MF3d/iStock by way of Getty Pictures

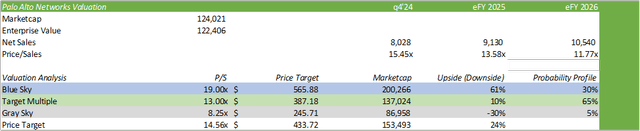

Palo Alto Networks (NASDAQ:PANW) is realizing the power of platformization adoption as extra firms transition from a single-point answer to complete platform adoption. Given the growing pattern the agency is realizing, I imagine this could drive vital development whereas bolstering margins within the coming quarters as Palo Alto continues to execute on new buyer adoption. Regardless of the difficult macroeconomic setting, I imagine there can be a driving power behind continued cybersecurity adoption, particularly with Palo Alto’s launch of their Prisma Entry Browser, which has the potential to cut back buyer TCO by 80%. I reiterate my BUY ranking for PANW shares with a worth goal of $433/share at 14.56x eFY26 worth/gross sales.

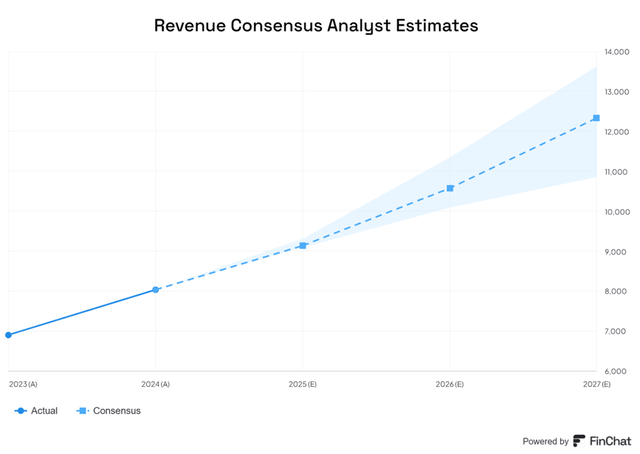

FinChat

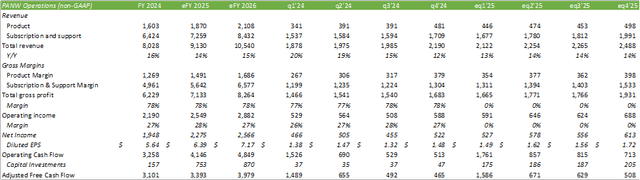

Palo Alto Networks Operations

Palo Alto is realizing the power of platformization as extra prospects flip from single-point options to platformization. Administration cited one in all their largest, excessive 8-figure offers with Schlumberger (SLB), who signed on with all three platform choices. Schlumberger was beforehand an present firewall and XSOAR buyer, broadened their cybersecurity funding with Palo Alto Networks to increase their firewall footprint and add Prisma Entry and Prisma Cloud.

It’s changing into extra prevalent that prospects are turning from single-point options to purchasing into the full platform, or multi-platforms, that Palo Alto has to supply. Palo Alto added 90 new platform prospects in this autumn’24 alone and now has over 1,000 of their largest 5,000 prospects below the platform mannequin. Palo Alto’s total purpose is to transform single-point prospects to a single platform and drive enlargement into changing into multiplatform prospects. The enterprise case is sensible. As administration had specified by their ready remarks for this autumn’24, breach remediation with Palo Alto’s platform has decreased publicity from days to minutes and hours.

Considered one of Palo Alto’s touchdown instruments is their SASE, which grew 40% in FY24. Over a 3rd of SASE prospects had been new to Palo Alto and might doubtlessly transition to investing within the broader platform. I imagine one of many largest drivers for adoption of Palo Alto’s SASE providing is that enterprises proceed operating the hybrid work setting, which can pose as a safety problem as extra gadgets acquire entry behind the firewall. Palo Alto modified the sport in this autumn’24 with the launch of their Prisma Entry Browser, which primarily cuts out the intermediary of utilizing a 3rd social gathering browser and URL filter by combining all of the options into one bundle. Palo Alto boasts that their browser elevated purposes’ efficiency by 5x and supplied prospects 80% much less TCO (complete value of possession) with carry your personal machine. This may doubtlessly enhance the client expertise considerably within the occasion of leveraging non permanent employees or contract labor.

