rypson/iStock Editorial through Getty Photos

The week noticed Delta Air Strains launch a blended earnings report, triggering an unsure response amongst buyers. However two different airways made to this week’s prime 5 gainers. In the meantime, three out of 5 of final week’s gainers noticed their fortunes reversed and landed among the many losers.

For the week ending July 15, The SPDR S&P 500 Belief ETF (SPY) was again amongst losses (-0.91%) after being within the inexperienced every week in the past. YTD, the ETF is –18.91%. The Industrial Choose Sector SPDR (XLI) was additionally again in purple (-1.22%) after a uncommon week of achieve within the prior week. YTD, XLI is -17.93%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +5% every this week. Nonetheless, YTD, solely two out of those 5 shares are within the inexperienced.

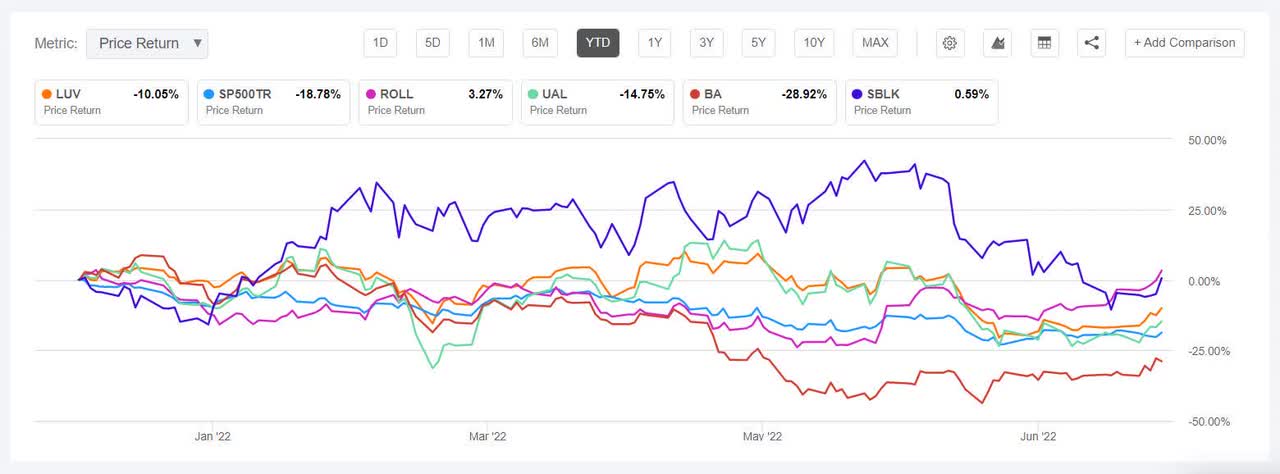

Southwest Airways (NYSE:LUV) +7.85%. Susquehanna made some strategic rankings adjustments forward of the earnings season for the airline sector on issues concerning the macro surroundings. Whereas a number of airways noticed their worth goal minimize and Jet Blue noticed its ranking downgraded to Impartial, the outlier within the group was Southwest Airways which was upgraded by the agency to a Constructive ranking from Impartial with varied income initiatives and the break into company journey seen supporting share worth.

The SA Quant Ranking on the shares is Robust Purchase, which which takes under consideration elements akin to progress and profitability, amongst others issues. In the meantime, the typical Wall Road Analysts’ Ranking is Purchase, whereby 11 out of 20 analysts give the inventory a Robust Purchase ranking. YTD, the inventory has shed -7.61%.

RBC Bearings (ROLL) +6.92%. The Oxford, Conn.-based firm’s inventory made it to the gainers’ record after over a month. The SA Quant Ranking on the inventory is Purchase, with Profitability having an element grade of C+ whereas Valuation with issue grade of D. The typical Wall Road Analysts’ Ranking can be Purchase, with an Common Value Goal of $222.5. YTD, the inventory has grown +4.76%.

The chart under reveals YTD price-return efficiency of the highest 5 gainers and SP500TR:

United Airways (UAL) +6.33%. The Chicago-based firm was among the many airline shares which noticed their worth goal minimize at Susquehanna. UAL worth goal was slashed to $43 from $60. The SA Quant Ranking and the typical Wall Road Analysts’ Ranking, each have a Purchase ranking on the inventory. YTD, RBA is -11.42%.

Boeing (BA) +6.23%. Earlier within the week, the corporate stated it delivered 51 airplanes in June to carry its H1 complete to 216 jets, up 38% from the primary six months of final 12 months and topping 50 for the primary time since March 2019. However the principle focus can be subsequent week’s Farnborough Worldwide Airshow within the U.Okay., the primary main air present after lockdown the place Boeing faces nice stress to safe orders.

The SA Quant Ranking on the inventory is Maintain, whereby the corporate’s Valuation has an element grade of D+ and Development carries a C grade. The typical Wall Road Analysts’ Ranking, nonetheless, differs and offers the inventory a Purchase ranking, whereby 13 out of 21 analysts give it a Robust Purchase ranking. YTD, BA has fallen -26.61%.

Star Bulk Carriers (SBLK) +5.79%. The Greece-based delivery firm leapfrogged from the decliners’ record it discovered itself in final week to take the quantity 5 spot among the many gainers this week. Star Bulk — which was amongst 2021 prime 5 industrial shares (on this section) — has gained +4.81% YTD, the one different inventory apart from RBC Bearings to be within the inexperienced amongst this week’s gainers. The SA Quant Ranking and the typical Wall Road Analysts’ Ranking on SBLK is Robust Purchase.

