AsiaVision

A recent Wall Street Journal article discussed how retail traders that made millions during the pandemic trading the market are now mostly wiped out.

“Amateur trader Omar Ghias says he amassed roughly $1.5 million as stocks surged during the early part of the pandemic, gripped by a speculative fervor that cascaded across all markets.

As his gains swelled, so did his spending on everything from sports betting and bars to luxury cars. He says he also borrowed heavily to amplify his positions.

When the party ended, his fortune evaporated thanks to some wrong-way bets and his excessive spending. To support himself, he says he now works at a deli in Las Vegas that pays him roughly $14 an hour plus tips and sells area timeshares. He says he no longer has any money invested in the market.

‘I’m starting from zero,’ said Mr. Ghias, who is 25.”

His story is not a one-off event. During the pandemic lockdowns in 2020 and 2021, scores of Americans turned to stock market gambling to replace sports betting as the economy was shuttered.

Between “stimulus checks,” swelling bank accounts, no job to go to, and a free stock trading app on every phone, retail traders poured into the market chasing everything from cryptocurrencies to bankrupt companies.

If all this sounds familiar, it should.

In June 2020, I wrote an article about the speculative behaviors of retail traders resembling what we saw in 1999 and 2007. To wit:

“Is it 1999 or 2007? Retail investors flood the market as speculation grows rampant with a palpable exuberance and belief of no downside risk. What could go wrong?

Do you remember this commercial?”

“The Etrade commercial aired during Super Bowl XLI in 2007. The following year, the financial crisis set in, markets plunged, and investors lost 50%, or more, of their wealth.

However, this wasn’t the first time it happened.

The same thing happened in late 1999. This commercial was aired 2 months shy of the beginning of the “Dot.com” bust as investors once again believed “investing was as easy as 1-2-3.”

Of course, at the time, retail traders were consumed by greed and the “fear of missing out.” However, as we concluded at the time:

“I get it. If you are one of our younger readers, who have never been through an actual “bear market,” I wouldn’t believe what I am telling you either.

However, after living through the Crash of ’87, managing money through 2000 and 2008, and navigating the “Great Crash of 2020,” I can tell you the signs are all there.“

A Change Of Psychology

We warned several times in different articles that the actions of retail traders would lead to very poor outcomes. One such note was that Gen Z’ers were taking on debt to invest.

“Young investors are taking on personal debt to invest in stocks. I have not personally witnessed such a thing since late 1999. At that time, ‘day traders’ tapped credit cards and home equity loans to leverage their investment portfolios.

For anyone who has lived through two ‘real’ bear markets, the imagery of people trying to ‘daytrade’ their way to riches is familiar. The recent surge in ‘Meme’ stocks like AMC and GameStop as the ‘retail trader sticks it to Wall Street is not new.“

But again, retail traders felt indestructible at the time as the market advanced almost daily, and the more risk you took, the more success you had.

However, as is always the case, “risk” and “reward” are not mutually exclusive, and taking on leverage to invest ultimately leads to poor outcomes. As I concluded in August of 2021:

“Investing is a game of ‘risk.’ It is often stated that the more ‘risk’ you take, the more money you can make. However, the actual definition of risk is ‘how much you will lose when something goes wrong.’

Following the ‘Dot.com crash,’ many individuals learned the perils of ‘risk’ and ‘leverage.’”

As the WSJ noted, Mr. Ghias borrowed heavily to amplify his positions.

The result was not unexpected.

However, importantly, Mr. Ghias is not alone, and the downturn in the market last year has many retail traders changing their psychology. To wit:

“Now some of these so-called retail investors are backing away from the markets after the worst year for stocks since 2008. Others are paring their positions or shifting their money to more conservative holdings, such as bonds or cash.”

Given the impact of retail traders on the markets in 2020 and 2021, their retreat from the market may also pose an additional headwind. However, most importantly, most of the money used by retail traders to boost the markets came from the pandemic-related stimulus. As another WSJ article notes, that is now mostly gone.

