dragana991/iStock via Getty Images

Investment Thesis

Monro (NASDAQ:MNRO) has declined by about a third in the last three months as a result of weak operating metrics as consumers trade down and the management’s reluctance to provide forward guidance. We believe the company has reported resilient results in Q1 amidst a significantly challenging macro backdrop, however, we believe there would be sequential weakness going forward, particularly as the gross margin benefits from its wholesale business divestiture wanes off. We believe the long-term prospects for Monro remain intact amidst increasing average age of vehicles in the US, however, near-term challenges remain, particularly within the tire market which remains its biggest revenue contributor. In addition, we await to see a tangible and continued track record of outperformance within its 300 small and underperforming stores and adopt a wait-and-watch strategy. Initiate at Neutral.

Company Background

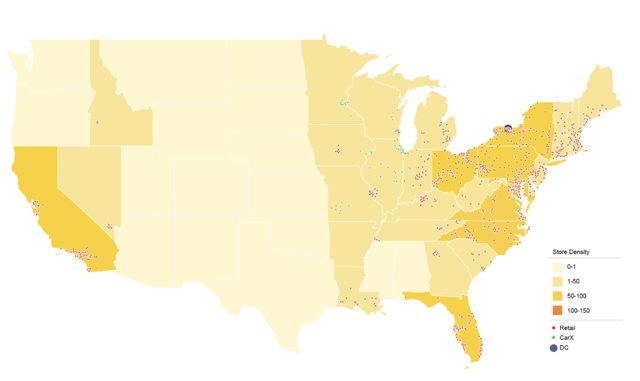

Monro is a leading player in retail tire and automotive service, operating a chain of ~1,300 independently owned centers along with ~80 franchised locations across 30+ states in the US. It has a dominant presence primarily in the Northeastern US and also has growing presence within the Southern and Western US.

Company filings

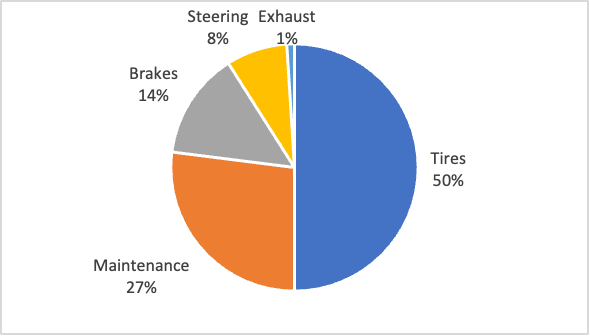

It offers a wide range of routine maintenance services for passenger cars, trucks, and light vans for brakes, drivetrain, wheel alignment and others serving about 5 mn vehicles annually. Tire segment forms the biggest revenue contributor, contributing about half of the revenue, along with maintenance service largely remaining stable over the years.

Revenue by Product (FY23)

Company filings

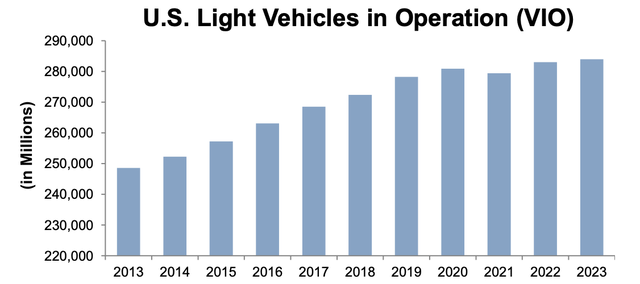

US Vehicle in Operations has shown a strong increase over the years, with a rapid growth during 2013-2017 in sales leading to a jump in vehicles in operation. This bodes well for the aftermarket industry as well as Monro which has a targeted market segment of vehicle age of 6 – 12 years which require regular maintenance as well as repairs.

