Government Abstract

In line with Federal Reserve Chair Jerome Powell, the Fed’s versatile common inflation concentrating on (FAIT) framework performed no position within the post-pandemic inflation surge, and officers acted swiftly as soon as inflation proved demand-driven. This paper reveals Powell’s claims will not be supported by the proof. The rise within the worth stage was pushed by a surge in nominal spending. Fed officers have been sluggish to acknowledge the issue and waited six months after acknowledging it to meaningfully tighten coverage. Removed from irrelevant, FAIT helps clarify why the value stage stays elevated in the present day. The paper concludes by evaluating different frameworks and arguing that the Fed ought to undertake both a nominal spending goal or a symmetrical common inflation goal.

Key Factors

- Publish-pandemic inflation was demand-driven — a results of financial coverage not provide constraints, “greedflation,” or fiscal coverage. The persistent rise within the worth stage was not an exogenous shock, however the results of extreme financial lodging that fueled a pointy surge in spending. Opposite to some well-liked views and remarks by Federal Reserve Chair Jerome Powell, provide constraints, company “greed,” and financial coverage can not clarify the magnitude, timing, or period of the inflation.

- The Fed misdiagnosed the post-pandemic inflation downside and responded too slowly. All through 2021, Fed officers continued to view inflation as transitory and supply-driven, whilst proof on the contrary mounted. They delayed tightening till March 2022 and proceeded cautiously thereafter, permitting inflation to overshoot their very own projections — which have been already nicely above the Fed’s acknowledged two-percent goal.

- Versatile common inflation concentrating on (FAIT) contributed to the issue. FAIT, the Fed’s financial coverage framework adopted in 2020, inspired the Fed to tolerate above-target inflation so as to make up for previous inflation undershoots, however supplied no mechanism to offset overshoots. This asymmetry just about assured tolerance of upper inflation and a everlasting rise within the worth stage — and undermined the Fed’s credibility.

- The Fed’s FAIT framework weakens long-run worth stability. By failing to stabilize the value stage or anchor inflation expectations round a predictable path, the FAIT framework will increase the dangers of long-term contracting and erodes confidence within the Fed’s capability to ship financial stability.

- Reforming the framework is important to make sure worth stability. The paper evaluates 4 options and recommends nominal spending concentrating on as the best choice for reaching worth stability and bettering communication. A symmetric common inflation goal is proposed as a viable second-best.

1. Investigating the Fed’s Concentrating on Framework

At a January 2025 press convention, Federal Reserve Chair Jerome Powell (2025) claimed that the Fed’s versatile common inflation concentrating on (FAIT) framework didn’t contribute to the post-pandemic inflation surge. As he put it:

There was nothing average concerning the overshoot. It was an exogenous occasion. It was the pandemic and it occurred and, you understand, our framework permitted us to behave fairly vigorously. And we did, as soon as we determined that that’s what we must always do. The framework had actually nothing to do with the choice to — we regarded on the inflation as — as transitory and — proper as much as the purpose the place the information turned in opposition to that. [W]hen the information turned in opposition to that in late ‘21, we modified our — our view and we raised charges quite a bit. And right here we’re at 4.1 % unemployment and inflation method down. However the framework was extra irrelevant than anything — that a part of it was irrelevant. The remainder of the framework labored simply fantastic as — as we used it — because it supported what we did to deliver inflation down.

In line with Powell, the non permanent rise in inflation was past the Fed’s management.[1] He argued that the framework didn’t inhibit the Fed’s response; quite the opposite, it supported the Fed’s efforts to rein in inflation. In Powell’s account, the Fed responded appropriately and aggressively as quickly as the information indicated that inflation was demand-driven. This paper challenges that account.

The next part argues that the rise in inflation (and, consequently, the rise within the worth stage) was not exogenous, however was pushed by excessively unfastened financial coverage, which fueled a surge in nominal spending. Though Powell is unclear about what he means by “exogenous,” his rationalization echoes a number of well-liked narratives that attribute the post-pandemic inflation to exterior components — resembling provide constraints, greedflation, and expansionary fiscal coverage.[2] None of those explanations withstands scrutiny. After evaluating every in flip, the proof overwhelmingly factors to a demand-driven inflation surge attributable to financial lodging (retaining rates of interest low, rising the cash provide, or each).

As mentioned in Part 3, the underlying downside was the Fed’s delayed response to a optimistic combination demand shock of its personal making. The Fed’s December 2021 projections clarify that officers anticipated inflation to fall within the closing months of 2021 with none change within the stance of financial coverage, suggesting they continued to view inflation as transitory — although Powell had retired the time period weeks earlier. In brief, Fed officers seen inflation as provide pushed as late as December 2021 and, because of this, failed to regulate coverage accordingly. This distinction issues: if the post-pandemic inflation surge was primarily supply-driven, there was little the Fed might have achieved to scale back it with out inflicting different issues; if, however, it was demand-driven, circumstances referred to as for tighter financial coverage to rein in extreme spending within the economic system.

Part 4 reveals that, opposite to Powell’s declare, the Fed didn’t change its coverage stance when the information turned in opposition to the transitory supply-side story within the again half of 2021. The Fed didn’t start elevating the federal funds charge goal till March 2022 — three months after Fed officers publicly acknowledged the demand-side nature of inflation. Even then, officers proceeded cautiously, regardless of inflation surging previous their projections through the early months of 2022. Certainly, it was not till July 2022 that Fed officers lastly took extra aggressive motion.

Part 5 argues that FAIT is much from “irrelevant” to understanding the Fed’s delayed response to the post-pandemic inflation surge. Its adoption in August 2020 marked a transparent shift from the Fed’s earlier inflation-targeting regime, formally launched in 2012. Whereas the sooner framework emphasised a symmetric two-percent inflation goal (a stance the Fed clarified in 2016), FAIT launched an specific dedication to make up for previous shortfalls, permitting inflation to reasonably overshoot the goal following intervals of undershooting.[3] In follow, nonetheless, the Fed’s implementation of FAIT was uneven: it invoked the framework to justify continued lodging in 2021 however made no effort to offset subsequent above-target inflation with below-target inflation.[4] This asymmetry inhibited the Fed’s response in two methods. First, it gave officers a rationale for delaying tightening, since average overshooting was according to the framework’s backward-looking logic. Second, it discouraged the pursuit of a superior goal — stabilizing the value stage — by making no provision for correcting upward drift as soon as inflation took maintain.

Lastly, Part 6 discusses a number of proposed options and revisions to the present framework. A few of these options — resembling symmetric common inflation concentrating on and nominal GDP stage concentrating on — seem extra more likely to promote worth stability and cut back the chance of comparable failures sooner or later. These choices are supplied to offer Fed officers and others keen on financial coverage with a contemporary perspective on the present framework and counsel methods it may be revised to strengthen financial stability.[5]

