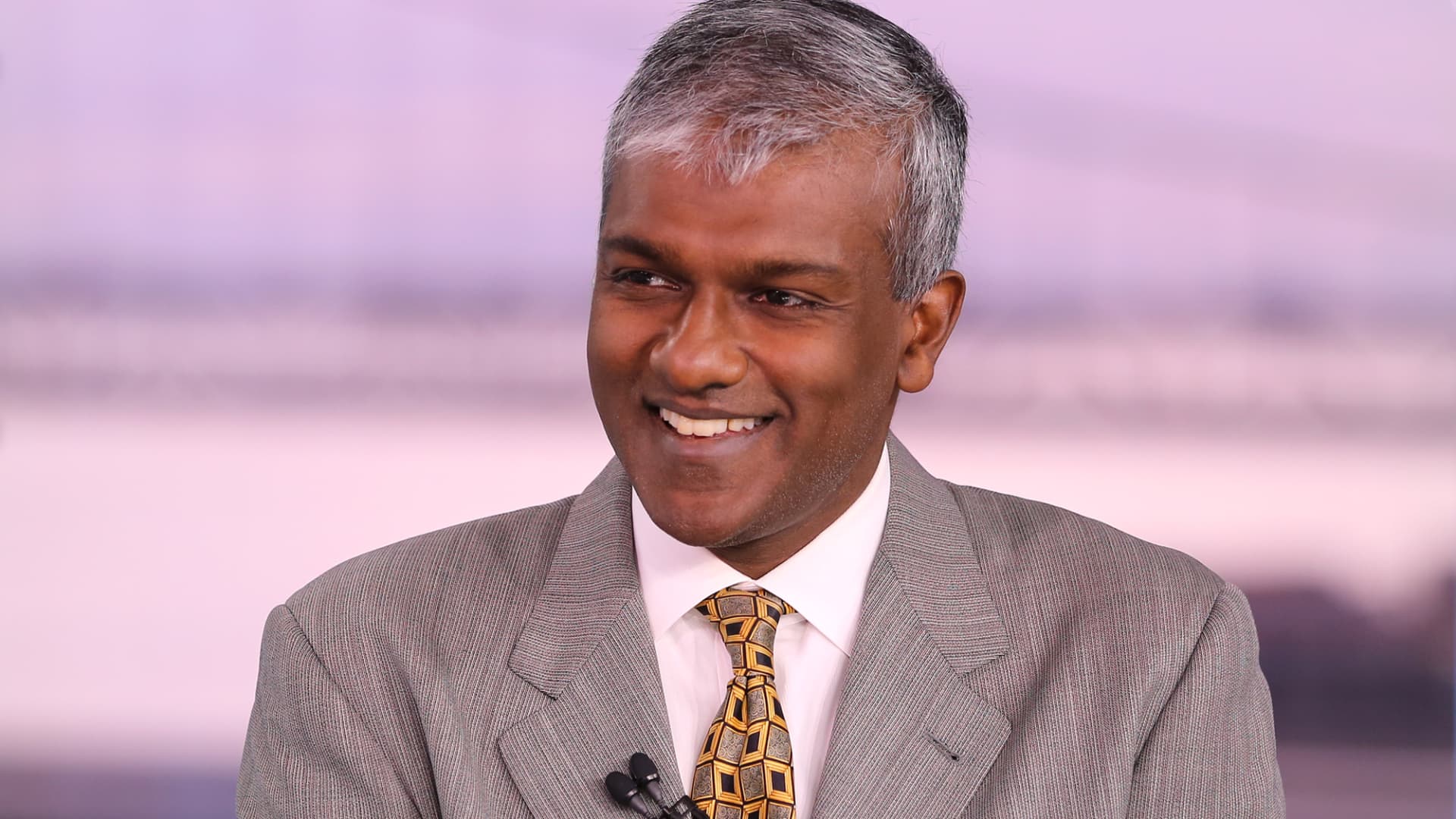

Hedge fund manager Dan Niles said he expects stock markets to fall by the middle of this year as the Federal Reserve opts to keep interest rates higher for longer. Niles, founder and senior portfolio manager of the Satori Fund, told CNBC’s “Street Signs Asia” Thursday that there was a “disconnect” between market expectations and the U.S. central bank’s messaging. His comments echo Fed Chair Jerome Powell, who said he doesn’t expect to cut rates this year after the central bank raised interest rates by 25 basis points Wednesday. However, interest rate swap data shows that a significant proportion of the market expects a cut in the base rate by the middle of this year. “I think that’s where the disconnect is,” said Niles. “Services, excluding housing, has still got strong inflation because the jobs market is just so strong, and that’s over 55% of the core inflation numbers that the Fed looks at.” “I think by the time you get to mid-year, and it becomes pretty apparent that the Fed is not going to be cutting, that’s when the unfortunate realization is going to be that the Fed is not going to help you out like people want,” he added. .SPX 1Y line Niles said his hedge fund, which is tech-focused, had positive gains in 2022 despite a 19% decline in the S & P 500 and a 33% decline in the Nasdaq . The current situation echoes events seen in the 1970s , he added, when premature rate cut predictions led to a surge in inflation and eventual hikes during the 1980s to bring it back under control. As a result, some stock markets lost a third of their value. However, despite his bearish outlook, the hedge fund manager said there could be several tailwinds in the near term for the U.S., such as the Fed pausing after two more rate hikes, inflation slowing, and China’s reopening. Earlier this year, Niles named his top defensive stocks to prepare for a potential steep market decline. He has previously said he expects the S & P 500 to fall to 3,000, more than 25% below its current level. — CNBC’s Weizhen Tan contributed to this report.