JamesBrey

Article Thesis

MPLX (NYSE:MPLX) is a high-quality energy midstream company that offers a very compelling dividend yield of 9% at current prices. The dividend looks safe, and between growth spending and share repurchases, MPLX has ample potential to increase the dividend further in the coming years.

MPLX Keeps Delivering

The world is experiencing an energy crisis, as growing energy demand due to the ongoing recovery from the pandemic occurs at the same time as supply disruptions due to the ongoing war in Ukraine, OPEC supply cuts, and so on. The world has become pretty reliant on US energy exports, e.g. to Europe via newly-built LNG terminals that seek to replace the natural gas imports that previously came from Russia.

In this environment, North American energy midstream companies such as MPLX are highly important — without their assets, the energy commodities that are produced in the US couldn’t be moved to end markets in the US and to export markets in Europe, Asia, and so on. One could thus argue that the assets that MPLX and its peers own have become even more important in the recent past, as they are now essential not only for the US, but also for many other markets around the world.

At the same time, many energy companies are highly profitable in the current environment, thanks to high energy prices. This, in turn, allows MPLX to negotiate aggressively when it comes to new contracts or contract renewals — its customers have the financial resources to pay higher prices. Of course, many contracts are locked in, thus there is no immediate impact on all of MPLX’s operations. But the environment for MPLX nevertheless is a positive one.

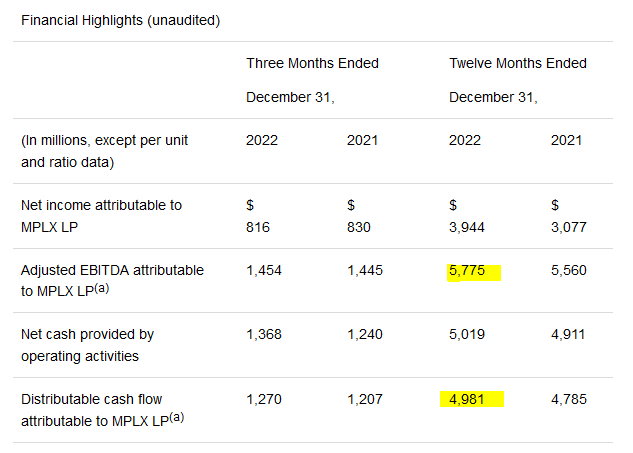

While energy infrastructure isn’t a high-growth industry, the positive environment has still allowed MPLX to grow its business at an attractive rate in the recent past. The following table is from MPLX’s Q4 earnings release from two weeks ago:

Seeking Alpha

The company grew its net income, EBITDA, operating cash flow, and distributable cash flow meaningfully in 2022, relative to 2021. I believe that EBITDA and distributable cash flow growth are the most important metrics here, while net income (which was up by close to 30%) is not as telling for midstream companies due to non-cash items such as depreciation.

Adjusted EBITDA was up 4% year over year, while distributable cash flow was up 4% as well. That is not an overly high growth rate in absolute terms, but we have to consider several things here. First, MPLX offers a very high dividend yield — when the returns from the shareholder payout are 9% already, even a mid-single digit growth rate is quite attractive. Second, MPLX’s growth performance on a per-share basis is somewhat better than the company-wide growth rate. MPLX’s share repurchases have lowered the share count by 2% over the last year, thus the per-share growth rate of EBITDA and distributable cash flow was 6%, which is pretty appealing, I believe.

Outlook For 2023

MPLX’s trailing results were attractive, but the future outlook matters a lot as well, of course. MPLX has announced that it plans to spend around $950 million on capital expenditure this year, which includes both its maintenance spending as well as its growth investments that are planned for the current year. That’s $95 million more than what MPLX has spent on capital expenditures last year — while an increase in capital spending means that free cash flows will be lower, all else equal, I believe that the $95 million spending increase will be more than offset by higher operating cash flows. After all, with operating cash flows of slightly more than $5 billion a year, operating cash flows would have to grow by less than 2% to balance out the increased capital spending.

