Discovering the best financial savings account can get you an additional $200 at no cost this 12 months.

Relying in your steadiness, it may make you much more cash.

Let’s say you might have $10,000 to place into top-of-the-line on-line financial savings account.

How a lot would that flip into at a giant financial institution financial savings account? Most large banks have an APY (annual proportion yield) of 0.15% or much less. After a 12 months, your account can be price $10,015. Not a lot of a acquire there.

I really like getting cash for nothing, however even I’ve a tough time getting excited over an additional $15.

Now let’s say you are taking that very same $10,000 and put it into a web-based high-yield financial savings account with an APY of two.25%.

After a 12 months, you’ll have $10,225.

That’s $225 for doing completely nothing. Everybody wants some further money readily available for an emergency fund anyway. Why not get as a lot as you’ll be able to whereas it sits there? All it takes is opening the best account.

One of the best on-line financial savings accounts

We’re going to do a deep dive into what to search for, which accounts are finest, tips on how to get the best APY, and tips for optimizing your financial savings accounts.

Right here’s a breakdown of what we’ll cowl:

What Issues When Selecting an On-line Financial savings Account:

- Person Expertise and Firm Popularity

- Charges

- Comfort

- FDIC Insurance coverage

- APY Charges

On-line Financial savings Account Opinions:

The 4 Step Course of to Selecting an On-line Financial savings Account

If you wish to skip all of that and open an account proper now, these excessive curiosity on-line financial savings accounts had been our high rated:

You’ll be proud of any of them. My private favourite is Ally.

What issues when selecting a web-based financial savings account

Right here’s how we consider these accounts.

Person expertise and firm popularity

Good on-line and cell apps make an enormous distinction as of late, however it doesn’t matter as a lot once you’re in search of a excessive curiosity on-line financial savings account.

It must be ok however not nice.

Why?

As a result of we hardly ever log into financial savings accounts. They normally have limits of having the ability to withdraw from them as much as 6 occasions monthly. By definition, they’re not meant for use commonly.

Having fast and easy accessibility to your funds is much less vital than working with an organization that has a dependable popularity.

Whereas most prospects can entry their high-interest charge accounts shortly in an emergency, not all monetary establishments are created equal. We skipped corporations that scored lower than 65 % of the Harris Ballot Company Popularity Rankings like Wells Fargo, Goldman Sachs, and Financial institution of America. We additionally factored in main scandals over the past 5 years.

Again to High

Charges

For on-line financial savings accounts, it’s completely important that you just get an account with none upkeep charges. Month-to-month upkeep charges was frequent. Fortunately, most accounts have executed away with them.

On any good financial savings account, you’ll hardly ever run into charges throughout regular utilization. However even on one of the best accounts, it’s attainable to set off charges for sure occasions:

- Returned deposit objects

- Overdraft objects paid or returns

- Extreme transaction price (like going over 6 withdrawals monthly)

- Expedited supply

- Outgoing home wires

- Account analysis charges

We’ve made positive to not embody any banks in our record which have upkeep charges. However you ought to be conscious of a few of these different price objects that do exist on each account.

Again to High

Comfort

What we think about to be “handy” with financial savings accounts falls into two buckets relying on the place you’re in your personal private finance journey.

Once you’re constructing financial savings for the primary time, it’s important to get an account with no minimal steadiness requirement. A $5 required steadiness or one thing like that’s superb, you simply don’t need to have to fret a couple of increased one.

Don’t put up with any account that requires a large minimal steadiness. There are such a lot of choices that don’t have any steadiness necessities in any respect. That is the very last thing you ought to be frightened about within the early days, particularly if an emergency comes up and you might want to withdraw money.

Afterward, what you think about to be handy usually adjustments.

When you’ve constructed sufficient of a money buffer for your self, you’ll care rather a lot much less about minimal balances. As a substitute, your accounts, playing cards, and banks have all gotten sophisticated sufficient that simplicity issues much more than it used to. At this stage, some people will go for a decrease APY to be able to consolidate their accounts and make every thing extra manageable.

Is that this the optimum technique to get each ounce of development out of your money? No, it isn’t. However the further piece of thoughts will be properly price the price. If this sounds interesting to you, verify to see if the financial savings account at your fundamental financial institution has a ok APY with none upkeep charges. If it does, it might be your best choice.

Again to High

FDIC insured

Don’t ever think about a web-based financial savings account that’s not FDIC insured. Because of this the account is assured by the federal authorities as much as $250,000 per depositor. If one thing horrible ought to occur to the financial institution, the federal authorities ensures you’ll nonetheless get entry to your steadiness, as much as $250,000. That is per depositor, so the $250,000 contains the mixed steadiness of all of your financial savings accounts on the identical financial institution.

Nearly each financial savings account is FDIC insured. It’s been a regular follow for a very long time. However hold a detailed eye on this any time you’re contemplating an revolutionary or distinctive strategy to storing your money.

