July 2025’s largest funding rounds showcase a various mixture of sectors and levels, from established fintech firms elevating nine-figure rounds to rising AI startups securing substantial seed funding. Utilizing information from CrunchBase, we’ve ranked the month’s largest offers and included key particulars on every firm’s background, traders, and progress trajectory. The highest rounds reveal continued investor confidence in each confirmed enterprise fashions and cutting-edge expertise performs.

🚀 REACH NYC TECH LEADERS

AlleyWatch is NYC’s main supply of tech and startup information, reaching the town’s most energetic founders, traders, and tech leaders. Be taught Extra →

9. INSHUR $35.0M

Spherical: Enterprise

Description: INSHUR is a digital insurance coverage platform offering business auto insurance coverage tailor-made for taxi, TLC, ride-share, and personal rent drivers. Based by Dan Bratshpis, David Daiches, Mathew Donfrancesco, Matthew Tomlinson, and Richard Anderson in 2016, INSHUR has now raised a complete of $114.6M in whole fairness funding and is backed by Trinity Capital, Viola FinTech, Munich Re Ventures, MTech Capital, and Jerusalem Enterprise Companions (JVP).

Buyers within the spherical: Trinity Capital

Business: Auto Insurance coverage, Industrial Insurance coverage, Insurance coverage, InsurTech

Founders: Dan Bratshpis, David Daiches, Mathew Donfrancesco, Matthew Tomlinson, Richard Anderson

Founding yr: 2016

Complete fairness funding raised: $114.6M

AlleyWatch’s unique protection of the spherical: INSHUR Raises $35M to Scale Embedded Insurance coverage Platform for Gig Financial system Drivers

9. Small Door $35.0M

Spherical: Enterprise

Description: Small Door is a membership-based veterinary service that provides surgical procedure, wellness, and preventative care. Based by Florent Peyre and Josh Guttman in 2018, Small Door has now raised a complete of $98.5M in whole fairness funding and is backed by Major Enterprise Companions, Alumni Ventures, Lerer Hippeau, Model Foundry Ventures, and Valspring Capital.

Buyers within the spherical: C&S Household Capital, Lerer Hippeau, Major Enterprise Companions, Toba Capital, Valspring Capital

Business: Well being Care, Medical, Pet, Veterinary

Founders: Florent Peyre, Josh Guttman

Founding yr: 2018

Complete fairness funding raised: $98.5M

AlleyWatch’s unique protection of the spherical: Small Door Veterinary Raises $35M to Scale Membership-Primarily based Pet Healthcare Mannequin

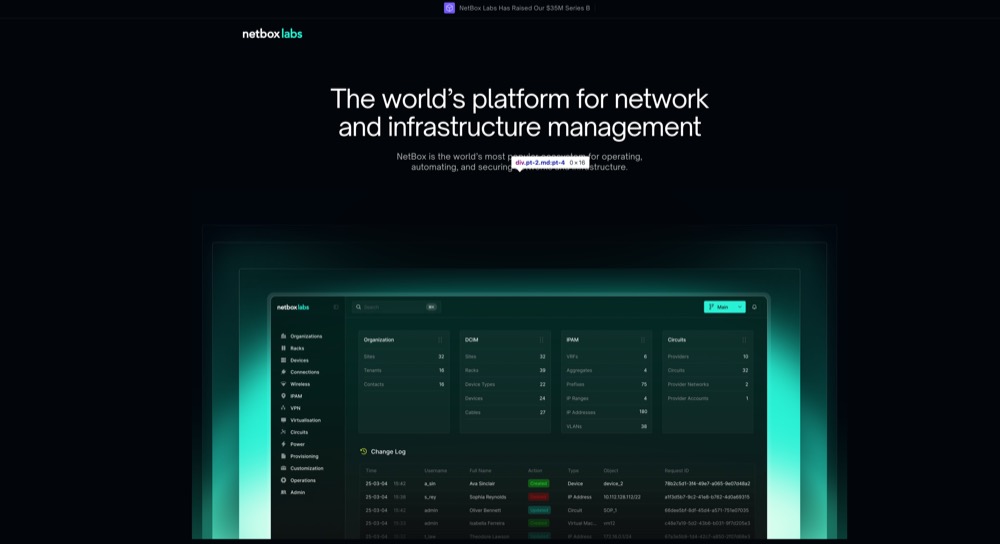

9. NetBox Labs $35.0M

Spherical: Sequence B

Description: NetBox Labs develops providers for the open-source NetBox IP deal with administration and information heart infrastructure administration platform. Based by Invoice Lapcevic, Jeremy Stretch, Kristopher Beevers, Mark Coleman, Salil Jani, and Shannon Weyrick in 2023, NetBox Labs has now raised a complete of $55.0M in whole fairness funding and is backed by Headline, Founder Collective, Two Sigma Ventures, NGP Capital, and Sorenson Capital.

