Mindstyle/iStock by way of Getty Pictures

Snack meals big Mondelez (NASDAQ:MDLZ) has had a great two years as pandemic induced lockdowns, and shopper panic shopping for pushed by pandemic-induced meals shortages boosted packaged meals gross sales. Mondelez reported income development of 8.05% year-over-year (YoY), accelerating from 2020 when revenues rose 2.7%. Internet earnings jumped 21% YoY to USD 4.3 billion. Heavy advertising, product innovation helped seize market share with the corporate’s cumulative market share exceeding pre-covid ranges.

Quick time period tailwinds related to larger pandemic-induced at-home snacking could recede, quick time period headwinds from price inflation

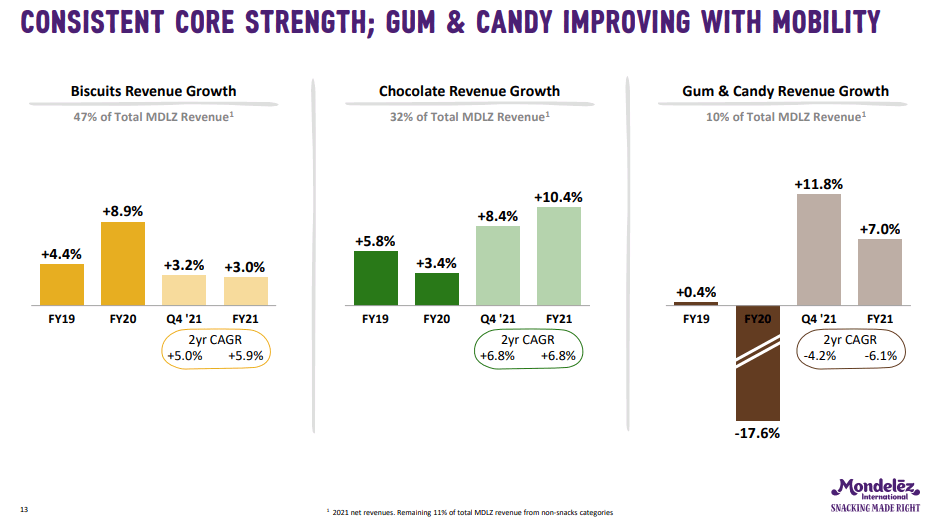

Mondelez has publicity to each at-home consumption and on-the-go merchandise. Mondelez’s core biscuits and candies enterprise – which is skewed in the direction of at-home consumption – loved an acceleration in demand throughout pandemic-induced lockdown durations around the globe over the previous two years, nevertheless with economies progressively opening up and shopper mobility rising, such quick time period tailwinds could progressively recede within the coming months (the corporate expects shopper mobility to choose up in H2 2022 however nonetheless stay 10%-15% under pre-covid ranges). Mondelez’s Gum and Sweet enterprise, which has already seen a choose up together with growing shopper mobility, may benefit from an easing of lockdown restrictions.

Mondelez Investor Presentation

Supply: Mondelez Investor Presentation

Nevertheless, Mondelez’s core Biscuits and Sweets enterprise which accounts for greater than 70% of the corporate’s revenues, might be affected.

