Ilja Enger-Tsizikov

The Cohen & Steers Select Preferred and Income Fund (NYSE:PSF) is a closed-end fund or CEF, that can be employed by those investors who are seeking to earn a high level of income from the assets in their portfolio. This fund is reasonably successful at that task, as its current yield of 7.81% is higher than many other things in the market today. However, this is far from the highest yield that investors can currently obtain from a preferred stock fund. After all, as we discussed a few days ago, the John Hancock Preferred Income Fund III (HPS) and some of the other funds from John Hancock beat this one in terms of yield by a comfortable margin. The Cohen & Steers Select Preferred and Income Fund does not have the worst yield available among its peers though, and it also manages to beat the iShares Preferred and Income Securities ETF (PFF), so it might still be worth considering as an option.

As regular readers are no doubt well aware, we last discussed the Cohen & Steers Select Preferred and Income Fund back in August of 2023. The overall environment in the market has changed considerably since that time. At the time that the previous article was published, most fixed-income securities were suffering from a general belief that the Federal Reserve was serious about its “higher for longer” commitment and long-term interest rates were rising in order to readjust for that environment. Thus, the fund’s share price declined for a month or two after that article was published. The market environment changed in mid-October when investors began to expect that the central bank would pivot and cut interest rates dramatically in 2024. That caused the fund’s share price to reverse course and it generally rose for the remainder of the year.

As we can see here, the fund’s share price is up 3.92% since we last discussed this fund, which is better than the 2.55% gain of the preferred stock index:

Seeking Alpha

Unfortunately, there could be some reasons to believe that the fund’s shares will not be able to hold onto its recent gains. This is because the interest rate cuts that have been priced into the fund’s shares and the preferred stocks in its portfolio require that the economy enter a severe recession within the next few weeks. That is very difficult to believe considering recent reports from the various government agencies that are responsible for tracking such things. In addition, inflationary pressures remain very strong and the Federal Reserve risks igniting another bout of inflation if it were to cut interest rates to any significant degree. If the Federal Reserve fails to deliver on the necessary interest rate cuts that are necessary to justify the current price of the assets that are held by this fund, it could give up some of the gains that investors have benefited from in recent months.

The fund’s investors have received far more gains than are visible simply by looking at the fund’s share price. This is because closed-end funds such as the Cohen & Steers Select Preferred and Income Fund typically pay out all of their investment profits to their owners, which results in their realized returns being much higher than the share price performance would imply. In the case of this fund, investors have realized a 7.57% total return since the date that my previous article was published. That is substantially above the total return of the preferred stock index, largely because the Cohen & Steers Select Preferred and Income Fund has a much higher yield:

Seeking Alpha

That total return was realized over the course of about five months, so it is sufficiently large to justify taking some of the money off of the table simply to reduce overall risk. This works well with my overall thesis and reasoning behind this downgrade of the fund.

About The Fund

According to the fund’s website, the Cohen & Steers Select Preferred and Income Fund has the primary objective of providing its investors with a very high level of current income. Unlike the websites of closed-end funds from other managers, this one does not provide an in-depth description of the fund’s strategies. All that it states is:

The primary investment objective of the Fund is high current income through investment in preferred and other securities. The secondary investment objective is capital appreciation.

Thus, all that we know from this description is that the fund’s assets will be primarily invested in preferred securities. The fact sheet does not really improve on this description, although it does state that investors should expect that the majority of the securities in the fund will be issued by banks, real estate investment trusts, insurance companies, and utilities. This would be in line with most other preferred stock funds.

After all, as I pointed out in a recent article on the John Hancock Preferred Income Fund III (linked in the introduction), banks are by far the largest issuers of preferred securities in the market. From that article:

The first thing that we notice here is that all of the securities in the fund’s largest positions list are either utilities or banks. This is not uncommon for a preferred stock fund because banks and utilities are the largest issuers of preferred stock in the market. As a result, almost any preferred stock fund will be very heavily weighted towards these two types of companies. With that said though, usually the overwhelming majority of companies in the top ten list are banks. This is due to international banking regulations that require banks to hold a certain percentage of their assets in the form of Tier One capital. Tier One capital refers to that proportion of a bank’s assets that are not simultaneously a liability to somebody else (such as a depositor). When regulators require that a bank increase its Tier One capital, its only options are to issue either common or preferred stock. The bank will often choose to issue the preferred stock in order to avoid diluting the common shareholders.