Buyers within the spherical: Flybridge, Headline, IBM, Mango Capital, NGP Capital, Notable Capital, Salesforce Ventures, Sorenson Capital, Two Sigma Ventures

Business: Info Know-how, Open Supply, Skilled Networking, SaaS

Founders: Invoice Lapcevic, Jeremy Stretch, Kristopher Beevers, Mark Coleman, Salil Jani, Shannon Weyrick

Founding yr: 2023

Complete fairness funding raised: $55.0M

8. Second $36.0M

Spherical: Sequence B

Description: Second is a fixed-income working system that automates buying and selling and portfolio administration workflows for fixed-income groups. Based by Ammer Soliman, Dean Hathout, and Dylan Parker in 2022, Second has now raised a complete of $56.0M in whole fairness funding and is backed by Andreessen Horowitz, Lightspeed Enterprise Companions, Index Ventures, Neo, and Venrock.

Buyers within the spherical: Andreessen Horowitz, Opposite, Index Ventures, Lightspeed Enterprise Companions, Neo, Venrock

Business: Analytics, Monetary Providers, FinTech, Danger Administration, Software program

Founders: Ammer Soliman, Dean Hathout, Dylan Parker

Founding yr: 2022

Complete fairness funding raised: $56.0M

AlleyWatch’s unique protection of the spherical: Second Raises $36M to Exchange Spreadsheet-Pushed Bond Buying and selling with Unified Platform

7. april $38.0M

Spherical: Sequence B

Description: April gives embedded tax planning and submitting instruments that combine into monetary platforms to energy smarter, real-time tax choices. Based by Ben Borodach and Daniel Marcous in 2021, april has now raised a complete of $78.0M in whole fairness funding and is backed by QED Buyers, Team8, Business Ventures, Nyca Companions, and iAngels.

Buyers within the spherical: Euclidean Capital, iAngels, Business Ventures, Nyca Companions, QED Buyers, Team8, Transpose Platform Administration, Treasury

Business: Monetary Providers, FinTech, Info Know-how, Tax Consulting, Tax Preparation

Founders: Ben Borodach, Daniel Marcous

Founding yr: 2021

Complete fairness funding raised: $78.0M

AlleyWatch’s unique protection of the spherical: april Raises $38M to Embed Tax Intelligence into Each Monetary Resolution

💡 CONNECT WITH NYC INNOVATORS

Be a part of NYC’s prime tech firms in reaching AlleyWatch’s engaged viewers of founders, traders, and decision-makers. Be taught Extra →

6. Trunk Instruments $40.0M

Spherical: Sequence B

Description: Trunk Instruments is a building tech firm that makes use of AI to assist groups handle venture information extra effectively. Based by Sarah Buchner in 2021, Trunk Instruments has now raised a complete of $69.9M in whole fairness funding and is backed by Perception Companions, Alumni Ventures, StepStone Group, Basis Capital, and True Ventures.

Buyers within the spherical: Innovation Endeavors, Perception Companions, Liberty Mutual Strategic Ventures, Prudence, Redpoint, StepStone Group

Business: Synthetic Intelligence (AI), Development, Productiveness Instruments, Mission Administration, Software program

Founders: Sarah Buchner

Founding yr: 2021

Complete fairness funding raised: $69.9M

6. Cowl Whale $40.0M

Spherical: Sequence B

Description: Cowl Whale is an insurtech firm that provides business auto insurance coverage merchandise. Based by Daniel Abrahamsen in 2019, Cowl Whale has now raised a complete of $83.0M in whole fairness funding and is backed by Morgan Stanley Enlargement Capital and Ambac.

Buyers within the spherical: Morgan Stanley Enlargement Capital

Business: Monetary Providers, Insurance coverage, InsurTech, Transportation

Founders: Daniel Abrahamsen

Founding yr: 2019

Complete fairness funding raised: $83.0M

5. Radical AI $55.0M

Spherical: Seed

Description: Radical AI is a expertise startup specializing in altering supplies science and superior manufacturing by means of synthetic intelligence. Based by Joseph Krause in 2024, Radical AI has now raised a complete of $55.0M in whole fairness funding and is backed by noa, Eni, AlleyCorp, NVentures, and Infinite Capital.

