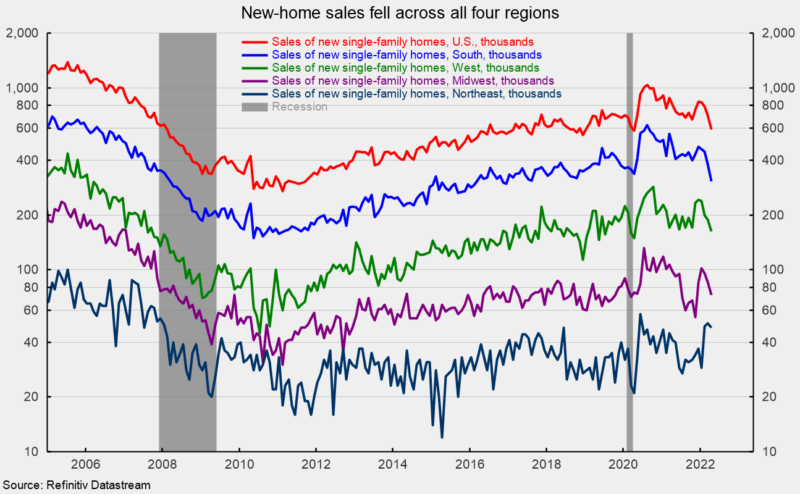

Gross sales of latest single-family houses plunged in April, declining 16.6 p.c to 591,000 at a seasonally-adjusted annual fee from a 709,000 tempo in March and simply barely forward of the 582,000 tempo on the backside of the lockdown recession. The April drop follows a ten.5 p.c decline in March, a 4.7 p.c fall in February, and a 1.0 p.c drop in January. The four-month run of decreases leaves gross sales down 26.9 p.c from the year-ago degree (see first chart). In the meantime, 30-year fastened fee mortgages had been 5.3 p.c in late Might, up sharply from a low of two.65 p.c in January 2021 (see first chart).

Gross sales of latest single-family houses had been down in all 4 areas of the nation in April. Gross sales within the South, the biggest by quantity, fell 19.8 p.c whereas gross sales within the Midwest dropped 15.1 p.c, gross sales within the West decreased 13.8 p.c and gross sales within the Northeast, the smallest area by quantity, sank 5.9 p.c for the month. From a yr in the past, gross sales had been up 17.1 p.c within the Northeast however had been off 12.4 p.c within the West, down 25.5 p.c within the Midwest, and off 36.6 p.c within the South to the bottom degree since December 2016 (see second chart).

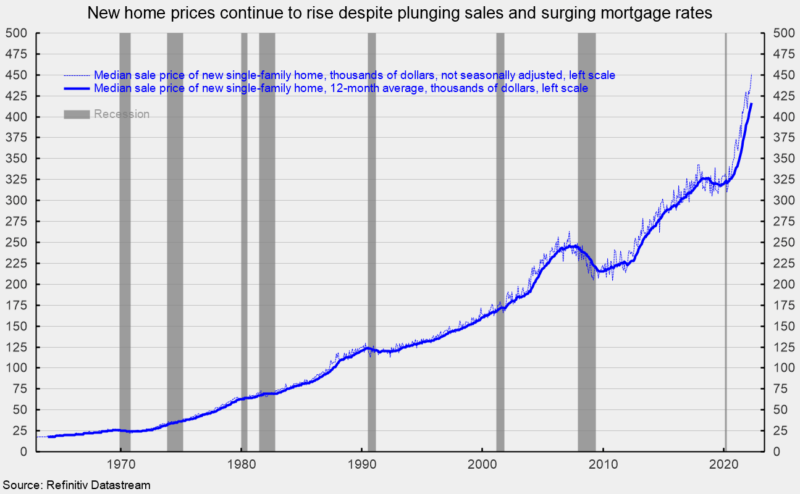

The median gross sales worth of a brand new single-family dwelling was $450,600 (see third chart), up from $435,000 in April (not seasonally adjusted). The acquire from a yr in the past is nineteen.6 p.c versus a 21.0 p.c 12-month acquire in April. On a 12-month common foundation, the median single-family dwelling worth continues to be at a document excessive.

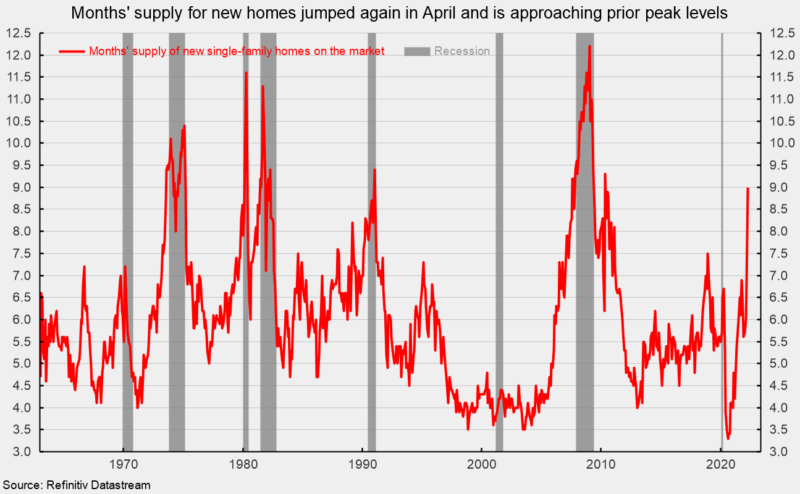

The overall stock of latest single-family houses on the market jumped 8.3 p.c to 444,000 in April, placing the months’ provide (stock occasions 12 divided by the annual promoting fee) at 9.0, up 30.4 p.c from April and 91.5 p.c above the year-ago degree (see fourth chart). The months’ provide is at a really excessive degree by historic comparability and is approaching peaks related to prior recessions (see fourth chart). The plunge in gross sales, excessive months’ provide, and surge in mortgage charges ought to weigh on median dwelling costs in coming months and quarters. Nevertheless, the median time in the marketplace for a brand new dwelling remained very low in April, coming in at 2.8 months versus 3.9 in March.