Kizel/iStock via Getty Images

The Background

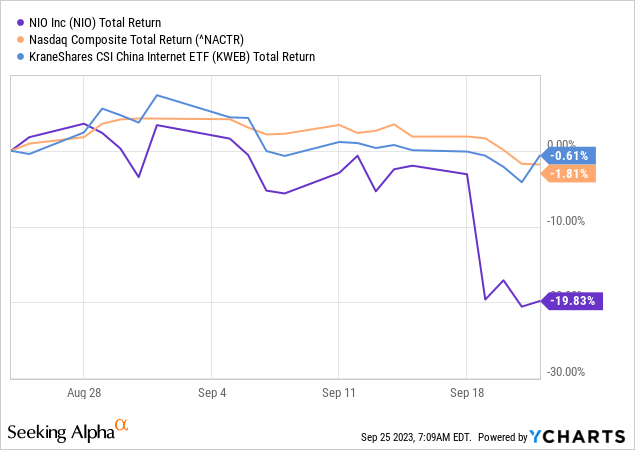

I have been covering NIO Inc. (NYSE:NIO) since November 2022, when 1 share was worth $11.34, and since then the stock price has fallen over 25%, and the recent rebound brought shareholders nothing but disappointment:

Seeking Alpha, my coverage of NIO stock

The stock’s decline has intensified significantly in recent weeks, and judging by the strength of the decline, it was not due to weakness in Chinese stocks or the high tech sector as a whole.

So, why is NIO correcting so much and does the stock have a chance to get out of this situation? In my opinion, NIO does have a chance, but a much more likely scenario for the development of events in the foreseeable future, in my opinion, is the continuation of the correction that has begun.

Why Do I Think So?

More than 3 months have passed since my last article on NIO, and in that time a lot of new information has surfaced that needs to be considered first.

On June 20, Bank of America’s analysts became more optimistic about NIO’s future sales, especially for the ET5 Touring model. At the time, NIO aimed for 10,000 sales in June and around 20,000 per month in the latter half of the year. They planned to open more test drive pop-up stores. There were some gross margin pressure concerns, but despite them, Bank of America maintained a Buy rating on the stock with a $11 price target due to NIO’s strong position in the premium smart EV segment, consistent model launches, and a focus on autonomous driving, powertrain, and charging solutions.

On the same date, we found out that NIO had secured a $738.5 million investment from CYVN Holdings, primarily owned by the Abu Dhabi Government. CYVN Holdings wanted to acquire 84.7 million newly issued class A ordinary shares of Nio at a per-share price of $8.72. Additionally, CYVN Holdings had an agreement to purchase 40.1 million Nio shares from a Tencent affiliate. Following this transaction, CYVN would hold ~7% of Nio’s shares and could nominate one director to Nio’s board if it maintained a 5% ownership stake. They also planned to collaborate on international business opportunities.

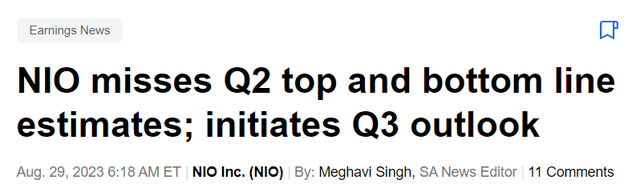

On July 1st, NIO reported delivering 10,707 vehicles in June 2023, totaling 23,520 deliveries for Q2. June’s deliveries included 6,383 premium electric SUVs and 4,324 premium electric sedans. This marked a 74% increase compared to the previous month but a 17.4% decrease YoY. These Q2 deliveries were at the lower end of their guidance. Nio also began delivering its All-New ES8 flagship SUV at the end of June. The year-over-year drop in June deliveries aligns with Xpeng (XPEV) but differs from Li Auto (LI) deliveries.

It seems to me that a number of the above-mentioned positive news from the company, its Arab partners, as well as one of the largest investment banks triggered a sharp increase in the stock price in July-August 2023 – this conclusion is confirmed chronologically:

Seeking Alpha News, June 20, 2023

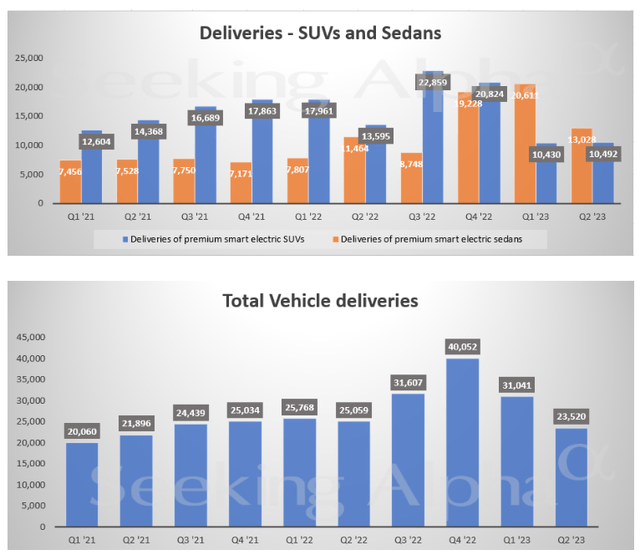

However, by August, NIO’s growth began to weaken. Weak macro data on the Chinese economy were released in early August, and by the end of the month, NIO missed both the top and bottom line estimates:

