PeopleImages/iStock by way of Getty Photos

On Holding AG (NYSE:ONON) via “On-Operating” is a Switzerland-based athletic attire model that has made a reputation for itself with high-performance trainers. Using a wave of name momentum, the corporate launched its IPO in 2021 on the heels of robust development with a formidable world growth technique.

That mentioned, shares have been beneath stress in opposition to a lofty valuation amid the broader market selloff amongst “high-growth” names. Considerations associated to the power in client spending as a worldwide theme have additionally added to uncertainty in regards to the firm’s near-term outlook. We anticipate shares to stay unstable with dangers seemingly tilted to the draw back over the subsequent a number of quarters in what we see as a harder working atmosphere.

In search of Alpha

ONON Earnings Recap

On-Operating began again in 2010 and is acknowledged for its “Cloudtec” and “Speedboard” sequence of shoe know-how with a patented sole design. The corporate was the official clothes shop of the Swiss Olympic Staff and counts on a gaggle of sponsored world-class athletes that endorse the product. The corporate has established a worldwide presence partnering with main specialty retailers whereas additionally specializing in its direct-to-consumer (DTC) enterprise. Total, the model is positioned towards the premium and high-end aspect of the class which is mirrored in its retail pricing.

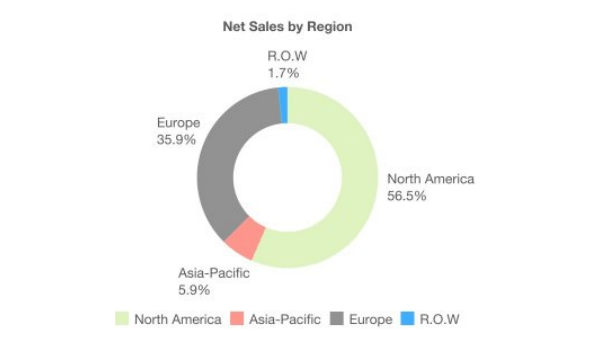

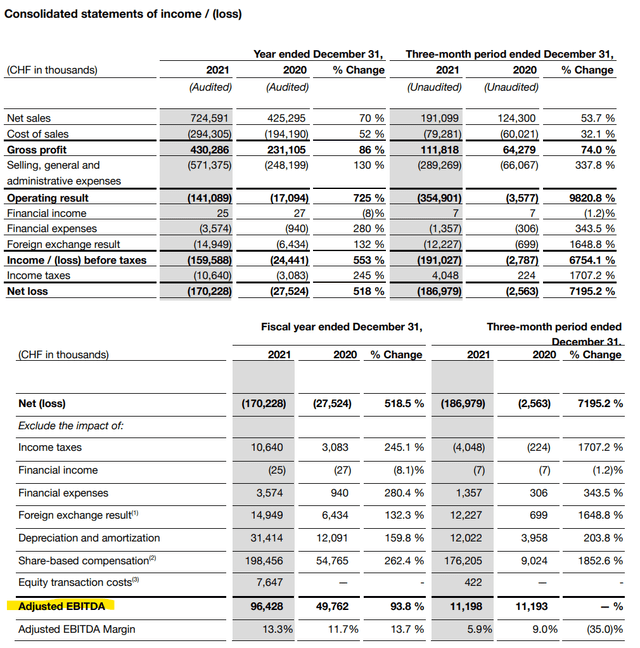

As talked about, development has been stable with the corporate final reporting its This autumn ends in late March highlighted by gross sales climbing 54% year-over-year and 100% simply in North America which now contributes to about 57% of the whole. For the full-year 2021, internet gross sales elevated 70% to CHF 724.6 million representing roughly $780 million. Administration famous the power of the DTC channel based mostly on its e-commerce platform added to margins. The gross revenue margin for the 12 months elevated to 59.4% from 54.3% in 2020.

supply: firm IR

Regardless of a internet loss for the 12 months of CHF -170 million as the corporate continues to put money into development, On Holding was in a position to attain non-GAAP EPS of $0.15 which excludes IPO-related bills and share-based compensation. Equally, the 2021 adjusted EBITDA at CHF 96.4 million, was up 93% y/y. Then again, the adjusted EBITDA margin throughout This autumn slipped to five.9% from 9% within the interval final 12 months reflecting some increased prices associated to logistics and provide chain constraints.

supply: firm IR

On Trainers are manufactured in Vietnam whereas roughly 25% of attire and equipment are made in China. The corporate is on monitor to develop manufacturing at a facility in Indonesia this 12 months as a part of its development technique. Nonetheless, the corporate expects provide chain constraints to be a recurring problem together with increased charges for sea and air freight.

