Mario Tama/Getty Photos Information

With the subscriber loss in 1Q22 and steering for additional subscriber deterioration in 2Q22, the weaknesses in Netflix’s (NASDAQ:NFLX) enterprise mannequin are simple, as we have been mentioning for years. Even after falling 67% from its 52-week excessive, 56% from our report in April 2021 and 39% since our report in January 2022, we expect the inventory has far more draw back.

Robust competitors is taking market share, limiting pricing energy, and making it clear that Netflix can not generate something near the expansion and earnings implied by the present inventory value.

First Subscriber Loss In Over 10 Years Ought to Not Be A Shock

Netflix misplaced 200,000 subscribers in 1Q22, which is properly under its prior steering for two.5 million additions and is the corporate’s first subscriber loss in 10 years. Extra alarming, administration guided for a further lack of 2 million subscribers in 2Q22.

We anticipate subscriber contraction could possibly be the norm shifting ahead, as famous in our January 2022 report as a result of competitors is taking significant market share and Netflix’s constant value will increase are clearly not properly acquired in such a aggressive market.

We anticipate Netflix will proceed to lose market share as extra opponents bolster their choices and deep-pocketed friends similar to Disney (DIS), Amazon (AMZN), and Apple (AAPL) proceed to speculate closely in streaming.

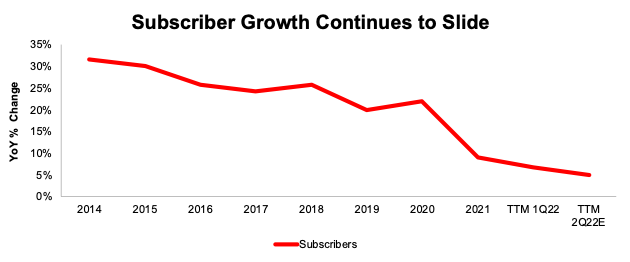

Aggressive Pressures Have Undermined Subscriber Progress For Years

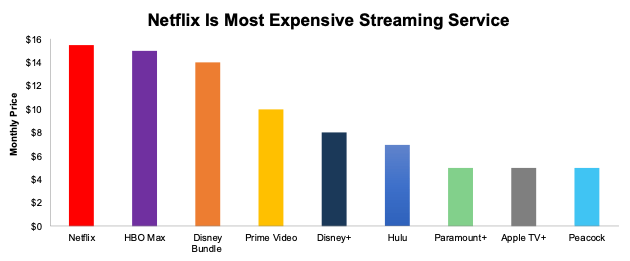

Whereas Netflix plans to proceed rising its content material spending “relative to prior years”, it is not clear that could be a profitable technique to spice up subscriber development. Per Determine 1, Netflix’s subscriber development has fallen from 31% YoY in 2014 to 7% YoY within the trailing twelve months led to 1Q22.

Netflix’s steering, which requires a lack of 2 million subscribers, implies subscriber development of simply 5% YoY within the TTM ended 2Q22.

Determine 1: YoY Subscriber Progress Fee Since 2014

NFLX Subscriber Progress YoY Since 2014 (New Constructs, LLC)

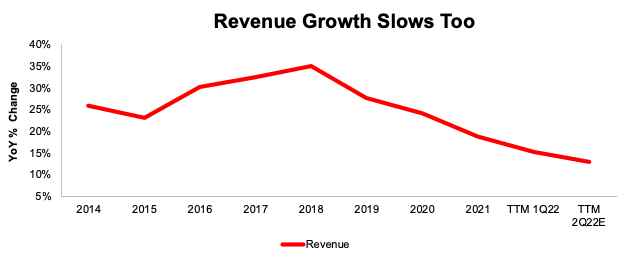

Income Progress Follows A Comparable Path

In its 1Q22 earnings press launch, Netflix acknowledged “excessive family penetration, mixed with competitors, is creating income development headwinds.” As well as, administration famous “the massive COVID enhance to streaming obscured the image till not too long ago.” Nonetheless, slowing income development is nothing new.

Actually, Netflix’s income development has fallen from 26% YoY in 2014 to fifteen% YoY within the TTM ended 1Q22. Administration’s steering implies income development falls even additional, to simply 13% YoY within the TTM ended 2Q22.

