The Kroger Co. (NYSE: KR) will be reporting fourth-quarter results on March 7 before the opening bell, amid expectations for an increase in earnings and revenues. The management’s strategy is currently focused on creating value for customers – through competitive prices, personalized promotion, and rewards – even as consumer spending remains under pressure.

Shares of the supermarket chain entered 2024 on a bright note and made steady gains so far, though the price briefly slipped below the one-year average in early February. The stock has gained about 5% since the beginning of the year.

Q4 Results Due

The retailer’s January quarter results will be released on March 7, at 8 a.m. ET. It is estimated that sales increased to $37.06 billion in Q4 from $34.82 billion in the prior year quarter. On average, analysts see a 14% year-over-year increase in adjusted earnings to $1.13 per share in the final three months of fiscal 2023.

The management recently warned that sales will likely be impacted by inflation in the rest of 2023 and beyond, and slashed its full-year guidance. At the same time, Kroger expects that customers on a budget would benefit from its efforts to increase value. The company had a relatively late entry into e-commerce, but it has made significant progress in that area by ramping up the online platform.

The aggressive e-commerce push and spending on technology have enabled the company to align itself with the shift in customers’ shopping habits, especially in the post-pandemic era. However, those investments are putting margins under pressure.

Kroger’s CEO Rodney McMullen said at the Q3 earnings call, “We are growing households and increasing loyalty, positioning Kroger for sustainable future growth. Customers are managing many economic factors that are pressuring their spending, including higher interest rates, reduced savings, and fewer government benefits, including SNAP. Although inflation is decelerating, customers are still adjusting to the impacts from eight consecutive quarters of broad and significant inflation.”

Q3 Results

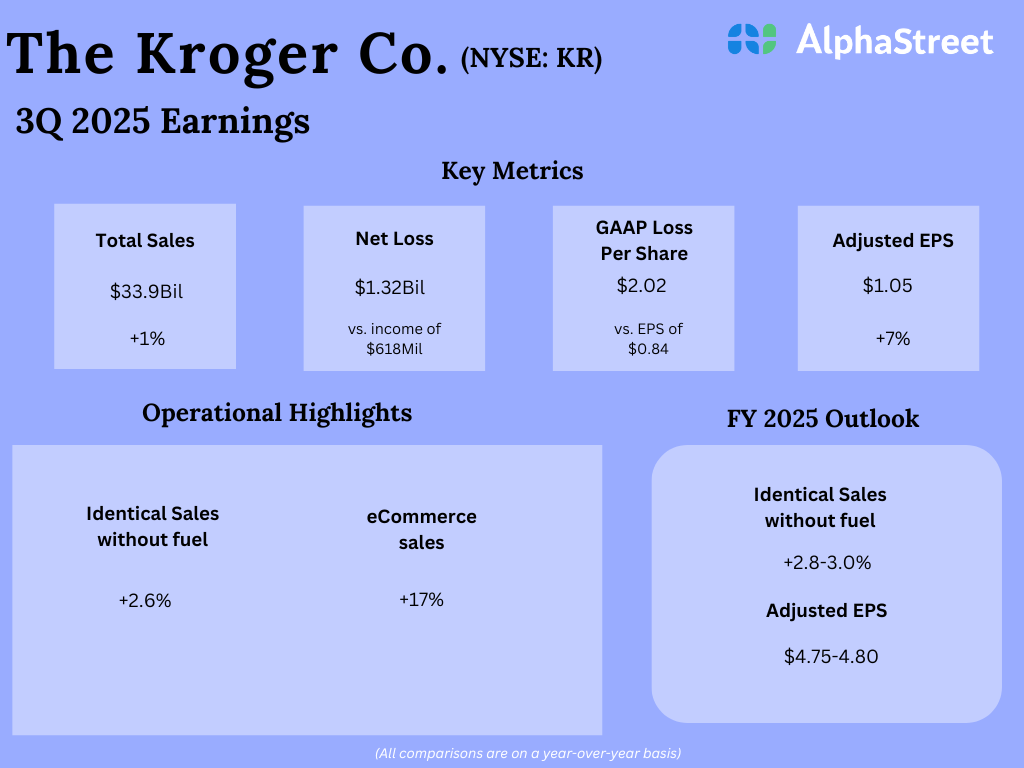

In the third quarter, identical sales decreased 0.6% annually, extending the slowdown that started a year earlier. Growth had decelerated in the trailing three quarters. At $34 billion, Q3 sales were broadly unchanged from last year and came in slightly above estimates. Adjusted earnings, meanwhile, increased 8% year-over-year to $0.95 per share. Profit beat estimates, as it did in every quarter for about four years.

Meanwhile, Kroger’s planned acquisition of supermarket chain Albertsons suffered a setback after the Federal Trade Commission opposed the deal, saying it would cause food prices to increase.

KR has been maintaining an uptrend ahead of next week’s earnings. The stock traded up 2.7% on Tuesday afternoon, after opening the session higher.