For instance, some people will retailer their money in a cash market account, which operates rather a lot like a financial savings account. Cash market accounts are normally FDIC insured. However cash market funds, which you place money into from a brokerage account, are usually not FDIC insured. A delicate but vital distinction throughout tenuous occasions.

One other instance: Robinhood tried to roll out a checking account that promised a 3% APY. That’s a checking account paying increased curiosity than any financial savings account that was out there on the time, by nearly 1%. Sounds superb proper?

It got here with quite a lot of catches, one among which was that it wasn’t FDIC insured. With out the FDIC insurance coverage, we don’t think about the upper APY definitely worth the threat.

Our stance is that each greenback of our financial savings needs to be lined by the FDIC, even when the steadiness is excessive sufficient that we’ve got to separate it up between a number of financial savings accounts.

The entire accounts that we assessment beneath are FDIC insured. Simply hold a watch out for this for those who’re exploring an atypical strategy to storing your money.

Again to High

APY charges

APY charges — the annual proportion yield — are the primary distinction between financial savings accounts. The upper your APY charge, the more cash that you just get mechanically each month.

APY charges throughout saving accounts typically fall into 3 tiers.

Large financial institution financial savings account APYs

For the overwhelming majority of huge financial institution financial savings accounts, the APY is horrible. Large banks assume that you really want a financial savings account alongside along with your checking account, so that they don’t do something to entice you for the financial savings account itself. Even when loads of on-line high-yield financial savings accounts are providing an APY of two%, large banks may solely provide a 0.15% APY. On a financial savings steadiness of $10,000, that’s a distinction between making $200 a 12 months versus $20 a 12 months.

This doesn’t apply to ALL large banks, however most of them do fall into this class. So hold a watch out for these. Until you actually need to maximize comfort by consolidating accounts and taking a decrease APY, it’s price discovering an account with a better APY.

Excessive yield financial savings account APYs

Excessive yield financial savings accounts have grow to be extraordinarily in style. These banks don’t have branches, they’re 100% on-line. Since save rather a lot from not having bodily areas, they go the financial savings onto you with a better APY.

Ally and American Specific are two of the most well-liked banks on this class.

The APY additionally stays up to date over time. Again through the monetary disaster, the Federal Reserve dropped rates of interest to 0% and most excessive yield financial savings accounts had APYs of 0.5-0.7%. Because the Federal Reserve elevated rates of interest, these identical accounts additionally elevated their APY. Each time rates of interest improve, you’ll get these will increase mechanically from these accounts. No must continuously change between accounts and chase one of the best charge.

Leading edge APYs

At any given second, there are a number of banks which are pushing the APYs increased than anybody else. They’re doing this as a promotional technique to draw extra prospects. A few of these banks hold tempo with altering rates of interest, a few of them don’t.

Whereas we don’t think about it definitely worth the effort to chase an additional 0.1% on our APY, these banks are an choice for those who’re seeking to maximize the APY in your financial savings.

On-line financial savings account opinions

Right here’s the lowdown on the most well-liked on-line financial savings accounts.

Axos financial savings account

- FDIC insured: Sure

- Minimal steadiness: None

- Upkeep charges: None

- APY: 1.30%

The APY is way decrease than different high-yield financial savings accounts — it’s common at finest. There’s no motive to open an Axos account until you’ve already maxed the FDIC limits on each different high-yield financial savings account and should get a decrease APY to horde all of your money.

I like to recommend selecting one of many different accounts from this record.

Uncover on-line financial savings account

- FDIC insured: Sure

- Minimal steadiness: None

- Upkeep charges: None

- APY: 1.60%

Uncover’s APY is fairly sturdy. Not fairly the highest, however it’s actually shut.

And for those who occur to have a Uncover card or checking account, protecting your accounts in a single place makes every thing rather a lot easier.

In case you have one other Uncover account, positively get a Uncover financial savings account.

HSBC

HSBC has a number of totally different financial savings accounts.

HSBC Premier Financial savings

- FDIC insured: Sure

- Minimal steadiness: $100,000 throughout your deposit accounts and funding balances. In case you go beneath this steadiness, there’s a $50 month-to-month price.

- Upkeep charges: None

- APY: 0.15%

The HSBC Premier accounts are for purchasers who’ve giant deposits at HSBC. Sadly, the APY is terrible. An APY that low with a minimal steadiness of $100,000 is sort of insulting.

This can be a good instance of a traditional large financial institution financial savings account. A bunch of constraints with a horrible APY. Skip these accounts completely.

HSBC Direct Financial savings

- FDIC insured: Sure

- Minimal steadiness: $1

- Upkeep charges: None

- APY: 1.85%

HSBC does have a high-yield financial savings account with a aggressive APY. Usually, I’d suggest this account as a fundamental contender.