Determine 2: YoY Income Progress Fee Since 2014

NFLX Income Progress YoY Since 2014 (New Constructs, LLC)

Adverts To The Rescue? Or Simply Worse Consumer Expertise

Netflix, and significantly co-founder and co-CEO Reed Hastings, have lengthy been in opposition to an ad-supported Netflix. Nonetheless, after the subscriber miss and weak steering, that stance could also be altering. On the 1Q22 earnings name, Hastings famous that an ad-supported plan would section in over a few years, whereas stressing that buyers would nonetheless be capable of select an ad-free service.

Whereas an ad-supported service might assist the enterprise develop the top-line, customers largely do not get pleasure from ad-supported streaming platforms. An October 2021 survey by Morning Seek the advice of discovered of U.S. adults:

- 44% mentioned there are too many adverts on streaming providers

- 64% mentioned focused adverts are invasive

- 69% assume adverts on streaming providers are repetitive

- 79% are bothered by the expertise

Time will inform if customers flock to an ad-supported Netflix, however the knowledge signifies it might immediately create a worse expertise.

Prime-Line And Subscriber Progress Aren’t The Solely Points

Netflix faces a litany of challenges to show its cash-burning enterprise right into a money earner and justify the expectations baked into its inventory value. Under, we current a short abstract of these challenges. You will get extra in-depth particulars in our January 2022 report.

Netflix’s First Mover Benefit Is Gone

The streaming market is now dwelling to at the very least 15 providers with greater than 10 million subscribers, and plenty of of those opponents, similar to Disney, Amazon, YouTube (GOOGL), Apple, Paramount (PARA) and HBO Max (WBD) have at the very least one among two key benefits:

- worthwhile companies that subsidize lower-cost streaming choices

- a deep catalog of content material that’s owned by the corporate, moderately than licensed from others

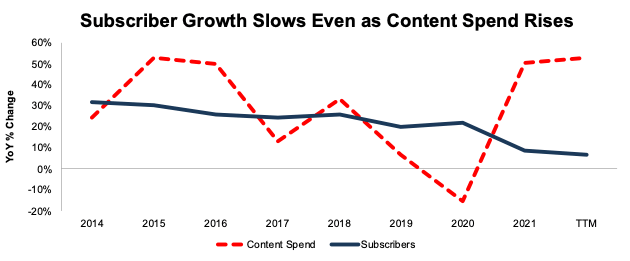

More durable To Hike Costs With So Many Low-Value Alternate options

We underestimated Netflix’s capability to boost costs earlier than, however now that competitors is flooding the market, our thesis is enjoying out as anticipated. Netflix’s projection for subscriber losses in 2Q22 signifies that its latest value hike, amidst a panorama of so many lower-priced alternate options, might have reached a ceiling for a way a lot customers can pay. Per Determine 3, Netflix now fees greater than each different main streaming service. For reference, we use Netflix’s “Normal” plan and the equal packages from opponents in Determine 3.

Determine 3: Month-to-month Value for Streaming Providers within the U.S.

Netflix Value Vs Competitors (New Constructs, LLC)

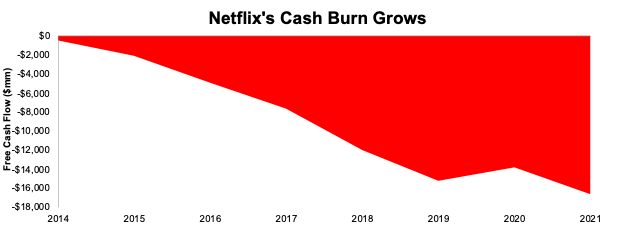

Cannot Have Progress And Money Flows

After constructive FCF in 2020, Netflix returned to its cash-burning methods, and generated -$2.8 billion in FCF in 2021. Since 2014, Netflix has burned by means of $16.6 billion in FCF. See Determine 4.

Determine 4: Netflix’s Cumulative Free Money Movement Since 2014

Netflix Money Burn Since 2014 (New Constructs, LLC)

Heavy money burn is more likely to proceed on condition that Netflix has one income stream, subscriber charges, whereas opponents similar to Disney monetize content material throughout theme parks, merchandise, cruises, and extra. Opponents similar to Apple, and Comcast/NBC Common (CMCSA) generate money flows from different companies that may assist fund content material manufacturing and decrease margins on streaming choices.

