Justin Sullivan/Getty Photographs Information

PayPal (NASDAQ:PYPL) shares could also be heading greater after the corporate studies first-quarter outcomes on April 27. At the very least, that is what somebody is betting on. It is undoubtedly a contrarian take, however simply have a look at how a lot the inventory has fallen from its July 2021 peak. PayPal as soon as traded at greater than $300 and is now buying and selling almost 70% off these highs at $89.

The corporate’s market cap as soon as stood at $360 billion. Now, that market cap is at $103 billion. This was a inventory that had an even bigger market cap than Financial institution of America. It is not to say that buyers had it proper; they did not, and the valuation made little or no sense on the peak. However markets could be irrational when shares are rising; in addition they could be irrational when shares are falling. Subsequent week’s earnings will inform us quite a bit in regards to the inventory from a rational or irrational perspective.

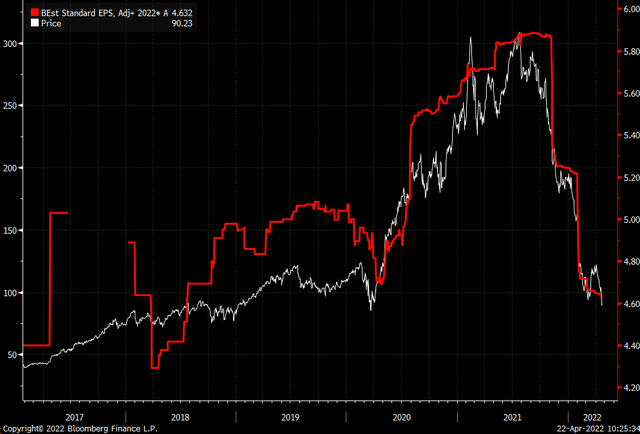

Bloomberg

Expectations for PayPal are very low, with analysts forecasting earnings to have dropped by a shocking 28.1% to $0.88 per share within the first quarter. In the meantime, income is predicted to have elevated by 6.1% to $6.4 billion. Earnings estimates for the 12 months even have collapsed and are mirrored within the inventory worth. What’s gorgeous is that in September 2019, analysts noticed this firm incomes $5.08 per share by the tip of 2022. Now analysts see the corporate making much less in 2022, simply $4.63 per share.

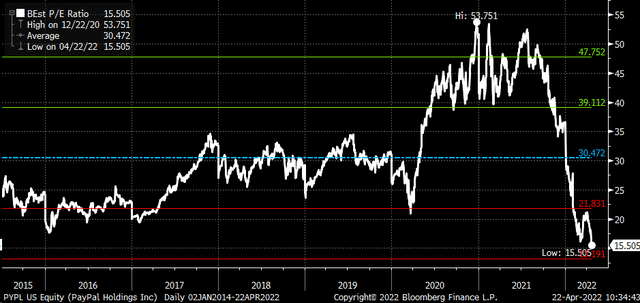

Bloomberg

Consequently, the inventory is buying and selling at its lowest PE ratio since coming public in late 2015. There’s quite a lot of dangerous information priced into this inventory, and until earnings proceed to drop, it seems to be too low-cost. That may make the corporate steering key, and if the corporate provides steering that is in keeping with full-year 2022 estimates, then the inventory in all probability rebounds following outcomes.

The traditionally low PE ratio signifies that the market would not imagine the present estimates that analysts have laid out and that these estimates will proceed to drop. That is why this firm wants to point out that its outlook is not getting worse and has, on the very least, stabilized.

Analysts estimate income will develop 13.9% to $7.1 billion for the second quarter, and earnings will drop by 2.6% to $1.12 per share. The total-year estimates are for income development of 15.5% to $29.3 and earnings to develop by 70 bps to $4.63 per share.

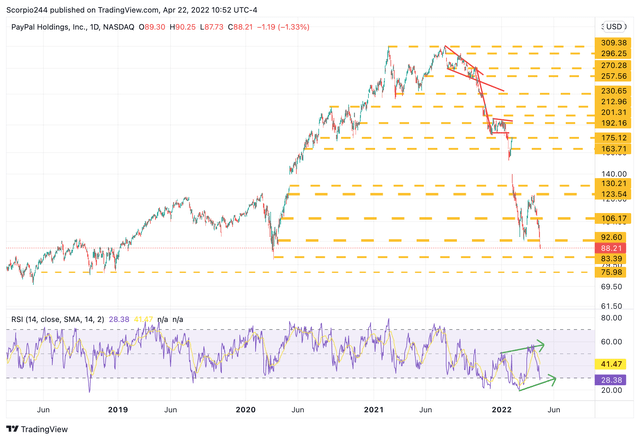

Bloomberg

Hoping For A Miracle

The dire outlook has somebody putting a slightly giant wager that issues aren’t as dangerous as they appear for PayPal. The open curiosity for the Might 20 $100 calls and places rose by nearly 10,000 contracts every on April 20. The information reveals the calls have been purchased on ask for $9.55 per contract, in the meantime, the places have been traded on the mid-point for $5 per contract. In accordance with the info, the dealer paid $4.55 per contract, which signifies the dealer took within the $5 put premium and that these put contracts have been offered. It is a bullish wager and means that PayPal is buying and selling at over $104.55 by the expiration date.

Close to Pandemic Lows

The inventory has been trending decrease and heading towards its pandemic lows of $83.40. If that stage breaks, the subsequent assist stage is at $76. However there are some indicators of a bullish divergence forming, with the RSI making the next excessive and its potential to make the next low. It could possibly be the early signal of the inventory beginning a development reversal.

If the inventory can maintain $83, it is prone to rebound again to $92.60 and probably as excessive as $106.

TradingView

The earnings will probably be essential as a result of if the corporate can present that issues don’t get worse, then the inventory might rebound as a result of the shares have by no means been cheaper from a valuation perspective. However it’s vital to recollect typically issues can all the time get even cheaper.

Steering is essential.

Investing as we speak is extra advanced than ever. With shares rising and falling on little or no information whereas doing the other of what appears logical. Studying the Markets helps readers reduce by means of all of the noise delivering inventory concepts and market updates, in search of alternatives.

We use a repeated and detailed strategy of watching the basic tendencies, technical charts, and choices buying and selling knowledge. The method helps isolate and decide the place a inventory, sector, or market could also be heading over numerous time frames.

To Discover Out Extra Go to Our Residence Web page