asbe/iStock through Getty Photos

Funding thesis and background

The Schwab U.S. TIPS ETF (SCHP) provides diversified publicity to U.S. Treasury Inflation-Protected Securities (“TIPS”). With inflation a up to date difficulty in lots of buyers’ minds, the SCHP fund can function a part of the core of a diversified portfolio to supply a hedge in opposition to inflation and market volatility.

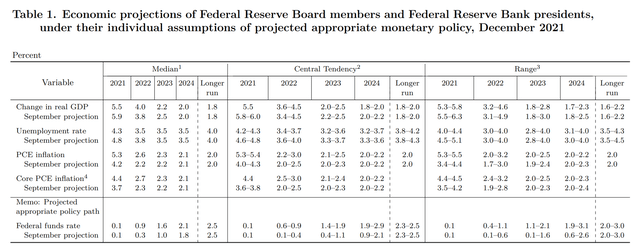

Again in 2021, the Fed’s narrative is that the inflation we have been seeing was transitory. In its more moderen assembly minutes, the Fed elevated its inflation forecast and views it to be extra persistent. For instance, the core PCE inflation in 2021 is projected to be 4.4% on this Dec 2021 assembly minutes as you may see from the chart beneath, above its earlier estimate of three.7%.

Beneath this background, this text analyzes how SCHP works and why it really works in its combat in opposition to inflation, particularly underneath the present inflationary environments. The outcomes present that it may function a easy and efficient car to combat inflation and on the identical time present a hedge to the present market valuation dangers.

Supply: Fed’s assembly minutes launch Dec 2021.

SCHP: fundamental data and recap

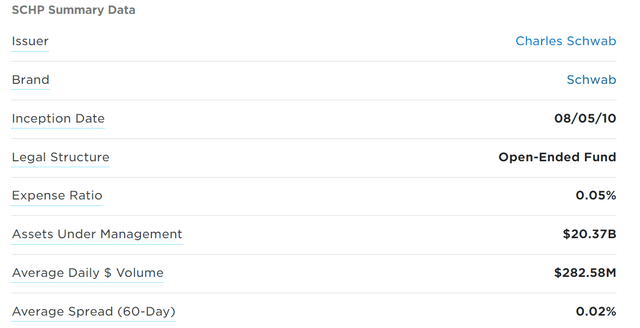

The fundamental details about this fund is offered beneath in case there are readers new to this fund. As seen, it is among the well-liked Schwab ETFs with a comparatively giant AUM above $20B. It fees a rock-bottom low price of 0.05%. It trades with a good each day quantity and a really tight unfold of 0.02%.

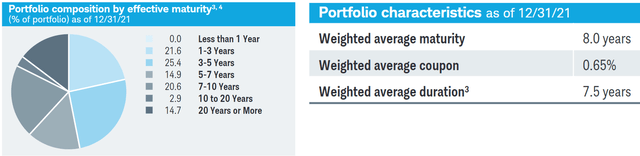

The following chart reveals the composition of the SCHP fund. As prompt by its identify, the fund completely holds United States Treasury bonds. And it invests within the total maturity spectrum of the U.S. TIPS market, and subsequently is totally different from a short-term oriented fund like Vanguard Brief-Time period Inflation-Protected Securities Index Fund ETF Shares (VTIP). Its weighted common maturity is 8 years (in comparison with the two.7 years of VTIP). As a consequence of its longer length, SCHP’s sensitivity to rate of interest change is bigger than VTIP and will likely be additional elaborated on later.

Supply: ETF.com Supply: Schwab ETF description

SCHP: how does it work?

The central thought of TIPS is to supply safety in opposition to inflation. The best way the safety works is that the principal of a TIPS is adjusted primarily based on the inflation, and you might be paid the adjusted quantity at maturity. In distinction, the principal of a “regular” bond is fastened and doesn’t change. The principal of a TIPS will increase with inflation and reduces with deflation.

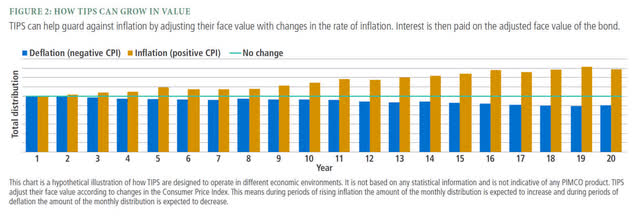

The next chart from PIMCO illustrates how TIPS normally ought to carry out underneath totally different macro-economic circumstances. As seen, the principal of TIPS ought to improve in an inflationary atmosphere due to their inflation adjustment. Nevertheless, its worth may decline underneath deflation or keep flat if there isn’t a change in inflation. In fact, in any case, the buyers all the time obtain the coupon funds along with or as an offset for the principal adjustments.

Supply: PIMCO

SCHP: Does it actually work?

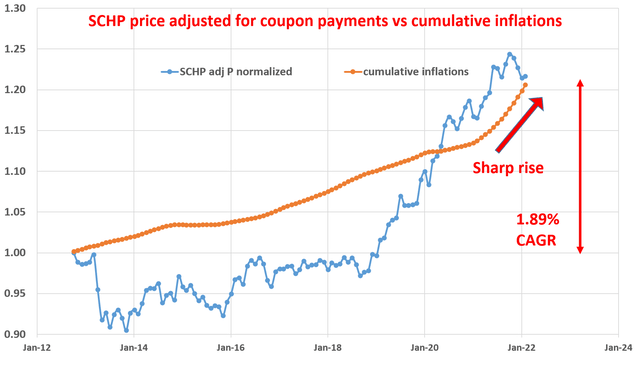

The brief reply is sure. The longer reply is proven within the chart beneath.

