baona

The Industrial Select Sector SPDR (XLI) was among the nine out of 11 S&P 500 sectors that finished the week ending Dec. 2 in the green (+1.02%)

The SPDR S&P 500 Trust ETF (SPY) too gained in the week (+1.14%) mainly due to a major rally on Wednesday driven by Federal Reserve Chair Jerome Powell showing signs that the Fed could begin slowing its interest rate hikes maybe from the December meeting. However, the U.S. manufacturing sector dipped into contraction in November. YTD, SPY is -14.33%, while XLI is -3.29%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +8% each this week. However, YTD, only one of these five stocks is in the green.

Kanzhun (NASDAQ:BZ) +36.45%. The Chinese online recruitment platform saw its stock rally following its Q3 earnings (Nov. 29 +9.22%) which beat analysts estimates and continued to trade higher the next day as well (Nov. 30 +14.27%). However, the stock has been very volatile in the past few months. BZ was among the top five gainers (in this segment) in June (+30%) but was among the worst five performers in Q3 (-38.60%). In past month, the the stock has already swapped places between top five gainers and losers in consecutive weeks. YTD, BZ has shed -43.98%, the most among this week’s top five gainers.

The SA Quant Rating, which takes into account factors such as Momentum, Profitability, and Valuation among others, has a Hold rating on the shares. BZ has a factor grade of B- for Profitability and C for Growth. The rating is in contrast to the average Wall Street Analysts’ Rating of Strong Buy, wherein 8 out of 12 analysts tag the stock as such.

Amerco (UHAL) +13.25%. The Reno, Nev.-based moving and storage operator’s stock rose throughout the week. YTD, UHAL has fallen -7.79%. The SA Quant Rating on the shares is a Hold, with score of A for Momentum and B for Valuation.

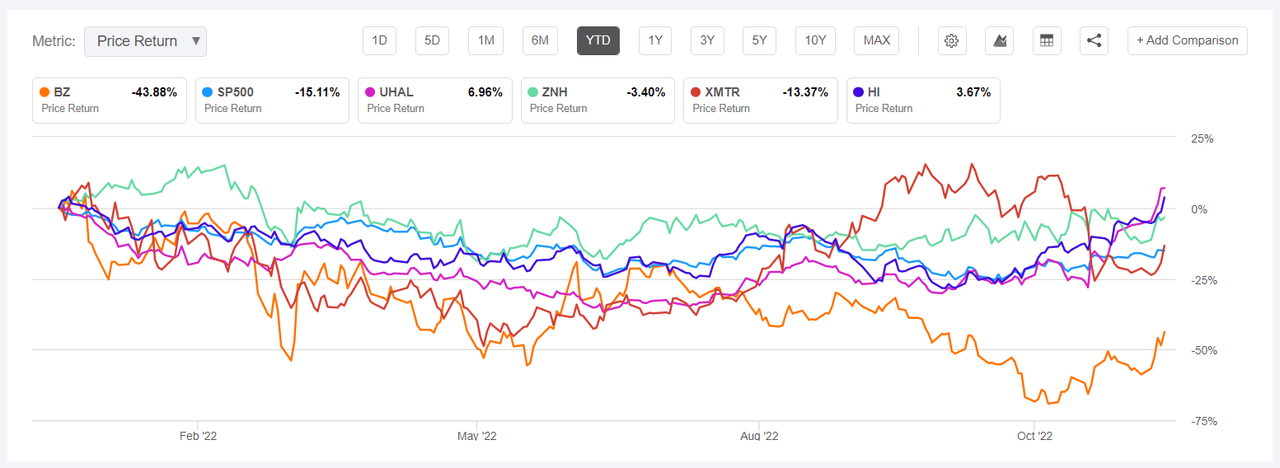

The chart below shows YTD price-return performance of the top five gainers and SP500:

China Southern Airlines (ZNH) +10.40%. The stock gained throughout the week, barring Dec. 1, and the most on Tuesday (+4.70%). YTD, the shares have dipped -2.33%.

Xometry (XMTR) +10.09%. The Derwood, Md.-based company — which provides a marketplace for manufacturing parts — was among the best five gainers a two weeks ago as well and was the second best performing stock in Q3 +67.87% (in this segment). YTD, the stock has declined -8.86%.

The SA Quant Rating on XMTR is Hold, with a A+ score for Growth and B- for Momentum. The average Wall Street Analysts’ Rating differs with a Buy rating, wherein 3 out of 8 analysts view the the stock as Strong Buy.

Hillenbrand (HI) +8.84%. The Batesville, Ind.-based company’ stock is the only only one among this week’s top five gainers to be in the green YTD, having gained +2.08%. The SA Quant Rating on HI is Hold, while the average Wall Street Analysts’ Rating is Strong Buy.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -4% each. YTD, two out of these five stocks are in the green.

Zim Integrated Shipping Services (NYSE:ZIM) -24.43%. The Israeli company was among the shipping stocks that sunk on Monday (-17.37%) amid China COVID curb woes, among other things. ZIM the worst performing stock (in this segment in Q3 (-45.70%) and YTD, has declined -67.04%, the most among this week’s worst five.

The SA Quant Rating on the ZIM is Hold, with a score of A+ for Profitability and F for Growth. The average Wall Street Analysts’ Rating agrees with a Hold rating of its own, wherein 5 out of 7 analysts tag the stock the same.

Elbit Systems (ESLT) -10.05%. The Israeli aero/defense company’s Q3 results came below analysts estimates that sent the stock tumbling -10.56% on Nov. 29. YTD, the stock has shed -1.99%. The average Wall Street Analysts’ Rating on ESLT is Buy, wherein 1 tags it as Strong Buy while the other 2 see it as Hold. The SA Quant Rating disagrees with a Hold rating, with a factor grade of D- for Valuation and C- for Momentum.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

RBC Bearings (RBC) -6.64%. The Oxford, Conn.-based company is one of the two stocks which is in the green YTD, +13.63% among this week’s five decliners. The SA Quant Rating on RBC is Buy, with a C+ score for Profitability and A- for Momentum. The average Wall Street Analysts’ Rating is also Buy, wherein 3 out of 8 analysts see the the stock as Strong Buy.

Ryder System (R) -5.96%. The Miami-based logistics and transportation provider has seen its stock grow +9.58% YTD. The SA Quant Rating on the stock is Hold, with a B+ score for Valuation but D score for Growth. The average Wall Street Analysts’ Rating concurs with a Hold rating, wherein 7 out of 8 analysts tag the stock as such.

Watsco (WSO) -4.43%. The Miami-based company, which distributes air conditioning and heating equipment, has shed -14.86% YTD. The SA Quant Rating on WSO is Hold, with Profitability carrying an a score of B+ and Growth C. The average Wall Street Analysts’ Rating too has a Hold rating, wherein 4 out of 13 analysts tagging the stock as Strong Buy.