What’s the actual ‘state of Open Banking’?

Two and a half years into Open Banking, you would be right to ask how things are going.

The expectation, or hope, was one of widespread adoption after a few years – we’re not quite there yet.

But how are things really going? Which banks’ data is readily available for use? What’s the quality of that data? And who is offering Open Banking powered services to consumers today?

Although many answers to these questions are circulating, they’re not all based on facts. So, using data from our Open Banking platform, extensive consumer research, deep industry relationships, and years of operational experience, we set out to separate fact from fiction and bust some Open Banking myths!

Data availability in Open Banking

Myth #1 – Most banks and financial products aren’t available via Open Banking

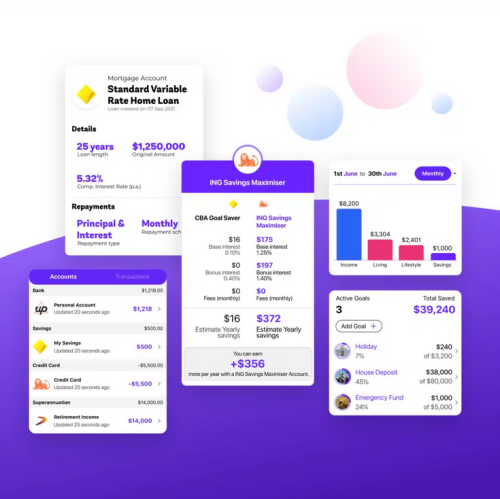

Open Banking launched in Australia on 1 July 2020, with only the Big Four banks and a few financial products available. In the two and a half years since, the regime gradually expanded to what it is today: more than 110 banks share data for over 30 financial products.

From transaction and savings accounts to mortgages and personal loans – they’re all available via Open Banking. A significant milestone was on 1 October 2022, when data-sharing obligations for joint accounts kicked in for non-major banks, and the initial Open Banking roll-out was completed.

The Treasury estimates Open Banking currently covers over 99% of all household deposits in Australia.

What’s more, some providers that weren’t available via traditional ways of data sharing, like Up, HSBC, Wise and Paypal, are available via Open Banking. And, as more banks implement security measures to combat Electronic Data Capture, aka screen-scraping, Open Banking is becoming the standard on which businesses can rely.

There are still some gaps, though: Non-bank lenders, Buy-Now-Pay-Later, pay-day lenders and superannuation providers aren’t available via Open Banking yet, though they will likely be added with ‘Open Finance’.

The Open Banking user experience

Myth #2 – Open Banking is unreliable and slow, and lots of data is missing

We’ll break this up into a) the ability to get the data (fast) and b) the quality of the data.

a) Speed and reliability of Open Banking data

To build a successful Open Banking use-case, reliability is critical. Open Banking can significantly streamline a loan application, but not if the customer gets stuck linking their bank account. Or if it takes too long to retrieve the data.

So, how reliable is Open Banking? The only way to know for sure is by looking at the data. Having made more than 90% of all Open Banking API calls in Australia to date, Frollo has an excellent dataset to evaluate speed and reliability.

And this data shows us that we reliably get transaction data from Open Banking in under 1 second. So while a small minority of Data Holders are slow, unreliable or both, most are fast AND reliable.