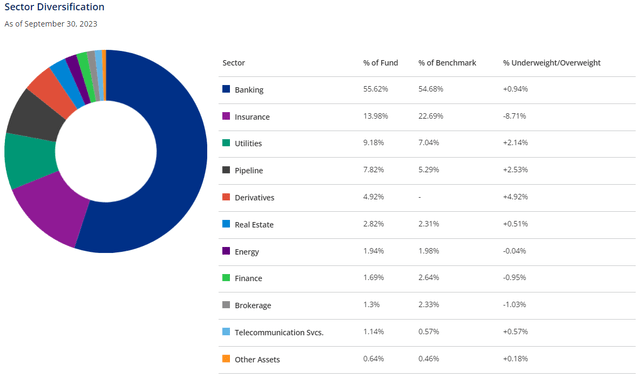

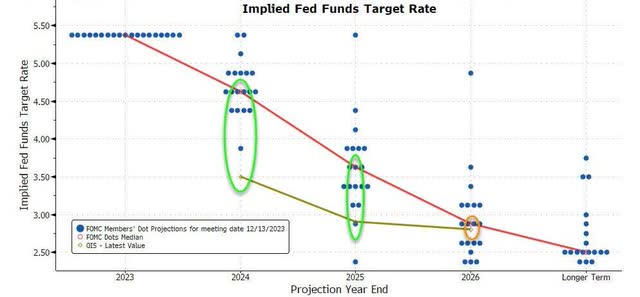

The Cohen & Steers Select Preferred and Income Fund is certainly not an exception to this rule about the dominance of banking companies in its portfolio. As we can see here, the banking sector currently accounts for 55.62% of the fund’s assets:

Cohen & Steers

That is less than the weight that some other preferred stock funds have assigned to the banking sector. For example, the Flaherty & Crumrine Total Return Fund (FLC) currently has 57.00% of its assets invested in banks. However, it is still higher than the 54.68% of the fund’s benchmark index, which is a special index presumably created by Cohen & Steers. The fact sheet states that it is a composite index consisting of the following:

- 55% ICE Bank of America U.S. Investment Grade Institutional Capital Securities Index.

- 20% ICE Bank of America Core Fixed Rate Securities Index.

- 25% Bloomberg Developed Market USD Contingent Capital Index.

The fund’s benchmark has changed a few times over the years, but it has always been a composite index consisting of other preferred stock and contingent capital indices. That could make it more difficult to track its performance over time, so I have opted to benchmark this fund against the ICE Exchange-Traded Preferred and Hybrid Securities Index which is tracked by the iShares Preferred and Income Securities ETF. That is the index fund that the Cohen & Steers Select Preferred and Income Fund is compared to in the introduction to this article.

The fact that this fund has a fairly high allocation to the banking sector is something that might be concerning considering the challenges that this sector faced last year. However, as I discussed in a recent article,

The banking sector is currently sitting on $600-$700 billion of unrealized losses. This is mostly due to fixed-rate U.S. Treasuries, mortgage loans, and other instruments that declined in value in a rising interest rate environment. The scale of these losses is sufficient that it may worry some investors, but this is a very different problem than the banking sector experienced back in 2007. There has not been a spike in defaults that is forcing banks to realize losses. As long as there are no more bank runs, the unrealized losses should eventually be erased as the securities mature, or interest rates decline and cause capital appreciation in the currently depreciated securities. The Federal Reserve implemented a program back in the Spring of 2023 that has generally been effective at preventing banks from needing to sell their depreciated assets to meet the withdrawal demands of depositors, so we probably do not have to worry about this problem.

