Nike, Inc. (NYSE: NKE) has long been ruling the sportswear market but the company had its share of problems when headwinds like the pandemic and economic slowdown hit the business world. However, the sneaker giant effectively navigated through the challenges on the strength of its scale and robust portfolio.

Stock Rallies

Nike’s stock rallied after it reported first-quarter results this week. A few months ago, NKE entered a downward spiral as it failed to maintain momentum after making a strong recovery from the lows experienced more than a year ago. The shares have lost about 45% since peaking in November 2021. Currently, it is more favorably priced than at any time in the recent past, offering a rare buying opportunity that long-term investors wouldn’t want to miss. The company’s board has been raising the dividend regularly every year – currently, the yield is 1.3%.

Nike’s strong earnings performance and favorable inventory position have helped allay fears of a sales slowdown. In a testament to the strong demand for athleisure products, rival apparel brand Skechers is doing quite well both at the bourses and in terms of financial performance, often beating the market. However, the power of the Nike brand and aggressive innovation, an area where the company lagged in the past, should enable Nike to stay on the top in the foreseeable future.

Good and Bad

In general, apparel companies are seeing an uptick in margins as shipping costs, which escalated in the pandemic era, are declining and have almost reached the pre-COVID levels. But unlike others, being a global player, Nike’s profits are often impacted by unfavorable foreign exchange rates. Also, the economic slowdown in China, a key market for Nike, will be a drag on the company’s sales in the near term.

From Nike’s Q1 2024 earnings call:

“As the global athletic market leader, our scale and portfolio allow us to create an impact that only NIKE can. Consumers all over the world recognize NIKE as the number one champion for athletes and sports, as we fuel inspiration and push the limit of human potential with the industry’s most innovative products. Over the past few years, we’ve navigated through an unprecedented external environment. We’ve worked through many challenges, societal, geopolitical, global health, supply chain, and more. And during this time NIKE has grown larger and stronger.”

Mixed Q1

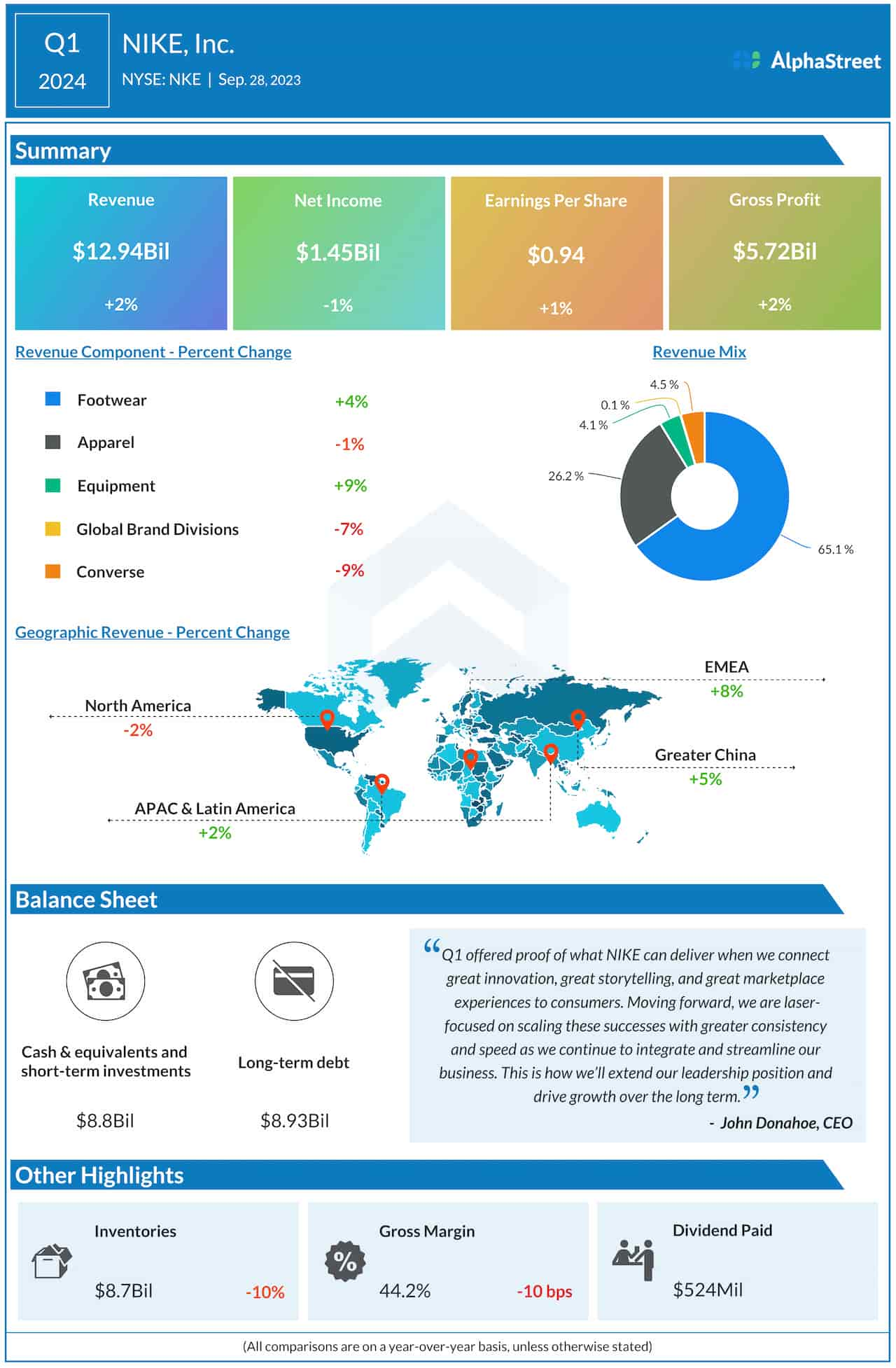

First-quarter revenues advanced to $12.94 billion from $12.69 billion in the same period of the previous year but fell short of expectations, marking the first miss in about two years. Sales in the Footwear segment, which accounts for around 65% of the total, increased by 4%. Net income came in at $1.45 billion or $0.94 per share in the August quarter, compared to $1.47 billion or $0.93 per share a year earlier. The bottom line came in above experts’ estimates. Encouraged by the double-digit growth in the running shoes category, the company is deepening its focus on serving all segments of that community.

The stock got a much-needed boost soon after the earnings announcement. The shares maintained the uptrend and traded up 6% on Friday afternoon.