It might sound easy enough to do, but many parents actually don’t know the best way to save money for kids or, at the very least, where to start.

I am not saying my ways are the best, but they certainly work for me and my little ones. Depending on your current financial situation, they might help you figure out the best way to save money for your kids.

Using these tips has helped me come up with a way to secure a better financial future for my kids without overstretching or causing unnecessary financial strain in the now.

Why Is It Important to Save Money for Our Kids?

Healthy savings will get them off on the right foot when they leave home to start a life of their own, increasing their potential for a successful future.

The money savings process provides a platform to impart financial literacy, teach financial responsibility from a tender age, and teach discipline when it comes to things like budgeting and delayed gratification.

The savings also functions as an emergency fund should anything happen to us or our kids while they are still growing up. You will enjoy the peace of mind of knowing they are cared for in the case of almost any eventuality. A will or inheritance fund ensures the savings will be spent wisely for the benefit of your kids.

Your Best Practice Guide to Saving Money for Kids

Here are some excellent tips on the best way to save money for kids.

Define Your Savings Goal

The ideal savings option will vary for different parents based on their financial goals and circumstances. Motivation ranges from emergency funds to specific stages of the child’s future, like higher education, buying their first car, or even jump-starting retirement savings. Define what you are saving for, set targets, and draw up a plan.

Set Up a Savings Account(s) for the Kid(s)

Approach your preferred financial institution and set up an account designed for the savings you settled on. Similar solutions are structured differently across each financial institution.

Budgeting

As parents, we budget all the time. Budgeting is a great way to improve money management, ensuring you always leave something for your kid’s savings account (and your own fun fund for date night or vacation). Many sources of funds can be included in the savings plan.

You can set it up so that an amount is transferred from your own bank account to the kid’s account. Some parents, myself included, also deposit their work bonuses in their kids’ savings accounts up to a predetermined date.

Alternatively, you can agree to collect all the money the children earn from chores, lawn mowing, babysitting, or other side jobs they do on their own and then set that money aside in their savings accounts after giving them a weekly stipend for their hard work, of course.

Financial Education

All this planning and investment can be undone if your kid grows up without the financial education to develop positive money habits. Involve them in your financial planning at a young age so they grasp the concept of money. Teach them your ways, one might say.

Financial literacy involves more than what children learn from listening and observation. It involves practicing positive money management habits like restrained spending, taming the urge for instant gratification and budgeting.

Add a checking account to their savings account so they get used to financial tools like a debit card for younger kids and banking apps for teens. Most of these allow the parents to keep an eye on the child’s spending habits, too, so we can easily reign things in if they start running wild.

What Is the Best Way to Save Money for a Child?

Now that you are familiar with the territory, let’s look at the options available as our kids outgrow the piggy bank we have been filling with spare change since they were babies.

College Savings Plans

College is quite expensive, and it pays to have a head start on your child’s college savings so there is adequate time to accumulate funds gradually. A good education increases your child’s earning potential and job security, leading them to financial success.

The 529 Investment Plan

A 529 Investment Plan is a tax-advantaged investment account designed to encourage saving toward future education expenses. It’s named after Section 529 of the Federal Tax Code and is sponsored by the state or a state agency.

Savings are tax-deferred, and you can withdraw the funds tax-free to pay for qualified education expenses like tuition, books, and accommodation. It lets you save for your child’s future attendance at designated colleges or universities at prevailing rates.

Custodial Accounts

A custodial account offers another opportunity to save on your child’s behalf or gift them when you get a bonus or any other windfall. One party, the custodian (typically the parent), controls the funds on behalf of the minor (the beneficiary), who will gain access to the account when they come of age (this ranges from 18 to 21, depending on the state).

As a custodian, you are free to spend the funds on anything, provided it is for the benefit of the minor. While they don’t come with the tax benefits of a 529 plan, they cover a wider scope of expenses. Once your child attains the required age, you will relinquish control of the account to them, and they can claim full use of the funds.

