Trying on the largest US startup funding rounds from Could 2025, leveraging information from CrunchBase, we’ve analyzed essentially the most important enterprise capital offers of the month. Past the uncooked funding numbers, this evaluation consists of detailed details about every firm’s trade focus, founding group, enterprise mannequin, and complete funding historical past to supply deeper context about these high-growth ventures

The AlleyWatch viewers is driving progress and innovation on a worldwide scale. With its regional media properties, AlleyWatch serves because the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with creating distinguished model placement, driving demand era, and constructing thought management among the many overwhelming majority of key decision-makers within the New York enterprise neighborhood and past. Study extra about promoting to NYC Tech at scale.

11. Statsig $100.0M

Spherical: Sequence C

Description: Bellevue-based Statsig gives instruments for A/B testing, characteristic administration, and product analytics to assist groups optimize product growth. Based by Vijaye Raji in 2021, Statsig has now raised a complete of $153.4M in complete fairness funding and is backed by Sequoia Capital, Madrona, ICONIQ Progress, Gokul Rajaram, and Dylan Discipline.

Buyers within the spherical: ICONIQ Progress, Madrona, Sequoia Capital

Trade: Analytics, Massive Information, SaaS

Founders: Vijaye Raji

Founding 12 months: 2021

Complete fairness funding raised: $153.4M

11. TensorWave $100.0M

Spherical: Sequence A

Description: Las Vegas-based TensorWave is an AI and HPC cloud platform that makes use of AMD accelerators to help demanding AI workloads. Based by Darrick Horton, Jeff Tatarchuk, and Piotr Tomasik in 2023, TensorWave has now raised a complete of $146.7M in complete fairness funding and is backed by Nexus Enterprise Companions, Translink Capital, Prosperity7 Ventures, Maverick Capital, and AMD.

Buyers within the spherical: AMD Ventures, Magnetar Capital, Maverick Silicon, Nexus Enterprise Companions, Prosperity7 Ventures

Trade: Synthetic Intelligence (AI), Cloud Computing, Cloud Infrastructure, Generative AI, IaaS

Founders: Darrick Horton, Jeff Tatarchuk, Piotr Tomasik

Founding 12 months: 2023

Complete fairness funding raised: $146.7M

11. LMArena $100.0M

Spherical: Seed

Description: San Francisco-based LMArena targeted on constructing a impartial, open, community-driven platform. Based by Anastasios Angelopoulos in 2025, LMArena has now raised a complete of $100.0M in complete fairness funding and is backed by Andreessen Horowitz, Lightspeed Enterprise Companions, Felicis, Kleiner Perkins, and The Home Fund.

Buyers within the spherical: Andreessen Horowitz, Felicis, Kleiner Perkins, Laude Ventures, Lightspeed Enterprise Companions, The Home Fund, UC Investments

Trade: Synthetic Intelligence (AI), Communities, Machine Studying, Product Analysis

Founders: Anastasios Angelopoulos

Founding 12 months: 2025

Complete fairness funding raised: $100.0M

11. Snorkel AI $100.0M

Spherical: Sequence D

Description: Redwood Metropolis-based Snorkel AI is an AI platform that accelerates information labeling by utilizing machine studying for sooner mannequin coaching. Based by Alexander Ratner, Braden Hancock, Chris Re, Henry Ehrenberg, Manas Joglekar, Paroma Varma, and Vincent Sunn Chen in 2019, Snorkel AI has now raised a complete of $235.3M in complete fairness funding and is backed by Accel, BlackRock, Lightspeed Enterprise Companions, Walden Worldwide, and Greylock.

Buyers within the spherical: Addition, BNY, Greylock, Lightspeed Enterprise Companions, Prosperity7 Ventures, QBE Ventures

Trade: Synthetic Intelligence (AI), Information Assortment and Labeling, Enterprise Software program, Machine Studying

Founders: Alexander Ratner, Braden Hancock, Chris Re, Henry Ehrenberg, Manas Joglekar, Paroma Varma, Vincent Sunn Chen

Founding 12 months: 2019

Complete fairness funding raised: $235.3M

10. Proprietor $120.0M

Spherical: Sequence C

Description: Palo Alto-based Proprietor is a know-how firm that gives instruments for native restaurant house owners to boost gross sales and on-line presence. Based by Adam Guild and Dean Bloembergen in 2018, Proprietor has now raised a complete of $182.2M in complete fairness funding and is backed by Y Combinator, Headline, Activant Capital, GTMfund, and Alt Capital.