2. What Drove the Publish-Pandemic Rise within the Worth Degree?

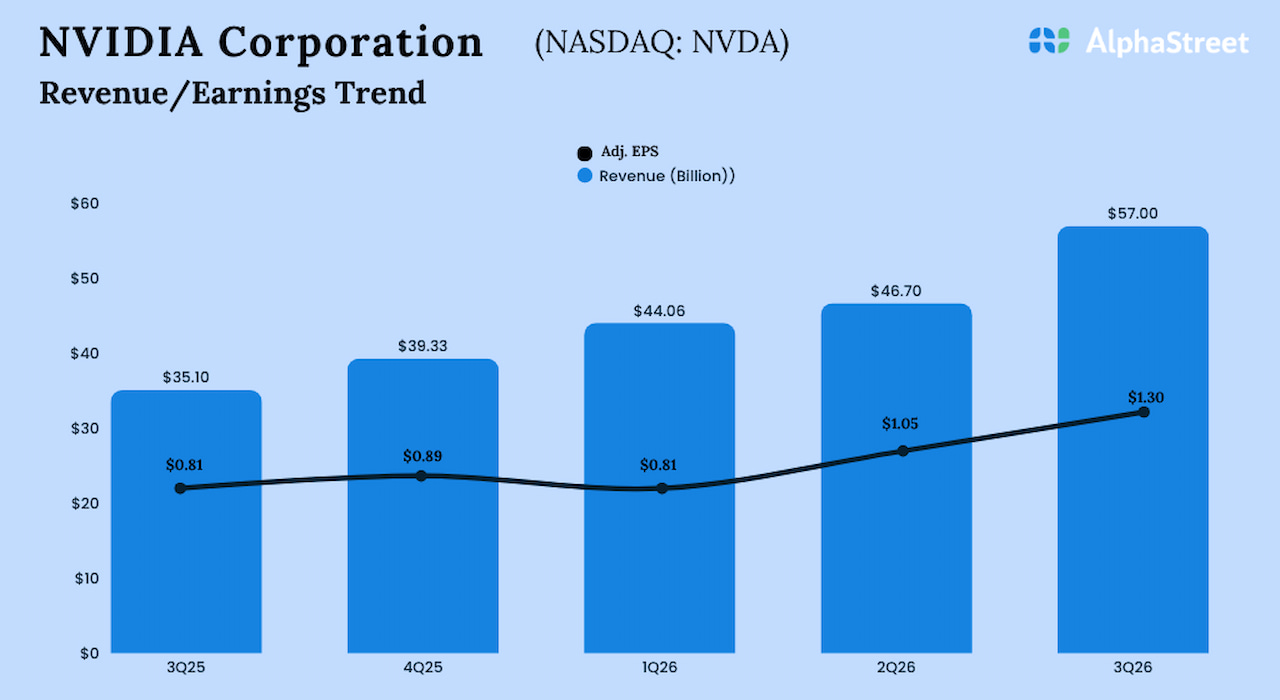

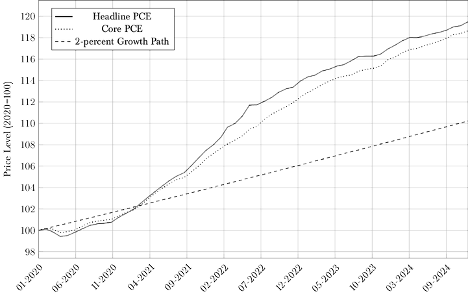

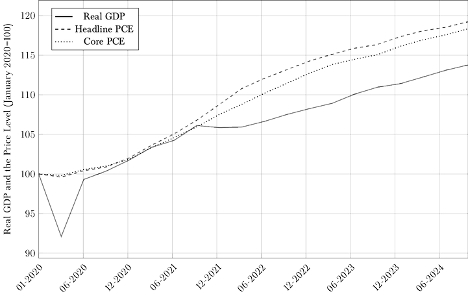

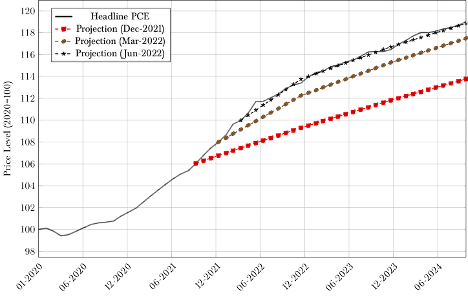

The worth stage has risen considerably since January 2020 (see Determine 1). To grasp why — and to evaluate Chair Powell’s declare that this rise was “exogenous” — it’s useful to look at how the non-public consumption expenditures (PCE) worth index, the Fed’s most popular measure of inflation, developed throughout this era. The paper begins by reviewing the trajectory of the value stage, then evaluates three well-liked, however in the end unconvincing, explanations for the post-pandemic inflation surge, and eventually presents a extra compelling different: a surge in nominal spending fueled by overly accommodative financial coverage.

2.1. The Trajectory of the Worth Degree: 2020–2024

Determine 1 plots each headline and core private consumption expenditures (PCE) indices from January 2020 alongside the Fed’s two-percent goal development path, providing a transparent view of when — and by how a lot — the value stage diverged from the Fed’s goal. Because the determine makes clear, each headline and core PCE inflation initially fell beneath the Fed’s goal, however the decline was temporary. By March 2021, the value stage had absolutely returned to the goal path, and within the months that adopted, surged previous it.

Determine 1: Headline and Core PCE Worth Indices

Between January 2020 and September 2021, annual headline and core PCE inflation averaged 3.1 and a couple of.9 %, respectively — however over the subsequent 9 months, they accelerated sharply, averaging 7.7 and 5.6 %.[6] Inflation started to average after mid-2022. Headline PCE inflation averaged 3.2 % between June 2022 and June 2023, and for 2024, it averaged 2.5 %. Over the identical intervals, core PCE inflation averaged 4.3 and a couple of.8 %, respectively.

Nonetheless, by December 2024, the headline PCE worth index was 8.4 proportion factors above the place it could have been had the Fed constantly met its two-percent inflation goal. Whereas inflation charges have come down from their 40-year highs, the value stage stays completely elevated relative to its goal path. What brought on the value stage to diverge so persistently from the Fed’s goal?

2.2. Three Unsatisfying Explanations

Powell’s remarks counsel that he and different Fed officers view the rise within the worth stage as exterior their management. Take into account three well-liked however in the end unconvincing explanations for the inflation surge — company greed, expansionary fiscal coverage, and provide constraints — all of which might plausibly align with Powell’s description of the post-pandemic surge as “exogenous.” To be clear, this isn’t to counsel that these components performed no position within the rise within the worth stage; slightly, none of those explanations accounts for the timing, magnitude, and persistence of the inflation surge, indicating that another rationalization is important.

2.2.1. Issues with the “Greedflation” Rationalization

As the value stage started to rise following the pandemic, many commentators on the political left attributed the surge in inflation to rising company earnings, arguing that corporations exploited provide disruptions and powerful demand to extend costs nicely past their value will increase. Sen. Elizabeth Warren (D-MA), for instance, tweeted in April 2022, “Companies have found out they will use inflation as cowl to not solely go alongside their very own elevated prices to shoppers, but in addition to cost gouge to spice up their revenue margins.” Echoing this sentiment, former Sen. Sherrod Brown (D-OH) remarked in 2023 that “company executives […] faux they’re making ‘robust decisions’ about costs whereas reporting report revenue will increase quarter after quarter” and advised that “this profiteering” was “one of many greatest drivers of inflation.”

Whereas it might be tempting to dismiss these feedback as mere political rhetoric, some economists have developed extra formal variations of the greedflation view. Lorenzoni and Werning (2023), for instance, argue that inflation arises from battle: totally different financial brokers have incompatible goals over relative costs, and every workout routines solely partial or intermittent management over the costs they set. Of their staggered-pricing mannequin, every agent raises costs at any time when it has the chance. The result’s that although relative costs stay unchanged, the cumulative worth will increase pushed by this battle generate a “basic and sustained inflation in all costs.”[7]

Weber and Wasner (2023) provide one other model of this argument. When an exterior shock causes enter prices to rise, they contend, corporations with market energy can successfully collude to lift their costs.[8] Provided that “all corporations need to defend their revenue margins and know that the opposite corporations pursue the identical objective,” Weber and Wasner keep, “they will improve costs, counting on different corporations following swimsuit.” Furthermore, if bottlenecks create non permanent market energy, they argue, corporations can “hike costs not solely to guard however to extend earnings.” In different phrases, when non permanent bottlenecks create extra market energy, corporations would possibly elevate their markups — not merely passing on larger enter prices, however rising earnings as nicely.

The greedflation rationalization supplies incumbent politicians with a handy scapegoat, so it’s no shock that they like it to different, extra standard explanations. There are, nonetheless, a number of issues with this view. For one, it’s inconsistent with fundamental worth principle (Hendrickson 2024). Companies can not elevate costs with out risking a lack of clients. Larger enter prices cut back revenue margins. It follows {that a} rise in a agency’s markup implies considered one of three issues. First, the agency might have initially set its worth too low and later corrected it. Second, it might have raised its worth too excessive and did not make some worthwhile gross sales. Third, it might have skilled a rise in demand, permitting it to cost extra with out dropping clients. The primary two instances indicate that corporations weren’t maximizing earnings earlier than the pandemic, which, whereas doable, appears unlikely. Within the third case, the upper demand — not greed — explains the rise in markups.[9]

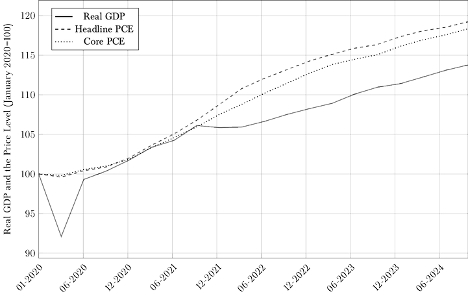

One other downside with this view is that it assumes market energy operates primarily by elevating costs by limiting output. Whereas such a mechanism is theoretically believable, it can not account for the dimensions of the post-pandemic inflation with out implying an implausibly giant contraction in combination output development.[10] But even setting that subject apart, the empirical report is inconsistent with the greedflation narrative: output was rising alongside inflation, not falling, through the interval in query, which means that the noticed rise in markups was largely pushed by stronger demand, not an increase in market energy (See Determine 2).