Throughout the 2022 steerage, the corporate sees a 700-800 foundation level headwind in opposition to the gross margin from 2021 ranges contemplating general increased prices. Nonetheless, the expectation is for “hypergrowth” into the second half of the 12 months to fulfill rising client demand for ON merchandise. Administration is anticipating gross sales to achieve CHF 990 million this 12 months, representing a 37% enhance from 2021. The goal for adjusted EBITDA at CHF 130 million, if confirmed, could be a rise of 35% y/y.

Lastly, with proceeds from the IPO, we notice that On Holding ended the 12 months with CHF 653 million in money in opposition to CHF 163 million in long-term monetary debt. We view the stability sheet and liquidity place as a robust level within the firm’s funding profile.

Is On Holding Overvalued?

The expansion tendencies for ON Operating communicate for themselves. The corporate has been profitable in connecting with its goal clients and pushing the boundaries between merely being a footwear maker right into a broader way of life model.

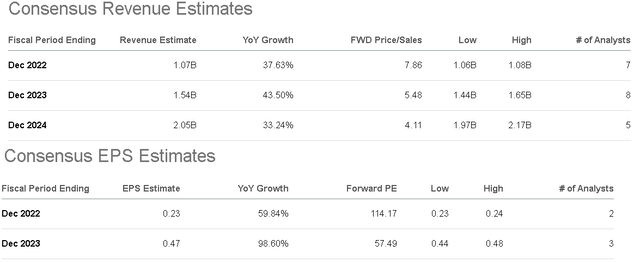

Trying on the present consensus estimates, expectations are excessive with the market forecasting income development to common almost 38% per 12 months via 2024 whereas EPS ramps up in direction of a forecast for $0.23 this 12 months and $0.47 by 2023.

In search of Alpha

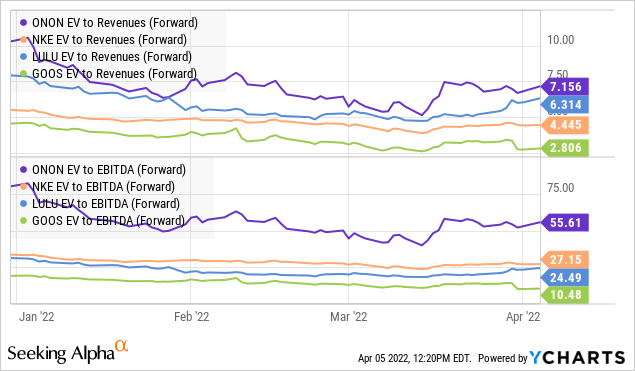

Nonetheless, there are causes to be skeptical. Anybody following the attire business can look again at a number of high-flying rising client manufacturers that merely weren’t in a position to stay as much as the hype. Shares of Below Armour Inc (UA) and even Canada Goose Holdings Inc (GOOS), for instance, have confronted spectacular selloffs from their highs, and function a warning on the problem of actually breaking via into the mainstream and justifying a valuation premium.

For On Operating, the bullish case is that it could compete and in the end seize market share from the worldwide leaders within the sportswear class together with Nike Inc (NKE), Adidas AG (OTCQX:ADDYY), and even Lululemon Athletica Inc (LULU). As nice as their footwear could also be, each model can declare to have “the very best” and quite a lot of it comes right down to advertising. The purpose right here is to say that On Holding nonetheless has lots to show.

Whereas we’re certain the corporate is ok and can discover its place over the long term, the problem for the inventory comes right down to the present valuation. Contemplating the 2022 consensus estimates, ONON at a 7x EV to ahead income a number of and 56x EV to ahead EBITDA, trades at a premium to sportswear business comparables.

Giving the corporate the advantage of the doubt that it’ll attain 2022 targets, the consensus name for the corporate to greater than double revenues in direction of $2 billion by 2024 is a stretch in our opinion. The perception we provide is that roughly 93% of present gross sales are based mostly on footwear. From there, On Holding might want to considerably develop its attire choices to maintain its excessive development fee. That may very well be an issue as a result of it might find yourself dragging margins decrease if the corporate is not in a position to transfer the merchandise at comparable markups to a wider group of consumers.

Ultimate Ideas

With shares of On Holding down by almost 60% from a excessive in November of 2021, our name is that it is most likely too late to try to quick the inventory. We fee ONON as a maintain, balancing the robust working momentum in opposition to what we consider remains to be an expensive valuation with loads of dangers tilted to the draw back.

Via 2022, the potential that client spending will get hit by elevated inflation or weaker macro development can open the door for the corporate to underperform expectations. Monitoring factors for the subsequent few quarters embrace the development within the gross margin and the adjusted EBITDA metric.