PeopleImages/iStock via Getty Images

Investment Thesis

RingCentral (NYSE:RNG) is not happy to see its stock down more than 90% from its former highs. This has led to Vlad Shmunis, the company’s long-standing CEO and founder, transitioning to the role of Executive Chairman.

The company has also made many other product changes, in an attempt to reinvigorate its underlying business. But with more than $1.5 billion of net debt and nearly all its free cash flow being stock-based compensation that is added back, one has to wonder whether there’s much left here for passive investors?

Even though the stock is clearly down from its highs, I’m not sure this is a compelling investment. Hence, I’m staying neutral here.

Rapid Recap

In my previous analysis titled “Navigating Growth Challenges”, I said:

RingCentral, Inc. growth rates are slowing down. And to compound matters, its balance sheet is meaningfully overleveraged.

Furthermore, given its slowing pace of growth, this means that investors are increasingly valuing the business on its current valuation, rather than as a growth story.

More specifically, investors are looking at its enterprise value, and wondering whether paying 20x forward free cash flows is all that enticing? I’m not convinced it is.

Since I made those comments, here’s RNG’s performance.

RNG stock performance

Today I still stand by these arguments. Here’s why.

RingCentral’s Near-Term Prospects

RingCentral operates as a cloud-based communications and collaboration platform with two core divisions: Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS).

UCaaS offers a comprehensive suite of communication tools encompassing voice, video, and collaborative functionalities, designed to cater to general business communication and collaboration requirements. In essence, RingCentral’s UCaaS seeks to simplify internal communication and foster teamwork among team members.

In contrast, CCaaS is custom-tailored for contact center settings, featuring functionalities like inbound and outbound call routing, Interactive Voice Response, queue management, and call recording. CCaaS primarily serves as a platform for delivering customer service and aiding businesses in efficiently managing customer inquiries across diverse communication channels, including voice, email, and social media.

As of last quarter, RingCentral has introduced new products, including RingSense for Sales, RingSense for Phone, and RingCX, all designed to empower organizations with advanced communication and collaboration capabilities.

More specifically, RingSense for Sales received several enhancements, including integrations with third-party applications and AI-driven features. RingSense for Phone leverages conversation intelligence to enhance voice conversations with live transcription and post-call summaries. While, RingCX offers a native integrated omnichannel experience for contact center agents, including AI-powered transcripts.

Next, we’ll discuss its financials.

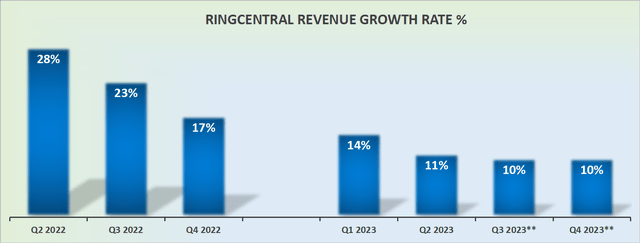

Revenue Growth Rates Have Matured

RNG revenue growth rates

Putting aside its new rolled-out product features, the graphic above describes a company that is today ex-growth. It’s difficult to imagine today that up until very recently, this company could be counted on for mid-20s% to 30% CAGR.

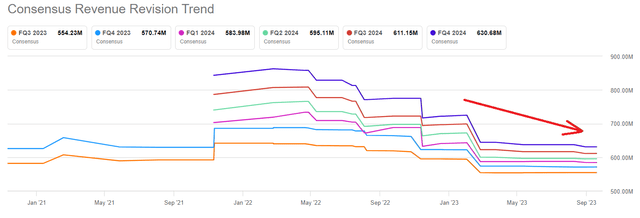

SA Premium

Anyone who follows my work will know, I often advise, don’t fight the Street. If analysts following your stock are still in the process of downwards revising their estimates, you’ll be fighting uphill.

This doesn’t mean that analysts can’t be wrong. Indeed, they often are wrong. But I personally would let analysts stop reducing their revenue consensus estimates before I would recommend getting involved with a stock.

Profitability Profile Doesn’t Inspire Much Hope

Here’s RingCentral’s guided profitability profile together with its Q1 2023 results:

RNG Q1 2023

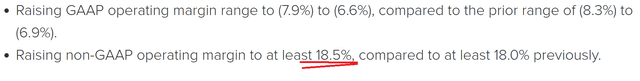

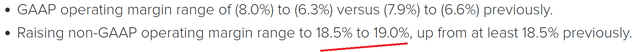

And next, we see RingCentral’s profitability after its Q2 2023 results.

RNG Q2 2023

On the surface, this is great, management is upwards revising its profitability profile. Moreover, keep in mind that at the start of 2023, together with its Q4 2022 results, management had originally guided RingCentral’s non-GAAP operating margins to be around 18%.

This means RingCentral is clearly working hard to improve its cost structure, right?

The problem here is that RingCentral’s stock-based compensation makes up about 18% of its revenues. In other words, for every $1 of revenues, there’s about 18 cents going out the door as executive compensation. This is quite extravagant for a business that is growing at such as slow clip.

By extension, when management highlights RingCentral’s very strong free cash flow profile, similarly keep in mind that, slightly over 100% of this year’s free cash flow estimate of around $290 million is made up of stock-based compensation. Note, that stock-based compensation this year will be around $400 million.

On a positive consideration, RingCentral’s stock-based compensation hasn’t grown significantly over the years. In fact, this year stock-based compensation is only up approximately 4% compared with its revenue growth rates of approximately 10%.

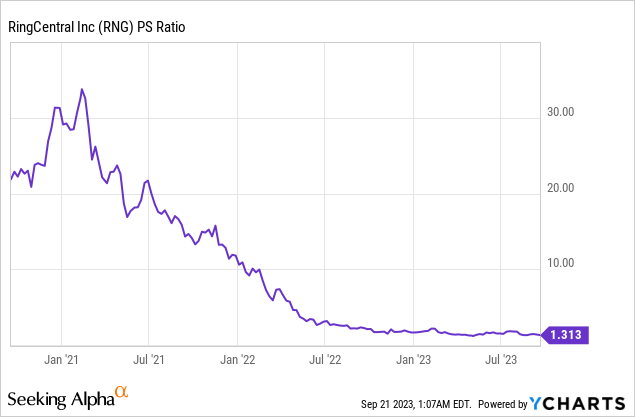

On the other hand, it’s difficult to make the argument that anyone is paying a premium for this stock today. As you can see above, in the past 3 years RingCentral’s multiple has generally moved in only one direction, and that is of compressing with time.

In other words, the thesis is evidently not blemish-free. But at the same time, investors are truly not being asked to pay much of a premium to get involved with this stock.

The Bottom Line

RingCentral has seen its stock decline substantially, prompting the company’s CEO and founder, Vlad Shmunis, to transition to the role of Executive Chairman.

Despite several product changes aimed at revitalizing the business, RingCentral carries significant net debt and relies heavily on stock-based compensation, raising questions about its attractiveness to outside investors.

While the stock’s decline is evident, its investment appeal remains uncertain, leading to a neutral stance.

Further, the company’s growth rates have slowed, and profitability remains a concern, with stock-based compensation accounting for a significant portion of expenses. Despite efforts to improve profitability, RingCentral’s valuation has been on a downward trajectory, which makes it somewhat interesting, but then we circle back to the question of its overleveraged balance sheet.