2.2.2. Issues with the Expansionary Fiscal Coverage Rationalization

One other widespread rationalization for the post-pandemic inflation — well-liked on, although not unique to, the political proper — is that it was pushed by expansionary fiscal coverage. The federal authorities sharply elevated spending to mitigate the financial fallout of the pandemic and the accompanying restrictions on financial exercise. Congress approved $3.3 trillion throughout 5 reduction payments handed in 2020 and a further $1.8 trillion in 2021. As Romer (2021) observes, these measures “ran the gamut from extremely helpful and acceptable to largely ineffective and wasteful.” Importantly, policymakers made no point out of upper future taxes to offset these expenditures. Because of this, combination demand rose: households and corporations, anticipating larger present and future earnings however no offsetting tax burden, elevated their spending. That rise in nominal spending, in flip, put upward strain on costs.[11]

There may be definitely advantage to this view. Certainly, the underlying reason behind excessive and hyperinflation is usually reckless fiscal coverage (Sargent 1982). Nonetheless, some proponents of the fiscal rationalization state it in a method that successfully — if not all the time deliberately — absolves the Fed of any culpability. Expansionary fiscal coverage solely boosts combination demand if the Fed accommodates it.[12] An increase in deficit spending by the federal authorities pushes rates of interest larger. If, in response to larger rates of interest, the Fed adjusts its coverage charge upward, non-public spending will decline to offset the rise in public spending, leaving combination demand unchanged. The federal authorities’s fiscal response to the pandemic might have made the Fed’s job harder, but it surely can not, by itself, clarify the rise in inflation that adopted; that final result required financial lodging. On this case, slightly than elevating rates of interest to offset the inflationary strain of upper deficit spending, the Fed held charges close to zero and continued large-scale asset purchases — insurance policies that exacerbated, slightly than countered, the fiscal stimulus and allowed combination demand to surge.

2.2.3. Issues with the Provide-Constraint Rationalization

Essentially the most believable interpretation of Powell’s place — and maybe probably the most extensively accepted rationalization for the inflation surge — is that pandemic-induced provide constraints brought on the value stage to rise. COVID-19 and the ensuing restrictions on financial exercise sharply curtailed the economic system’s capability to supply items and providers in 2020. Though most individuals returned to work as governments relaxed these restrictions, provide chain disruptions lingered, constraining productive capability by a lot of 2021.[13]

The availability-constraint rationalization is simple: the pandemic decreased combination output (measured as actual GDP), rising the shortage of products and providers, which in flip drove up costs. Whereas theoretically sound — and certainly, fairly intuitive — this rationalization faces two basic issues. First, the timing is off. The sharpest contraction in output occurred in 2020, but costs rose by lower than two % on common over the primary 12 months of the pandemic. Inflation didn’t start to rise in earnest till the economic system had largely recovered from the preliminary provide disruptions, as proven in Determine 2, which plots actual GDP alongside each the headline and core PCE worth indices. When inflation accelerated, output and the value stage have been rising collectively — not shifting in reverse instructions, as one would count on following an opposed provide shock, which tends to scale back the economic system’s productive capability, resulting in decrease output and better costs as a result of elevated shortage.[14]

Determine 2: The Path of Actual GDP and the Worth Degree

The second, and extra basic, downside with the supply-constraint view is that it can not account for the everlasting rise within the pattern worth stage. In the usual combination demand and provide framework, non permanent provide shocks trigger short-run deviations in output and costs however go away the long-run worth stage path unchanged. For a given charge of combination demand development, the value stage rises briefly when output falls beneath potential, however returns to pattern as output recovers. By the top of 2024, actual GDP had almost returned to its pre-pandemic development path, but the value stage remained nicely above its two-percent goal path. In brief, the persistence of an elevated worth stage is inconsistent with a purely supply-driven rationalization.

To make sure, provide disruptions possible contributed to the surplus inflation noticed for the reason that begin of 2020. The query is, by how a lot? Complete spending within the economic system — i.e., nominal GDP or nominal earnings — grew at a median annual charge of 4.1 % over the five-year interval previous the pandemic. Throughout that point, actual GDP — inflation-adjusted output — grew by 2.5 % per 12 months, whereas inflation — as measured by the GDP deflator — averaged 1.5 %. From the beginning of 2020 to the top of 2024, actual GDP development averaged simply 2.3 %. With out a change in complete spending, nominal GDP would have continued to develop at its pre-pandemic tempo, and the slowdown in actual GDP development would have pushed the typical inflation charge up modestly — to round 1.7 % per 12 months. In actuality, nonetheless, the GDP deflator grew at a median charge of three.9 % over the identical interval. Therefore, solely about 10.3 % of the noticed extra inflation could be attributed to decreased output — whether or not as a result of pandemic-related provide constraints or, as mentioned earlier, rising market energy.[15]

2.3. The Actual Drawback Was Nominal

Whereas the Fed performed financial coverage fairly nicely in 2020 — particularly given the peculiarities of the COVID-19 contraction — it was caught off guard when combination demand picked up in 2021 (Cachanosky et al. 2021). Nominal GDP, which had grown at a median annual charge of 4.1 % within the rapid pre-pandemic interval, surged by 10.7 % from 2021:Q1 to 2022:Q1, and by 7.4 % from 2022:Q1 to 2023:Q1. Though provide constraints contributed to extra inflation, the core downside was that the Fed did not stabilize combination demand (Beckworth and Horan 2025; Luther 2024; Schibuola and Martinez 2021).

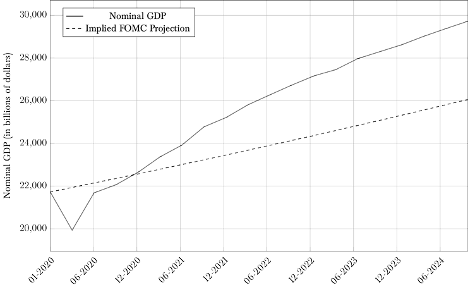

To understand the dimensions of the surge in nominal spending, it’s helpful to check the precise trajectory of nominal GDP to the Federal Open Market Committee’s (FOMC) implicit pre-pandemic projection. This projection could be inferred by combining the FOMC’s projections of actual GDP development and inflation to estimate the anticipated path of nominal spending — merely the sum of these two elements. In December 2019, the median projection for long-run annual actual GDP development was 1.9 % and for inflation was two %, implying a projected long-run nominal GDP development charge of three.9 % per 12 months. Determine 3 plots this projected path alongside the precise path of nominal GDP.

Determine 3: The Path of Nominal GDP and the FOMC’s Implied Projection

Because the determine reveals, nominal spending surged previous the FOMC’s implied projection in early March 2021 and has remained elevated ever since. By the top of 2024, nominal GDP stood 14 % above the extent implied by the FOMC’s December 2019 projection. This divergence underscores the extent to which the Fed allowed combination demand to overshoot. It additionally highlights the central coverage failure behind the inflation surge: had the Fed begun tightening in early 2021 — when nominal GDP started rising above its pre-pandemic pattern — it might need prevented the persistent rise within the worth stage.

This surge additionally helps account for the rise in company earnings and the autumn in unemployment beneath its “pure charge.” If output costs rise quicker than enter costs, then an sudden surge in nominal spending — just like the one skilled after the pandemic — will briefly improve company earnings.[16] Companies, desperate to seize these earnings by assembly the rising demand, will rent extra employees and thereby drive the unemployment charge decrease. These developments — which the greedflation and supply-constraint views wrestle to clarify — comply with naturally from a demand-driven story. Therefore, not like the opposite explanations of inflation, the deal with nominal spending can account for all of the “stylized information” of the post-pandemic inflation.

Why did the Fed wait so lengthy to tighten regardless of this surge in nominal spending? As the subsequent part explains, the delay possible stemmed from policymakers’ perception that the inflation was supply-driven. Had they centered on nominal spending slightly than inflation, Fed officers would have seen a lot sooner that financial coverage was off observe — and might need averted the inflationary surge altogether. Extra importantly, it could have averted the lack of credibility and actual financial distortions related to such a protracted and preventable overshoot.

3. The Fed’s Misdiagnosis: Mistaking Demand for Provide

In his remarks on the January 2025 press convention, Chair Powell claimed that the Fed started tightening financial coverage as quickly as information indicated that inflation wouldn’t come down by itself. As proven, this declare is unfaithful; the information had turned in opposition to the supply-constraint view of inflation months earlier than Powell formally retired the time period “transitory” in November 2021. Furthermore, as late as December 2021, the Fed’s inflation projections implied that officers nonetheless anticipated inflation to say no with none coverage tightening — suggesting that they continued to view inflation as the results of non permanent provide constraints, regardless of mounting proof on the contrary.

