 20 years, the denominator in the equation needs to include the Federal Reserve’s assets to better reflect the current situation. If we take this into consideration, the equation becomes total market capitalization to GDP plus Fed Assets ratio. Using this equation, we derive the current ratio to be 114.9%. This ratio is still below 120%. Therefore, the broad market is not super expensive, but is still quite expensive as it is still far above the fairly valued range of 75% – 90%.

GuruFocus.com

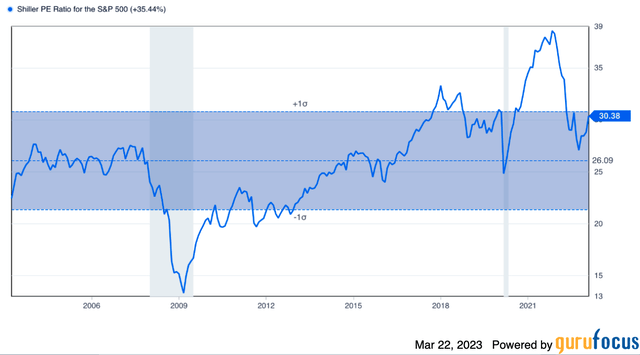

Schiller P/E ratio is still way above the historical range

Let us now look at another valuation metric, the Schiller P/E ratio for the S&P 500. Since IWV has comparable performance to the S&P 500 index and that both the S&P 500 index and the Russell 3000 index are both considered broader market indexes, we think this valuation metric provides a good gauge to IWV’s valuation. For reader’s information, Schiller P/E ratio for the S&P 500 index basically calculates the P/E ratio based on average inflation-adjusted earnings of the S&P 500 index from the previous 10 years. The value range of Schiller P/E ratio within 1 standard deviation to the median valuation is between 22x and 33x in the past 20 years. As can be seen from the chart below, the current Schiller P/E ratio of 30.38x is towards the higher end of its historical range. Therefore, we think IWV may be slightly overvalued.

GuruFocus.com

Should you be a buyer of IWV?

There is a lot of macroeconomic uncertainties in 2023. We believe inflation may be quite sticky and, therefore, rates may need to be kept elevated for a lengthy period. Since it typically takes 6~12 months to have the monetary policy ripple through the economy, the damage of last year’s aggressive rate hike may not be felt in the second half of 2023. However, we believe a recession is likely the outcome. Given that the stock market bottom usually is not reached before the recession, but in the midst of a recession, it is likely that we may see the broader stock market testing its previous bottom reached in October 2022. Given the fact that IWV’s valuation still appears expensive, we do not think right now is the time to invest.

Investor Takeaway

Given macroeconomic uncertainties in 2023 and IWV’s still expensive valuation, we think investors should exercise caution and wait for a wider margin of safety before initiating a position in iShares Russell 3000 ETF.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.