This week’s prime 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -9% every. YTD, all these 5 are within the purple.

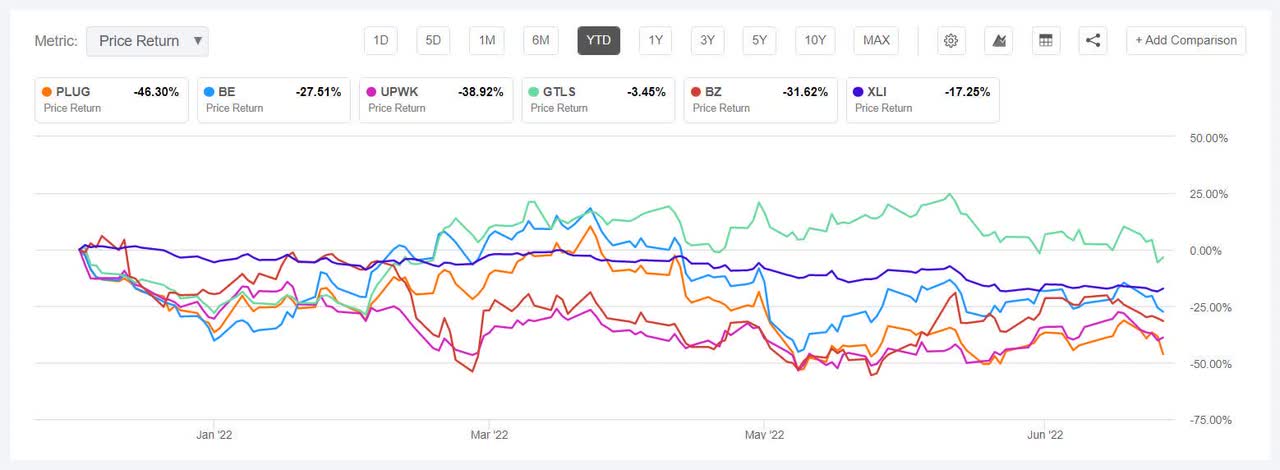

Plug Energy (NASDAQ:PLUG) -21.80%. Photo voltaic and alternate vitality shares plunged on July 15, together with Plug (-12.90%), after Sen. Joe Manchin pulled out of talks with Democratic leaders on a sweeping financial package deal that included new spending on local weather measures. President Biden, nonetheless, has pledged ‘govt motion’ on local weather. The inventory decline additionally made Latham, New York-based Plug see the #1 loser tag after being the highest gainer every week in the past.

The SA Quant Ranking on the inventory is Promote, with Profitability having an element grade of F and Momentum having a D+ issue grade. The ranking is in distinction to the typical Wall Road Analysts’ Ranking of Purchase, whereby 14 out of 28 analysts give the inventory a Robust Purchase ranking. YTD, Plug has declined -45.24%.

Bloom Power (BE) -15.08%. The San Jose, Calif.-based Bloom, which gives energy technology platform, additionally misplaced amid the local weather spending talks fallout. The corporate was additionally among the many gainers final week following the U.S. authorities’s plans to carry tariffs on Canadian photo voltaic merchandise. The SA Quant Ranking on the inventory is Maintain, with Profitability having an element grade of D whereas Valuation having an element grade of D-. However the common Wall Road Analysts’ Ranking differs and offers the inventory a Purchase ranking, whereby 8 out of 20 analysts give it a Robust Purchase ranking.

The chart under reveals YTD price-return efficiency of the worst 5 decliners and XLI:

Upwork (UPWK) -14.97%. The inventory was additionally like Plug and Bloom which noticed its fortunes reversed because it landed among the many decliners too after being among the many gainers every week in the past. Initially of the week, BTIG lowered its worth goal on UPWK to $30 from $34. The Santa Clara, Calif.-based firm, which gives an internet work market, was among the many prime 5 gainers (on this section) for June, however YTD, the inventory has shed -39.64%. The SA Quant Ranking on the inventory is Promote, with Profitability having an element grade of D+ whereas Valuation having an element grade of F. The ranking is in distinction to the typical Wall Road Analysts’ Ranking of Purchase, whereby 4 out of 11 analysts give it a Robust Purchase ranking.

Chart Industries (GTLS) -12.41%. The Ball Floor, Ga.-based firm, which makes tools for the vitality and industrial fuel industries, fell essentially the most on July 14 (-9.66%) this week. YTD, the inventory has declined -6.88% however the common Wall Road Analysts’ Ranking is Robust Purchase with an Common Value Goal of $206.11. In the meantime, the SA Quant Ranking on the inventory is Purchase.

Kanzhun (BZ) -9.61%. The Chinese language on-line recruitment platform gained nicely in June (+30%) and was among the many prime 5 (on this section). The inventory was the highest industrial gainer for 2 weeks straight in June however has additionally seen its fare share of volatility prior to now few months. BZ was among the many worst 5 decliners within the first week of Could, having made to the highest within the final week of April. Related tendencies had been seen in March. The typical Wall Road Analysts’ Ranking is Purchase, which differs with the SA Quant Ranking of Maintain. YTD, Kanzhun has misplaced -31.74%.