This failure to acknowledge the demand-driven nature of the issue was evident all through 2021. FOMC members have been sluggish to acknowledge the rise in combination demand, as mirrored of their post-meeting statements in April, June, July, and September of that 12 months. In every case, they described the rise in inflation as “largely reflecting transitory components” (Bergman and Luther 2022). That characterization is according to the view that inflation was as a result of provide constraints — not extra combination demand.

This disconnect can be evident within the FOMC’s 2021 Abstract of Financial Projections. Desk 1 stories the median FOMC member’s precise and implied inflation projections — i.e., what inflation must be within the remaining months to hit the year-end goal — together with their projections for the federal funds charge (FFR) (Federal Reserve 2021a, 2021b, 2021c, 2021d, 2022a, 2022b). For every projection spherical, the annualized PCE inflation charge that had already occurred — from the start of the 12 months by the latest month for which information was out there on the time of the projection — is calculated. From that is derived the implied annualized inflation charge for the remaining months of the 12 months — that’s, the speed that will be according to the median FOMC member’s full-year projection given the inflation already noticed.

Desk 1: Median FOMC Member’s Precise and Implied PCE Inflation Projections and Federal Funds Price Projections for 2021 and 2022

| Projection Date | Inflation Projection for Present 12 months | Annualized Inflation 12 months-to-Date | Implied Annualized Inflation for Remaining Months | Median FFR Projection for Present 12 months | Median FFR Projection for Following 12 months |

| Mar 2021 | 2.4% | 5.1% | 2.2% | 0.1% | 0.1% |

| Jun 2021 | 3.4% | 5.7% | 2.3% | 0.1% | 0.1% |

| Sep 2021 | 4.2% | 5.9% | 1.9% | 0.1% | 0.3% |

| Dec 2021 | 5.3% | 5.8% | 2.7% | 0.1% | 0.9% |

| Mar 2022 | 4.3% | 6.0% | 4.1% | 1.9% | 2.8% |

| Jun 2022 | 5.2% | 5.8% | 4.3% | 3.4% | 3.8% |

Notes: Annualized inflation year-to-date displays the change in costs from the start of the 12 months during which the projection was made by final month for which PCE information was out there on the time of the projection. Implied annualized inflation charge for remaining months is set by the change in costs required over the months not but recorded on the time of the projection to realize the median FOMC member’s projection for the 12 months, given the change in costs that had already been recorded.

In March 2021, with year-to-date inflation averaging 5.1 % annualized, the median FOMC member projected simply 2.4 % inflation for the complete 12 months. That implied they anticipated inflation to common solely 2.2 % annualized over the remaining months. By June, recorded year-to-date inflation had risen to five.7 %, and the median FOMC projection elevated to three.4 % — however once more, this assumed inflation would sluggish, with an implied annualized charge of simply 2.3 % for the remainder of the 12 months. In September, year-to-date inflation averaged 5.9 % annualized, and the median projection rose to 4.2 % — implying a pointy deceleration to simply 1.9 % annualized over the ultimate months. In December, year-to-date inflation averaged 5.8 % annualized, but the median projection for the 12 months rose solely to five.3 % — once more suggesting that FOMC officers anticipated a dramatic slowdown in inflation over the ultimate two months regardless of no change in financial coverage.

All through this era, the median projection for the federal funds charge remained unchanged, signaling that FOMC members anticipated inflation to fall with out the necessity for coverage tightening. They may see that offer constraints had largely eased, but they continued to count on inflation to return to regular by itself. Certainly, the FOMC’s post-meeting assertion from November 2021 indicated that officers continued guilty provide constraints for the elevated inflation charges, noting that they have been “largely reflecting components which can be anticipated to be transitory.”

By December, FOMC members gave the impression to be dropping confidence within the supply-disruptions view. The phrase “transitory” was purged from the post-meeting assertion, and Fed officers lastly acknowledged the demand-side downside: “Provide and demand imbalances associated to the pandemic and the reopening of the economic system have continued to contribute to elevated ranges of inflation,” they wrote. However they nonetheless anticipated inflation — which had averaged 5.8 % by October — would fall to a median of two.7 % over the remaining two months. Furthermore, the FOMC didn’t instantly elevate its coverage charge, regardless of having acknowledged the demand-side downside. As a substitute, it started tapering asset purchases and signaling that charge hikes wouldn’t start till March 2022.

Regardless of Powell’s declare on the contrary, the rising consensus amongst economists is that the Fed ought to have acknowledged the rise in combination demand a lot earlier. By September 2021, the proof was clear sufficient {that a} shift in coverage stance was warranted. For instance, all eight coverage guidelines evaluated by Papell and Prodan-Boul (2024) really useful elevating the federal funds charge by 2021:Q3, if not earlier. Likewise, Eggertsson and Kohn (2023) argue that “from September 2021 onward, it was turning into more and more clear, a minimum of on reflection, that the inflation surge was broad primarily based and chronic.”

4. A Gradual and Hesitant Coverage Response

Chair Powell claims that after Fed officers acknowledged that inflation was demand-driven, they rapidly modified course. Once more, nonetheless, this assertion misses the mark. Though the FOMC acknowledged in December 2021 that inflation was a minimum of partially as a result of extra combination demand, it didn’t start elevating charges till March 2022 — a number of months later — and even then proceeded cautiously. Furthermore, as inflation continued to exceed the FOMC’s projections through the early months of 2022, officers have been sluggish to speed up the tempo of tightening. In brief, not solely did Fed officers misdiagnose the character of the issue — as soon as they acknowledged it, they have been sluggish to behave.

As proven in Desk 1, the median FOMC member projected in December 2021 that inflation would attain 5.3 % for the 12 months. The total vary of projections (not proven within the desk) was 5.3 to five.5 %. On the time, FOMC members had entry to PCE information by October 2021 and different indicators — together with firsthand observations — by November. But they considerably underestimated inflation. In January 2022, the Bureau of Financial Evaluation introduced that inflation had really been 5.8 % in 2021 — above the complete vary of projections. That estimate would later be revised as much as 6.2 %.

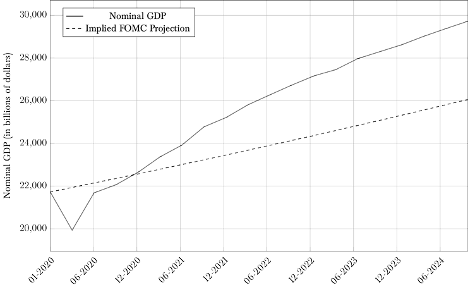

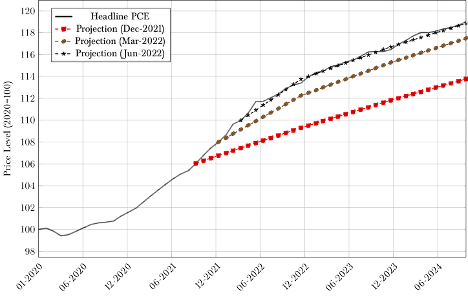

As an instance how rapidly costs outpaced FOMC projections following their acknowledgment of demand-side pressures in December 2021, think about the value stage paths implied by the median FOMC member’s inflation projections in December 2021, March 2022, and June 2022. In every case, the implied worth stage begins with the latest month for which information was out there on the time of the projection. Determine 4 presents the ensuing sequence.

Determine 4: Private Consumption Expenditures Worth Index and Median FOMC Member’s Implicit Worth Degree Projections

Notes: Implicit worth stage projections are primarily based on the median FOMC member’s PCE inflation projections for the next years and the latest month for which PCE information was out there when the projections have been made.

PCE information launched in December 2021, January 2022, and February 2022 constantly confirmed that costs have been rising a lot quicker than the median FOMC member had projected. But the FOMC didn’t elevate its coverage charge in January 2022, nor did it name a particular assembly to take action in February. It was not till March 2022 — with year-to-date inflation already at 6.0 % — that the FOMC lastly raised the federal funds charge, after which solely by 25 foundation factors. The median FOMC member revised their inflation projection for 2022 from 2.6 % in December 2021 (not proven in Desk 1) to 4.3 % in March 2022, and their projection for the federal funds charge from 0.9 % to 1.9 %. But officers didn’t speed up the tempo of tightening past what that they had beforehand indicated.[17]

Equally, PCE information launched in March and April 2022 confirmed that costs have been nonetheless rising nicely above the median FOMC member’s expectations. But the FOMC didn’t name an emergency assembly in April. As a substitute, it raised the coverage charge by 50 foundation factors in each Might and June. In June 2022, the median FOMC member revised their 2022 inflation projection as much as 5.2 % and their federal funds charge projection as much as 3.4 %. However the actual federal funds charge remained destructive. The Fed had eased off the accelerator — but it surely had not but hit the brakes.

