DZ Lab/iStock via Getty Images

PetMed Express (NASDAQ:PETS) is currently underperforming and were trading near their 52-week lows just prior to their most recent earnings release. And over the past one year, shares are down nearly 30%.

Seeking Alpha – 1-YR Price Performance Of PETS

The underperformance is in stark contrast to sector peer, Chewy (CHWY), who is up about the same way in the other direction. As a result, they are also trading at nearly 2x the pricing multiple as PETS.

Seeking Alpha – 1-YR Price Performance Of CHWY

In a prior update on PETS, I cited the competitive landscape as one challenging hurdle to overcome. Since then, shares have declined by about 5%. Following their results, I have become more bullish due in part to the pullback in valuation, the attractive dividend yield, and generally positive takeaways from their recent results that largely met my expectations.

What Did PETS Expect Heading Into Their Earnings Release?

Consensus revenue estimates for Q4 was approximately +$65.8M. This would have been essentially flat on a YOY basis. Consensus EPS, on the other hand, stood at $0.11/share or down about 63% YOY.

In the prior quarter, their acquisition of PetCare RX was pending and was seen as a significant opportunity to expand their own catalog through the addition of over 13K non-medication health and wellness products offered through PetCare RX’s portfolio.

While the rate of growth in overall general and administrative (“G&A”) costs were expected to be lower, higher acquisition-related costs were still expected due to the push for completion in fiscal Q4.

And though the acquisition was expected to eventually be accretive to their bottom line in the coming years, it was expected to deliver immediately to their top-line revenue figures.

Aside from the transactional activity, management also was not expecting to see a repeat of the deep promotions applied in prior quarters. In Q3, for example, their gross profit percentage came in at 25.9%. This was down significantly from the 29.2% reported in the same comparable period due in part to higher seasonal promotions.

Following a 9% YOY growth in net new customers, their first since Q1 of 2021, management was rightfully optimistic on their ability to not only grow their customer base but to also be able to sell more to them.

Repeat sales, for example, were down 4% in the prior quarter. This was notable since these sales account for about 90% of their total revenues.

The decline, however, was their lowest YOY decline in the last six quarters. Providing confidence of their ability to improve further on this was an expected expansion in their catalog of offerings, as well as the continued growth of their AutoShip program.

While consumer trade-down was one discussion item, it was viewed as a non-factor due to their predominant focus on medications and prescriptions.

Did PETS Meet Expectations In Their Q4 Release?

In Q4, PETS reported net sales of +$62.4M. This was down 5.4% YOY and about +$3.0M shy of estimates. In addition, quarterly GAAP EPS of ($0.25)/share came in well below consensus estimates of $0.39/share.

EPS was also lower even when factoring in $0.29/share of exclusionary items that were not reflective of their ongoing operations. This exclusion pertains to the accrual of prior year tax liabilities, which was discussed in their prior earnings release.

Two notable metrics that were on watch were growth in net new customers and subscriptions. In Q3, the company saw net new customer growth for the first time in 2.5 years. And their AutoShip program grew to 42% of their total revenues, which represented an 8% sequential increase and a doubling on a YOY basis.

In Q4, the positive trend continued, with new customers increasing for the second consecutive quarter, up 12%. In addition, their AutoShip program grew to their highest share of total revenues, at 44%.

Another positive during the quarter was an improvement in gross margins to 27.9%. While this is still down from the 29.4% reported in the same period last year, it’s up from the 25.9% reported last quarter.

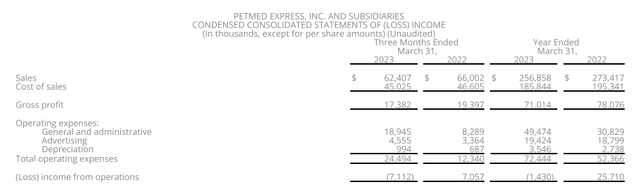

Q4FY23 Earnings Release – Snapshot Of Operating Results To Highlight Comparative Gross Margins

Following the completion of PetCare RX, management expects their addressable market to grow significantly in the periods ahead. In addition, they are expecting the acquisition to help them further diversify away from medication and into more discretionary product offerings.

Though there will still be some trailing costs, the expense base is expected to remain flat on a steadily growing topline. By year end, the acquisition is expected to become accretive to results.

What To Do With PETS Following Earnings?

There are still hurdles to overcome in the competitive landscape, but PETS appears to be making progress. In addition, their pristine balance sheet that is free of long-term debt and their longer tenure in the sector provide further confidence that they can continue improving in future periods.

While shares may not ring of value at first glance, trading at nearly 40x forward earnings, they are still a value in relation to peers such as CHWY. In addition, the high-yielding dividend payout provides income-focused investors a stable source of cash flows as the company works through competitive pressures.

Recent results were also positive on several fronts. Promising trends were noted in both new customer acquisitions and in their AutoShip program. In addition, margins improved sequentially from 25.9% to 27.9%.

And, moreover, bottom line earnings in future periods are expected to be assisted via the accretive benefits of their recent acquisition of PetCare RX, as well through a slowing in the rate of G&A expense growth.

Nevertheless, shares were still down immediately following results on missed expectations for revenues and earnings for the quarter. And in addition to missing on both the top and bottom lines, the company also reported another quarter of declining repeat sales, as well as weakness in their Flea & Tick brand, which was stung by aggressive price discounting in the over-the-counter market.

Though recent earnings may have disappointed some, I view the negativity as an attractive opportunity to build a moderate position in a sector leader that provides an above average dividend payment and is largely insulated from the more notable threats in today’s market environment, such as trade-down and risks pertaining to debt servicing.