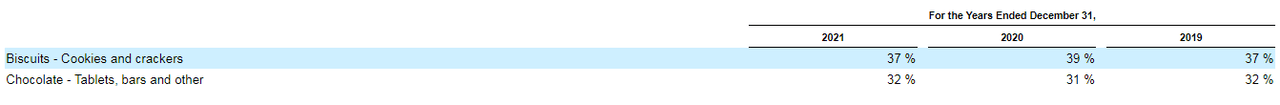

Mondelez 10-Okay 2021

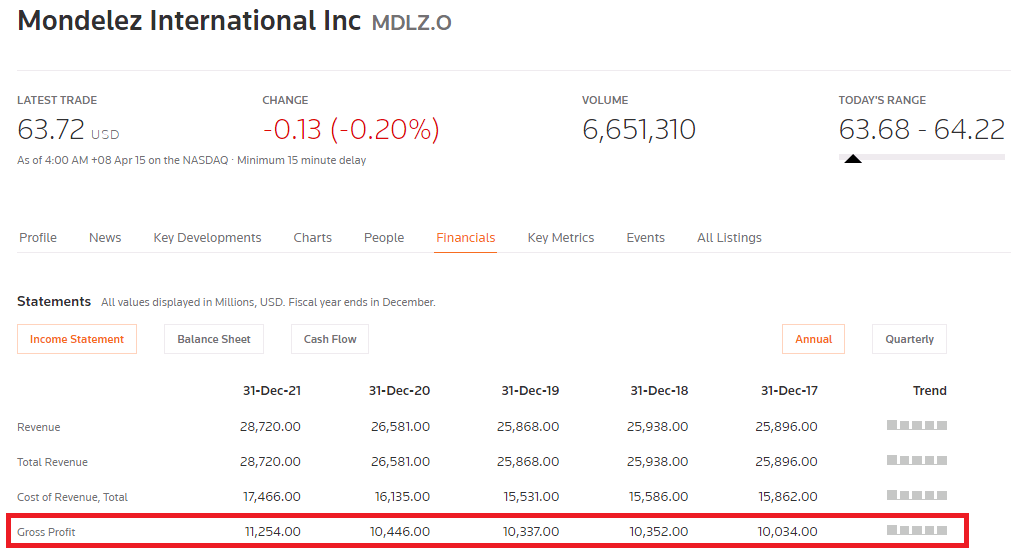

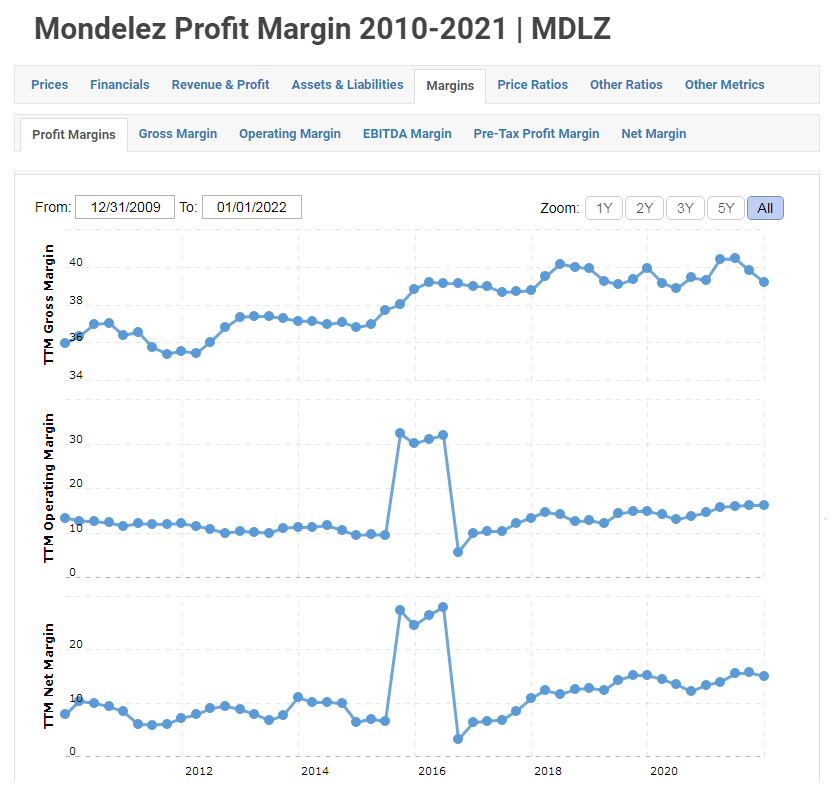

In the meantime, packaged meals makers together with Mondelez, have been grappling with provide chain and value inflation challenges pushed by hovering costs for key uncooked supplies, notably wheat, eggs, palm oil, and milk, impacting margins throughout the sector. Mondelez’s robust model portfolio and pricing energy helped the corporate move on these prices to shoppers in 2021, with the corporate’s gross margins seeing only a slight decline in comparison with the previous few years. Mondelez reported a gross margin of 39.2% in FY 2021, a shade lower than the 40% reported in 2019 and 2018. 2021 gross earnings rose 7.7% YoY to USD 11.2 billion.

Reuters

Going ahead, Mondelez expects commodity worth challenges to proceed in 2022, however with inflationary pressures anticipated to be excessive within the first half of the yr and pricing actions anticipated in the direction of the latter a part of the yr, the corporate general expects a sequential enchancment in gross revenue {dollars} over the quarters.

Macrotrends

Long run development supported by persevering with investments into model constructing and advertising, and strategic growth into new snack classes and premium snacks, and rising markets publicity

Mondelez continues to construct its legacy manufacturers by way of heavy advertising and product revitalizations, led by its two USD 1 billion manufacturers – Oreo and Cadbury. Oreo, launched greater than a century in the past, is widely known because the world’s favourite cookie model and steady model constructing, witty social media advertising and ads, and product improvements (Mondelez continues to roll out new Oreo flavors) have helped the model keep related and win the stomachs of youthful snackers as properly (surveys point out younger shoppers are main Oreo followers).