The Fed didn’t get severe about bringing down inflation till July 2022, when it shocked markets with a 75-basis-point charge hike. It then adopted up with extra 75-basis-point hikes in September and November, a 50-basis-point hike in December, and 25-basis-point hikes in February, March, Might, and July 2023 — at which level the federal funds charge goal vary had elevated to five.25 to five.5 %. Sadly, the injury had already been achieved: the Fed’s sluggish response to the surge in combination demand had pushed the value stage nicely above its pre-pandemic development path. As the subsequent part explains, the Fed’s uneven implementation of the FAIT framework all however assured that such an error would destabilize the value stage path.

5. The Position of the FAIT Framework

In line with Chair Powell, the FAIT framework didn’t inhibit the Fed’s response to the post-pandemic inflation. Right here, too, Powell is mistaken. The FAIT framework inspired the Fed to delay tightening financial coverage and prevented the Fed from tightening sufficiently to deliver the value stage again all the way down to its prior two-percent development path. The delay meant costs rose larger than they in any other case would have. The shortcoming to return the value stage to its prior development path risked unanchoring expectations from two %.

Underneath FAIT, the Fed goals to realize two % inflation on common over time — but it surely doesn’t goal inflation symmetrically. As a substitute, it offsets solely intervals of below-target inflation. When inflation exceeds two %, because it did following the pandemic, the Fed merely goals to deliver inflation again down to 2 %, with out compensating for the overshoot. Because of this, the value stage stays completely elevated relative to its preliminary path.

The Fed adopted FAIT to deal with a selected downside. Following the onset of the Nice Recession in 2008, it constantly undershot its two-percent inflation goal. Regardless of a number of rounds of quantitative easing, inflation averaged simply 1.5 % from January 2009 to January 2020.[18] Fed officers fearful that persistently low inflation would unanchor expectations and put downward strain on nominal rates of interest. Coupled with slower inhabitants and productiveness development — which decrease actual rates of interest — below-target inflation risked pushing nominal charges to the zero decrease sure, thereby constraining the Fed’s capability to reply to future downturns.[19] By committing to offset intervals of below-target inflation, Fed officers believed the FAIT framework would assist anchor expectations at two % and cut back the probability that nominal rates of interest would once more method the zero decrease sure (Brainard 2020; Clarida 2020; Powell 2020).

Our current expertise with FAIT reveals that Fed officers have been solely partially proper. The framework might assist forestall inflation expectations from falling persistently beneath goal, but it surely doesn’t forestall them from drifting persistently above it. Certainly, if corporations and households consider the Fed will make up for below-target inflation however refuse to offset above-target inflation, they’ll fairly count on inflation to exceed two % on common. In brief, the “F” in FAIT — which provides Fed officers the pliability to pursue their inflation goal asymmetrically — conflicts with the “A,” which is meant to indicate that inflation will common two % over time.

One consequence of the FAIT framework is that, regardless of assertions on the contrary (see, for instance, Federal Reserve (2020)), inflation expectations won’t be well-anchored at two %. Companies and households can not reliably count on that inflation will common two % on a go-forward foundation. Because of this, any long-term contracts they enter into will likely be primarily based on the belief that inflation will are inclined to exceed two %. Extra troubling, nonetheless, is that events to long-term contracts should account for the likelihood that sudden inflation will result in everlasting wealth transfers (e.g., from lenders to debtors when fastened funds lose actual worth). Thus, long-term contracting underneath FAIT is riskier than it could be underneath different frameworks. To the extent that this larger danger discourages long-term contracting, FAIT may additionally impede financial development.

One other consequence of the FAIT framework is that it encourages the Fed to delay tightening financial coverage when vital. As a result of the framework permits inflation to run above two % for a time so as to make up for prior undershoots, officers might hesitate to reply to early indicators of rising inflation — particularly if current inflation has averaged beneath goal. In follow, this creates an asymmetry: the Fed is fast to ease when inflation falls wanting two % however sluggish to tighten when it exceeds the goal. This asymmetry was evident within the wake of the pandemic, when officers emphasised previous inflation shortfalls to justify continued lodging, whilst nominal spending surged and inflation pressures mounted. On this method, FAIT’s backward-looking nature blunted the Fed’s responsiveness at a essential second.

Chair Powell might insist that FAIT didn’t inhibit the Fed, however this declare doesn’t match the information. FAIT not solely contributed to the preliminary rise within the worth stage, it additionally supplied no mechanism for correcting the price-level drift as soon as inflation took maintain.

6. What Ought to the Fed Do?

If FAIT didn’t inhibit the Fed’s response, as Chair Powell claims, one would possibly fairly count on Fed officers to protect the FAIT framework going ahead. Why repair what isn’t damaged? In actual fact, through the overview course of, Fed officers have indicated that they’ll possible take away the asymmetry implied by FAIT. Regardless of their public statements, Chair Powell and different Fed officers clearly acknowledge the issues with the FAIT framework mentioned above. In any occasion, the query the Fed now faces is the way to revise its framework in gentle of current expertise.

This part considers 4 potential revisions to the present framework:

- returning to a symmetric inflation goal

- implementing a symmetric common inflation goal

- elevating the inflation goal

- transitioning to a nominal spending goal

Though the final choice might provide the best potential advantages, it additionally presents vital communication challenges. A symmetric common inflation goal might obtain lots of the similar advantages as a nominal spending goal, if applied successfully. Against this, returning to a symmetric inflation goal or elevating the inflation goal doesn’t signify an apparent enchancment over the present framework. Every proposal is reviewed in flip.

6.1. Symmetric Inflation Concentrating on

Maybe the least radical revision to the present framework could be to revert to the symmetric inflation goal (IT) adopted in 2016. Underneath IT, the Fed doesn’t try to make up for under- or overshoots. As a substitute, it lets bygones be bygones and goals to ship two-percent inflation interval by interval. The framework is symmetric within the sense that over- and undershoots are handled equally, with deviations from the goal leading to random short-run fluctuations across the two-percent path, slightly than systematic over- or underperformance.

The primary benefit of IT is that it’s comparatively simple to speak to the general public. The draw back is that, if adopted strictly, it could possibly constrain the Fed’s capability to conduct countercyclical financial coverage. Take into account a sudden destructive combination demand shock that reduces inflation. If costs are sticky, actual output will briefly fall beneath its potential. Underneath IT, the Fed would proceed aiming for two-percent inflation going ahead, however from a cheaper price stage than households and corporations had anticipated previous to the shock. Since output will stay beneath potential till expectations and the value stage modify, this method may end up in a sluggish restoration.

Quite than lowering the chance of long-term contracting, IT might make such contracts even riskier than underneath the present FAIT framework. Though households and corporations can fairly count on inflation to common two % underneath IT, the potential for sudden deviations implies that everlasting wealth transfers are extra possible. Underneath IT, the Fed doesn’t appropriate for previous errors, so it might (randomly) over- or undershoot its goal. Against this, underneath FAIT, the Fed commits to creating up for intervals of below-target inflation, so these getting into long-term contracts want solely fear about above-target surprises.[20] In brief, the vary of potential wealth transfers — and, correspondingly, the chance related to long-term contracting — is more likely to be larger underneath IT.

6.2. Symmetric Common Inflation Concentrating on

Essentially the most easy revision to the present framework could be to make the typical inflation goal symmetrical. Underneath a symmetric common inflation concentrating on (AIT) regime, the Fed would intention to realize two-percent inflation, on common, over time — which means that officers would offset each over- and undershoots. As underneath the present FAIT framework, the Fed would enable inflation to exceed two % briefly following intervals of below-target inflation. In contrast to FAIT, nonetheless, the Fed would additionally enable inflation to fall beneath two % briefly following intervals of above-target inflation.

This method affords a number of benefits over FAIT. Most significantly, by making up for previous misses in each instructions, a symmetric AIT framework would are inclined to stabilize the value stage over time. This final result is extra according to the Fed’s worth stability mandate, would assist tackle longstanding considerations concerning the redistributional results of price-level shocks, and would higher replicate the historic classes of the Volcker-Greenspan period (Binder 2025; Hetzel 2025) Furthermore, it could cut back the chance related to long-term contracting relative to each IT and FAIT.