As such, there is probably no reason to avoid the Cohen & Steers Select Preferred and Income Fund just because you may have some concerns about the banking sector exposure. However, as is always the case, it is important that your portfolio has appropriate diversification to ensure that you do not have an excessive degree of exposure to any individual sector. As such, it may be a good idea to hold other funds that have low financial sector exposure if this one is in your portfolio.

As mentioned in the quote above, it is typical that a fund such as the Cohen & Steers Select Preferred and Income Fund will include a number of banks among its largest positions. This is certainly the case here, as we can see by looking at the largest positions in this fund’s portfolio:

Fund Fact Sheet

There are four banks among the fund’s largest positions, which is actually fewer than I really expected to see. We would certainly expect to see more than this considering that 55.62% of the fund’s total assets are invested in the banking sector. However, it seems likely that we would see more banks among the largest positions if it were not for those two interest-rate swaps. As I have pointed out in a few previous articles on other closed-end funds, the rapid increase in interest rates that we saw in 2022 and early 2023 created problems for many closed-end funds that tend to employ significant levels of leverage in their strategies. Fixed-income funds, in particular, are fairly well-known for this, as leverage has been one of the only ways to earn respectable yields from fixed-income securities in the incredibly low-interest rate environment that existed over the past decade.

Cohen & Steers funds hedge their interest rate exposure to essentially guarantee that their interest expenses will be at a set rate regardless of interest rate movements in the broader market. It is actually a pretty good thing considering the problems that leverage has caused for preferred stock funds from some other fund houses. The size of these swaps results in them being among the largest holdings in this fund, but if they were not here then it seems likely that we would see more banks on the list.

The Thesis And Potential Threats

As mentioned in the introduction, the recent market environment has proven to be very good for this fund. The United States 10-Year Bond Yield (US10Y) peaked on October 19, 2023, and has generally been declining since that time:

CNBC

The share price of preferred stock typically correlates with the ten-year U.S. Treasury. Thus, as yields declined since mid-October, the price of the assets that are held by the Cohen & Steers Preferred and Income Fund have gone up. This is reflected in the price of this fund’s shares, which have gone up by an impressive 14.55% since October 19, 2023:

Seeking Alpha

However, we can see that the price performance of the shares has moderated somewhat since the start of 2024. The shares are up 2.49% year-to-date, but they are still down from their December peak. This is because the market has begun to doubt the narrative that the Federal Reserve will aggressively reduce interest rates over the course of this year. This makes a great deal of sense since the interest rate cut expectations that are currently baked into preferred stock prices are very optimistic and unrealistic.

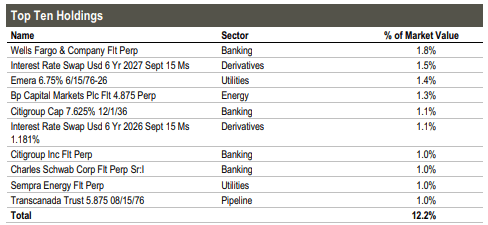

As of today, the market is expecting that the effective federal funds rate will decline by 1.384 percentage points by the end of 2024:

Zero Hedge/Data from Bloomberg

This would require five or six 25-basis point cuts in the next eight meetings of the Federal Open Market Committee. There is virtually nobody that expects a rate cut in January, although the market did think that was possible back in December. The market currently expects that the first rate cut will come in March, and it is probable that this fund will give up some of its recent gains if that scenario becomes doubtful.

There has only been one time in history (during the 1980s) when the Federal Reserve reduced the federal funds rate by 125 basis points or more in the absence of a very severe recession. I find it very hard to believe that the unemployment rate will suddenly go to 10% within the next three weeks. Thus, it seems very unlikely that a severe recession is on the horizon that will drive the Federal Open Market Committee to think that monetary conditions need to be loosened in order to prevent economic problems. Indeed, the market has already done a great deal to loosen up monetary conditions by driving long-term interest rates down by nearly 100 basis points since the middle of October. The minutes from the Federal Reserve’s December meeting suggest largely the same thing, and they suggest that the committee members think that monetary conditions are already loose enough, and it does not need to be cut.