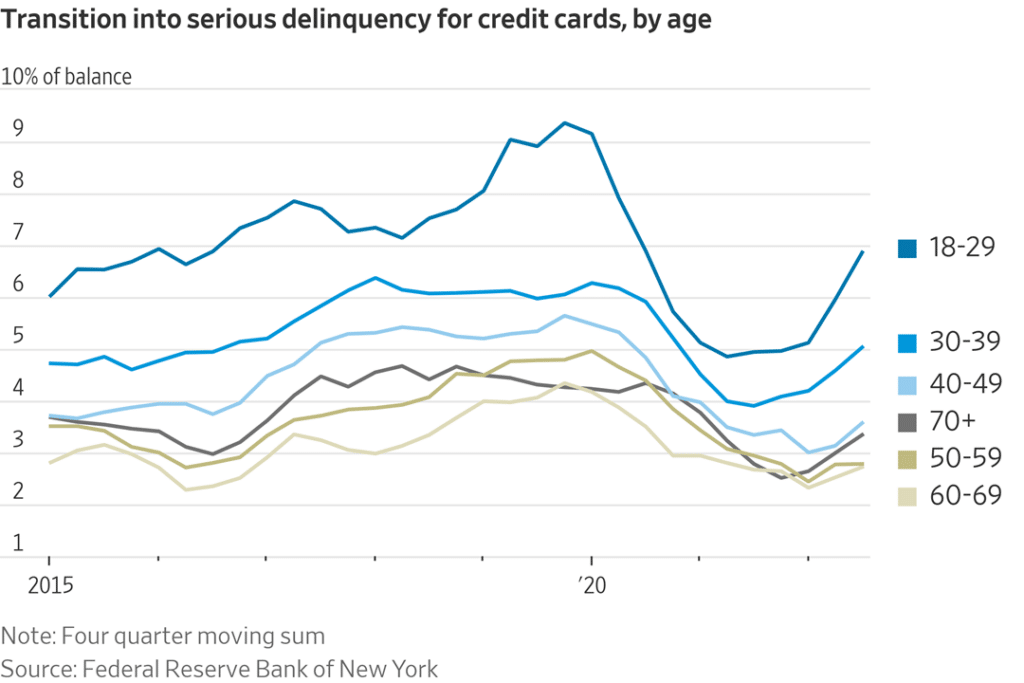

Of course, that lack of capital is now also catching up with the ability to pay off the increased credit card debt taken on by the younger generation to fund their lifestyle. As Jeff Sparshott of WSJ notes:

“In 2020 and into 2021, a combination of government pandemic stimulus and reduced spending, for example on restaurants and travel, fattened Americans’ wallets. This cash helped Americans make it through a period of high inflation last year, but the forces that had acted to boost savings reversed direction as pandemic relief unwound and prices soared. Today, some people are having to cut back on their spending or add to their credit-card balances. Many have had to tap their savings to stay afloat, say economists.”

Of course, all of this is a function of the incredibly bad advice dished out on social media that retail traders consumed without question.

Don’t Be Bearish

In May 2022, I wrote an article for the Epoch Times titled “The Inevitable End Of Bad Advice.” which discussed a WSJ article on the rise of a “new generation of financial media stars.”

“As the U.S. retreated amid the pandemic to its couches, millions of would-be stock pickers—some flush with stimulus cash—fired up social media and messaging apps and dove headlong into the world of retail investing.

Many of these influencers have no formal training as financial advisers and no background in professional investing, leading them to pick stocks based on the whims of popular opinion or to dispense money-losing advice.”

According to the article, you needed to be relatable, sell the dream, and not be bearish.

The problem with the “don’t be bearish” bias should be evident. Only listening to one-half of the story makes investors “blindsided” by the other half.

“We know that day trading does not produce long-term wealth for the vast majority of people who do it, but these influencers are preying on that part of the human brain that has fewer inhibitions, that thinks: ‘I will be the exception.’ That leads to speculation and other kinds of very high-risk behavior.” – Ted Klontz, Professor Of Behavioral Finance, Creighton University.

The demand by Gen Z’ers for “don’t be bearish” commentary is why they ignored the same signs that negatively impacted both Millennials and Boomers previously.

While social media stars “got rich” for their free “don’t be bearish” investing advice, it is worth noting their “riches” didn’t come from their investing skill. Instead, it came from their skill in producing products and ads. Such is not much different than how Wall Street makes its money.

Experience tends to be a brutal teacher, but it is only through experience that we learn how to build wealth successfully over the long term.

As Ray Dalio once quipped:

“The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.”

Such is why every great investor in history, in different forms, has one basic investing rule in common:

“Don’t lose money.”

The reason is simple: you are out of the game if you lose capital.

Many young investors have gained much experience by giving most of their money to those with experience.

It is one of the oldest stories on Wall Street.

So, while Millennials were quick to dismiss the “Boomers” in the financial markets for “not getting it.”

There was a more simple truth.

We did “get it.”

We have been around long enough to know how these things eventually end.

If only someone could have warned them.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.