To see how AIT would scale back the chance of long-term contracting, think about once more the potential outcomes for these getting into long-term contracts. Underneath AIT, the Fed would possibly (randomly) err by delivering above- or below-target inflation. In contrast to underneath the present framework, nonetheless, the Fed would then try to make up for this error, finally restoring the value stage to its pre-shock anticipated path. By doing so, the AIT reduces the chance of long-term contracting. In brief, underneath AIT the value stage is mean-reverting and, therefore, a lot simpler to foretell.

One other benefit of AIT is that it might immediate the Fed to behave extra rapidly following combination demand shocks. As a result of AIT requires the Fed to make up for previous errors, the additional the value stage deviates from its goal development path, the extra aggressively the Fed should reply to deliver it again on observe. For instance, suppose the Fed considerably undershoots its goal for an prolonged interval. In that case, it might want to generate inflation that’s larger for longer than would have been vital had officers acted sooner. Given the political unpopularity of sustained inflation, Fed officers would possibly want to maintain inflation nearer to focus on by remaining vigilant for deviations and correcting them promptly once they happen.

Nonetheless, AIT has a minimum of one essential downside: it permits the Fed to reply to provide shocks.[21] As Selgin (1997) explains, modifications within the worth stage pushed by provide shocks convey helpful data that permits households and corporations to make knowledgeable manufacturing and consumption selections. When the Fed offsets such price-level modifications, it imposes pointless prices — particularly on corporations — that will in any other case stay unaffected by the shock, since they need to now modify costs to accommodate the Fed’s response.[22]

The Fed would possibly allow a brief deviation within the worth stage attributable to a provide shock, anticipating it to dissipate as actual output returns to potential. However AIT doesn’t require such restraint; it permits — and should even encourage — offsetting these deviations, even when doing so is counterproductive.

In the course of the Fed’s most up-to-date framework overview — which in the end produced the present FAIT framework — AIT “garnered probably the most public consideration…and lots of observers anticipated it to be the Fed’s new framework” (Beckworth and Horan 2025). Certainly, the prominence of AIT in these discussions possible contributed to the preliminary confusion concerning the Fed’s uneven implementation of FAIT. In sum, adopting AIT in the present day would signify a modest — although significant — shift from the present framework. The general public would possible discover a symmetric goal extra intuitive, and Fed officers and journalists have already achieved a lot of the work to clarify how AIT operates. For these causes, a transition to AIT would possible be simpler to speak than extra radical options.

6.3. Elevating the Inflation Goal

Some economists, together with Jason Furman (2023a), have argued that the Fed ought to use its upcoming framework overview as a chance to lift its two-percent inflation goal.[23] This revision could possibly be applied throughout the present framework, or paired with one of many different inflation-targeting frameworks mentioned earlier. Furman contends {that a} larger inflation goal would “cushion the economic system in opposition to extreme recessions” and “give the Fed extra scope to chop rates of interest and thereby stimulate the economic system.” He additionally argues that, since households and corporations would incorporate larger anticipated inflation into wage and debt contracts, there may be little purpose to fret about its results on employees and collectors (Furman 2023b).

There are a number of issues with this argument. First, the declare that larger inflation can cushion downturns depends on the view that employees are unwilling to just accept nominal wage cuts (Akerlof, Dickens, and Perry 1996). However as White (2025) explains, this reluctance isn’t an immutable behavioral truth; it’s an institutionally contingent final result.[24] In the course of the US postbellum interval (1865–1896), for instance, actual output grew at a median annual charge of three.7 % whereas inflation averaged 2.0 %. It’s unclear how larger inflation would have improved financial efficiency in that context.

Second, Furman’s declare {that a} larger inflation goal would give the Fed extra room to chop rates of interest is deceptive. The zero decrease sure on nominal rates of interest solely constrains coverage in a low-inflation atmosphere if the Fed restricts itself to rate of interest devices. As White (2025) notes, nonetheless, there isn’t any purpose the Fed should achieve this. For instance, it might as an alternative conduct coverage by adjusting the financial base, during which case the zero decrease sure could be irrelevant.

Lastly, Furman’s declare that larger anticipated inflation wouldn’t hurt employees and collectors is mistaken. As White (2025) explains, larger anticipated inflation will increase the price of holding cash balances, lowering the positive factors from change. It additionally distorts financial selections by interacting with unindexed taxes on curiosity earnings and capital positive factors.[25] These results are removed from trivial and would in the end hurt each employees and collectors (Feldstein 1997, 1999; Lagos and Wright 2005; Lucas 2000). Fortuitously, Fed officers don’t seem like taking this suggestion significantly. Throughout his semiannual testimony to the US Senate Banking Committee, Chair Powell acknowledged, “We expect it’s actually essential that we do follow a two-percent inflation goal and never think about altering it” (The Semiannual Financial Coverage Report back to the Congress 2023).

6.4. Nominal Spending Concentrating on

The most suitable choice could be for the Fed to desert inflation concentrating on altogether and as an alternative undertake a nominal spending goal. Underneath this framework, the Fed adjusts the cash provide to offset modifications in cash demand, thereby making certain that nominal spending follows a predetermined development path. Like common inflation concentrating on (AIT), this method requires the Fed to make up for intervals when nominal spending deviates from its goal path, but it surely differs from AIT by permitting provide shocks to go by to the value stage and inflation charge. A nominal spending goal thus behaves like AIT within the case of combination demand shocks, however spares the Fed having to determine whether or not to deviate from its inflation goal in response to combination provide shocks, which it’s ill-equipped to deal with instantly with its current instruments (rate of interest modifications and asset purchases) that may solely affect combination demand, not provide. Like AIT, it makes the value stage extra predictable over longer time horizons.[26]

To make sure, there’s a communication problem related to shifting from FAIT to a nominal spending goal. The Fed’s previous frameworks have conditioned the general public to assume when it comes to an inflation goal of 1 type or one other. Because of this, a nominal spending goal might initially seem to be a radical departure from the established order. That stated, Binder (2020) argues that nominal spending concentrating on would in the end enhance central financial institution communication:

A part of the problem of inflation concentrating on is that many individuals both have no idea what inflation is or perceive it very in another way than central bankers do. Many individuals don’t perceive that larger inflation generally is a consequence of upper combination demand. On surveys of shopper expectations, for a lot of shoppers, reported inflation expectations are actually a proxy for his or her beliefs concerning the basic state of the economic system — that’s, shoppers report larger inflation expectations when financial sentiment is poor.

By permitting “the Fed to border its coverage selections when it comes to earnings slightly than inflation,” a nominal spending goal helps alleviate public confusion concerning the relationship between inflation and actual output fluctuations (Binder 2020). It additionally reduces uncertainty amongst households and corporations about how the Fed will stability the 2 sides of its twin mandate. On this method, a nominal spending goal might considerably enhance central financial institution communication.

Furthermore, whereas a nominal spending goal might sound like a dramatic departure from the established order, it may be applied utilizing acquainted rate of interest guidelines. For instance, Orphanides (2025) proposes a pure development concentrating on rule, which prescribes how the Fed ought to set its coverage charge primarily based on the projected development of nominal spending and the “pure” development charge — outlined because the sum of the Fed’s two-percent inflation goal and the estimated development charge of potential output. Had the Fed adopted this rule throughout and instantly after the pandemic, it could have begun tightening a lot sooner and prevented the value stage from rising as excessive because it did.

In sum, nominal spending concentrating on isn’t solely economically sound however institutionally possible, representing the best choice for selling financial stability going ahead.

7. Conclusion

Opposite to Chair Powell’s claims, the 2020-2024 rise within the worth stage was not exogenous — it was the results of an combination demand shock attributable to the Fed itself. Officers failed to acknowledge the demand-driven nature of the issue, regardless of mounting proof. Nor, opposite to Powell’s declare, did they act swiftly to appropriate course as soon as they realized that financial coverage was far off observe. Removed from being irrelevant, the FAIT framework helps clarify why the value stage stays nicely above its pre-pandemic development path. In brief, FAIT has failed. It doesn’t promote worth stability — it enabled the very best inflation in forty years. It doesn’t anchor expectations — it has eroded the Fed’s credibility.

