Editor’s word: Searching for Alpha is proud to welcome Pragmatic Worth Investing as a brand new contributor. It is simple to develop into a Searching for Alpha contributor and earn cash to your greatest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click on right here to seek out out extra »

Vladimir Zakharov/iStock through Getty Pictures

Smith & Wesson Manufacturers, Inc. (NASDAQ:SWBI) designs, manufactures, and sells firearms, however by means of the years has ventured into different segments which might be considerably associated to their major enterprise, like out of doors merchandise and safety providers. However because the spinoff of the Outside division on August 24, 2020, the corporate its again to its roots within the firearms trade.

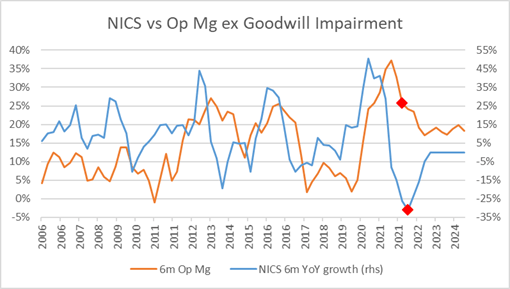

Understanding The Cycle

I’ve learn many articles concerning the firm right here, and in my view, most don’t deal with the primary attribute of SWBI: That may be a deeply cyclical enterprise and any bullish or bearish tackle it ought to begin and finish with analyzing the stage of the cycle wherein the corporate is at any given second.

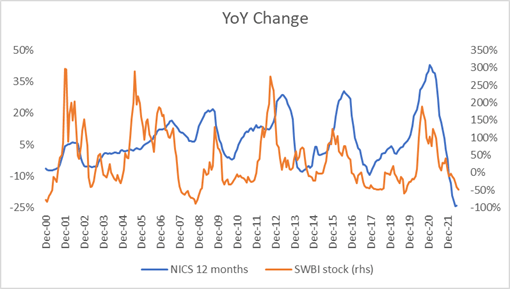

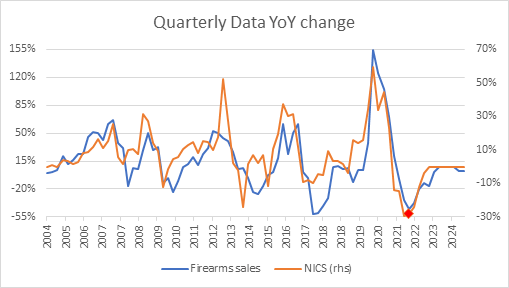

The subsequent chart monitoring the dynamics between the inventory efficiency and NICS Firearms Background Checks revealed by the FBI is an effective strategy to visualize this cyclicality. And it exhibits that proper now the inventory is way nearer to the underside of the cycle.

FBI

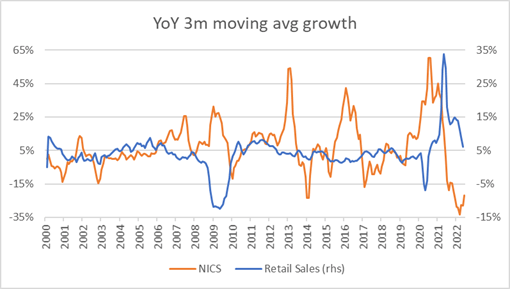

The corporate is classed within the Client Discretionary Sector, however the excellent news is that its cycle is just about unrelated to the patron cycle that you could monitor with Superior Retail Gross sales. And given the present macro backdrop, that could be a essential difficulty.

