The current monetary efficiency of Levi Strauss & Co. (NYSE: LEVI) exhibits the corporate has successfully navigated macroeconomic uncertainties and inflationary strain. After shrugging off COVID-related headwinds, the informal clothes retailer received again on monitor rapidly supported by robust buyer demand throughout all enterprise segments and geographical areas.

However the uptrend is but to replicate on the efficiency of the San Francisco-based denim big’s inventory, which has remained on a dropping streak for greater than a 12 months now. In the meantime, the market’s indifference to final week’s constructive second-quarter outcomes might be linked to the muted efficiency of the general inventory market. The worth has practically halved since peaking early final 12 months. The compelling valuation, mixed with the administration’s initiatives to boost shareholder worth by means of share repurchase and strategic M&A offers make the inventory a great guess.

Purchase LEVI?

Market watchers are fairly bullish on LEVI, and the spectacular goal worth underscores the constructive view. In brief, it’s a good time to purchase the inventory now as a result of profitability is on an upward trajectory and money flows are fairly wholesome. With the worst of the pandemic virtually over, shoppers are as soon as once more including discretionary gadgets like garments and footwear to their buying listing. That’s excellent news for Levi Strauss’ shareholders.

Learn administration/analysts’ feedback on Levi Strauss’ Q2 2022 earnings

Of late, there have been robust efforts to ramp up the e-commerce platform and strengthen the direct-to-customer channel, which contributes considerably to gross sales. It was the corporate’s digital capabilities that enabled it to get well somewhat rapidly from the slowdown skilled quickly after the onset of the pandemic.

Levi Strauss CEO Chip Bergh mentioned in a current interplay with analysts: “Our e-commerce enterprise stays wholesome, with income persevering with to far exceed pre-pandemic ranges. We did see a moderation in on-line visitors as shoppers returned to buying in our shops in massive numbers. E-commerce stays an essential driver of our progress algorithm, and we’re dedicated to tripling its dimension over the subsequent 5 years after efficiently rising e-commerce into practically a $0.5 billion enterprise over the past decade.”

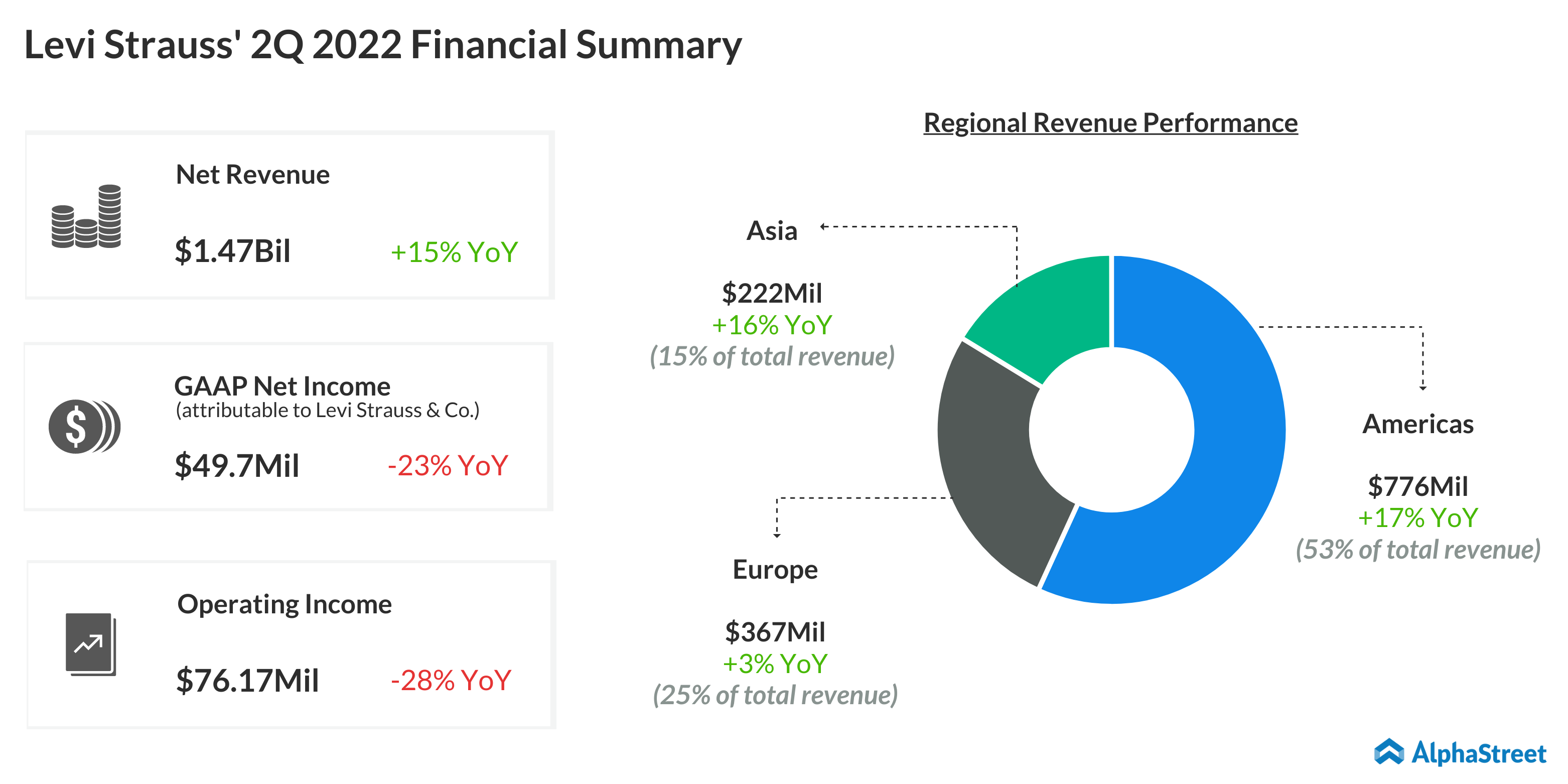

Reflecting double-digit progress throughout all the important thing geographical segments, Levi Strauss’ second-quarter revenues rose 15% yearly to $1.47 billion, which additionally surpassed the market’s expectations. Consequently, adjusted revenue moved as much as $0.29 per share from $0.23 per share within the corresponding interval of 2021.

Key Information

The highest line continues to profit from the brand-led, direct-to-customer enterprise mannequin and diversified portfolio. The administration has reaffirmed the full-year steering whereas stressing its dedication to persistently creating worth for shareholders. Apparently, the corporate has a formidable monitor report of producing higher earnings than broadly anticipated.

Highlights of Levi Strauss’ Q1 2022 monetary report

In a transfer geared toward diversifying the enterprise, Levi Strauss final 12 months acquired Past Yoga marking its foray into the activewear section. The deal helped the corporate develop its girls’s put on footprint and allocate world assets and the digital ecosystem to additional develop the Past Yoga model.

Dangers

However no enterprise is resistant to the lingering macro uncertainties and geopolitical points. Going ahead, client sentiment would largely depend upon financial restoration and easing of inflation strain. A key danger dealing with Levi Strauss is that clients are prone to reduce down spending on non-essential gadgets when their buying energy is squeezed. One other concern is the provision chain disaster dealing with the broad retail sector.

Levi Strauss’ inventory this week barely recovered from a two-year low however continued to commerce under its 52-week common. It has misplaced about 33% for the reason that starting of the 12 months.