On reflection, these outcomes are hardly shocking. By focusing narrowly on inflation, FAIT will increase the chance of misdiagnosing demand shocks as provide shocks — because the Fed did in 2021. Had officers centered on nominal spending, they’d have seen that combination demand was rising quickly — in different phrases, that households and corporations have been rising their spending at a tempo nicely above the corresponding change within the economic system’s productive capability, placing upward strain on costs, warranting tighter financial coverage. The Fed’s uneven method to FAIT possible contributed to its sluggish response. If the framework had required officers to make up for above-target inflation, they’d have had stronger incentives to behave rapidly and restrict the scale of the mandatory correction. As a substitute, the asymmetry just about ensures that inflation will exceed two % on common.

FAIT was designed to deal with the perceived downside of persistently low inflation following the Nice Recession. In that slender respect, it succeeded: it eradicated low inflation, however on the expense of worth stability. What the Fed wants is a sturdy financial coverage framework able to responding to a variety of financial circumstances. No matter its different deserves, FAIT is lower than the duty.

To that finish, every of 4 potential revisions to the Fed’s financial coverage framework was evaluated. Of those, two stand out as particularly promising. The most suitable choice could be for the Fed to undertake a nominal spending goal, which might assist anchor expectations, keep away from inappropriate responses to produce shocks, guarantee a well timed response to demand shocks, and enhance communication with the general public. This method could also be troublesome to clarify initially. A symmetric common inflation goal could be a viable second-best choice, providing many — although not all — of the advantages of nominal spending concentrating on. Both different could be a transparent enchancment over the established order and would possible have produced higher financial coverage lately.

Getting this historical past proper issues. If Fed officers are to keep away from repeating the identical errors, they need to acknowledge their position in driving costs completely larger. As they overview the framework this 12 months, they need to bear one factor in thoughts: both FAIT enabled the value stage to rise completely above its pre-pandemic path, or it failed to forestall it. Both method, it should go.

References

Akerlof, George A., William T. Dickens, and George L. Perry. 1996. “The Macroeconomics of Low Inflation.” Brookings Papers on Financial Exercise 1:1–59.

Alvarez, Santiago, Alberto Cavallo, Alexander MacKay, and Paolo Mengano. 2024. Markups and Value Cross-through Alongside the Provide Chain. Social Science Analysis Community.

Ball, Laurence. 2014. The Case for a Lengthy-Run Inflation Goal of 4 %. Working Paper. WP/14/92. Worldwide Financial Fund.

Beckworth, David, and Patrick J. Horan. 2025. “The Destiny of FAIT: Salvaging the Fed’s Framework.” Southern Financial Journal 91(4):1391–1403.

Bergman, William, and William J. Luther. 2022. “When Did The Fed Change Its Tune?” https://aier.org/article/when-did-the-fed-change-its-tune/.

Binder, Carola. 2020. “NGDP Concentrating on and the Public Fed Coverage.” Cato Journal 40(2):321–42.

Binder, Carola. 2025. “The Rise of Inflation Concentrating on.” Southern Financial Journal 91(4):1229–46.

Blanchard, Olivier J., Giovanni Dell’Ariccia, and Paolo Mauro. 2010. Rethinking Macroeconomic Coverage. Worldwide Financial Fund.

Blanco, Andrés. 2021. “Optimum Inflation Goal in an Economic system with Menu Prices and a Zero Decrease Certain.” American Financial Journal: Macroeconomics 13(3):108–41.

Brainard, Lael. 2020. “Bringing the Assertion on Longer-Run Targets and Financial Coverage Technique into Alignment with Longer-Run Adjustments within the Economic system.” Introduced on the Brookings Establishment, September 1, Washington, D.C.

Brown, Sherrod. 2023. “Brown To Powell: Put Staff First within the Struggle Towards Inflation | U.S. Senator Sherrod Brown of Ohio.” https://www.brown.senate.gov/newsroom/press/launch/sherrod-brown-to-powell-put-workers-first-fight-against-inflation.

Cachanosky, Nicolás, Bryan P. Cutsinger, Thomas L. Hogan, William J. Luther, and Alexander W. Salter. 2021. “The Federal Reserve’s Response to the COVID-19 Contraction: An Preliminary Appraisal.” Southern Financial Journal 87(4):1152–74.

Clarida, Richard H. 2020.“The Federal Reserve’s New Framework: Context and Penalties.” Introduced on the Bookings Establishment, November 16, Washington, D.C.

Cochrane, John H. 2023. The Fiscal Principle of the Worth Degree. Princeton College Press.

Cutsinger, Bryan P., and William J. Luther. 2022. “Seigniorage Funds and the Federal Reserve’s New Working Regime.” Economics Letters 220:110880.

Di Giovanni, Julian, Ṣebnem Kalemli-Özcan, Alvaro Silva, and Muhammed A. Yildirim. 2023. Pandemic-Period Inflation Drivers and World Spillovers. Nationwide Bureau of Financial Analysis.

Eggertsson, Gauti B., and Don Kohn. 2023. The Inflation Surge of the 2020s: The Position of Financial Coverage. 87. Brookings Establishment.

Federal Reserve. 2020.“2020 Assertion on Longer-Run Targets and Financial Coverage Technique.” https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications-statement-on-longer-run-goals-monetary-policy-strategy.htm.

Federal Reserve. 2021a. “December 2021: Abstract of Financial Projections.”

Federal Reserve. 2021b. “June 2021: Abstract of Financial Projections.”

Federal Reserve. 2021c. “March 2021: Abstract of Financial Projections.”

Federal Reserve. 2021d. “September 2021: Abstract of Financial Projections.”

Federal Reserve. 2022a.“June 2022: Abstract of Financial Projections.” https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20220615.htm.

Federal Reserve. 2022b.“March 2022: Abstract of Financial Projections.” https://www.federalreserve.gov/monetarypolicy/fomcprojtable20220316.htm.

Feldstein, Martin. 1997. “The Prices and Advantages of Going from Low Inflation to Worth Stability.” Pp. 123–56 in Lowering inflation: motivation and technique, edited by C. D. Romer and D. H. Romer. Chicago, IL: College of Chicago Press.

Feldstein, Martin. 1999. “Capital Revenue Taxes and the Good thing about Worth Stability.” Pp. 9–40 in The prices and advantages of worth stability, edited by M. Feldstein. Chicago, IL: College of Chicago Press.

Furman, Jason. 2023a. “The Fed Ought to Fastidiously Goal for a Larger Inflation Goal.” Wall Road Journal, August 20.

Furman, Jason. 2023b. “Sudden Inflation Can Result in Redistribution, Hurting Collectors and Presumably Staff.” https://x.com/jasonfurman/standing/1693791191760781471.

Gordon, Robert J. 1996. “Touch upon Akerlof et Al.” Brookings Papers on Financial Exercise 1:60–66.

Grimm, Maximilian, Òscar Jordà, Moritz Schularick, and Alan M. Taylor. 2023. “Free Financial Coverage and Monetary Instability.”

Hendrickson, Josh. 2024.“Worth Principle as an Antidote.” https://www.economicforces.xyz/p/price-theory-as-an-antidote.

Hendrickson, Joshua. 2025. “The Case for Nominal GDP Degree Concentrating on.” Southern Financial Journal 91(4):1404–19.

Hetzel, Robert L. 2025. “Monetarism and Financial Coverage.” Southern Financial Journal 91(4):1347–71.

Hogan, Thomas L. 2025. “The Failure of Ahead Steerage: Classes from the Pandemic Restoration.” Southern Financial Journal 91(4):1265–86.

Eire, Peter N. 2025. “The Devolution of Federal Reserve Financial Coverage Technique, 2012–24.” Southern Financial Journal 91(4):1247–64.

Jordan, Jerry L., and William J. Luther. 2022. “Central Financial institution Independence and the Federal Reserve’s New Working Regime.” The Quarterly Assessment of Economics and Finance 84:510–15.

Lagos, Ricardo, and Randall Wright. 2005. “A Unified Framework for Financial Principle and Coverage Evaluation.” Journal of Political Economic system 113(3):463–84.

Lorenzoni, Guido, and Iván Werning. 2023. Inflation Is Battle. Nationwide Bureau of Financial Analysis.

Lucas, Robert E. 2000. “Inflation and Welfare.” Econometrica 68(2):247–74.

Luther, William J. 2024. “Impartial Nominal Spending and the Nominal Spending Hole.”

Mankiw, N. Gregory. 1996. “Touch upon Akerlof et Al.” Brookings Papers on Financial Exercise 1:66–70.

Miller, Tracy. 2024. “Fiscal Coverage and Inflation Management: Insights from the COVID Financial Response.” Mercatus Coverage Transient Collection.

Nelson, Invoice. 2025. “How the Federal Reserve Received so Big, and Why and How It Can Shrink.” Southern Financial Journal 91(4):1287–1322.

