Ross Tomei/iStock via Getty Images

Rapid Recap

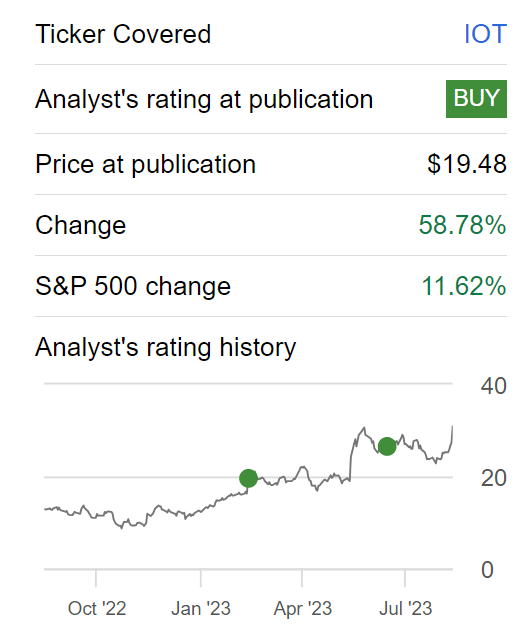

Since I penned my analysis of Samsara (NYSE:IOT) titled Inflection Quarter, the stock has been on a tear.

Author’s work on Samsara

I followed up my original analysis by arguing that:

My thesis for investors’ upside comes less from the expectations for a higher re-rating on the stock’s multiple, and more based on the assertion that if investors are able to buy Samsara’s stock now and hold for a couple of years, they’ll be rewarded as the company’s intrinsic value grows into its valuation.

I stand by these comments today. I believe that Samsara has strong prospects ahead and its stock is still attractively valued. However, I don’t believe that investors should be banking on a further multiple expansion. And I address this concern in my analysis that follows.

Accordingly, I warn readers from the start, that there’s considerable nuance required when appraising Samsara.

Customer Adoption Curve

Samsara’s Connected Operations Cloud, coupled with its range of Internet of Things products, offers diverse industries the ability to leverage IoT data effectively. Essentially, Samsara’s Connected Operations Cloud platform allows businesses heavily reliant on physical operations to make use of IoT data for valuable insights and operational enhancements.

Fundamentally, Samsara uses IoT connectivity to provide real-time data and operational visibility, significantly improving safety, efficiency, and sustainability in physical operations. It offers a tailored solution designed to maximize the utilization of physical assets.

For example, from its earnings call last week, here’s a quote:

Using Samsara for safety and telematics across 20 sites, DHL Express saw a 26% reduction in accidents and a 49% reduction in accident-related costs. Equally as impressive, DHL supply chain also saw a 50% reduction in driver turnover reaching their lowest driver vacancy ever. Driver turnover is a major cost for our customers, and it’s incredible to see the positive impact our products can have by helping companies enhance safety and improve retention.

To put it plainly, Samsara bridges the gap between the physical world and IoT connectivity, facilitating cloud-based workflows.

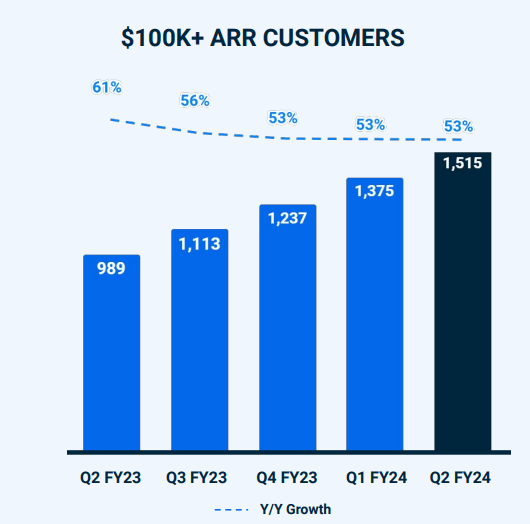

But beyond its alluring narrative, followers of my work will have seen me reference on numerous occasions that one should always pay the most attention to a company’s customer adoption curve.

IOT Q2 2024

What you see above is that Samsara’s customers are embracing its platform in droves. There’s no reason for paying customers to join its platform unless they see clear value in paying more than $5K in annualized revenue per year, and as much as $1 million for its largest customer.

Moving on, let’s now turn to discuss the most contentious matter, its growth rates ahead.