Cadbury Dairy Milk follows an analogous playbook with heavy advertising and product improvements following a localization technique to extend shelf area and market share. New product launches embody Cadbury Dairy Milk Kurma – kurma means “dates” in Malay – launched in 2022 Indonesia and Malaysia in the course of the month of Ramadhan when dates grow to be standard to interrupt quick, Cadbury Dairy Milk Silk Mousse launched in 2021 in India the place wealthy, decadent sweetened milk-based confectionery are extraordinarily standard, and Cadbury Dairy Milk Durian launched in 2019 in durian-loving Malaysia).

Mondelez can be creatively fusing its iconic manufacturers to create contemporary new snacks like its Cadbury Dairy Milk Oreo chocolate bar.

Total, Mondelez’s promoting and promotion bills have been rising steadily through the years in absolute and relative phrases reflecting the corporate’s aggressive advertising efforts to construct its manufacturers and drive gross sales. Mondelez expects to extend advert spend in 2022 to drive visibility and help larger shelf costs.

Mondelez promoting and promotion bills

|

US {dollars} |

A&P spend / complete revenues % |

|

|

2021 |

1.6 billion |

5.4% |

|

2020 |

1.4 billion |

5.2% |

|

2019 |

1.2 billion |

4.7% |

|

2018 |

1.17 billion |

4.5% |

Whereas biscuits and chocolate at the moment make up the majority of the corporate’s revenues, the corporate is actively making strategic acquisitions to develop its product classes and capitalize on rising developments. Mondelez’s acquisition of Chipita, expands the corporate’s product portfolio into pastries.

Refrigerated vitamin bars have been a rising pattern within the U.S. currently, and Mondelez was fast to scoop up market chief Excellent Snacks in 2019 which expanded Mondelez’s product portfolio into refrigerated vitamin bars. The worldwide refrigerated snacks market remains to be at early phases and is projected to develop at round 5% by way of 2027. Mondelez’s international presence, localized snack market data, retail and distribution networks are benefits that would assist the corporate scale the model worldwide.

The corporate can be increasing into the premium section with the corporate buying premium snack corporations like premium cookie maker Tate’s Bake Store.

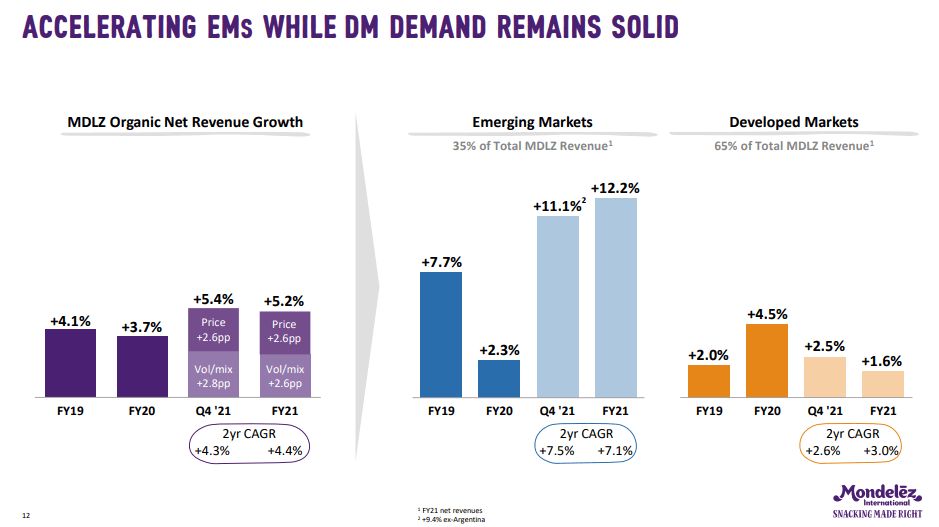

About 35% of Mondelez’s income is derived from rising markets which provides super long run development potential; Euromonitor expects snack gross sales to develop 4 instances quicker in rising markets than in developed markets by way of 2025.

Mondelez Investor Presentation

Portfolio evolving to fulfill altering shopper habits

Previous to the pandemic, numerous gamers within the packaged meals area noticed stagnant income development as shoppers more and more shunned packaged meals and turned to contemporary, pure meals or within the case of snacking – more healthy “higher for you” snacks as a substitute. Packaged snack meals big Mondelez loved strong income development in the course of the peak of the pandemic over the past two years, however this was not the case pre-pandemic when income development was comparatively lackluster.