Enormous Crimson Flag – Subscriber Progress Fell Regardless of Content material Spend Rising

Netflix’s free money circulate was constructive in 2020 for the primary time since 2010. However constructive FCF comes virtually totally from Netflix reducing content material spending in the course of the COVID-19 pandemic. Netflix can not generate constructive FCF and improve content material spending.

Previously, we noticed a powerful relationship between content material spend and subscriber development. So, the spend appeared price it. As of yesterday’s earnings launch, we’re seeing that relationship break down.

Per Determine 5, even after considerably rising content material spend in 2021 and over the TTM, Netflix’s subscriber development continued to fall YoY. Contemplating the hyper-competitive, content material pushed nature of the streaming enterprise, a scarcity of subscriber development is a big pink flag. Throwing billions of {dollars} at content material is not going to be sufficient to fend off competitors, and even when spending closely on content material, new subscribers aren’t displaying up.

Determine 5: Change in Subscriber Progress & Content material Spend: 2014 – TTM

Netflix Subscriber Progress YoY vs Content material Spend YoY Change Since 2014 (New Constructs, LLC)

Lack Of Dwell Content material Limits Subscriber Progress

Netflix has traditionally stayed out of the dwell sports activities area, a stance that appears unlikely to alter. Co-CEO Reed Hastings acknowledged in mid 2021 Netflix would require exclusivity that’s not supplied by sport leagues with the intention to “supply our prospects a secure deal.” For customers that require dwell content material as a part of their streaming wants, Netflix is both not an possibility, or have to be bought as a complementary service with a competitor.

In the meantime, Disney, Amazon, CBS, NBC, and Fox (every of which has its personal streaming platform) are securing rights to increasingly more dwell content material, particularly the NFL and NHL, giving them a very talked-about providing that Netflix can not match. Extra not too long ago, Apple started broadcasting Friday Night time Baseball and it is reported that Apple is nearing a deal for NFL Sunday Ticket, which might solely bolster its dwell choices.

Netflix’s Present Valuation Implies Subscribers Will Double

We use our reverse discounted money circulate mannequin and discover that the expectations for Netflix’s future money flows look overly optimistic given the aggressive challenges above and steering for additional slowing in person development. To justify Netflix’s present inventory value of ~$220/share, the corporate should:

- keep its 5-year common NOPAT margin of 12% [1] and

- develop income 13% compounded yearly by means of 2027, which assumes income grows at consensus estimates in 2022-2023 and 12% every year thereafter (equal to 2022 income estimates)

On this situation, Netflix’s implied income in 2027 of $59.5 billion is 4.4x the TTM income of Fox Corp (FOXA), 2.1x the TTM income of Paramount World, 1.5x the mixed TTM income of Paramount World and Warner Bros. Discovery (WBD) and 82% of Disney’s TTM income.

To generate this stage of income and attain the expectations implied by its inventory value, Netflix would want:

- 335 million subscribers at a median month-to-month value of $14.78/subscriber

- 424 million subscribers at a median month-to-month value of $11.67/subscriber

$14.78 is the common month-to-month income per membership in america and Canada in 1Q22. Nonetheless, the vast majority of Netflix’s subscriber development comes from worldwide markets, which generate a lot much less per subscriber. The general (U.S. and worldwide) common month-to-month income per subscriber was $11.67 in 2021. At that value, Netflix wants to almost double its subscriber base to over 424 million to justify its inventory value.

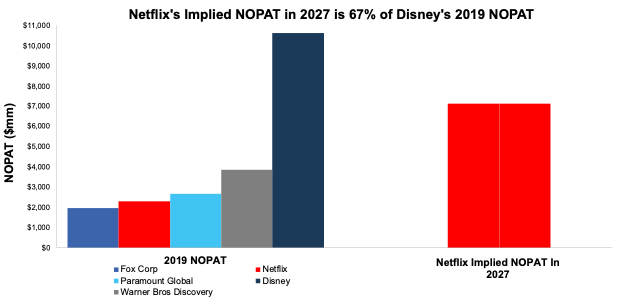

Netflix’s implied NOPAT on this situation is $7.1 billion in 2027, which might be 3.6x the 2019 (pre-pandemic) NOPAT of Fox Corp, 1.9x the 2019 NOPAT of Paramount World, 1.1x the mixed 2019 NOPAT of Paramount World and Warner Bros. Discovery, and 67% of Disney’s 2019 NOPAT.