However HSBC is only a horrible financial institution. Each interplay with them is harder than it needs to be. The one motive I’d ever think about opening an HSBC account if I wanted an enormous, worldwide financial institution for some motive.

Regardless that this account appears nice on paper, you’ll remorse it in case your expertise is something like ours.

Ally financial savings account

- FDIC insured: Sure

- Minimal steadiness: None

- Upkeep charges: None

- APY: 1.6%

We’re big followers of Ally. They’ve grow to be one of many main high-yield financial savings accounts.

Sure, Ally doesn’t technically have the best APY, however it’s darn shut. And so they replace their APY usually. So if rates of interest proceed to rise, you’ll get a better APY with out having to do something.

Their account UI is fairly slick too, and it’s at all times bettering.

I’ve an Ally account myself.

Be at liberty to cease studying right here and open an Ally account proper now. You received’t remorse it.

Capital One 360 Financial savings

- FDIC insured: Sure

- Minimal steadiness: None

- Upkeep charges: None

- APY: 1.7%

Capital One used to have an APY that lagged the remainder of the market, making it a sub-standard alternative. You’d have to make use of one other financial institution or their Capital One 360 Cash Market account to get a aggressive APY.

Now they’ve an APY that’s simply nearly as good as most banks. It’s one of many high contenders.

Particularly when you’ve got Capital One bank cards, it’s very nice to maintain every thing at one financial institution.

Marcus by Goldman Sachs

- FDIC insured: Sure

- Minimal steadiness: None, however there’s a deposit restrict of $1,000,000 for all of your financial savings account and CDs

- Upkeep charges: None

- APY: 1.7%

Goldman Sachs jumped into the high-yield financial savings account house with one of many highest APYs.

They do restrict deposits to a complete of $1,000,000, however that’s not a significant concern. You’ll need to cut up up your money balances throughout a number of banks to get all of it FDIC insured anyway.

In case you’re in search of your first high-yield financial savings account, it is a implausible choice.

American Specific financial savings account

- FDIC insured: Sure

- Minimal steadiness: None

- Upkeep charges: None

- APY: 1.7%

American Specific was one of many first to introduce a high-yield financial savings account, and it’s been round for awhile now.

Lately, the APY is barely decrease than a few of the rivals. Whereas American Specific does replace their yields continuously, they’re at all times 0.10-0.20% off the best charges. Whereas it’s nonetheless an amazing choice, I’d select one of many different accounts because of this alone.

One different caveat: the American Specific financial savings account isn’t built-in into the identical login account because the American Specific bank cards. Even when you’ve got each, it appears like having two totally different banks. There’s no further simplicity from making an attempt to consolidate.

Barclays financial savings account

- FDIC insured: Sure

- Minimal steadiness: None

- Upkeep charges: None

- APY: 1.7%

One other nice choice. Nice APY, no upkeep charges or minimal balances — you’ll be able to’t go improper with a Barclays on-line financial savings account.

Synchrony financial savings account

- FDIC insured: Sure

- Minimal steadiness: None

- Upkeep charges: None

- APY: 1.7%

Synchrony can also be an amazing choice. The APY is likely one of the highest and has no minimums or upkeep charges.

Vio Financial institution

- FDIC Insured: Sure

- Minimal Deposit: $100

- Upkeep Charges: None

- APY: 1.85%

This account presents increased returns as a result of the financial institution has no bodily areas. They provide a aggressive APY with a low minimal deposit. You’ll need to look out for the $5 price to obtain paper statements and a $10 price for any withdrawal over the allotted six transactions monthly.

Comenity Direct Financial institution

- FDIC Insured: Sure

- Minimal Deposit: $100

Upkeep Charges: None - APY:1.90%

Comenity Financial institution has aggressive charges and doesn’t cost a upkeep price. Shoppers additionally get free ACH transfers, free on-line statements, free incoming transfers, and limitless deposits on their cell app or by way of ACH switch. They do cost for outgoing wire switch, official verify requests, and paper assertion charges. Comenity has an interest-earning restrict on balances of $10 million.

Residents Entry

- FDIC Insured: Sure

- Minimal Deposit: $5,000

- Upkeep Charges: None

- APY: 1.85%

Whereas Citizen’s Entry does have a better minimal steadiness to earn curiosity, the APY may be very aggressive, and so they rank excessive for his or her CDs as properly. Citizen’s Entry doesn’t have a cell app and so they don’t provide any checking accounts, so that you’ll have to separate your funds between two monetary establishments.

The 4-step course of to selecting one of the best on-line financial savings account

- Examine the banks that you just presently have accounts with and see if they’ve a aggressive financial savings account. If the APY is similar to the accounts we listed above, stick along with your present financial institution.