Orphanides, Athanasios. 2025. “Enhancing Resilience with Pure Progress Concentrating on.” Southern Financial Journal 91(4):1420–39.

Papell, David H., and Ruxandra Prodan-Boul. 2024. Coverage Guidelines and Ahead Steerage Following the Covid-19 Recession. Social Science Analysis Community.

Powell, Jerome. 2020.“New Financial Challenges and the Fed’s Financial Coverage Assessment.” https://www.federalreserve.gov/newsevents/speech/powell20200827a.htm.

Powell, Jerome. 2025.“FOMC Press Convention Transcript of January 29, 2025,” January 29, Washington, D.C.

Romer, Christina D. 2021. “The Fiscal Coverage Response to the Pandemic.” Brookings Papers on Financial Exercise 89–110.

Rouanet, Louis, and Alexander William Salter. 2025. “Mission Creep on the Federal Reserve.” Southern Financial Journal 91(4):1323–46.

Sargent, Thomas J. 1982. “The Finish of 4 Large Inflations.” Pp. 41–98 in Inflation: Causes and Results, edited by R. E. Corridor. College of Chicago Press.

Schibuola, Alexander D., and Andrew B. Martinez. 2021. “The Expectations Hole.”

Selgin, George. 1997. Lower than Zero: The Case for a Falling Worth Degree in a Rising Economic system. London: The Institute of Financial Affairs.

Selgin, George. 2018. Floored!: How a Misguided Fed Experiment Deepened and Extended the Nice Recession.

The Semiannual Financial Coverage Report back to the Congress. 2023.

Warren, Elizabeth. 2022. “One of many Causes Why Costs Are Up?” https://x.com/SenWarren/standing/1520495104380874760.

Weber, Isabella M., and Evan Wasner. 2023. “Sellers’ Inflation, Earnings and Battle: Why Can Massive Companies Hike Costs in an Emergency?” Assessment of Keynesian Economics 11(2):183–213.

White, Lawrence H. 2025. “Ought to the Federal Reserve Increase Its Inflation Goal?” Southern Financial Journal 91(4):1372–90.

[1] Inflation refers back to the charge at which the value stage is rising. The worth stage itself is a measure of the typical costs of products and providers at a cut-off date. A brief rise in inflation means costs are rising quicker for a interval; a everlasting rise within the worth stage means they continue to be elevated even after inflation returns to regular, which is actually what occurred over the previous few years.

[2] Whereas Chair Powell has not explicitly endorsed the greedflation or fiscal-policy-driven explanations, these views have formed the broader public discourse round post-pandemic inflation and infrequently inform the interpretation of exterior or “exogenous” causes. Together with them right here clarifies the distinction between demand-driven inflation and non-monetary accounts of the inflation surge. Furthermore, even when Powell attributes inflation primarily to supply-side components, these claims relaxation on the broader premise that inflation stemmed from forces exterior the Fed’s management.

[3] The framework was meant to anchor expectations and stop rates of interest from approaching the zero (or, efficient) decrease sure. Some economists want the phrase “efficient,” which acknowledges that, as a result of transaction prices, nominal rates of interest would possibly fall to a stage barely beneath zero.

[4] The asymmetry within the Fed’s new framework was not initially apparent. Its 2020 Assertion on Longer-Run Targets and Financial Coverage Technique (Federal Reserve 2020) explicitly addresses solely the case of below-target inflation. But it surely additionally changed the language of “deviations of employment from the Committee’s assessments of its most stage” with “shortfalls of employment from the Committee’s evaluation of its most stage,” signaling a extra one-sided focus.

[5] This effort is a part of a broader symposium reviewing the Fed’s framework, together with contributions that look at the historic evolution of inflation concentrating on (Binder 2025; Hetzel 2025), assess the Fed’s implementation of FAIT (Beckworth and Horan 2025; Eire 2025), and think about different rules-based frameworks (Hendrickson 2025; Orphanides 2025; White 2025). The symposium additionally explores problems with mission creep (Rouanet and Salter 2025), ahead steering (Hogan 2025), and working regimes (Nelson 2025).

[6] Until in any other case acknowledged, inflation charges reported herein are calculated because the repeatedly compounded annualized charge of change within the private consumption expenditures worth index. This method produces extra interpretable and comparable charges throughout time intervals.

[7] Though Lorenzoni and Werning’s conflict-inflation mannequin affords a chic formalization of how staggered price-setting by totally different brokers can generate sustained inflationary pressures, there isn’t any position for cash, financial coverage, or different nominal determinants of the value stage. Because of this, the mannequin’s notion of “inflation” displays ongoing relative worth changes in a purely actual atmosphere, elevating questions on whether or not it meaningfully describes the dynamics of inflation as economists usually perceive it.

[8] The collusion needn’t be specific. “In addition to a proper cartel and norms of worth management,” Weber and Wasner write, “there could be implicit agreements that coordinate worth hikes.”

[9] Alvarez et al. (2024) discover that complete markups have been steady over the interval. Since an increase in enter prices places downward strain on markups, one would possibly interpret the proof as indicating a relative improve in markups following the pandemic. In different phrases, corporations have been in a position to go on larger prices to shoppers with out lowering their margins — suggesting stronger demand, not rising greed.

[10] For a given charge of nominal spending development, there’s a one-to-one tradeoff between inflation and actual output development. Therefore, for decreased output to clarify even one proportion level of inflation, market energy would want to have lowered actual GDP development by a full proportion level. That might signify a roughly 50 % discount in pattern actual GDP development — implausible given the noticed restoration. In different phrases, blaming inflation on falling output as a result of elevated market energy would require an unrealistically giant collapse in actual financial exercise — one thing we merely didn’t observe.

[11] See Cochrane (2023) for a theoretical account of the fiscal principle of the value stage — the view that costs rise when individuals consider the federal government won’t elevate sufficient future tax income to cowl its money owed.

[12] Many advocates of the fiscal principle of the value stage, together with Miller (2024), acknowledge that the current extra inflation resulted from “a mixture of financial and financial coverage.”

[13] Compounding these challenges, Russia’s invasion of Ukraine in February 2022 additional disrupted international provide — particularly in vitality markets — pushing oil and different commodity costs larger. The invasion was largely unanticipated, nonetheless, so its contribution to the noticed rise within the worth stage (a lot of which occurred earlier) is restricted.

[14] Unemployment was additionally falling as inflation accelerated, additional undermining the supply-shock rationalization.

[15] Di Giovanni et al. (2023) estimate a multi-country, multi-sector New Keynesian mannequin and equally conclude {that a} surge in combination demand — not opposed provide shocks — was the first driver of inflation in 2021 and 2022.

[16] Another excuse sudden will increase in nominal spending have a tendency to lift measured company earnings is that the Fed’s remittances to the Treasury — that are more likely to rise with extreme financial stimulus — are recorded as company earnings within the Nationwide Revenue and Product Accounts.

[17] As Orphanides (2025) explains, rising inflation decreased the actual coverage charge over this era — passively loosening financial coverage when tighter financial coverage was required.

[18] Selgin (2018) explains how the Fed’s new flooring system, adopted in October 2008, prevented the big improve in reserves from restoring the value stage. See additionally: Cutsinger and Luther (2022), Jordan and Luther (2022), and Nelson (2025).

[19] As mentioned beneath, White (2025) notes that the zero decrease sure solely limits the Fed’s rate of interest coverage, not its total capability to affect combination demand.

[20] Technically, whether or not they should fear about below-target inflation is dependent upon the size of the contract, timing of funds, and the pace at which the central financial institution makes up for undershooting its goal. However the basic level stays.

[21] As mentioned earlier, inflation pushed by provide shocks — resembling disruptions to manufacturing or will increase in enter prices — is usually exterior the Fed’s management. Makes an attempt to counteract these shocks danger imposing pointless financial distortions, particularly if actual output is already constrained.

[22] Furthermore, AIT might amplify macroeconomic volatility (Grimm et al. 2023).

[23] Such proposals will not be new. See, for instance, Blanchard et al. (2010), Ball (2014), and Blanco (2021).

[24] Gordon (1996) and Mankiw (1996) make an identical level.

[25] When taxes are levied on nominal curiosity earnings and capital positive factors slightly than inflation-adjusted quantities, larger anticipated inflation will increase the tax burden on savers and buyers. This discourages saving and funding, although the actual (inflation-adjusted) return might not have modified.

[26] As Hendrickson (2025) explains, nominal spending concentrating on replicates a Pareto-optimal aggressive financial equilibrium — that’s, an final result during which nobody could be made higher off with out making another person worse off.