Uniform Transfers to Minors Act (UTMA) Accounts and Uniform Gifts for Minors Act (UGMA)

UTMA and UGMA accounts are popular examples of custodial accounts. They are set up to hold gifts that a minor has received. Once the gift is granted or transferred to the account, it can’t be revoked and becomes the minor’s asset. It is held under their social security number and taxed as their income.

Custodial Brokerage Account

A custodial brokerage account refers to when the custodial account is used as an investment account to increase savings. Savings and gifts can be channeled to a mutual fund, invested in stocks or bonds, transferred to money market accounts or any other credible investment. You will manage these investments until your child comes of age. And then it is up to them to take over.

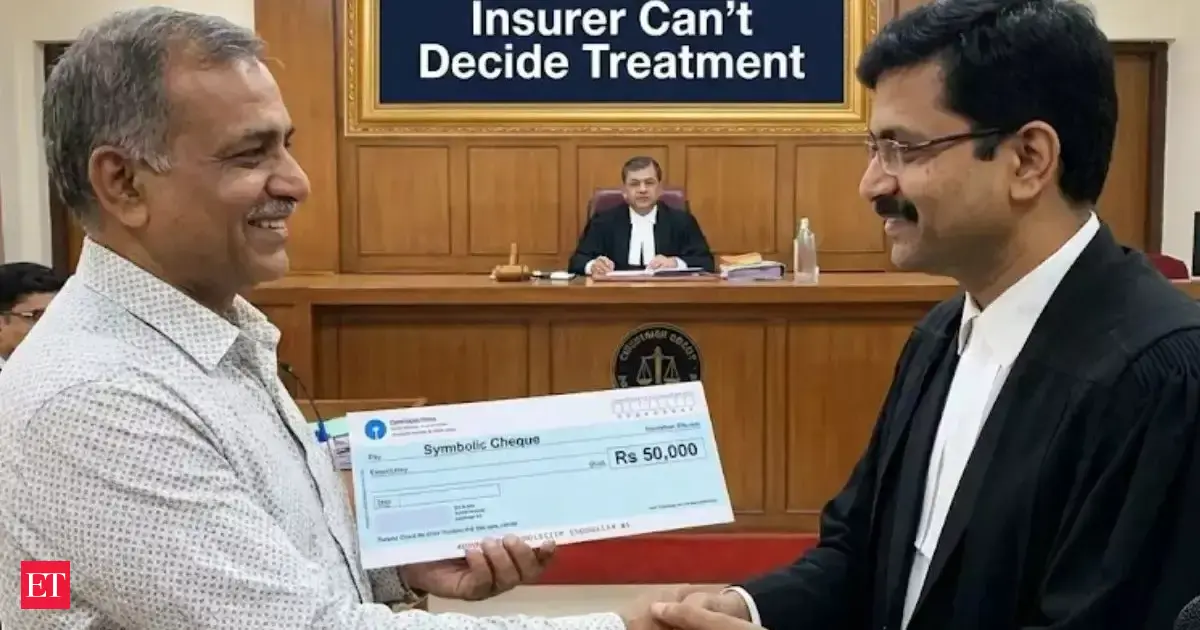

Creating a Trust Fund for Your Child

You can always get a lawyer, an accountant, or a team with both professions to set up a trust fund for your kid(s). Besides savings, the trust fund can incorporate assets you want to transfer to the kids as they age. The trust will dictate the process and ensure your assets are transferred to the right beneficiaries when the time comes.

How to Save Money for Kids in a Nutshell

There is no limit to the number of savings accounts you can have for your child. It is actually encouraged to spread your eggs in different baskets so that you can optimize them.

One might have competitive interest rates, while another allows you to invest in assets. You can also save for a particular item that requires a separate account without locking out subsequent gifts.

Just identify the combination that works for you and make sure you teach them about other aspects of financial health as they grow, and you can cross one more thing off your list of worries as a parent. Happy savings!