This chart reveals the normalized worth of SCHP since its inception. The value is already adjusted for coupon funds so it reveals the entire return. And the normalized worth is in contrast in opposition to the cumulative inflations throughout that very same time frame (the orange line). As seen, SCHP delivered a complete return of about 20% since 2012 or a bit above 2% CAGR. And as you may see, such a return virtually precisely matched the inflation throughout this time period. The cumulative inflation can be a bit above 20%, with a CAGR of about 1.9%. Though the catch is that SCHP’s whole return could not all the time observe inflation as you may see. It solely tracks it within the long-term (say longer than about 10 years or so). And at last, observe the sharp surge of inflation beginning in 2021.

Supply: creator primarily based on Yahoo Finance information.

However then inflation isn’t meant to be a short-term difficulty to begin with. In any case, as you may see, 1.89% CAGR is nothing alarming and the cumulative impact is barely about 20% even compounded over a decade. Nevertheless, for a lot of buyers (e.g., retirees) with 30 or 40 years of funding horizon, inflation turns into a dominant difficulty. Within the U.S., a broadly accepted measurement of inflation is the Client Worth Index (“CPI”), a measurement of the rise within the worth of products and companies over time.

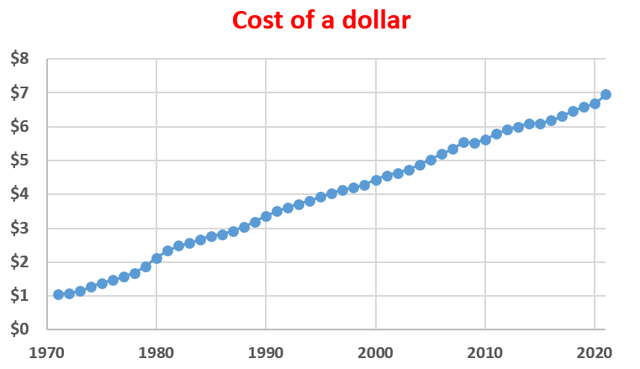

Because the chart beneath reveals, costs have risen steadily within the U.S. over the previous 5 a long time, signaling a gentle and protracted rise in inflation. And you can too see that over 5 a long time – the everyday horizon of an investor’s whole timeframe from the buildup stage to the tip of retirement – inflation could be important. $1 in 50 years in the past is equal in buying energy to greater than $7 at present, a rise of greater than sevenfold!

Supply: creator

Conclusions and remaining ideas

The SCHP fund provides diversified publicity to short-term U.S. Treasury Inflation-Protected Securities. With inflation a up to date difficulty in lots of buyers’ minds, this text analyzes how SCHP ought to work and whether or not it really works or not. The outcomes present:

- It may function a easy and efficient car to combat inflation. These outcomes present that SCHP delivered a complete return of greater than 20% since its inception in 2012, or close to 2% CAGR, which precisely balances out the inflation throughout the identical time frame.

- Though the catch is that SCHP’s whole return could not all the time observe inflation. It solely tracks it within the long-term (say longer than about 10 years or so) – however inflation isn’t meant to be a short-term difficulty to begin with.

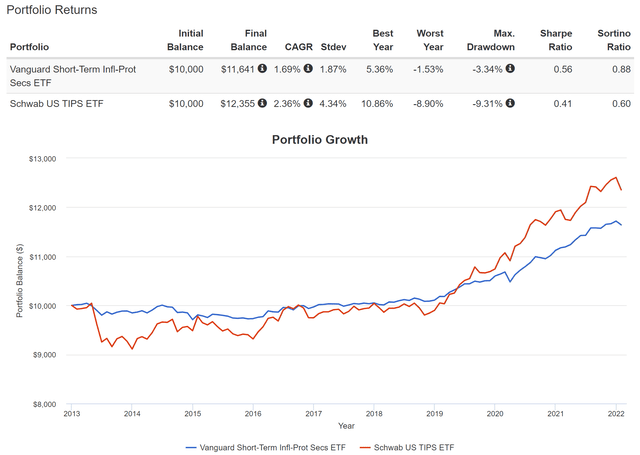

- Lastly, for readers excited by evaluating SCHP to different well-liked TIPS funds resembling VTIP, the next chart reveals the long-term efficiency comparability. As seen, they each delivered about the identical long-term return previously decade. Though SCHP outperformed VTIP by a small margin at the price of giant volatility. As aforementioned, the reason being its longer maturity. SCHP’s weighted common maturity is 8 years, in comparison with the two.7 years of VTIP. As a consequence of its longer length, SCHP’s worth fluctuates greater than VTIP. And the fluctuations have occurred to be in SCHP’s favor previously decade. There is no such thing as a good or dangerous selection right here. It is all is dependent upon particular person buyers’ danger tolerance degree and circumstances. For instance, if you must actively withdraw, then a short-duration fund could be a more sensible choice as a result of cheaper price volatility.

Supply: simulator from Portfolio Visualizer, Silicon Cloud Applied sciences LLC