Seeking Alpha News, NIO

NIO’s Q2 2023 results showed a Non-GAAP EPADS of -$0.45, missing expectations by $0.04. Revenue reached $1.21 billion, a 14.8% YoY decline, missing by $60 million. Vehicle deliveries in Q2 totaled 23,520 units, comprising 10,492 electric SUVs and 13,028 electric sedans, marking a 6.1% decrease from Q2 2022 and a 24.2% drop from Q1 2023. Vehicle sales for Q2 were $990.9 million, down 24.9% YoY and 22.1% QoQ. The vehicle margin in Q2 2023 was 6.2%, contrasting with 16.7% in Q2 2022 and 5.1% in Q1 2023.

Seeking Alpha data

Looking ahead to Q3 2023, NIO anticipated delivering between 55,000 and 57,000 vehicles, representing a 74.0% to 80.3% increase from the same quarter in FY2022. They also expected total revenues to range between RMB 18,898 million ($2,606 million) and RMB 19,520 million ($2,692 million), reflecting a 45.3% to 50.1% growth compared to Q3 2022, Seeking Alpha News reported.

On September 1st, we found out that NIO had achieved a cumulative delivery milestone of 383,908 vehicles as of August 31, 2023, delivering 19,329 vehicles [+81.0% YoY, but -5.5% QoQ]. In about 2 weeks after that news came out, NIO announced a proposed offering of $500 million in convertible senior notes due in 2029 and another $500 million in convertible senior notes due in 2030, intending to use part of the net proceeds to repurchase some of its existing debt securities, with the remainder allocated for bolstering its balance sheet and general corporate purposes.

On September 21, NIO announced the launch of a high-end smartphone designed to be used with its electric cars.

In my opinion, the QoQ decline in deliveries [and the earnings miss], the new mezzanine financing, and the shift in development focus [from EVs to smartphones] were the turning point for the reversal of the optimism rally for NIO – again, this is confirmed chronologically:

Seeking Alpha News, August 29, 2023

I am not a shareholder of NIO Inc., but if I were an investor in the company, I would ask a logical question: What’s happening with management’s strategic vision?

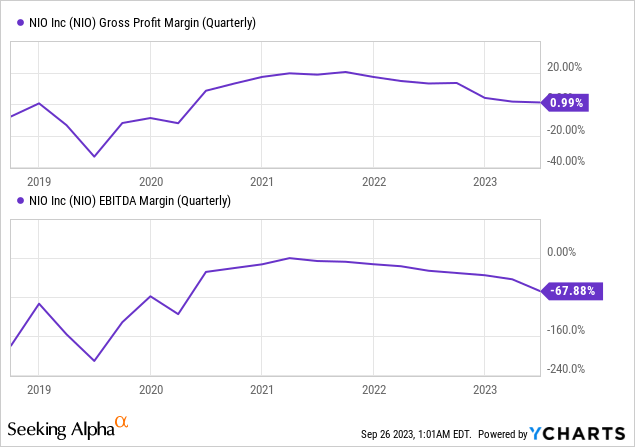

The company’s key margins remain poor and continue to decline since their peak levels of FY2022:

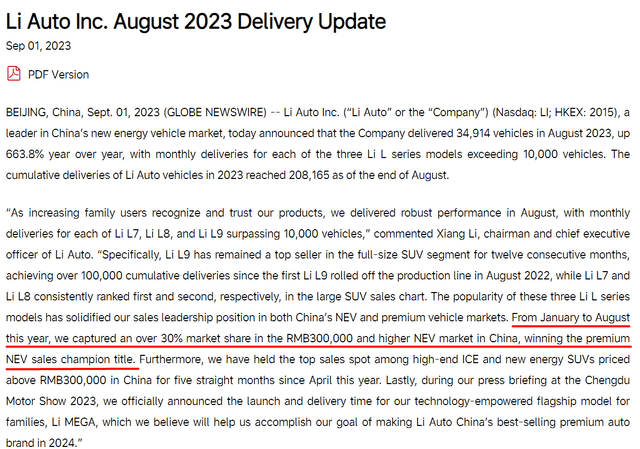

Judging by the QoQ dynamics of deliveries, NIO still can’t show growth while other competitors are doing much better – take Li Auto for example.