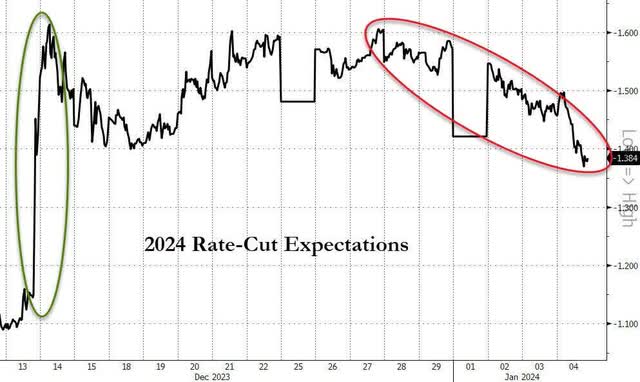

The dot plot shows that all but five of the thirteen committee members expects that there will be three or fewer rate cuts in 2024. Of those five that expect four or more interest rate cuts, four of them think that there will be four interest rate cuts. Only one of the committee members expects anything close to the market’s current expectations:

Zero Hedge/Data from FOMC

This is the reason why we started to see the market weaken last week, as traders realized that the euphoria had gone too far. However, as the Fed futures market expectations chart above shows, the market still expects more interest rate cuts in 2024 than the Federal Open Market Committee members. Thus, the price of the preferred stocks held by the Cohen & Steers Select Preferred and Income Fund is too high, and the fund is vulnerable to a near-term correction.

With that said a possible risk to this thesis could be the end of the temporary program that the Federal Reserve set up to protect the nation’s banking system against further bank runs that could trigger sales of depreciated assets. Simon White, Bloomberg’s macro strategist points out that the end of this program might slightly strengthen the case for a March 2024 interest rate cut. This is because a rate cut would reverse some of the unrealized losses that banks are currently sitting on. However, the market has already done a lot of work at erasing these unrealized capital losses so such a rate cut may not be necessary. It is still a potential risk to this thesis, though.

In short, investors in the Cohen & Steers Select Preferred and Income Fund may want to sell some of their positions in order to lock in their gains before a market correction that would undoubtedly occur if the Federal Reserve fails to reduce the federal funds rate in March. If nothing else, such a move would help reduce the overall risk that is likely sitting in the fixed-income portion of most portfolios right now.

Leverage

As is the case with most closed-end funds, the Cohen & Steers Select Preferred and Income Fund employs leverage as a method of increasing the effective yield of the assets in its portfolio. I explained how this works in my previous article on this fund:

In short, the fund is borrowing money and using that money to purchase preferred stock and bonds. As long as the purchased securities have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case. It is important to keep in mind though that this strategy is much less effective today with rates at 6% than it was a few years ago when rates were near 0%. This is because the difference between the interest rate paid by the fund and the yield of the assets that it purchases is much less than it once was.

However, the use of debt in this fashion is a double-edged sword because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

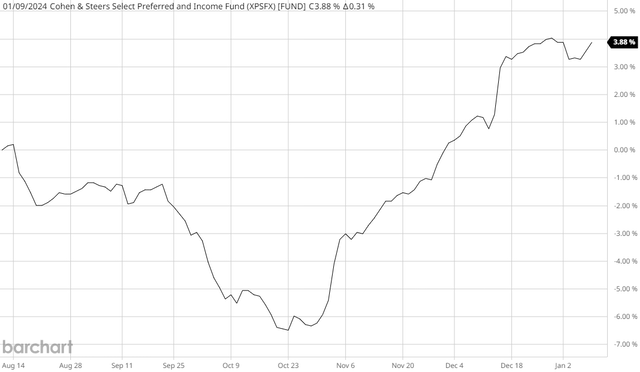

As of the time of writing, the Cohen & Steers Select Preferred and Income Fund has leveraged assets comprising 34.52% of its portfolio. This is quite a bit lower than the 35.42% leverage that the fund had the last time that we discussed it, which makes a certain amount of sense. After all, the fund’s net asset value has increased by 3.88% since the date that the previous article was published:

Barchart

Thus, if its leverage were to remain completely static then it would now represent a lower percentage of a larger portfolio. Closed-end funds rarely significantly increase or decrease the actual amount of borrowings in their portfolios in dollar terms, so this is the likely scenario.