The agency can also be beefing up their subscription choices with their “superior” options. This contains Superior URL Filtering, Superior WildFire, and Superior DNS Safety. Superior URL Filtering was launched in this autumn’24 and is anticipated to start ramping in eFY25. In complete, Prisma Cloud has 14 modules for patrons to select from to bolster their safety posture. With their current acquisition of Dig Safety, Palo Alto launched their information safety posture administration module, which helps combine information safety inside Prisma Cloud. Palo Alto additionally launched AI safety posture administration as their 14th module. Given the recognition of GenAI purposes within the office, Palo Alto created an approval listing for the 136 out there GenAI apps, with 54 allowed and 82 blocked. Ideally, this can assist forestall information loss and defend towards malicious responses to make sure a secure and efficient adoption of GenAI within the office.

One issue that brings a sure attraction is Palo Alto’s acquisition of QRadar from IBM and the related partnership. QRadar is anticipated to carry $10s of tens of millions in income in eFY25 as prospects transition from the legacy SIEM to XSIAM. I imagine this deal has the potential of changing a very good proportion of those prospects from single-point options to investing in a complete platform answer supplied by Palo Alto, particularly post-XSIAM conversion. IBM (IBM) may also be working with Palo Alto in cross-selling Palo Alto’s platform choices as a most well-liked safety answer. Regardless of Palo Alto not essentially receiving a technological benefit on account of the acquisition, Palo Alto will acquire entry to a brand new buyer base with the inclusion of extra offers pushed by IBM. So, regardless of the deal solely bringing south of $100mm in annual income, the potential for land-and-expand offers considerably extra worth.

Palo Alto Networks Financials

Company Stories

Waiting for eFY25, I imagine Palo Alto will notice 14% top-line development and scaled development in eFY26 on account of their partnership with IBM and rising platform adoption. I imagine top-line development can be pushed by each these endogenous components plus extra exogenous components comparable to growing nation-state threats as international stability stays in flux. I anticipate this scaled development can be mirrored throughout working margins as extra subscription-based companies are adopted on account of platformization. Administration can also be implementing AI options internally to enhance operational effectivity that will end in a leaner and simpler group. One instance administration offered was of their AI worker expertise that automates IT-related tickets. This characteristic is anticipated to alleviate their service desk operations by 80%.

For eq1’25, I’m forecasting $2.12b in income and $1.49/share in adjusted diluted EPS. For eFY25, I’m forecasting $9.13b in income and $6.39/share in adjusted diluted EPS.

Dangers Associated To Palo Alto Networks

Bull Case

Palo Alto Networks is realizing power by scale as prospects transition from single-point options to complete platformization. Superior options comparable to their net browser presents prospects a powerful cost-savings enterprise alternative as workers will not require a company-issued laptop computer or PC in sure circumstances because the characteristic protects the corporate on the endpoint. CrowdStrike’s (CRWD) current Home windows incident could draw additional curiosity in Palo Alto’s choices because the agency permits prospects better management over system updates. Additional AI adoption on the office could drive development for Palo Alto’s associated subscription choices.

Bear Case

Extra cybersecurity firms are following go well with with the platformization mannequin and will deter prospects from switching over. This partly could also be pushed by the present macroeconomy setting and will push enterprises to contemplate remaining on their present platform. The current jobs revision might also create some insights to the macro setting and will counsel headcount will not be as sturdy as anticipated, resulting in fewer endpoints that want safety on the enterprise stage. CrowdStrike reported sturdy development of their q2’25 earnings outcomes, suggesting that the affect wasn’t as unhealthy as initially anticipated.

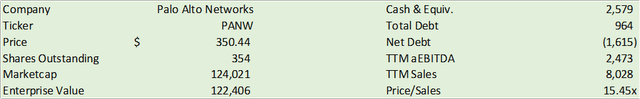

Valuation & Shareholder Worth

Company Stories

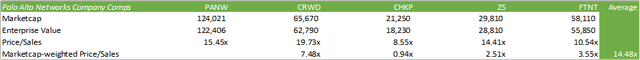

PANW shares presently commerce at 15.45x trailing worth/gross sales, a premium to its cybersecurity friends and a reduction to platform competitor CRWD.

In search of Alpha

Given Palo Alto’s development initiatives, I imagine PANW shares could notice some convergence in direction of CRWD on account of better platform adoption. Given this issue, I’m growing the highest buying and selling a number of in my valuation desk to 19x as a excessive goal for PANW shares to commerce at. Utilizing a mean chance of the array of historic buying and selling multiples plus the worth convergence issue, I fee PANW shares with a BUY ranking with a worth goal of $433/share at 14.56x eFY26 worth/gross sales.

Company Stories