This submit is a part of a sequence sponsored by Professional Insured.

MGA and wholesale insurance coverage operations are notoriously advanced—dozens of shifting items unfold throughout disconnected instruments, electronic mail inboxes, and outdated software program. From consumption and underwriting to doc dealing with and dealer communication, groups have traditionally been pressured to cobble collectively makeshift workflows simply to get the job completed. That patchwork strategy creates inefficiency, confusion, and threat at each flip.

Professional Insured adjustments that. By integrating coverage administration, workflow automation, doc dealing with, and CRM into one fashionable platform, we’ve reimagined how insurance coverage groups work. Submissions, paperwork, and dealer interactions all reside in a single intuitive system, streamlining operations from begin to end.

Coverage and Workflow Administration, Seamlessly Related

Professional Insured begins by turning sophisticated processes into clear, visible workflows. Each submission, quote, and coverage follows a clearly outlined path—divided into intuitive phases—so your workforce all the time is aware of the place they’re and what’s subsequent.

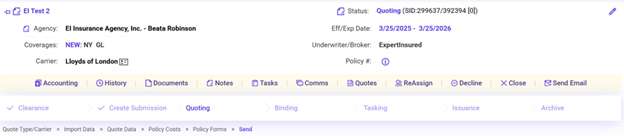

Picture 1: Standing bar exhibiting the submission lifecycle from clearance to issuance.

In the course of the submission course of, customers can immediately see what stage a file is in—whether or not it’s awaiting clearance, being quoted, or prepared for binding. This visible format makes onboarding simple and eliminates second-guessing.

![]()

Picture 2: Person-specific work queues exhibiting energetic gadgets.

Every person sees their customized queue of labor, exhibiting precisely which submissions or insurance policies they’re answerable for and what stage every one is in. Have to reassign work? Merely transfer the merchandise to a different person’s queue—it’s immediately transferred, with full visibility into who owns what and the place it sits within the workflow.

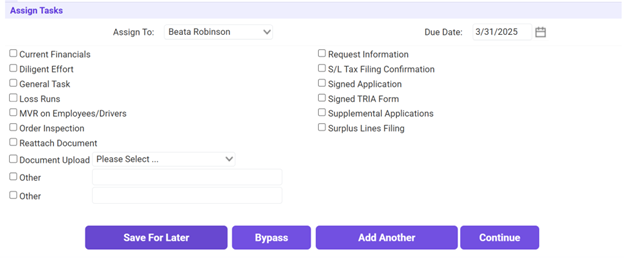

Picture 3: Tasking interface permitting customers to assign obligations throughout groups.

Past customary workflow duties, Professional Insured helps versatile tasking. Whether or not or not somebody “owns” a submission or coverage, they are often assigned particular follow-ups, questions, or approvals—making collaboration seamless, with out breaking course of integrity.

Paperwork, Embedded The place You Work

Paperwork are on the core of each insurance coverage transaction—however in most methods, they’re handled as an afterthought. Saved in shared drives, buried in electronic mail threads, or named inconsistently throughout folders, they’re usually arduous to search out and more durable to handle. Professional Insured adjustments that by embedding doc administration immediately into the coverage lifecycle—so the whole lot is saved, organized, and accessible precisely the place and when it’s wanted.

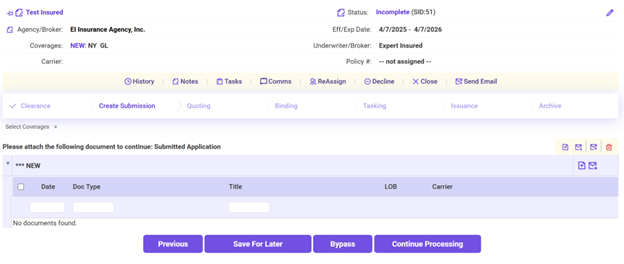

Picture 4: A required software doc being uploaded throughout submission.

Whether or not you’re gathering an software, a signed quote, or supporting paperwork, the whole lot could be uploaded by way of drag-and-drop proper into the system. You may label paperwork with customized tags (like “Loss Runs,” “Signed Binder,” or “Dealer Submission”) to maintain the whole lot structured and searchable. These paperwork keep hooked up to the coverage or submission, so there’s no threat of them getting misplaced in a shared drive or somebody’s inbox.

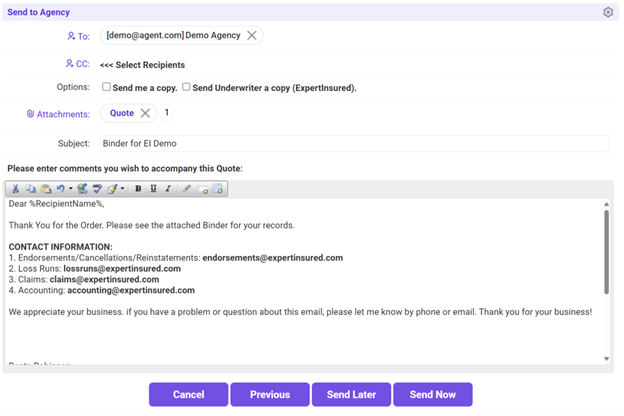

Picture 5: Paperwork being despatched to a dealer by way of electronic mail with out leaving the system.

Professional Insured additionally makes it simple to share paperwork, too. Have to ship a quote letter or request lacking gadgets? You may electronic mail paperwork immediately from the system—no must obtain or toggle to Outlook or Gmail.

And it really works the opposite manner, too. Since Professional Insured connects on to your electronic mail, you’ll be able to simply pull attachments from an electronic mail straight into the system with only a click on—no saving, renaming, or importing required. Discovered a dealer’s submission bundle in your inbox? Simply choose the e-mail and drop the paperwork proper the place they belong within the workflow.

With full model historical past, embedded templates for doc era, and seamless in-and-out communication, doc administration in Professional Insured isn’t simply an add-on—it’s a completely built-in a part of your underwriting and servicing course of. Organized, audit-ready, and all the time precisely the place you anticipate it.

CRM That Works Like You Do

Relationships energy the wholesale insurance coverage enterprise, however conventional CRMs are sometimes disconnected from the coverage methods they’re presupposed to assist. Professional Insured brings CRM performance immediately into your day by day workflow, so each interplay is grounded in actual enterprise exercise.

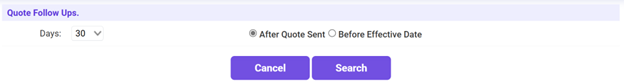

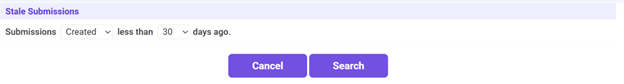

Picture 6: Shortly seek for stale submissions and ship focused follow-ups from inside the system.

Monitor each submission, quote, and dialog together with your producers in a single place. You may set follow-up reminders, seek for brokers with inactive submissions, and electronic mail them immediately—with out switching instruments.

As a result of CRM lives inside the identical platform as your coverage information, your insights are all the time correct, actionable, and in context. You’re not simply logging contact information—you’re proactively strengthening dealer relationships and driving income.

Conclusion: The Energy of True Integration

Professional Insured isn’t only a cleaner UI—it’s a shift in how insurance coverage operations can and will work. With coverage workflows, doc administration, and CRM all dwelling in a single platform, groups transfer sooner, collaborate higher, and serve brokers extra successfully.

This degree of integration removes friction, improves readability, and helps development—with out the overhead of juggling a number of methods. For MGAs and wholesalers who need to scale intelligently and function with confidence, Professional Insured is the system that lastly brings all of it collectively.