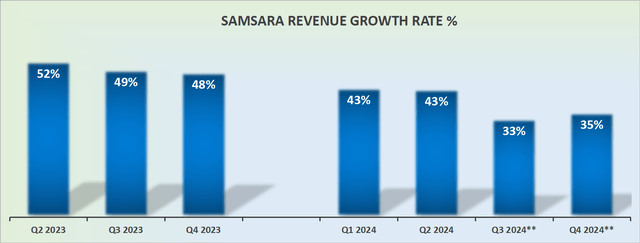

Revenue Growth Rates Point Towards A Slight Dip

IOT revenue growth rates

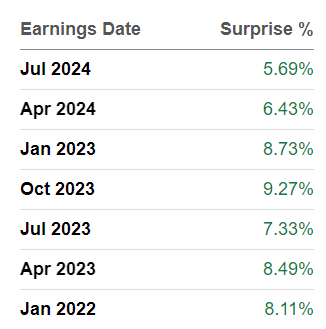

There’s good news and bad news when it comes to Samsara’s guidance ahead. The good news is that management guides conservatively to allow for an easy beat later on when the quarter is ultimately reported, see below.

SA Premium

Above we can see Samsara’s habit of easily beating analysts’ consensus revenue estimates by at least the mid-single digits.

This means that Samsara can still be counted for growing at more than 30% CAGR for at least the foreseeable future. That’s great and backs up its narrative of a ”fast-growing futuristic tech” company, the exact sort of stock that investors are always willing to put a very high multiple upon.

The bad news is that even if we were to add 5% or even 6% growth on top of the guidance for H2 2024, it appears that Samsara is unlikely to match the revenue growth rates that it was putting out last year, at the high 40s% CAGR.

This isn’t an immediate problem of course. But when a stock is being valued on a premium valuation, any slowdown in its expected revenue growth rates can have quite a dramatic impact on the valuation that investors may be willing to assert to the stock.

In other words, for Samsara to continue to carry a premium valuation on its stock, investors must have a high degree of confidence in the sustainability of its growth rates. The topic we’ll discuss next.

IOT Stock Valuation — Not Cheap

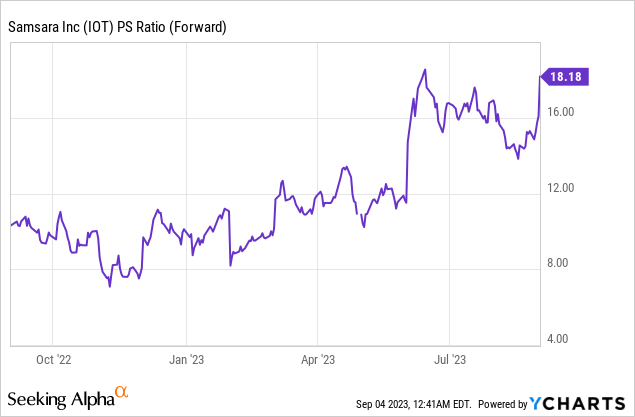

As you can see above, Samsara’s multiple has more than doubled in 2023. More specifically, Samsara’s multiple has gone from around 8x forward sales to 18x forward sales.

How much further can its multiple go? Can a stock’s multiple, with the right narrative go to 20x forward sales? Perhaps 25x forward sales? I am not sure of the answer to these questions.

I believed that the time when I would be seeing stocks priced at 20x forward sales came to a halt when interest rates were no longer 0%. It turns out that despite interest rates being expected to be higher for longer, this hasn’t dampened investors’ enthusiasm to pay for stocks with the right story.

On the other side of the equation, it’s important to be mindful that Samsara is making strong progress on its underlying profitability. It looks likely that by this time next year, Samsara will be non-GAAP profitable.

Of course, this non-GAAP profitability eschews the fact that approximately 29% of its running costs are in the form of stock-based compensation. Put another way, for every $1 in revenues, management takes 29 cents as stock-based compensation. But as long as the share price is going up, I don’t believe this consideration will unduly perturb investors.

The Bottom Line

In my earlier analysis titled “Inflection Quarter” on Samsara, I highlighted the company’s impressive performance, and since then, the stock has continued to soar. My perspective on Samsara remains positive, driven by its strong growth prospects and what I consider to be an attractive valuation.

However, I’m exercising caution regarding the expectation of further multiple expansion. This leads to a crucial consideration: Samsara’s customer adoption curve indicates substantial growth, but sustaining its historically high growth rates may pose a challenge.

This issue becomes more significant as Samsara’s valuation has significantly increased. On the flip side, Samsara has been making strides in improving its underlying profitability, although it’s important to note that a substantial portion of its operating costs are attributed to stock-based compensation. Despite this, Samsara continues to be an intriguing investment opportunity, offering the potential for substantial returns in the future.