- Target date funds (TDFs), which make up over half of total 401(k) assets, are not following the investment theory they claim to, exposing investors to excessive risk.

- The TDF industry is dominated by three firms, Vanguard, Fidelity and T Rowe Price, which manage 65% of the $3.5 trillion in TDFs, stifling innovation and maintaining high risk levels.

- Personalized Target Date Accounts (PTDAs) are a promising solution to the current problems in TDFs, offering a blend of managed accounts with target date glidepaths.

The biggest investment in 401(k) plans is not what providers say it is. At $3.5 trillion and growing, target date funds (TDFs) are more than half of total 401(k) assets. They are by far the most popular choice of qualified default investment alternative (QDIA). There are 40 million investors in TDFs in the US. There’s a good chance you’re one of them.

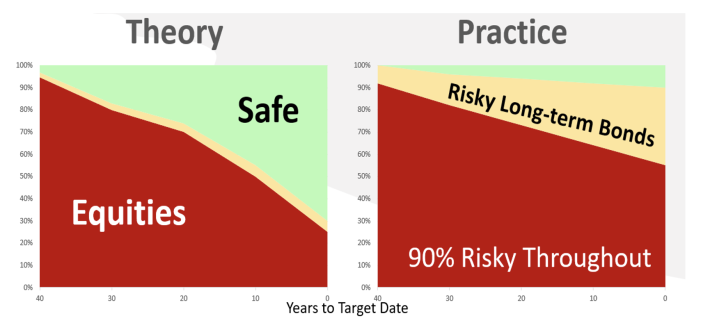

Yet, the theory that TDFs say they follow is not actually being followed. It’s a big fat fake out designed to increase profits. The book that presents the academic theory prescribes a very safe 80% risk-free allocation at retirement, but most TDFs are 90% risky at their target date.

Consequently, defaulted participants are in great jeopardy relative to the theory, and don’t know it. But now you know that the theory is very protective at retirement while TDF practice is not.

Lifetime investment theory invests 80% safe at retirement

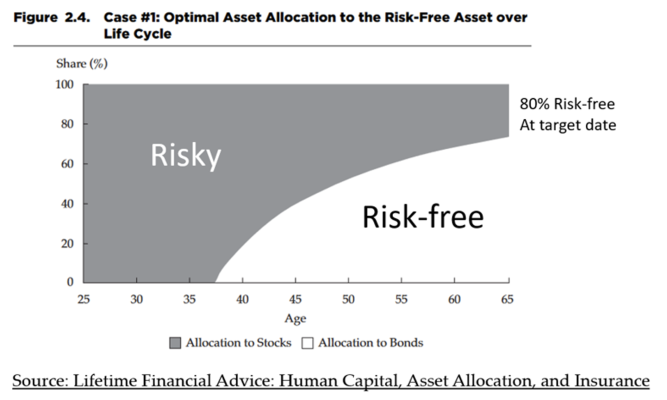

The book that establishes the theory for TDF glidepaths is Lifetime Financial Advice: Human Capital, Asset Allocation, and Insurance , published in 2007, the year following the passage of the Pension Protection Act of 2006 that launched the preference for TDFs as the QDIA. Four respected academics authored the book: Roger Ibbotson, Moshe Milevsky, Peng Chen and Kevin Zhu.

Lifetime investment theory integrates Human Capital (present value of future earnings) with Financial Capital, as shown in the following image that is commonly displayed by TDF providers.

The book is 104 pages. The most important graph is shown below. It prescribes the path for Financial Capital. The book shows the allocations to just 2 assets — Risky and Risk-free.

As you can see, Lifetime Financial Advice is 80% Risk-free at retirement, but that’s much more conservative than typical TDFs.

TDF practice is 90% risky at all dates

TDFs no longer “glide.” They “hover” at a constant 90% in risky assets at all ages. By contrast Lifetime Financial Advice reduces risk over time.

Long-term bonds are no longer “safe,” although their value increased consistently for the 40 years from 1981 to 2021. But that’s changed now as the world deals with inflation caused by very expensive quantitative easing coupled with the fight against COVID. Unlike the previous 40 years, interest rates are more likely to go up rather than down in the future. Bonds are risky.

High risk is here to stay as long as the TDF industry is dominated by just a few firms that call all the shots.

The oligopoly

65% of the $3.5 trillion in TDFs is managed by just 3 firms – Vanguard, Fidelity and T Rowe Price.

Oligopolies are never good for consumers because they block new entrants and stifle innovation. Oligarchs like the status quo, so they protect it. Lawsuits could change all that.

Excessive risk lawsuits

The next market crash will expose fiduciaries to lawsuits for excessive risk in default investments. Throwing a dart at the dartboard of “Qualified” Default Investment Alternatives (QDIAs) doesn’t fulfil the fiduciary Duty of Care that is like our responsibility to protect our children from possible harm. Where there’s harm, there’s a foul. “Good heart but empty head” is not a defense, nor is procedural prudence. Excessive fees were procedurally prudent until successful lawsuits changed that. Substantive prudence rules.

Even if lawsuits aren’t filed, employee morale will be crushed, and employers will be blamed. As we learned in 2008, many defaulted participants think they are guaranteed against loss as they near retirement.

The oligopoly could end.

The Safe group of TDFs

Not all TDFs are 90% risky. A few actually follow lifetime investment theory, including the Federal Thrift Savings Plan (TSP), the office professional’s union OPEIU, the SMART Target Date Fund Index and some personalized target date accounts. They actually exist.

Help is on the way

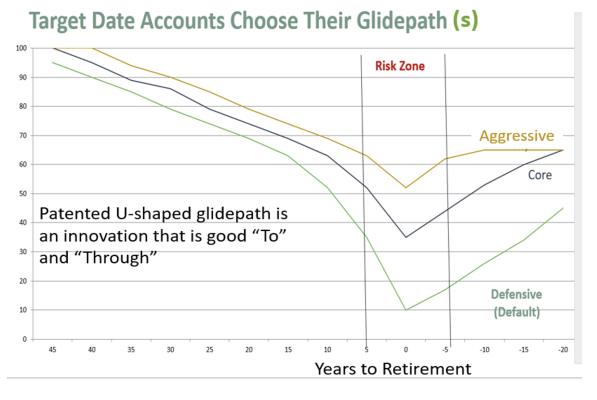

The future of QDIA investments lies in Personalized Target Date Accounts (PTDAs) that solve the current problems in TDFs, especially the one-size-fits-all shortcoming.

TDFs are popular because they’re simple one-size-fits-all set-it-and-forget-it approaches, but one-size-fits-all causes them to be bad fits for many, so the industry has sought solutions to this problem and other problems like all-proprietary investing.

One promising solution is PTDAs that blend managed accounts with target date glidepaths, where several glidepaths are provided from which non-defaulted participants can choose. Non-defaulted participants are provided guidance in this selection through education and a managed account construct. They can move to any combination of glidepaths at any time.

The QDIA remains one-size., but approximately one third of the assets in TDFs are from non-defaulted participants.

Conclusion

The big fat 401(k) fake out is exposing defaulted participants to excessive risk as they approach retirement. Innovations like PTDAs address this problem and the one-size-fits-all problem, but innovations rarely gain acceptance in the presence of an oligopoly. Excessive risk lawsuits could make innovations more attractive.

In the meantime, if you are invested in a TDF consider moving out of it as you approach retirement and moving to safety. Help is on the way, but it will take a while.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.