|

12 months ended December, |

Mondelez |

|

2021 |

8% |

|

2020 |

2.8% |

|

2019 |

-0.3% |

|

2018 |

0.2% |

Mondelez nevertheless has been evolving to fulfill altering shopper consuming habits with the corporate having in place a number of methods to fulfill this goal. First, the launch of brand name extensions centered round well-being, reminiscent of Mondelez’s Cadbury Dairy Milk with 30% much less sugar launched within the UK and India in 2019, “Oreo Zero” zero-sugar Oreos launched in 2021 in China, and the launch of Philadelphia cream cheese with 100% pure substances in Europe. Second, acquisitions of well-being-focused snack manufacturers, reminiscent of Mondelez’s acquisitions of Hu Grasp Holdings in 2021 (the guardian firm of well-being snack firm Hu Merchandise), Grenade (a UK sports activities vitamin firm well-known for its protein bars), and Connoisseur Meals in 2021 (an Australian premium well-being targeted biscuit and cracker firm). Third, constructing their very own manufacturers, and making investments into rising, early-stage manufacturers by way of Mondelez’s devoted innovation and enterprise hub – SnackFutures. Manufacturers Mondelez has invested in by way of its enterprise hub embody Uplift Meals in 2019 (a snack maker targeted on prebiotic purposeful snacks) and types which were organically developed by way of the hub embody CaPao (a wellness snack model providing wholesome plant-based snacks with upcycled cacao fruits), NoCoe (crackers made with largely natural substances and nil preservatives and components), Filth Kitchen Snacks (wholesome air dried vegetable snacks, and pressed snack bars made with greens, fruits, nuts and seeds, with no added sugar or synthetic substances), and Ruckus and Co (ready-to-drink frozen smoothies containing natural milk, fruit puree, and greens, a product largely aimed toward children).

It stays to be seen nevertheless how profitable the corporate will probably be in realigning its portfolio in the direction of more healthy snacks and constructing a more healthy picture. Mondelez’s zero-sugar Oreos as an example acquired bland curiosity from Chinese language snackers suggesting the corporate’s portfolio evolution problem isn’t any straightforward feat. In the meantime its low-sugar Cadbury Dairy Milk bar accounts for only a tiny fraction of revenues (1.1% as of 2020 in keeping with this WSJ article).

Dangers

Fats taxes and authorities regulation

Worldwide weight problems has tripled since 1975 and governments are more and more devising strategies to counter this rising well being drawback. Over 50 nations worldwide have already imposed taxes on sugar-sweetened drinks (SSBs) and as weight problems charges improve it’s attainable that these taxes could prolong to different “unhealthy”, “junk” meals reminiscent of high-sugar snacks like biscuits, desserts, chocolate, and sweet as properly. A examine revealed by the BMJ revealed that sugary snacks really account for a much bigger proportion of free sugar and power consumption than sugary drinks and that decreasing purchases of sugary snacks, as an example by way of a snack tax, may probably have a larger impression on addressing weight problems. Researchers from the Universities of Oxford, Cambridge, and Exeter and the London Faculty of Hygiene and Tropical Drugs point out that this feature is ‘worthy of additional analysis and consideration as a part of an built-in strategy to tackling weight problems’. The Philippines, which reported some success in chopping sugary-drink gross sales following a sugar tax, is now contemplating imposing a snack tax along with potential promoting restrictions for junk meals, sweet, delicate drinks and quick meals as properly. This yr, India, a key rising marketplace for Mondelez, introduced it is going to be imposing a tax on snack meals to counter rising weight problems within the nation.

Financials

There will not be many corporations immediately corresponding to Mondelez, nevertheless by way of chocolate Hershey (HSY) might be one in all them, and by way of snacks Basic Mills (GIS).

Mondelez will not be as worthwhile as chocolate big Hershey however surpasses Basic Mills in some profitability metrics, notably by way of margins, in addition to by way of development with Mondelez’s income and internet revenue development being significantly larger than Basic Mills.

Mondelez nevertheless stands out among the many trio as having the bottom quantity of debt, which higher positions the corporate to make acquisitions – a key a part of its development and portfolio realignment technique.

Monetary metrics for the newest monetary yr

|

Mondelez |

Hershey |

Basic Mills |

|

|

Income development YoY % |

8% |

10% |

3% |

|

Internet revenue development YoY % |

21% |

15% |

7% |

|

Gross margin % |

39% |

45% |

35% |

|

Return on property % |

4.7% |

15% |

7% |

|

Complete debt to fairness % |

69% |

182% |

133% |

Abstract

Using on the covid-induced snacking pattern, Mondelez has been rising market share, serving to drive prime line and backside line development. Whereas quick time period challenges specifically price inflation and decelerating at-home snacking may dampen monetary efficiency, long run portfolio realignment in the direction of wholesome snacks, product innovation, heavy branding, and strategic acquisitions bode properly for the corporate. The snack market nevertheless is extraordinarily aggressive, and it stays to be seen how profitable the corporate will probably be in its portfolio evolution effort within the face of shopper snacking behaviors shifting in the direction of more healthy snacks. Nonetheless, the corporate has in place long run methods to deal with this as a part of its effort to keep up and improve its market share, together with a devoted enterprise hub to determine and construct promising manufacturers, and a comparatively low debt burden which leaves the corporate properly ready to accumulate promising manufacturers.