Shares of Philip Morris Worldwide Inc. (NYSE: PM) have been down over 7% on Tuesday after the corporate delivered blended outcomes for the second quarter of 2025. Income and earnings noticed development in comparison with the earlier 12 months however whereas the underside line beat expectations, the highest line fell wanting estimates. Listed here are the principle takeaways from the earnings report:

Combined outcomes

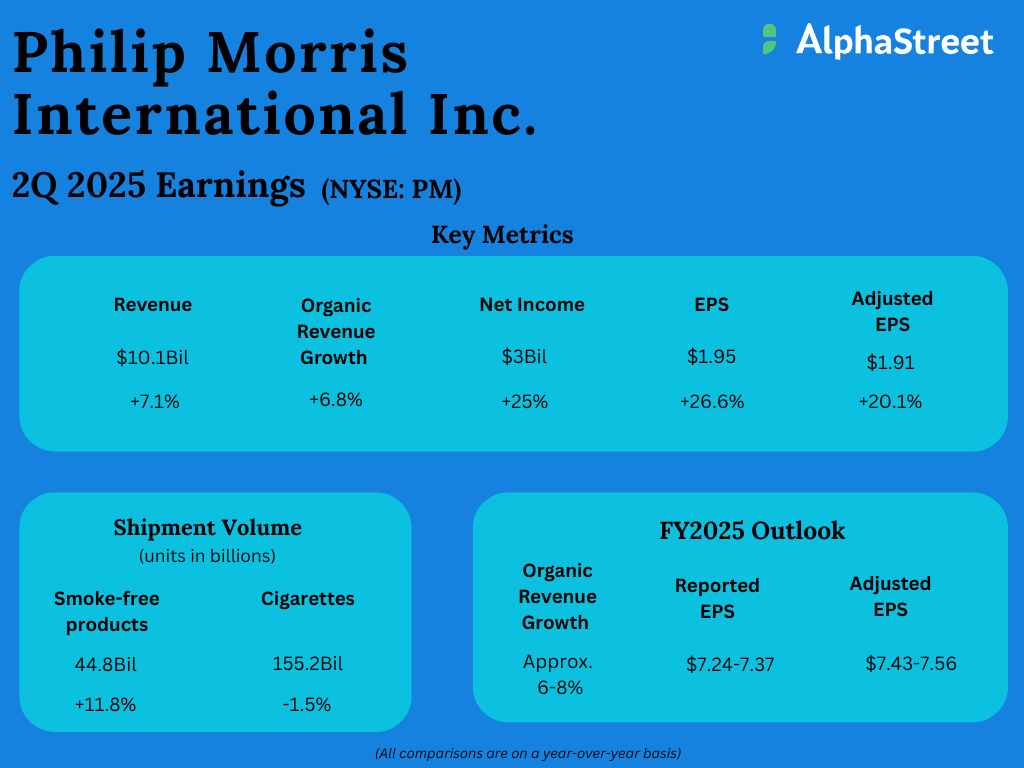

In Q2 2025, PM generated revenues of $10.1 billion, which have been up 7.1% from the year-ago quarter, however beneath expectations of $10.3 billion. Natural income development was 6.8%. GAAP earnings per share grew 26.6% year-over-year to $1.95. Adjusted EPS rose 20.1% to $1.91, surpassing estimates of $1.86.

Enterprise efficiency

PM’s smoke-free enterprise continued its momentum within the second quarter with double-digit development in shipments, income and gross revenue. Shipments grew 11.8%, income was up 15.2%, and gross revenue rose 23.3%. The corporate’s smoke-free merchandise can be found in 97 markets and the enterprise accounted for 41% of web revenues in Q2.

The smoke-free portfolio is led by IQOS, which exceeded $3 billion in revenues in Q2. IQOS continued its sturdy development in Japan and Europe and in addition gained share in markets like Jakarta, Mexico Metropolis and Seoul. Inside the oral smoke-free product class, cargo quantity elevated by 23.8% in Q2, led by nicotine pouches. Nicotine pouches volumes grew over 40% within the US and greater than doubled internationally.

Inside combustibles, web income grew 2.1%, helped by sturdy pricing. Cigarettes quantity dropped 1.5% within the quarter. The Marlboro model continues to achieve market share and the corporate’s total cigarette class share remained broadly steady.

Outlook

For the total 12 months of 2025, PM expects natural income development of 6-8%. Reported EPS is anticipated to be $7.24-7.37 whereas adjusted EPS is anticipated to be $7.43-7.56.