Buyers within the spherical: AlleyCorp, Eni, Infinite Capital, noa, NVentures, RTX Ventures

Business: Superior Supplies, Synthetic Intelligence (AI), Manufacturing

Founders: Joseph Krause

Founding yr: 2024

Complete fairness funding raised: $55.0M

4. Savvy Wealth $72.0M

Spherical: Sequence B

Description: Savvy Wealth is a technology-enabled wealth administration agency that gives a digital-first platform for monetary advisors. Based by Muller Zhang and Ritik Malhotra in 2021, Savvy Wealth has now raised a complete of $105.8M in whole fairness funding and is backed by Alumni Ventures, BoxGroup, Index Ventures, Thrive Capital, and Business Ventures.

Buyers within the spherical: Brewer Lane Ventures, Canvas Ventures, Euclidean Capital, Business Ventures, The Home Fund, Thrive Capital, Vamsi Yadlapati, Vestigo Ventures

Business: Monetary Providers, FinTech, Info Know-how, Private Finance, Wealth Administration

Founders: Muller Zhang, Ritik Malhotra

Founding yr: 2021

Complete fairness funding raised: $105.8M

3. Yieldstreet $77.0M

Spherical: Enterprise

Description: Yieldstreet is another funding platform that gives retail traders entry to income-generating funding merchandise. Based by Dennis Shields, Michael Weisz, and Milind Mehere in 2015, Yieldstreet has now raised a complete of $416.7M in whole fairness funding and is backed by Gaingels, Monroe Capital, Greycroft, Edison Companions, and FJ Labs.

Buyers within the spherical: Cordoba Advisory Companions, Edison Companions, Gaingels, Kingfisher Funding Advisors, Mayfair Fairness Companions, RedBird Capital Companions, Tarsadia Investments

Business: Finance, Monetary Providers, FinTech, Wealth Administration

Founders: Dennis Shields, Michael Weisz, Milind Mehere

Founding yr: 2015

Complete fairness funding raised: $416.7M

📈 ENGAGE NYC DECISION MAKERS

Join with NYC’s tech ecosystem by means of AlleyWatch, essentially the most trusted voice in native tech and startups. Be taught Extra →

2. Bilt Rewards $250.0M

Spherical: Enterprise

Description: Bilt Rewards is a funds and commerce community that permits customers to earn factors on hire and HOA funds funds. Based by Ankur Jain and David Wyler in 2021, Bilt Rewards has now raised a complete of $813.3M in whole fairness funding and is backed by Basic Catalyst, Wells Fargo, Fifth Wall, United Wholesale Mortgage, and Eldridge Industries.

Buyers within the spherical: Basic Catalyst, GID, United Wholesale Mortgage

Business: FinTech, Loyalty Applications, Actual Property, Rental Property

Founders: Ankur Jain, David Wyler

Founding yr: 2021

Complete fairness funding raised: $813.3M

1. Ramp $500.0M

Spherical: Sequence E

Description: Ramp is a monetary operations platform designed to save lots of firms money and time. Based by Eric Glyman, Gene Lee, and Karim Atiyeh in 2019, Ramp has now raised a complete of $1.8B in whole fairness funding and is backed by Citi, Basic Catalyst, BoxGroup, Stripe, and Sequoia Capital.

Buyers within the spherical: 137 Ventures, 8VC, Altimeter Capital, Avenir, Citi, Coatue, D1 Capital Companions, Definition, Emerson Collective, Founders Fund, Basic Catalyst, GIC, GV, ICONIQ Capital, Khosla Ventures, Lightspeed Enterprise Companions, Lux Capital, Operator Collective, Pinegrove Capital Companions, Sands Capital Ventures, Sequoia Capital, Stripe, Sutter Hill Ventures, T. Rowe Worth, Thrive Capital

Business: Finance, Monetary Providers, FinTech

Founders: Eric Glyman, Gene Lee, Karim Atiyeh

Founding yr: 2019

Complete fairness funding raised: $1.8B

🎯 TARGET NYC TECH

Attain essentially the most influential leaders in NYC’s startup ecosystem by means of AlleyWatch’s premium promoting options. Be taught Extra →