blackCAT/E+ via Getty Images

Any prism through which an investor views the sports betting sector winds up at the same dead end: Yes, it’s a business with a great future operating on thin profit margins, overcrowded with far too many operators still losing money. The market leaders will be virtually impossible to dislodge in the years ahead since they all have the resources to absorb losses to hold and build share and, in some cases, are getting ever closer to turning profitable between late this year and early 2024.

So where does that leave all the wannabees? Basically, the entire sector shares the same outlook. Namely, we will fight to maintain share in mature states, battle for real estate in new states and invest to make sure our tech stacks are loaded with features to keep customers happy, involved and spending.

Enter Fanatics, the still privately held, soon-to-be public, mass marketer of team sports apparel with its huge 92m database of sports fans who management thinks could form the basis of its betting site skyrocketing past sector leaders toward #1. Good luck Fanatics, a cold shower awaits you. This is not to imply the company is totally delusional, mind you. They will find a place given their resource base. We have to point out that of the presumed 92m souls who buy their stuff, how many are underage, in their teens, or thin on discretionary spend?

Another question arises as to whether a sports fan who buys a sweatshirt is automatically a person who will make a lay down on a game Thirdly, if you are a fan for this NFL team or that and want an “official” garment, where can you buy it? In the stadium, yes, online at the NFL site, at Fanatics? A handful of places, right? Now, look at the choices Mr. and Ms. Bettor has: For openers, they can bet on 15 immediate sites but add the total of live and fringe books and the residual illegal bookies, and maybe you are looking at 90 places you can bet.

So Fanatics will join the fray, battle for share and, if lucky, might scratch out a single-digit business somewhere up ahead.

We set the stage here just to look at an operator with an entirely different approach to the global online sports betting and online casino business relative to the current US sector: That company is Super Group Ltd. (NYSE:SGHC), a global sports and casino betting brand with its Betway and Spin sites competing in the UK, EU, Africa, South America, and Ontario Canada.

What commands our attention here is that the company is the only one which has stated that among its goals is M&A. Most other operators in the space purvey the usual mantra, yes, if an opportunity arises, we’ll look at it. MGM’s Bet MGM unit, a partnership with the UK’s Entain, is looking to acquire the 50% it does not own. Otherwise, everyone else is rowing their own boat for the foreseeable.

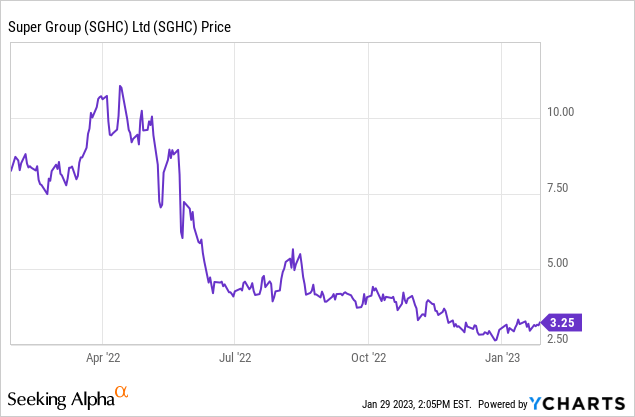

The outlier: SGHC (NYSE), a SPAC deal that debuted in May 2021 valued at $5b, or $10 a share and down 60% since

When the deal went public, there was considerable hype in the sector, with some analysts projecting that legal sports betting in the US would be a $200b business by the late 2020s. Time of course had other plans for sports betting that did not include anything near such dreamlike punditries. That did not detract from the expectation that yes, online sports betting was indeed a viable business, and at some point, it would possibly attain a revenue base of ~$40b by 2027. Break that down by market shares and assume a dramatic reduction in marketing cost, and you have stocks worth the holding.

Now that the SPAC heat has cooled down, and the market has taken a deep breath and a big fat grain of salt about forecasts for the sector, we see that latecomers like SGHC have taken a beating. However, on a closer look, we find that it has far more interesting prospects below the surface than just another international sports betting operator with a toe dip in the US.

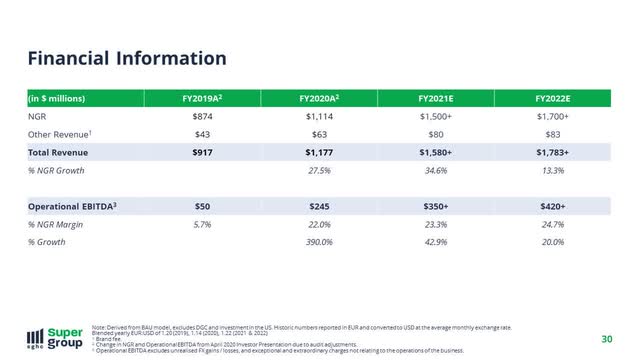

Its Betway and Spin gaming sites are viable. Its estimated revenue base for 2022 runs between 1.15b and 1.28b euros, with EBITDAE at 200m to 225m euros. Not shabby. Plus, Super Group is live in 7 US states, though it doesn’t begin to scratch a viable share of market yet. But it sustains its ad presence in several major sports betting markets like New York. But for investors, the question arises: What is the game here?