Buyers within the spherical: Alex Bard, Alt Capital, Andrew Steele, Brett Schulman, Christina Cacioppo, Dharmesh Shah, Fidji Simo, Garrett Langley, Headline, Jack Altman, Jason Lemkin, Jonathan Neman, Josh Reeves, Matt Maloney, Max Mullen, Meritech Capital Companions, Y Combinator

Trade: CRM, Eating places, Software program

Founders: Adam Guild, Dean Bloembergen

Founding 12 months: 2018

Complete fairness funding raised: $182.2M

9. Stash $146.0M

Spherical: Sequence H

Description: New York-based Stash develops a private finance utility to mix banking, investing, and recommendation into one platform. Based by Brandon Krieg, David Ronick, and Ed Robinson in 2015, Stash has now raised a complete of $572.3M in complete fairness funding and is backed by StepStone Group, Union Sq. Ventures, Goodwater Capital, Coatue, and Founders Fund.

Buyers within the spherical: Goodwater Capital, Serengeti Asset Administration, StepStone Group, T. Rowe Worth, Union Sq. Ventures, College of Illinois Basis

Trade: Apps, Banking, FinTech, Cellular Apps, Private Finance

Founders: Brandon Krieg, David Ronick, Ed Robinson

Founding 12 months: 2015

Complete fairness funding raised: $572.3M

AlleyWatch’s unique protection of this spherical: Stash Raises $146M to Improve Monetary Steerage with its AI-Powered Platform

8. Atlas Information Storage $155.0M

Spherical: Seed

Description: South San Francisco-based Atlas Information Storage is an info know-how firm targeted on information storage options. Based by Varun Mehta and Invoice Banyai in 2025, Atlas Information Storage has now raised a complete of $155.0M in complete fairness funding and is backed by Deerfield Administration, ARCH Enterprise Companions, Bezos Expeditions, Tao Capital Companions, and Earth Foundry.

Buyers within the spherical: ARCH Enterprise Companions, Bezos Expeditions, Deerfield Administration, Earth Foundry, IQT, Rsquared VC, Tao Capital Companions

Trade: Information Administration, Database, Data Expertise

Founders: Varun Mehta, Invoice Banyai

Founding 12 months: 2025

Complete fairness funding raised: $155.0M

7. Awardco $165.0M

Spherical: Sequence B

Description: Lindon-based Awardco is a human sources know-how firm that makes a speciality of worker recognition and rewards options. Based by Mike Sonnenberg, Steven J Sonnenberg, and Tanner Runia in 2011, Awardco has now raised a complete of $235.0M in complete fairness funding and is backed by Common Catalyst, Sixth Road, Spectrum Fairness, and Ryan Smith.

Buyers within the spherical: Common Catalyst, Ryan Smith, Sixth Road, Spectrum Fairness

Trade: B2B, Worker Advantages, Human Sources, SaaS

Founders: Mike Sonnenberg, Steven J Sonnenberg, Tanner Runia

Founding 12 months: 2011

Complete fairness funding raised: $235.0M

6. Addepar $230.0M

Spherical: Sequence G

Description: Mountain View-based Addepar is a software program and information platform for even essentially the most advanced funding portfolios. Based by Jason Mirra and Joe Lonsdale in 2009, Addepar has now raised a complete of $761.4M in complete fairness funding and is backed by Valor Fairness Companions, Vitruvian Companions, 8VC, WestCap, and Cota Capital.

Buyers within the spherical: 8VC, EDBI, Valor Fairness Companions, Vitruvian Companions, WestCap

Trade: Monetary Companies, FinTech, SaaS, Software program

Founders: Jason Mirra, Joe Lonsdale

Founding 12 months: 2009

Complete fairness funding raised: $761.4M

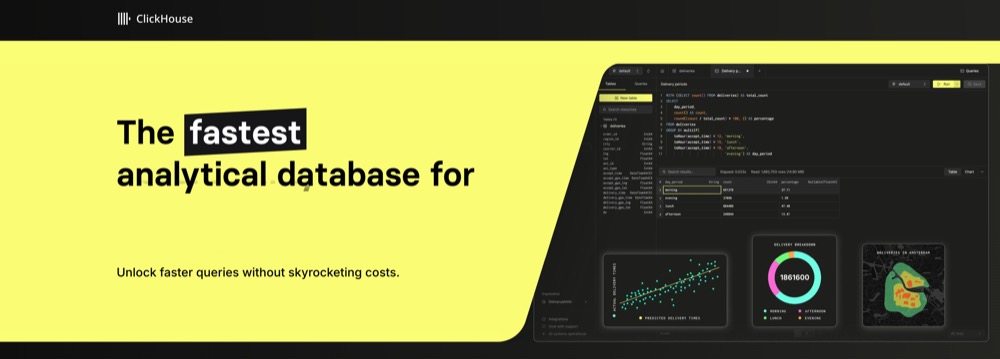

5. ClickHouse $350.0M

Spherical: Sequence C

Description: Palo Alto-based ClickHouse gives an open-source database system for real-time analytical reporting. Based by Aaron Katz, Alexey Milovidov, Alexey Milovidov, Yury Izrailevsky, and Yury Izrailevsky in 2021, ClickHouse has now raised a complete of $650.0M in complete fairness funding and is backed by Bessemer Enterprise Companions, Khosla Ventures, Nebius Group, Lightspeed Enterprise Companions, and Index Ventures.