FBI and U.S. Census Bureau

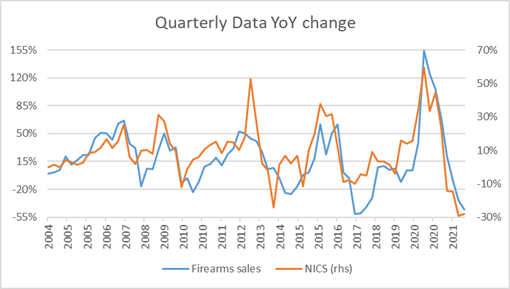

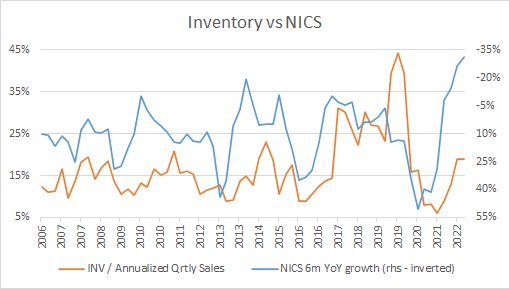

One other necessary level to contemplate is the truth that these cycles have an effect on the corporate by means of a list cycle in two totally different levels of the distribution chain. The one that you could monitor by trying on the stock figures that the corporate experiences, and one other that you just can not see (or perhaps you possibly can, and I don’t understand how) that pertains to the stock of the distribution channel. With the corporate’s stock going one or two months behind the stock of the distribution channel, the adjustments in Firearms gross sales (excluding all non-firearm gross sales) are usually greater than the change in NICS statistics in what may be defined by some type of bullwhip impact as you possibly can see within the subsequent chart.

FBI and SWBI monetary releases

This chart additionally serves the aim of displaying that the uncooked NICS statistics revealed by the FBI are a reasonably good proxy to trace the cycle, regardless that I’m conscious that the corporate tracks the adjusted NICS reported by the NSSF.

All these charts exhibits that SWBI will not be a inventory to only purchase and neglect about, it’s a deeply cyclical firm in an trade that has enough trade information to make these cycles considerably predictable and it’s best to attempt to purchase the inventory close to the underside of the cycle as measured by NICS statistics and promote and even quick close to the highest.

The query now’s if we’re on the backside of the cycle or not. My view is that we’re near it, but when I used to be attempting simply to time the cycle, I ought to have waited to place this out after the following quarterly outcomes encompassing the months of Could by means of July. However there’s a catalyst that will present itself within the subsequent few weeks. Extra on that later.

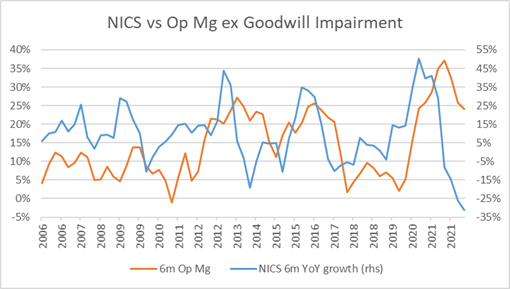

First, let’s take a look at how effectively has the corporate carried out in the course of the present downturn within the NICS cycle with respect to previous episodes. For that, I used 6 months metrics to isolate the final two quarters that incorporate actually the worst 6 months lower in NICS figures within the historical past that the FBI experiences (beginning December 1998).

FBI and SWBI monetary releases

I might say it has carried out fairly effectively. The discount in margins has been reasonable contemplating the extent of discount in NICS figures.

A essential level referring to their potential to keep up margins is the administration of inventories.

FBI and SWBI monetary releases

And relating to this level they’ve carried out consistent with earlier cycles, however a lot better than over the past downturn. Anyway, I anticipate stock to quarterly annualized gross sales to extend and possibly peak on the following quarter contemplating that two of the months (could/June) that make that quarter are displaying a discount of 21.7% versus final 12 months and for the truth that the following quarter are usually the weakest by way of seasonality. So once more, in case you simply need to time the underside of the cycle, it’s best to await the following quarterly outcomes.