LI Auto’s press release, author’s notes

And while NIO continues to burn investors’ money while attracting more and more capital that will most likely be burned for several years as well, management announces the creation of a smartphone.

What do you think: Why doesn’t Tesla (TSLA) make its own smartphones? I think this is a very complex manufacturing process that, when combined with another complex manufacturing process such as electric vehicle manufacturing, threatens the overall operational efficiency of the company that dares to do this.

NIO is deeply unprofitable, with expanding negative EBITDA margin, QoQ delivery declines, weak Chinese economy, and extremely fierce market competition, attracting hundreds of millions of dollars in new mezzanine capital, and announcing that it will severely complicate its operating activities, as if hinting to investors that they need not wait for positive margin growth in the foreseeable future.

For this reason, I remain very skeptical about NIO’s prospects: the recent corporate actions show me that the risks have shifted even more to the negative, and at the same time, I don’t think much growth potential has been added. I don’t understand why you need a separate smartphone when you can get by with an ordinary application if the goal is to control the car remotely to make it more convenient for drivers.

The Bottom Line

Of course, there are risks to my thesis. First of all, this stock is heavily oversold, and there is already a lot of negativity in its price. If management makes any kind of announcement (e.g., canceling the development of a smartphone with new investor money) or shows strong quarterly growth numbers in deliveries or financials, the NIO stock could be back up to the $10-11 price range in short order. Second, I may be misreading the situation surrounding recent corporate events: Perhaps after some time, NIO will prove that the recent news was not negative at all but rather foreshadowed a qualitative turnaround in this growth story.

That said, I still have to rate NIO stock a “Sell” because I think the risks have only increased recently, but the growth potential has remained unchanged.

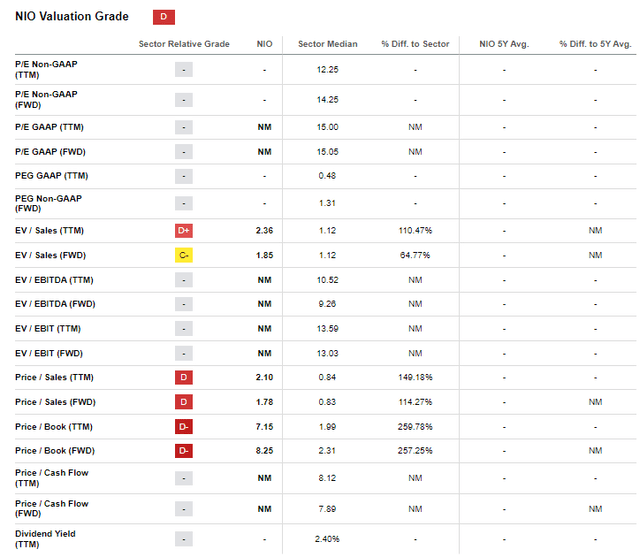

When people say that NIO is a cheap company because it has a price-to-sales (P/S) ratio of less than 2x, I smile because I know that there is nothing more to valuation multiples than P/S and P/B:

Seeking Alpha, NIO’s Valuation

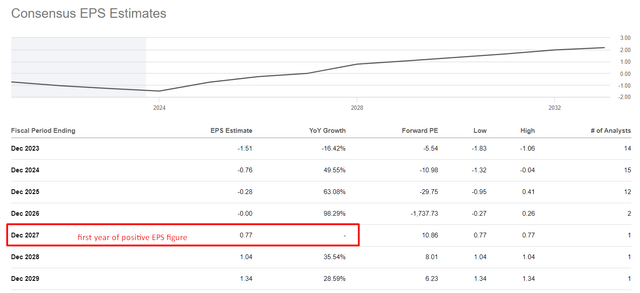

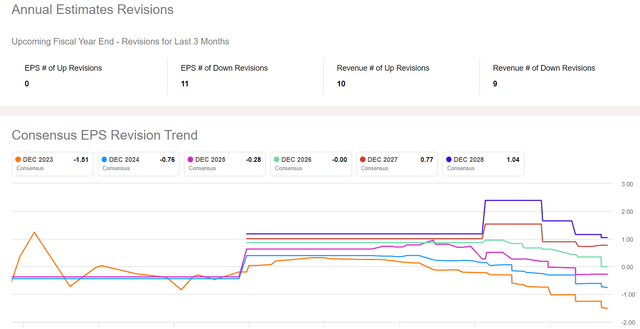

At the same time, the company will not become profitable until 2027 – and we know that analysts keep lowering their forecasts. I wrote about this risk in my last articles on NIO, and what actually started to happen this year.

Seeking Alpha, author’s notes Seeking Alpha

Unfortunately, many seem to forget that the car business is a tough place – both in terms of competition and production processes. Here, every venture must be justified, or the market will punish you. Unfortunately, in my opinion, the time of punishment for NIO is getting closer and closer.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.