Determine 6 compares Netflix’s implied NOPAT in 2027 with the 2019 NOPAT[2] of different content material manufacturing corporations.

Determine 6: Netflix’s 2019 NOPAT and Implied 2027 NOPAT vs. Content material Producers

NFLX DCF Implied NOPAT vs Friends (New Constructs, LLC)

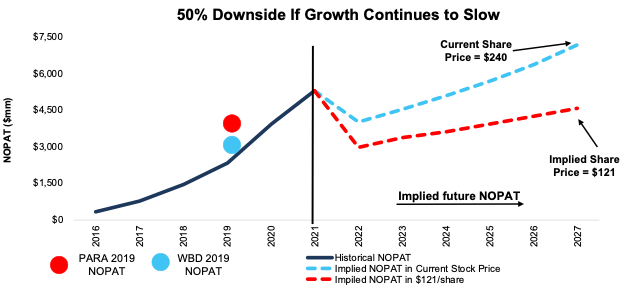

There’s Practically 50% Draw back If Margins Fall To Streaming Historical past Common

Ought to Netflix’s margins fall even additional given aggressive pressures, extra spending on content material creation, and/or subscriber acquisition, the draw back is even larger. Particularly, if we assume:

- Netflix’s NOPAT margin falls to 9% (equal to common since 2014) and

- Netflix grows income by 10% compounded yearly by means of 2027, (equal to administration’s guided YoY income development price for 2Q22) then

the inventory is price simply $121/share at present – a forty five% draw back. On this situation, Netflix’s income in 2027 could be $51.3 billion, which means Netflix has 289 million subscribers on the present U.S. and Canada common month-to-month value or 367 million subscribers on the total common income per subscriber of $11.67/month. For reference, Netflix had 222 million subscribers on the finish of 1Q22.

On this situation, Netflix’s implied income of $51.3 billion is 3.8x the TTM income of Fox Corp., 1.8x the TTM income of Paramount World, 1.3x the mixed TTM income of Paramount World and Warner Bros. Discovery and 70% of Disney’s TTM income.

Netflix’s implied NOPAT on this situation could be 2.3x the 2019 (pre-pandemic) NOPAT of Fox Corp., 1.2x the 2019 NOPAT of Paramount World, 70% the mixed 2019 NOPAT of Paramount World and Warner Bros Discovery, and 43% of Disney’s 2019 NOPAT.

Determine 7 compares the agency’s historic income and implied NOPAT for the eventualities above for instance the expectations baked into Netflix’s inventory value. For reference, we additionally embody the pre-pandemic NOPAT of Paramount World and Warner Bros. Discovery.

Determine 7: Netflix’s Historic NOPAT vs. DCF Implied NOPAT

NFLX DCF Implied NOPAT (New Constructs, LLC)

Perhaps Too Optimistic

The above eventualities assume Netflix’s YoY change in invested capital is 14% of income (half of 2021) in every year of our DCF mannequin. For context, Netflix’s invested capital has grown 40% compounded yearly since 2014 and alter in invested capital has averaged 26% of income every year since 2014.

It’s extra doubtless that spending will have to be a lot larger to attain the expansion within the above forecasts, however we use this decrease assumption to underscore the chance on this inventory’s valuation.

This text initially printed on April 20, 2022.

Disclosure: David Coach, Kyle Guske II, and Matt Shuler obtain no compensation to write down about any particular inventory, model, or theme.

[1] Assumes NOPAT margin falls to be nearer with historic margins as prices improve from pandemic lows. For instance, Netflix tasks working margin between 19-20% in 2022, down from 21% in 2021.

[2] We use 2019 NOPAT on this evaluation to research the pre-COVID-19 profitability of every agency, given the pandemic’s impression on the worldwide economic system in 2020 and 2021 and the opposite enterprise segments of those friends.