Black Friday is quick approaching, and consumers are gearing up. The Nationwide Retail Federation expects greater than 183 million folks to buy over the weekend spanning Thanksgiving to Cyber Monday this yr. However fraudsters are making ready for Black Friday too, in search of alternatives to steal your cash or private info.

Earlier than you dive into vacation buying, discover ways to spot widespread scams and shield your self.

1. Phony order and supply notifications

Fraudsters generally ship phishing emails and textual content messages impersonating supply companies or in style retailers like Amazon. These messages, which usually declare there’s a problem with processing or delivering the order, could request fee info or embody malicious hyperlinks.

A message would possibly say one thing like, “A part of your tackle is lacking. Please click on on this hyperlink to finish the tackle,” says Raj Dasgupta, senior director of worldwide advisory at BioCatch, a fraud prevention agency.

When you get an analogous message while you’re not anticipating a package deal, that ought to increase doubts, Dasgupta says. However even when you’ve got ordered one thing, don’t overlook warning indicators.

It is uncommon for supply companies to carry up packages or search fee, as a result of delivery prices are virtually at all times charged to the shipper, not the receiver, says Cliff Steinhauer, director of data safety and engagement on the nonprofit Nationwide Cybersecurity Alliance.

Keep away from clicking on hyperlinks in texts or emails, and don’t share private or fee particulars. To confirm whether or not an order replace is real, “return to your unique order on the location,” Steinhauer says. You’ll be able to log in and test the order standing and attain out to customer support instantly if there’s an issue, he says.

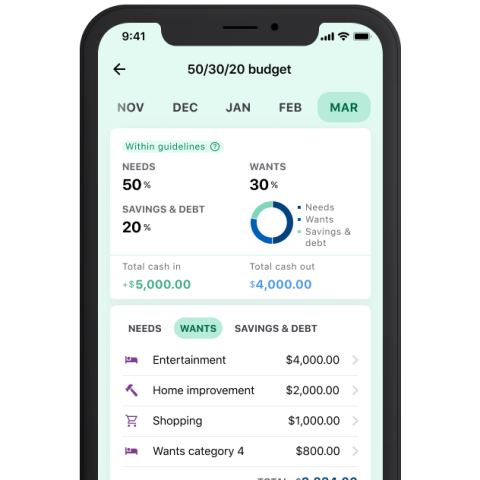

Get began with funds planning

Test your present spending throughout classes to see the place it can save you

2. Faux web sites and merchandise

When buying on-line, fastidiously scrutinize sellers and merchandise to keep away from winding up with counterfeit objects — or nothing in any respect.

Sponsored advertisements on social media websites and engines like google aren’t at all times vetted sufficient, Steinhauer says, which implies chances are you’ll come throughout scams.

Fraudsters purchase Google advertisements for in style search phrases like “Black Friday offers” or fascinating merchandise, similar to train tools, Dasgupta says. When folks click on on these advertisements, they could land on a “sophisticated-looking faux web site” that mimics a widely known website, similar to Macy’s, or on a made-up firm’s web page, he says. Consumers by no means obtain the product they’re making an attempt to buy, or they get an inferior product.

Ignore “sponsored” hyperlinks, and browse URLs intently. There’ll often be “one thing off,” Steinhauer says, similar to a slight misspelling or dashes within the web site title that aren’t usually there. “One of the best factor is to go to the authentic web site or app that you already know is the fitting one, and simply store there,” he says.

Look ahead to third-party vendor scams on authentic web sites, too. Some firms, similar to Walmart and Goal, enable outdoors distributors to promote merchandise via their platforms — and the reliability can differ. Studying vendor critiques before you purchase may help you keep away from dangerous actors.

Be cautious of sellers who ask for reward playing cards or peer-to-peer funds. If a service like Venmo or Money App is the one fee methodology accepted, that’s an instantaneous crimson flag, Dasgupta says. And if a deal appears too good to be true, it most likely is.

3. Deceptive QR codes

A QR code, or fast response code, is a barcode that often results in a web site when scanned with a smartphone digicam. “Quishing” is when scammers create QR codes that hyperlink to fraudulent web sites or set up malware on gadgets. These codes could present up on parking meters, in mysterious packages delivered to your bodily tackle or in your e-mail inbox.

For instance, a scammer posing as your financial institution would possibly e-mail you a code and instruct you to replace your login credentials. Electronic mail companies typically filter out identified malicious hyperlinks or domains and ship them to your spam folder, Steinhauer says, however a QR code can get previous these filters as a result of it’s a picture.

Do not scan codes you obtain unexpectedly, and intently examine QR codes in public locations for indicators of tampering.

Heed the recommendation above, and observe these extra steps to protect towards fraudsters.

-

Freeze your credit score. A credit score freeze restricts entry to your credit score report, serving to to stop anybody from opening credit score accounts in your title. You’ll be able to place a free credit score freeze with every of the three main credit score bureaus.

-

Look ahead to uncommon account exercise. Test your free credit score stories and bank card or financial institution statements for accounts you didn’t open or purchases you didn’t make.

-

Store in particular person. Think about buying at trusted brick-and-mortar shops, when you’ve got the choice. You’ll know the corporate and its merchandise are the actual deal.

-

Use a bank card. Paying with a bank card is safer than a debit card, reward card or peer-to-peer companies. Bank cards supply stronger fraud safety, together with the power to dispute fees, and the cash doesn’t come instantly out of your checking account.

-

Don’t share private particulars. It’s regular to supply some info for on-line orders, like your tackle and bank card quantity. However authentic purchases won’t ever require delicate info similar to your date of delivery or Social Safety quantity. When you get a message asking for these particulars, passwords or account numbers, don’t reply.

-

Report any scams you encounter. Flag rip-off advertisements you see on websites like Google and Instagram. When you’ve been scammed, file a report with the Federal Commerce Fee at reportfraud.ftc.gov.

Get began with funds planning

Test your present spending throughout classes to see the place it can save you