SGHC archives

The stock has fallen to $3.25, the company just announced a $25m share buyback as well as closing on the acquisition this month of a UK site called Jumpman. Before that, SGHC did another deal to acquire a tech gaming operator that it says will bring a big plus in their ability to access more markets with lots more tech razzle dazzle for players. We shall see.

A key corporate goal: M&A, makes this stock a buy

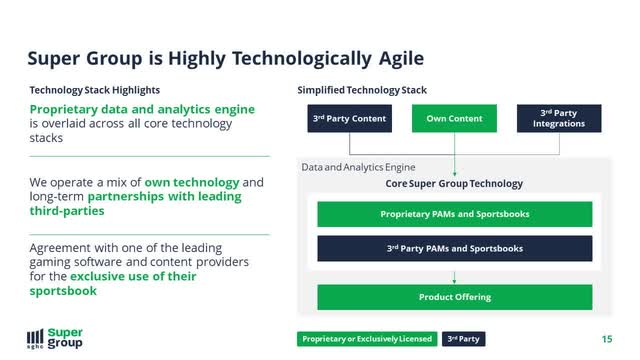

The company exudes the usual yada yada yada of all competitors in the space about sharpening its tech stack, broadening its marketing approach, building our its global reach in general and in particular, eyeballing the US market as a core goal. Where it appears to veer in its own direction is its publicly stated goal that M&A is, indeed, one of its ongoing areas of expansion. Most other competitors in the sector are understandably lip service talkers about M&A.

Yet, everyone knows that M&A indeed is one of the 600lb gorillas in the sports betting sector room. There is no way that 15 to 20 sports betting platforms are digging out viable shares of the market going forward in the US. Everyone knows that sooner or later there’s going to be consolidation. Every operator below the top tier group of at the most five, will eventually either merge, sell or be sold, forming a much tighter revenue share sector than what we see now.

SGHC

SGHC has put that prospect as a main objective for its future. It is a certain sign that these guys do have a realistic grip on what lies ahead. And their skill sets are part of the key. We always put a management context into all our calls on gaming and wagering stocks. What we see in SGHC is a group of key people who come from Goldman Sachs as bankers as well as executive positions in the NFL. What they see is that fighting for market share crumbs absorbs far too much effort and money if you want to build revenue and subsequently investor returns.

SGHC has already acquired the two aforementioned business. Our expectation is that more will come whether by merger, acquisition or partnerships. Standalone, it is a viable global entry in sports betting as it is no leader but a participant taking a meaningful revenue share out of markets in which it now operates outside of the US.

Its management has a transactional mentality. And that in our view is the basic rationale to take a shot with the stock at $3.25 a share. You have a billion plus ongoing revenue base, an EBITDA in the black, an overall balance sheet capable of sustaining its growth ahead. But mostly you have a clear pathway expressed by management that it intends to grow by buying or merging itself into an ultimately larger and profitable entity. At $3.25, the margin of safety here against its current operational numbers is sound.

And its upside we believe has a key ingredient that any sports betting operation needs to have in its recipe for growth: It can exponentially expand by savvy acquisitions/mergers. It could be a cheaper and smarter way to grow the business than working the salt mines with marketing pick and shovel dealing to buy customers. Right now, SGHC says it has 2.7m existing global customers outside the US. It has made a start in Ontario, where we are just coming into the heartland of the NHL season that should provide some revenue lift going forward.

SGHC is thinly traded, about 175,000 shares a day, reflecting a ho-hum of Mr. Market attitudes at the moment. The bet here is that the company will continue to keep is roving crosshairs in the sector for opportunities to acquire or merge with like-minded or undervalued competitors. In a way, this has to be seen as a 2, and 2 could make 5 stock. Attractive entry point, sustaining business base, no excessive debt burden, and very big, big eyes on possible deals for compatible companies.

Between its share repurchase, its kill shot on outstanding warrants, and expectations of more M&A activity going forward, it represents a toe dip for a gaming portfolio that could not make more sense to investors who understand how the real-world dynamics of the future of sports betting will unfold.

Our PT based on a reasonable expectation of steadily improving revenues and earnings as well as possible transactions coming within the next year or so, gets us to worse case of $5.70 to best case of $6.80 by 3Q23.