Shares of Lennar Corporation (NYSE: LEN) were down 3% on Monday. The stock has dropped 36% year-to-date and 25% over the past 12 months. The homebuilder delivered mixed results for its third quarter of 2022 last week and is seeing a slowdown in the housing market due to higher interest rates and inflation. However, despite these near-term challenges, the company believes the long-term prospects for housing remain strong.

Trends and strategy

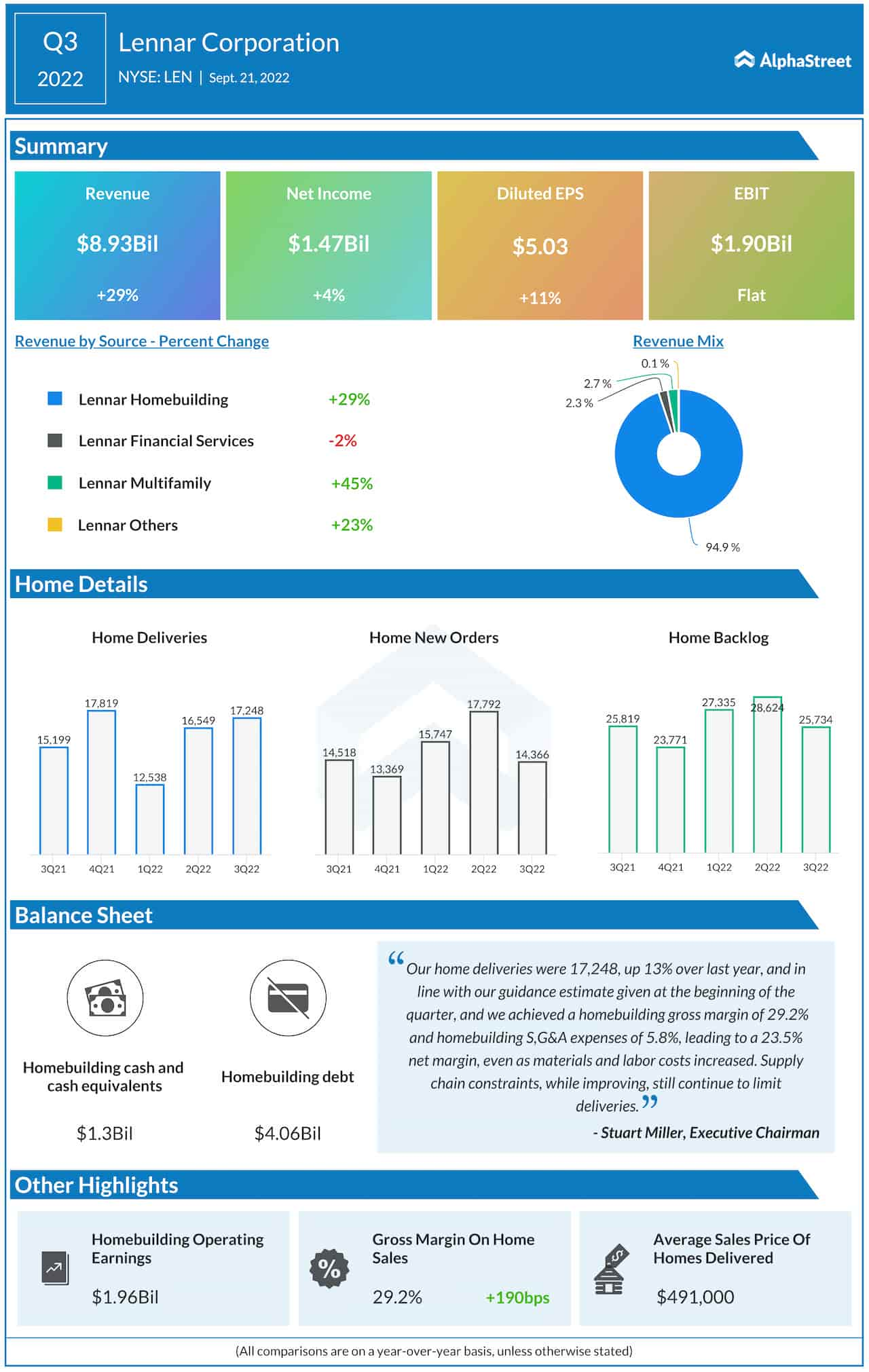

Supply chain constraints and labor shortages have impacted the production of homes while inflation and higher interest rates have made home ownership less affordable. These factors have led to a slowdown in the housing market. In Q3, Lennar saw new orders drop by 12% YoY to 14,366 homes while new orders dollar value fell 11% to $6.7 billion.

There continues to be an increase in household formation and the labor market remains strong. There is a limited supply of houses, rentals are scarce and rents remain high. Lennar continues to see reasonably strong demand in the housing market and despite near-term headwinds, it believes the long-term prospects for housing continue to be strong.

While the company sees strength in some markets, it continues to work on adjusting its prices and rolling out incentives to drive sales in other more challenged areas. Sales pace per community averaged at 4 homes for the third quarter. This was achieved by lowering the base new order sales price and increasing sales incentives in many communities.

During Q3, Lennar continued to make progress on its land light strategy. At quarter-end, the company owned 184,000 home sites and controlled 307,000 home sites amounting to a total of 491,000 home sites. This translates to 2.9 years of home sites owned, an improvement from 3.3 years in the prior year.

Mixed quarterly results

For the third quarter of 2022, Lennar’s total revenues increased 29% year-over-year to $8.9 billion but fell short of expectations. Adjusted EPS increased 58% YoY to $5.18, surpassing projections. GAAP EPS rose 11% to $5.03. Deliveries increased 13% to 17,248 homes. Gross margin on home sales improved 190 basis points YoY to 29.2%.

Outlook

For the fourth quarter of 2022, Lennar expects new orders to range between 14,000 and 15,500 and ending community count to increase about 5% from the third quarter. Home deliveries in Q4 are expected to range from 20,000-21,000 while average sales price is estimated to be $475,000-480,000. Gross margin is expected to be 26-27%. Q4 EPS is expected to be $4.65-5.30.

Click here to read more on housing stocks