Prostock-Studio

The Smoke-Free Investment Thesis Is Interestingly Robust

It is no wonder that Philip Morris International (NYSE:PM) has aggressively pursued the Swedish Match (OTCPK:SWMAY) acquisition in October 2022, despite the 9.5% increase in deal value to $15.7B. The former has reported expanding global demand for smoke-free products (reduced-risk products in the financial report) thus far, accounting for $2.36B or 29.3% of its FQ3’22 revenues. Otherwise, $6.97B or 29.5% of its FY2022 revenues YTD. These numbers suggest an accelerated CAGR of 20.7%, compared to FQ3’19 levels of $1.34B or 17.5% in revenues. Otherwise, $4.05B or 18.3% for the first three-quarters of FY2019, respectively.

On the same note, PM’s combustible tobacco products have suffered a decline of -3.7% or -$0.68B at the same time, suggesting a notable cannibalization effect during the rise of smoke-free products. The same has been observed by researchers at King’s College London, in which smoking of cigarettes has fallen among adults in England as vaping gained in popularity. The country also aims to achieve its ‘smoke-free’ goal by 2030, as similarly planned by the US government. Now, why does this matter?

According to statistics, 56% of Swedish consumers have stopped smoking cigarettes after switching to snus, a smoke-free tobacco product placed between the upper lip and gum. By December 2022, the Swedish Public Health authority reported that the number of smokers had remarkably reduced to 5.6% of the population, against 2019 levels of 6.4% and 2009 levels of 11%. This number indicates that Sweden has one of the lowest smoking prevalence against the EU average of 25% in 2022 and the US average of 12.5% in 2020. Naturally, this brings Sweden much ahead in the global race of a ‘smoke-free generation’ by 2040, defined as a decline in adult smoking to below 5%.

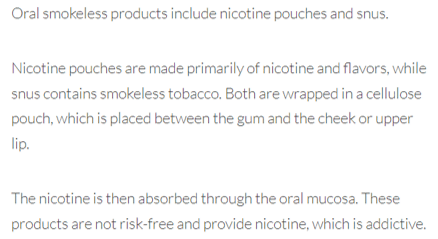

Seeing that Swedish Match’s nicotine pouches account for 38% of the volume share in the US by FQ3’22, we are not surprised by the tobacco giant’s interest in acquiring the company indeed. Nicotine pouch is very similar to snus, however with the critical difference of being tobacco-free, best described by PM below:

How Are Nicotine Pouches Different From Snus?

PM

Furthermore, Swedish Match’s robust market share of 22% in the cigar segment in 2021 does not hurt either, since cigars and other combustible tobacco products continue to account for 69.8% of PM’s revenues in the latest quarter. Therefore, we reckon that the acquisition is somewhat justified, despite the latter’s elevated long-term debts of $21.7B in the last quarter, since only $255M will be due by 2024 and the rest are remarkably well-laddered through 2044.

Furthermore, WHO projects that there may be 1.27B tobacco users in 2025, suggesting a minimal decline of -2.3% from 2020 levels of 1.3B. Therefore, PM’s advocacy for improved smoke-free products that deliver the same satisfaction is justified, considering the sustained consumer demand for tobacco products. Despite the high (addictive) nicotine content, the company claims that its smoke-free products offer a reduction of up to -95% in toxicants such as nitrosamines, carbon monoxide, and volatile organic compounds, compared to traditional cigarettes. As a result, these products may reduce the risk of smoking-related diseases, such as lung cancer, cardiovascular disease, and emphysema.

As the US Food and Drug Administration has stated, “inhalation of nicotine (i.e., nicotine without the products of combustion) is of less risk to the user than the inhalation of nicotine delivered by smoke from combusted tobacco products.” This is why PM has aggressively invested over $9B in R&D and commercialization efforts on smoke-free options, with more research already underway. Gizelle Baker, VP of Global Scientific Engagement in PM, said:

As part of our ongoing long-term assessment, PMI has conducted repeated post-market cross-sectional surveys in a representative sample of the adult population from Japan, Italy, and Germany to monitor the prevalence of the tobacco heating system [THS] after its commercialization. As of September 2022, there are approximately 19.5 million users of PMI heated tobacco products [HTPs] globally, excluding Russia and Ukraine, of which approximately 13.5 million (69%) have switched to PMI HTPs and stopped smoking. (Daily News Egypt)

This is also the reason why many global beer brands and craft breweries have similarly offered non-alcoholic beers as healthier drinking alternatives. Interestingly, the beer giant, Anheuser-Busch InBev SA/NV (BUD), has guided a goal of at least 20% in its beer volume to be no- or low-alcohol by 2025. Consumers are similarly demanding more options for safer drinking habits, with the rising trend of Dry January and Sober October thus far.

