Kameleon007/E+ through Getty Photographs

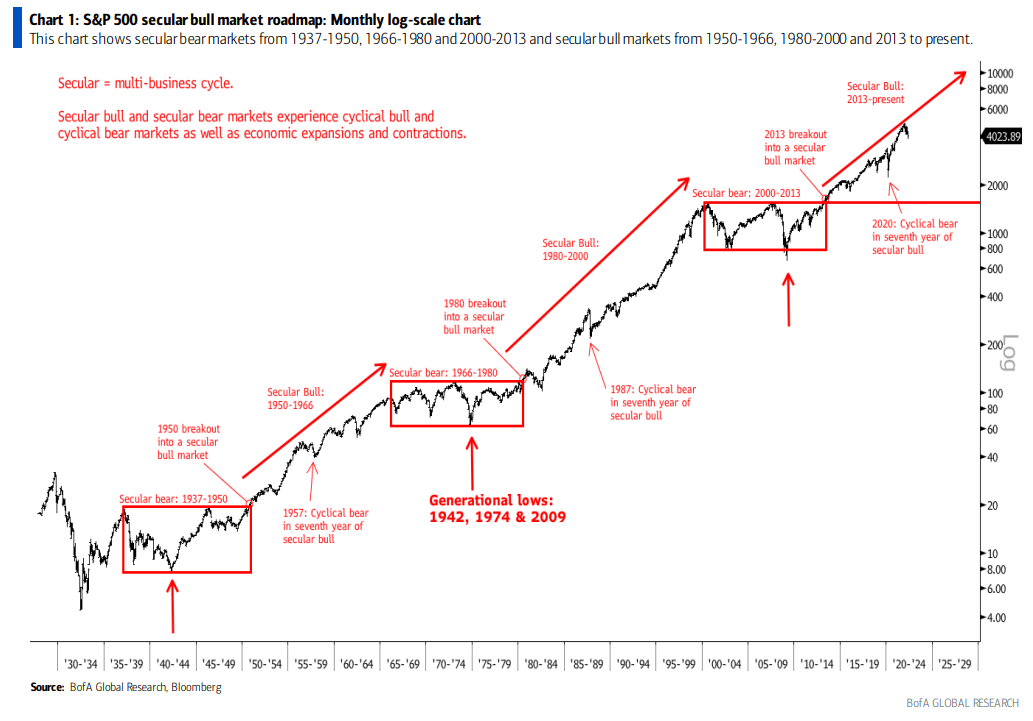

The secular bull market that began in 2013 is getting into its tenth 12 months and the uptrend can proceed for a number of years, in accordance with BofA technical strategist Stephen Suttmeier.

The secular bull for the S&P 500 (SP500) (NYSEARCA:SPY) began with a breakout in April 2013 that topped the 2000 and 2007 peaks.

“The 2013 breakout from the 2000-2013 buying and selling vary is just like the secular bull market breakouts from 1980 and 1950 that ended the buying and selling ranges or secular bear markets from 1966-1980 and 1937, 1950, respectively,” Suttmeier mentioned. “Since these secular bull markets lasted till 2000 and 1966, or 20 and 16 years, respectively, the secular bull market from 2013 has room to run primarily based on these previous bull markets.”

“We imagine that the 2020 correction marked ‘half time’ for the present bull market and means that the uptrend can final into 2027 (late 2020s).”

For this 12 months, the S&P has resistance at 5,000 and assist at 4,800.

However cyclical bear markets stress check secular bull markets. A draw back check stage of three,800 was efficiently defended on Friday. The 200-week shifting common of three,475 can be a giant check stage.

Bull markets and 10-year yields

Proper now the S&P is at 4,024 and the 10-year Treasury yield (TBT) (TLT).

The 1950-66 secular bull market began with low rates of interest, similar to the present one, and it did not finish till the 10-year hit 5%, Suttmeier mentioned.

- “The beginning of the 1950-1966 fairness bull market coincided with the tip of a 25-year downtrend and the start of a 36-year uptrend for the US 10-year yield.”

- “The beginning of the 1980-2000 fairness bull market coincided with the tip of a 36-year uptrend and the start of the 39-year downtrend for the US 10-year yield that will have resulted in 2020.”

- “The secular cycles for the US 10-year yield final for much longer than the secular cycles for the SPX. The 1920-1945 bond bull market (downtrend for yields) noticed an fairness bull market adopted by an fairness bear market. The 1945-1981 bond bear market (uptrend for yields) additionally noticed an fairness bull market adopted by fairness bear market. The 1981-2020 bond bull market noticed an fairness bull market, fairness bear market and the primary seven years of one other fairness bull market.”

Morgan Stanley mentioned the bear market rally has began.