- In any other case, decide an account from this record:

- Uncover On-line Financial savings Account

- Ally financial savings account

- Marcus by Goldman Sachs

- American Specific financial savings account

- Barclays financial savings account

- Synchrony financial savings account

- Attempt to decide an account from a financial institution that you just foresee doing different enterprise with. For instance, Ally has automotive loans and Uncover has their bank cards.

- In case you’re nonetheless unsure, go together with Ally.

What about sub-savings accounts?

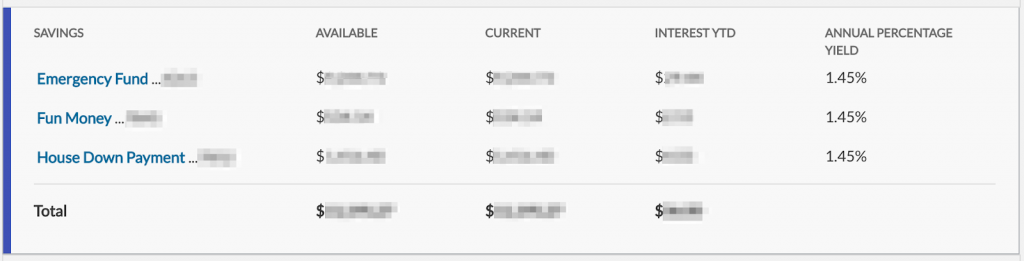

Considered one of our favourite financial savings account tips is to open “sub-accounts.” This permits us to simply funds for greater purchases by saving a bit of bit every month. We are able to additionally observe every thing by separating all of the accounts.

For instance, I’ve these classes in my very own financial savings account:

- Emergency fund

- Home downpayment

- Mini-retirement

- Christmas items

- Annual trip

Every month, cash goes into every of those separate accounts with the automated transfers that I arrange. And I can simply see how a lot I’ve saved in the direction of my objectives.

Ramit’s financial savings accounts used to seem like this again earlier than ING Direct was purchased by Capital One:

Right here’s a extra present instance in Ally:

Some financial savings accounts will name these “sub-accounts,” and every thing can be a part of the identical financial savings account. This can be a uncommon characteristic to search out although.

For everybody else, merely open up a number of financial savings account below the identical financial institution login. You may simply have 5-10 accounts on the identical financial institution. Then deal with every account for no matter saving class that you just like.

This implies you may get “sub-accounts” at any financial institution, even when they don’t have a “sub-account” characteristic.

Don’t chase yields

Look, there’s at all times a financial institution that has a barely increased APY. Banks use it as a promotion technique to get extra accounts, so it’s at all times altering.

Usually researching new APY charges, in search of that further 0.05% APY, opening accounts, and transferring cash all over wastes extra time than it’s price.

Don’t be a charge chaser.

Bear in mind IWT’s philosophy of huge wins. Give attention to the foremost wins that actually transfer the needle and neglect concerning the small stuff. Chasing increased APYs on financial savings accounts positively falls into the “small stuff” class.

Decide a financial savings account that has a aggressive APY from a financial institution that you just belief for the long run. Then stick with that call and work on bettering different areas of your life.

Cash market accounts vs financial savings accounts

The distinction between cash market accounts and financial savings accounts will be fairly complicated.

That’s as a result of there’s no sensible distinction.

Listed below are the similarities:

- The APY tends to be the identical between each kinds of accounts.

- You may withdraw as much as 6 occasions monthly.

- Some have ATM playing cards, some don’t.

- Some have minimums, some don’t.

- Each are FDIC insured.

Mainly they’re the identical account. In case your financial institution occurs to supply a cash market account with no upkeep charges, no minimal, and a aggressive APY, be at liberty to make use of it.

Now for the complicated half: cash market funds are fully totally different. They’re a part of brokerage accounts and assist you to place money whilst you wait to take a position it. Since cash market funds are usually not FDIC insured, so it’s not a great behavior to retailer masses of cash in them.

When to get financial savings accounts from a number of banks

In case you ask excessive web price people which financial savings accounts they’ve, typically they’ll record off half a dozen totally different banks.

At first, this is not sensible. Why all the additional complexity and totally different accounts?

There’s one motive: FDIC insurance coverage limits.

Most individuals are restricted to $250,000 price of insurance coverage at any given financial institution. Joint accounts and accounts throughout totally different classes (like retirement accounts) can improve this restrict, however that solely goes thus far. In case you have a considerable amount of money, the one method to hold it insured is to open up financial savings accounts throughout a number of banks.

That’s why people will begin opening up financial savings accounts throughout a number of banks.

In case you have a number of financial savings accounts to handle, Max will mechanically transfer balances round your accounts to optimize for the best APY whereas protecting all of your money insured. They do cost a 0.08% annual price for the service.

As for which accounts to open, we suggest beginning with these:

Any mixture of accounts which have sturdy APYs will work.