Buyers within the spherical: Battery Ventures, Benchmark, Bessemer Enterprise Companions, Bond, Coatue, FirstMark, Geodesic Capital, GIC, Index Ventures, IVP, Khosla Ventures, Lightspeed Enterprise Companions, Nebius Group

Trade: Analytics, Synthetic Intelligence (AI), Massive Information, Database, Software program

Founders: Aaron Katz, Alexey Milovidov, Alexey Milovidov, Yury Izrailevsky, Yury Izrailevsky

Founding 12 months: 2021

Complete fairness funding raised: $650.0M

💡 CONNECT WITH NYC INNOVATORS

Be a part of NYC’s prime tech firms in reaching AlleyWatch’s engaged viewers of founders, traders, and decision-makers. Study Extra →

4. Rippling $450.0M

Spherical: Sequence G

Description: San Francisco-based Rippling is a workforce administration platform that unifies HR, IT, and finance operations right into a single system. Based by Parker Conrad and Prasanna Sankar in 2016, Rippling has now raised a complete of $1.8B in complete fairness funding and is backed by Y Combinator, Sequoia Capital, Founders Fund, Sands Capital Ventures, and Coatue.

Buyers within the spherical: Baillie Gifford, GIC, GS Progress, Sands Capital Ventures, WiL (World Innovation Lab), Y Combinator

Trade: Employment, Human Sources, Data Expertise, InsurTech, IT Administration

Founders: Parker Conrad, Prasanna Sankar

Founding 12 months: 2016

Complete fairness funding raised: $1.8B

3. Perplexity $500.0M

Spherical: Enterprise

Description: San Francisco-based Perplexity is an AI-powered reply engine designed to supply correct, real-time responses to person queries. Based by Andy Konwinski, Aravind Srinivas, Denis Yarats, and Johnny Ho in 2022, Perplexity has now raised a complete of $1.2B in complete fairness funding and is backed by Accel, Bessemer Enterprise Companions, New Enterprise Associates, NVIDIA, and IVP.

Buyers within the spherical: Accel

Trade: Synthetic Intelligence (AI), Chatbot, Generative AI, Machine Studying, Pure Language Processing, Search Engine

Founders: Andy Konwinski, Aravind Srinivas, Denis Yarats, Johnny Ho

Founding 12 months: 2022

Complete fairness funding raised: $1.2B

2. Marvel $600.0M

Spherical: Enterprise

Description: New York-based Marvel is a meals supply startup that operates truck-based eating places from which shoppers can order meals by a cell app. Based by Juan Cappello and Marc Lore in 2018, Marvel has now raised a complete of $2.4B in complete fairness funding and is backed by Common Catalyst, Accel, New Enterprise Associates, Forerunner, and Bain Capital Ventures.

Buyers within the spherical: Accel, American Specific Ventures, Forerunner, Google Ventures, New Enterprise Associates

Trade: E-Commerce, Meals and Beverage, Meals Supply, Eating places

Founders: Juan Cappello, Marc Lore

Founding 12 months: 2018

Complete fairness funding raised: $2.4B

1. Grammarly $1.0B

Spherical: Enterprise

Description: San Francisco-based Grammarly is an AI-powered writing assistant that gives grammar checking, plagiarism detection, and generative textual content recommendations. Based by Alex Shevchenko, Alex Shevchenko, Dmytro Lider, and Max Lytvyn in 2009, Grammarly has now raised a complete of $1.4B in complete fairness funding and is backed by Common Catalyst, BlackRock, Spark Capital, IVP, and SignalFire.

Buyers within the spherical: Common Catalyst

Trade: Synthetic Intelligence (AI), Copywriting, Generative AI, Machine Studying, Digital Assistant

Founders: Alex Shevchenko, Alex Shevchenko, Dmytro Lider, Max Lytvyn

Founding 12 months: 2009

Complete fairness funding raised: $1.4B

The AlleyWatch viewers is driving progress and innovation on a worldwide scale. With its regional media properties, AlleyWatch serves because the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with creating distinguished model placement, driving demand era, and constructing thought management among the many overwhelming majority of key decision-makers within the New York enterprise neighborhood and past. Study extra about promoting to NYC Tech at scale.