Company, Auto care association

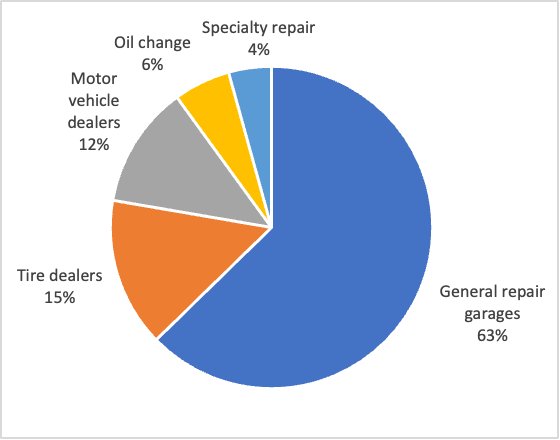

Monro operates in a highly fragmented $311 bn industry (~80% of US Aftermarket Automotive industry) with a wide range of motor vehicle dealers, general repair garages, tire dealers, specialty repair, and oil changing stations. Several gas stations, local, regional, and other players offer a wide variety of aftermarket services along with several independent garages with a total of 136,000+ outlets across the US.

US Distribution of Outlets (2022)

Company, Auto Care Association

Q1 Earnings and Q2 Preview

MNRO reported a weak Q1 with a 6.5% decline in sales, primarily due to the divestiture of its Wholesale tire and distribution assets. It reported a comp sales growth flat at 0.5% with a relatively better performance from its ~300 underperforming centers which delivered ~1% in comp sales growth. On a monthly basis, comps continued to decelerate with the company clocking comp sales growth of 2.4%, 0.7%, and (1.6%) for April, May, and June respectively while July comps (till 22nd July) remained positive at 0.6% also supported by lower base (0.7% decline in comp sales for corresponding period last year). On the product front, Tire segment which remains the biggest contributor to total sales (47% to total in Q1 compared to ~50% average contribution) grew just 1% YoY while maintenance services increased 3% YoY offset by a decline in Brakes (-2%), Alignment (-2%) and Front end (-9%).

Gross margins remained flat, primarily as a result of 220 bps benefit from its Wholesale business divestiture along with lower occupancy costs, which were largely offset by higher material costs and wage hikes. SG&A deleveraged by 220 bps as a result of an increase in store expenses and sticky fixed costs amidst declining sales, leading to an operating margin of 5.3% for the quarter compared to 7.5% last year. It reported an EPS of $0.31 missing the analyst expectations pegged at $0.39.

The company guided a low- to mid-single digit comparable sales growth for the year, driven by an outsized performance in the 300 underperforming stores. We believe this could be challenging given the considerable weak macro and demand headwinds, particularly within the replacement tire market, the biggest revenue contributor and high-margin segment for MNRO. The U.S. Tire Manufacturers Association (USTMA) revised its Feb 2023 guidance downwards for replacement tire shipments to 325.9 mn compared to 334.2 mn it was expecting previously for 2023 citing weakening trends.

Tire Shipment Forecasts

| Particulars | 2023 New | 2023 Prev | 2022 | Change |

| Passenger Vehicles | 210.5 | 215.8 | 213.7 | (1.5%) |

| Light Trucks | 35.9 | 37.9 | 37.2 | (3.6%) |

| Trucks | 22.4 | 25.2 | 26.6 | (16.0%) |

| Total | 325.4 | 334.2 | 332.0 | (2.0%) |

Source: USTMA

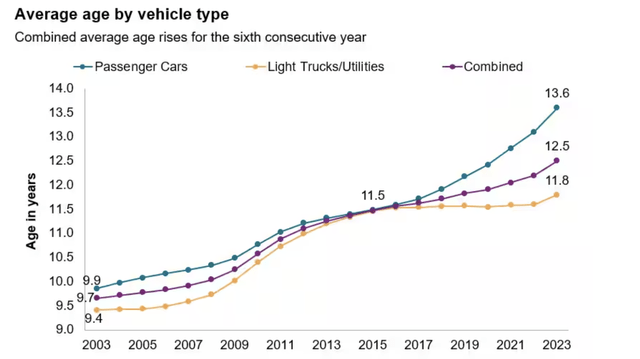

We believe maintenance service would continue to drive sales acceleration as a result of softness in new cars due to higher sticker prices and an increase in average age of the vehicle requiring regular maintenance services. This marks the highest yearly increase since 2008-2009 period where recessionary pressures led to a decline in demand for new vehicles.

