Sundaram Finance Ltd.’s management has opined about the incrementally weak business trends in certain key markets in South India along with the outlook of possible ~100 basis points lower net interest margins in medium term, emanating from increasing cost of funds and high competition (from banks) in the medium and heavy commercial vehicle segment.

However, we like the continued focus of Sundaram Finance on assets under management growth (double digit target), primarily through fortification of market share, which has been a constant point in the management commentary.

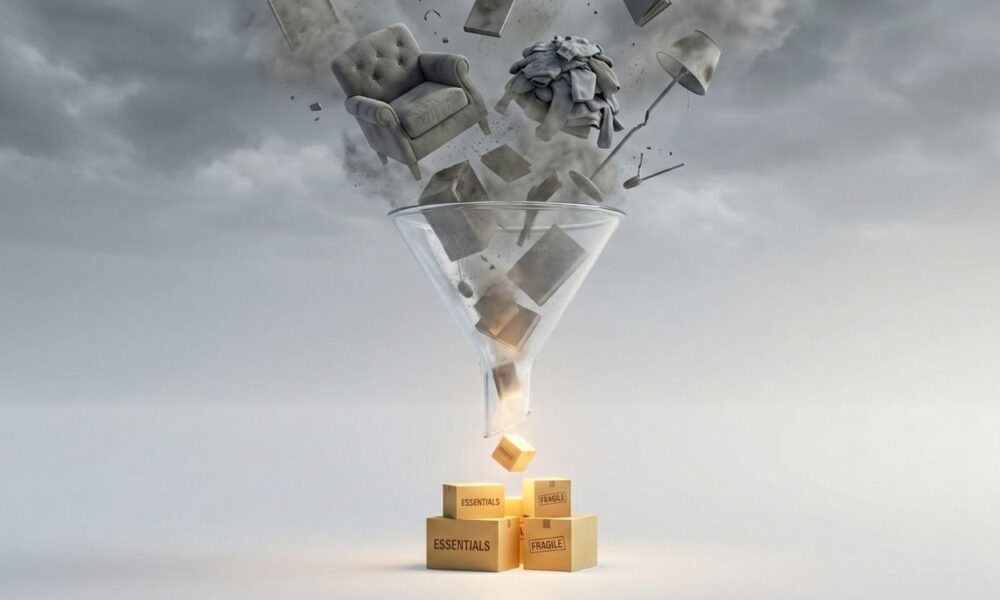

Rightsizing asset mix can help maintain asset quality which is a business strength of the company. Consequently, we cut down our NIM estimates for FY23E/FY24E which we believe will be offset by lower opex to maintain profitability.

rn

rn

Source link ","author":{"@type":"Person","name":"Index Investing News","url":"https://indexinvestingnews.com/author/projects666/","sameAs":["http://indexinvestingnews.com"]},"articleSection":["Financial"],"image":{"@type":"ImageObject","url":"https://gumlet.assettype.com/bloombergquint/2022-05/6b2bbe13-465d-446b-9058-fed550f4bb4a/A_person_holding_Indian_two_rupees_bank_notes_for_photograph___Source_BloombergQuint_.jpg?rect=0,319,3164,1661&w=1200&auto=format,compress&ogImage=true","width":1920,"height":0},"publisher":{"@type":"Organization","name":"","url":"https://indexinvestingnews.com","logo":{"@type":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link