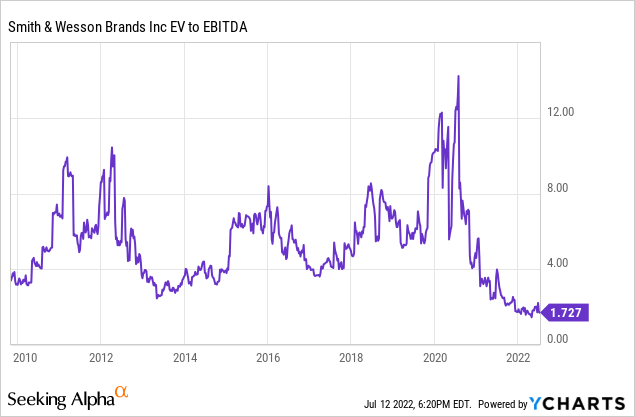

Stable Stability Sheet and Compelling Valuation

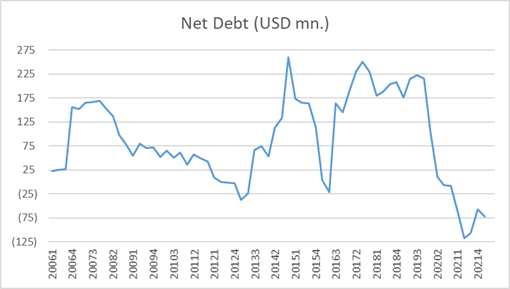

Altering topics, it is necessary to level out that the corporate is in considered one of its higher positions traditionally talking by way of indebtedness, with destructive internet debt and $120 million in money.

SWBI monetary releases

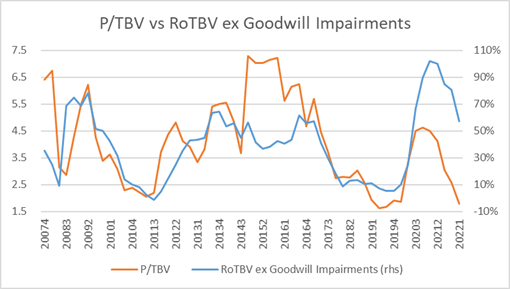

One other level is that the inventory is buying and selling very near the underside vary of Value to Tangible Guide Worth at lower than 2 instances. And that, for an organization that on common has printed a Return on Tangible e-book worth near 40% appears fairly enticing.

SWBI monetary releases

I do know that I’m subtracting goodwill and long-lived asset impairments to get to that return, so let’s verify the historic impairments that the corporate has reported prior to now 14 years to verify if that’s affordable.

The primary one occurred within the quarter ending October 2008, on the peak of the 2008 monetary disaster, once they reported a $98 million impairment. This was the one impairment associated to their major firearms enterprise.

The second occurred in the course of the quarters ending October 2010 and January 2011 for a complete of $90 million referring to the safety providers phase that they exited a few years later.

The third one occurred in the course of the quarter ending January 2019 for $10 million referring to a part of their enterprise that was later built-in into the out of doors phase that was spun out on august 2020.

And the ultimate one occurred in the course of the quarter ending April 2020 in the course of the peak of the COVID outbreak for $99 million additionally referring to the out of doors division that they later spun out.

So, I believe it’s legitimate to have a look at RoTBV ex these objects so long as the corporate stays centered on their major line of enterprise. And naturally, if at any time administration begins branching out into considerably associated new companies, I might be the primary to promote my place, their monitor document will not be the perfect one outdoors of their area of interest.

However let’s look ahead a bit bit to see how the corporate ought to take care of the following two quarters when the entire affect of the downturn must be mirrored. Within the final name administration identified to calendar 12 months 2019 as a framework for the approaching months, so I’m assuming the following 6 months (July – December) of the NICS figures are going to be the identical as they had been in 2019 after which I repeat 2022 month by month in 2023 and 2024 with none upturn in demand to be additional conservative (and going in opposition to historic patterns).

On the following few charts, the pink dots mark the final actual information and after which might be projections.

FBI, SWBI monetary releases and creator estimates

That may translate (within the subsequent chart) into a discount of greater than 5 share factors in Operational Margin regardless that the final two quarters already confronted a discount in gross sales greater than what I anticipate for the following two.