Even medical-use cannabis is increasingly adopted by multiple US states, such as California in 1996, New York in 2014, and Mississippi in 2022, despite being federally classified as a Schedule 1 drug. This is further supplemented by the US FDA-approved GW Pharmaceuticals’ (OTCPK:GWPRF) Epidiolex oral solution for treating seizures in patients over two years old with epilepsy. Interestingly, the Cannabidiol drug is placed in the least restrictive Schedule V of the Controlled Substances Act by the US Drug Enforcement Administration [DEA], suggesting a low potential for abuse. It is no surprise that global consumers seek alternatives to vices, as they are increasingly aware of the importance of maintaining a healthier and balanced lifestyle.

To address the growing demand, PM has offered multiple smoke-free products with various price ranges to appeal to different groups of end users. For example, the latest heat-not-burn tobacco heating system, BONDS by IQOS, will address the price-conscious consumers at ~$20, with its flagship IQOS targeting the premium segment at ~$90. These are in addition to the company’s wide range of smoke-free products, including e-vapor and oral nicotine products.

The global nicotine replacement therapy is also expected to expand from $44.5B in 2021 to $103.4B by 2028 at an accelerated CAGR of 15.1%, including inhalers, gum, transdermal patches, sublingual tablets, lozenges, E-cigarettes, and heat-not-burn tobacco products. As a result, PM’s ambitious goal of converting at least 40M smoking adults to smoke-free products by 2025 may be achievable indeed, due to the notable 0.5M conversion in FQ3’22 and 2.7M YTD to 19.5M IQOS users.

In the meantime, we encourage you to read our previous article on PM from October 2022, which would help you better understand its position and market opportunities.

So, Is PM Stock A Buy, Sell, Or Hold?

PM 1Y EV/Revenue and P/E Valuations

S&P Capital IQ

PM is currently trading at an NTM P/E of 18.03x, in line with its 3Y pre-pandemic mean of 18.09x though higher than its 1Y mean of 17.09x. It is evident that the excellent FQ3’22 earnings call has boosted its stock recovery by 19.1%, further aided by the optimism surrounding the Fed’s only-50 basis point hike & moderate November CPI report.

PM 1Y Stock Price

Seeking Alpha

Based on PM’s projected FY2024 EPS of $6.34 and current P/E valuations, we are looking at a moderate price target of $114.31. These numbers mirror the consensus estimate target of $106 as well, suggesting a minimal margin of safety for those who choose to load up here.

While PM has aggressively guided 50% of FY2025 revenues from the sale of smoke-free products, the company’s top and bottom line growth is expected to remain relatively stagnant at the same time. Market analysts project a revenue CAGR of 1.5% and an adj. EPS CAGR of 1% over the next few years, suggesting minimal growth. However, investors need not fret, since its EBIT/ net income/ FCF margins are also expected to expand by 1.1/ 1.9/ 2.5 percentage points then. Therefore, long-term investors may still enjoy sustained growth in the dividend rate to $5.35 by FY2024, suggesting yields of 5.28% for those who add at current levels. These numbers are impressive indeed, against its 5Y average yield of 2.5% and sector median of 2.45%

Nonetheless, we prefer to continue rating the PM stock as a Hold for now. While the November CPI report showed robust consumer index for tobacco and smoking products at 0.7% sequentially, it remains to be seen if the trend will persist through the Fed’s hike in 2023. With a projected terminal rate of 5.1%, market analysts already project a 70% chance of a recession in 2023. Therefore, depending on the market sentiments ahead, interested investors may potentially witness another $80s entry point. It would be prudent to exercise patience for now, since the stock has also been relatively volatile since September 2021.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.