As we can see though, the fund’s current leverage is still above the one-third of assets figure that we would ordinarily prefer to see. However, in this case, it is probably acceptable. After all, one of the defining characteristics of fixed-income securities is that they are usually less volatile than common equities. It is volatility that causes problems with leveraged strategies, so a fund that is investing in less volatile securities should be able to carry a higher amount of leverage than a fund that is investing in common equities. As such, the fund’s leverage is probably okay right now as it is not very much above the one-third level that we prefer.

Overall, the balance between the risk and reward with Cohen & Steers Select Preferred and Income Fund is probably acceptable. Risk-averse investors should not need to lose sleep over this fund’s use of leverage.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Cohen & Steers Select Preferred and Income Fund is to provide its investors with a very high level of current income. In pursuance of this objective, the fund invests in a portfolio that primarily consists of preferred stocks. Preferred stock typically delivers the majority of its total investment returns in the form of direct payments that are made to its owner. In this case, that would be the fund that collects these payments on behalf of its shareholders. The fund pools the money that it receives from the securities in its portfolio and then pays it out to its shareholders, net of the fund’s expenses. As preferred stock usually has a higher yield than many other things in the market and this fund uses leverage to collect payments from more securities than it could afford with just its own equity capital, we can expect that this business model would result in the fund’s shares having a very high yield.

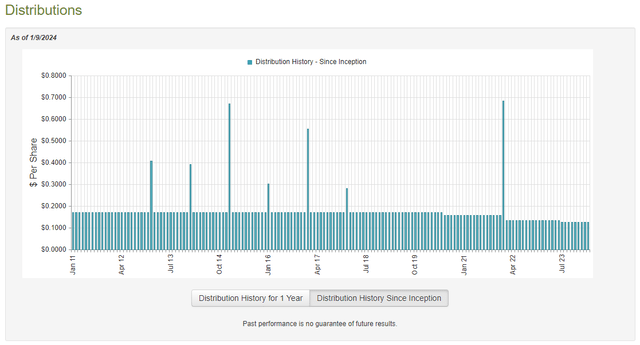

This is certainly the case, as the Cohen & Steers Select Preferred and Income Fund pays a monthly distribution of $0.1260 per share ($1.5120 per share annually), which gives it a 7.81% yield at the current price. This is not the highest yield that is available in the closed-end fund space, but it is not too bad compared to common equities and similar things. Unfortunately, the fund has not been especially consistent with respect to its distribution, and it has been reducing its payout over the past few years:

CEF Connect

Prior to the COVID-19 pandemic, this fund was a fairly reliable source of income, but the recent cuts have undoubtedly reduced its appeal in the minds of those investors who are seeking a safe and consistent income from the assets in their portfolios. The generation of income is perhaps more important than it was in past years due to the negative impact that today’s high levels of inflation have had on our standard of living. It costs much more to maintain a certain lifestyle today than it did a few years ago, so we need our incomes to be climbing with the passage of time. This fund’s distribution cuts have been doing the exact opposite.

However, as I have pointed out numerous times in the past, the fund’s distribution history is not necessarily the most important thing for new purchasers right now. After all, anyone who buys the fund today will receive the current distribution at the current yield and will not be adversely affected by any events that the fund has had to deal with in the past. The most important thing for anyone who is considering purchasing the fund today is how well the fund can sustain its current distribution. Let us investigate this.

Unfortunately, we do not have an especially recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. As such, this report will not have any information about the fund’s performance over the past six months. That is disappointing, as the fixed-income market has been somewhat volatile over that period. Over the summer, interest rates were rising, and the price of preferred stock was generally declining. That undoubtedly caused this fund to suffer some realized and unrealized losses. However, it might have been able to undo some of these losses during the highly euphoric period that began in the middle of October.