Analysts are predicting that MPLX will generate EBITDA of $5.91 billion this year, which would be up by $140 million versus 2022. MPLX has a clear history of outperforming expectations, however — the company has beaten profit estimates in 11 out of the last 12 quarters. I thus wouldn’t be surprised to see actual EBITDA come in at a higher level than what analysts are forecasting right now. But even if the estimate is spot on, MPLX should be able to grow its free cash flow this year, despite the forecasted capital expenditure increase. First, the EBITDA growth is likely higher than the capital expenditures growth. On top of that, MPLX has reduced its total debt position in recent years, and will likely reduce it further this year. This should result in lower interest expenses, which will positively impact operating cash flows, all else equal. Between these factors, I estimate that free cash flows could increase slightly this year, from $4.1 billion in 2022. Higher capital spending is thus not a major issue, even though many investors prefer to see capital spending at low levels as this allows for higher shareholder payouts and more debt reduction. Things should be seen in perspective, however: Despite the forecasted capital spending increase for 2023, MPLX will still operate with a clear FCF focus — even accounting for $950 million in maintenance and capital expenditure spending, free cash flows will most likely be more than 4x as high. There is thus no reason to worry that MPLX is “chasing growth” while forgetting about its shareholders.

The expected free cash flow increase will give MPLX optionality when it comes to utilizing this cash to drive shareholder value. It is pretty clear that the majority of those free cash flows will go to shareholders, as the dividend costs around $3.1 billion per year at the current level, or around three-quarters of the company’s expected free cash flows. If MPLX increases its dividend, that number will grow, of course. The company has hiked the dividend by 10% in November 2022, thus I expect that we might see a dividend increase towards the end of the current year. Another 10% dividend increase would make the dividend yield rise to almost exactly 10%, but even a smaller dividend growth rate would be quite attractive — when you combine a 9% dividend yield with a 3% growth rate, for example, total annual returns in the 12% range would be achievable at constant valuations.

Since MPLX will likely have around $1 billion of surplus cash flow after dividends, I expect that we will see a combination of debt reduction and buybacks. $500 million spent on both of these items would make MPLX’s total consolidated debt decline from $20.1 billion to $19.6 billion — relative to the expected EBITDA for the current year, that would make for a leverage ratio of 3.3. MPLX has lowered its leverage ratio from 3.9 in 2020 to 3.7 in 2021 and 3.5 in 2022, thus a reduction to 3.3 would be in line with the recent trend. One can argue that MPLX already has a pretty strong balance sheet, as a 3.5x leverage ratio is far from high for an energy infrastructure company. But strengthening the balance sheet further reduces risks and could thus make sense. $500 million spent on buybacks would be sufficient to reduce the share count by around 1.5%, which would have a small but nice impact on MPLX’s DCF and EBITDA per share growth rate going forward. As an added bonus, buybacks make the dividend safer over time, as the overall dividend cost declines as the share count shrinks, all else equal.

Still Attractively Valued

Thanks to a positive environment and MPLX’s progress in reducing leverage and growing its cash flow, MPLX has seen its shares perform well in the recent past. Over the last year, MPLX’s share price has risen, while the broad market performed rather badly in that time frame. MPLX also saw its shares rise by 8% over the last six months alone. This outperformance has resulted in MPLX becoming somewhat more expensive again, relative to how shares were valued last summer and fall.

But in absolute terms, MPLX is still far from pricey. Based on total consolidated debt of ~$20 billion at the end of 2022 and a market capitalization of $34 billion, MPLX’s enterprise value is ~$54 billion today. That means that the company trades with a 9.1x enterprise value to EBITDA multiple right now, which is very undemanding.

On a cash flow basis, MPLX looks inexpensive as well. The company generated free cash flows of $4.1 billion over the last year, which translates into a trailing free cash flow yield of 12%. Growth capital expenditures are already accounted for here, thus the distributable cash flow yield is even better. I also expect that the forward FCF yield is a little higher, as FCF should improve this year.

With a dividend yield of 9%, a 12% free cash flow yield, and a single-digit EV to EBITDA multiple, MPLX stock still looks like a compelling long-term pick. Total returns in the 10%+ range seem quite achievable to me, as the dividend yield alone contributes almost all of that already. With some added growth and some potential for multiple expansion, MPLX could offer compelling returns going forward.