FBI, SWBI monetary releases and creator estimates

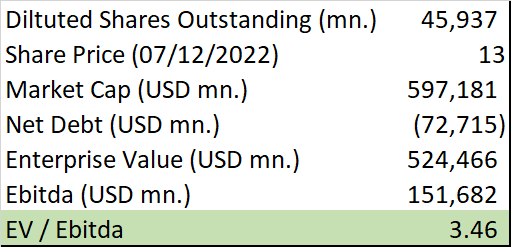

And that in flip would translate right into a 12-month EBITDA falling from $282 million to $151 million on the absolute backside of the cycle. Underneath these assumptions, with immediately’s EV will go away the corporate buying and selling at a valuation stage of three.46 instances EV/EBITDA, which doesn’t appear demanding and its manner bellow historic averages.

SWBI monetary releases and creator estimates

Over the last 7 years on an combination foundation the corporate has circled 65% of EBITDA into FREE CASH FLOW. So, in case you assume that the corporate stays at that backside of the cycle ceaselessly (that’s greater than conservative in my view), the corporate ought to have the ability to generate $99 million of FCF which places the inventory at an honest 16% FCF yield and a dividend yield of three% that’s lined with lower than 20% of FCF.

However there’s one unlucky scenario, the corporate has been compelled by the danger of state laws in Massachusetts that might prohibit the manufacturing of sure firearms, to maneuver its headquarters and a part of its manufacturing to Tennessee. This course of would require $120 million in capex and round $12 million in one-time bills, so FCF for the following 12 months must be near zero or barely destructive.

Aside from that, in case you agree with what I contemplate to be conservative assumptions I don’t see another important difficulty to level at.

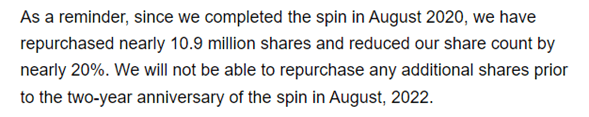

Buybacks

So, let’s return to that catalyst: inventory repurchases. The corporate accomplished its newest inventory repurchase authorization in the course of the quarter ending January 2022 and they don’t seem to be allowed to proceed with extra inventory repurchases till the second anniversary of the spinoff of the out of doors phase into what’s immediately American Outside Manufacturers, Inc. (AOUT).

The next is a remark from the CFO taken from the transcript of the most recent quarterly incomes name.

Searching for Alpha Transcript

And that essential two-year anniversary date is August 24, 2022, six weeks away and previous to the discharge of the following quarterly outcomes. So, let’s do some numbers: the corporate now holds $120 million in money with zero monetary debt, that alone must be enough to fund the additional capital expenditures. That in flip ought to go away the roughly $99 million of FCF to return to shareholders, $18.5 of these ought to go to dividends, making a $50 million (8% of the market cap) repurchase authorization a really lifelike prospect.

Dangers

Gun laws is all the time a risk, in actual fact, their relocation to Tennessee is expounded to it, however contemplating the prospects for the approaching mid-term elections, it is not one thing that I’m overly anxious about.

There’s additionally the potential for execution issues with their new services in Tennessee that may result in bills going over their steering.

I believe my assumptions for the NICS cycle are overly conservative and well-grounded in historic patterns, however there’s all the time the potential for one thing disrupting these patterns for the worst.

And at last, I believe it is necessary to say that there are various macroeconomic dangers on the horizon, with authorities considerably constrained by inflation. So, if the long run brings something near a 2008 occasion, none of those arguments will matter and the inventory most likely will go down with the market.

Conclusion

Smith & Wesson Manufacturers, Inc. is a really cyclical firm nearer to the underside of the cycle and its inventory is buying and selling at very compelling multiples even when contemplating backside of the cycle financials. The corporate has the money and steadiness sheet to face its capex necessities, it pays an honest 3% dividend yield lined a number of instances by FCF and there’s a very lifelike potential of buybacks in relation to a selected occasion (the two-year anniversary of the spin-off of AOUT).

And simply to finalize, it will be important for me to level out that I’m not married to this view, and I welcome any constructive criticism and new info that will assist me enhance my understanding of the corporate.

Thanks for studying and good luck together with your investments!