The most recent financial report will not include any information about how well the fund handled either of these periods. However, it is a more recent report than the one that we had available to us the last time that we discussed this fund, so it is still nice to have some more recent data to work with.

During the six-month period, the Cohen & Steers Select Preferred and Income Fund received $9,289,167 in interest and $2,096,415 in net dividends from the assets in its portfolio. This gives the fund a total investment income of $11,385,582 over the period. The fund paid its expenses out of this amount, which left it with $6,191,688 available for the shareholders.

This was unfortunately nowhere near enough to cover the $9,741,564 that the fund paid out in distributions during the period. At first glance, this is almost certainly going to be concerning because we would ordinarily prefer a fixed-income closed-end fund to fully cover its distributions out of net investment income. This one obviously failed to accomplish that goal.

However, there are other methods through which the fund can obtain the money that it needs to cover its distributions. For example, it might be able to exploit the price changes that preferred stocks exhibit when interest rates change. Profits from this are realized capital gains and are therefore not considered to be investment income for tax or accounting purposes. However, they clearly result in money coming into the fund that can be distributed to the shareholders.

Unfortunately, this fund generally failed at that task during the period in question, as it reported net realized losses of $16,414,855 that were only partially offset by $4,720,867 net unrealized gains. Overall, the fund’s net assets declined by $15,243,864 after accounting for all inflows and outflows during the period.

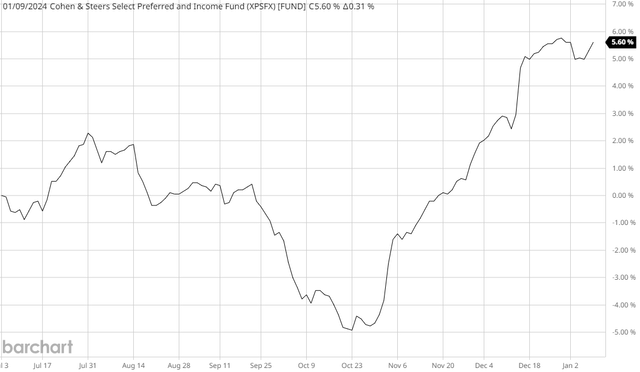

Thus, this fund clearly failed to cover its distributions during the first half of 2023. That certainly explains the distribution cut in July as the fund needed to reduce its outflow of money in order to prevent the continued destruction of its net assets. Fortunately, it does appear that the most recent distribution cut was sufficient. The fund’s net asset value is up 5.60% since July 1, 2023:

Barchart

This strongly implies that the fund managed to fully cover all of the distributions that it paid out since the closing date of the most recent financial report with a great deal of money left over. This is a good sign, but it does not guarantee that the fund can sustain its distribution at the current level. After all, as we discussed in this article, there is a very real chance that the securities in the fund’s portfolio will decline in price in the near future as the market adjusts to the possibility that near-term rate cuts may not be as substantial as it currently has priced in.

Valuation

As of January 9, 2024 (the most recent date for which data is currently available), the Cohen & Steers Select Preferred and Income Fund has a net asset value of $20.35 per share. However, the shares currently trade for $19.43 each. This gives the fund’s shares a 4.52% discount on net asset value at the current price. This is nowhere near as attractive as the 7.13% discount that the fund’s shares have had on average over the past month. As such, the fund’s entry price does not look particularly attractive right now, but the smaller-than-average discount does work pretty well as an exit price for those who are seeking to reduce their risk by taking some gains.

Conclusion

In conclusion, the Cohen & Steers Select Preferred and Income Fund has delivered fairly strong performance over the past few months on expectations that the Federal Reserve will substantially reduce interest rates this year. However, current economic data is too strong to support the market’s expectations and there is a very real risk that the fund will give up some of its recent gains if the central bank does not deliver on rate cut expectations. As such, it may make sense to take some profit sharing, especially with the fund’s valuation looking richer than average.