S&P Global Mobility

In addition, labor and technician shortage would continue to drive higher wage costs and competition between firms to retain talent and improve customer service, which could further put a dent in the gross margins.

We believe tire comp sales to decline in the low-single digits for Q2, driven by a decline in traffic while maintenance comp sales continue growing in the low-single digits with a low to mid-single digit decline in brakes and alignment. We expect gross margins to decline by about 200 bps YoY as a result of product cost inflation and SG&A deleverage due to declining sales and sticky fixed costs, and assume operating margins to decline by 300 bps.

Valuation

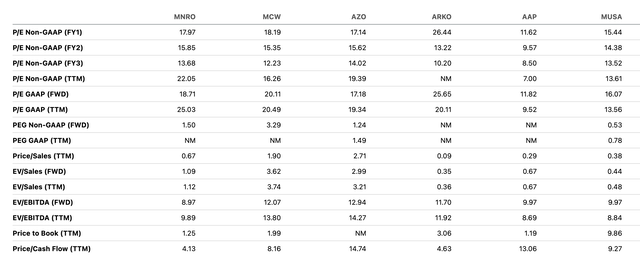

Monro trades cheaper on paper compared to its peers as well as its historical averages. On an EV/Fwd EBITDA basis, it trades at 9.0x and is amongst the cheapest compared to the peer set while on Price / TTM Cash flow basis as well it is amongst the cheapest at 4.1x. On a P/E basis, it trades at 18x Fwd P/E whereas in rest 4 appears to be more cheaper.

Seeking Alpha

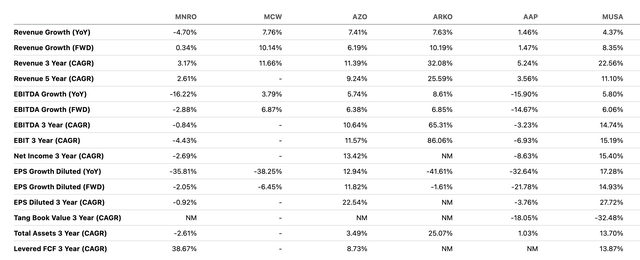

We believe the relative undervaluation is a result of a tepid outlook for the company as the forward-looking forecasts for revenue, EBITDA and EPS rank them amongst the bottom tier compared to its peers.

Seeking Alpha

While we believe the long-term prospects for the aftermarket automotive industry are intact driven by an increasing age of the vehicle with 74% of vehicles expected to be aged more than 6 years by 2028 which would continue to drive robust aftermarket sales. However, we believe near-term challenges remain, particularly for its tire business, and keenly await how things unfold for its tire business and a track record of operational outperformance in its small/underperforming stores.

Risks to Rating

Risks to rating include

1) Monro operates in a highly competitive and fragmented automotive repair market with several local and regional players as well as gas stations and mass merchandisers

2) Prolonged economic slowdown can heavily impact its business operations as a result of a squeeze in customer spends

3) Proliferation of EV cars would lead to a decrease in service needs which in turn could lead to a decline in service revenues

4) Company may not be able to retain talent amidst labor shortage and may have to pay higher wages, which can lead to a decline in its gross margins

5) Upside risks to rating include an outsized growth in maintenance revenues as a result of the increasing vehicle age, improvement in its underperforming stores and increase in share repurchases or dividends to drive shareholder value

Conclusion

We believe Monro has strong brand resonance amid a highly competitive and fragmented market and is perfectly capitalized for growth in the long term. However, we believe there are significant downside risks to management’s optimism, and we expect a slight decline in revenue for the year, driven by weakness in its tire business. It remains one of the heavily shorted stocks with a short interest of ~10%, and we believe while the current valuation may look attractive with a healthy dividend yield, there are significant downside risks to its ability to keep up its dividend and with limited repurchasing activity going forward (only a third of shares are left in its current share repurchase plan), it may not be able to provide much support to the stock price. Initiate at Neutral.