[This article is excerpted from Economic Controversies, chapter 21, “The Fallacy of the ‘Public Sector’” (2011). It originally appeared in the New Individualist Review (Summer, 1961): 3–7. Editor’s note: Various media outlets are reporting that the Trump administration has cut more than 100,000 federal jobs in recent days. The total may even be greater than 200,000. Naturally, the regime’s defenders repeatedly tell us that this all means a great and awful loss to …. something. Rothbard reminds us below that, however, that nothing has been lost. The employees of the so-called “public sector” are funded and sustained entirely by skimming from the hard work and productivity of the workers of the private sector. They provide no net addition to the “national product.” In fact, by removing wealth and dollars from the rightful owners of those dollars in the private sector, the public sector provides negative value.]

Now we have heard an important deal lately of the “public sector,” and solemn discussions abound by means of the land on whether or not or not the general public sector must be elevated vis-à-vis the “personal sector.” The very terminology is redolent of pure science, and certainly it emerges from the supposedly scientific, if somewhat grubby, world of “national-income statistics.” However the idea is hardly wertfrei; in reality, it’s fraught with grave, and questionable, implications.

Within the first place, we could ask, “public sector” of what? Of one thing referred to as the “nationwide product.” However notice the hidden assumptions: that the nationwide product is one thing like a pie, consisting of a number of “sectors,” and that these sectors, private and non-private alike, are added to make the product of the financial system as an entire. On this means, the idea is smuggled into the evaluation that the private and non-private sectors are equally productive, equally vital, and on an equal footing altogether, and that “our” deciding on the proportions of public to non-public sector is about as innocuous as any particular person’s resolution on whether or not to eat cake or ice cream. The State is taken into account to be an amiable service company, considerably akin to the nook grocer, or somewhat to the neighborhood lodge, during which “we” get collectively to resolve how a lot “our authorities” ought to do for (or to) us. Even these neoclassical economists who are likely to favor the free market and free society usually regard the State as a typically inefficient, however nonetheless amiable, organ of social service, mechanically registering “our” values and selections.

One wouldn’t assume it troublesome for students and laymen alike to understand the truth that authorities is not just like the Rotarians or the Elks; that it differs profoundly from all different organs and establishments in society; particularly, that it lives and acquires its revenues by coercion and never by voluntary fee. The late Joseph Schumpeter was by no means extra astute than when he wrote, “The speculation which construes taxes on the analogy of membership dues or of the acquisition of the companies of, say, a physician solely proves how far eliminated this a part of the social sciences is from scientific habits of thoughts.”

Aside from the general public sector, what constitutes the productiveness of the “personal sector” of the financial system? The productiveness of the personal sector doesn’t stem from the truth that persons are speeding round doing “one thing,” something, with their assets; it consists in the truth that they’re utilizing these assets to fulfill the wants and wishes of the customers. Businessmen and different producers direct their energies, on the free market, to producing these merchandise that might be most rewarded by the customers, and the sale of those merchandise could due to this fact roughly “measure” the significance that the customers place upon them. If hundreds of thousands of individuals bend their energies to producing horses-and-buggies, they’ll, these days, not have the ability to promote them, and therefore the productiveness of their output might be nearly zero. However, if a number of million {dollars} are spent in a given 12 months on Product X, then statisticians could effectively decide that these hundreds of thousands represent the productive output of the X-part of the “personal sector” of the financial system.

One of the vital vital options of our financial assets is their shortage: land, labor, and capital-goods elements are all scarce, and will all be put to numerous potential makes use of. The free market makes use of them “productively” as a result of the producers are guided, in the marketplace, to provide what the customers most want: vehicles, for instance, somewhat than buggies. Subsequently, whereas the statistics of the overall output of the personal sector appear to be a mere including of numbers, or counting models of output, the measures of output truly contain the vital qualitative resolution of contemplating as “product” what the customers are prepared to purchase. 1,000,000 vehicles, bought in the marketplace, are productive as a result of the customers so thought of them; one million buggies, remaining unsold, would not have been “product” as a result of the customers would have handed them by.

Suppose now that into this idyll of free change enters the lengthy arm of presidency. The federal government, for some causes of its personal, decides to ban vehicles altogether (maybe as a result of the various tailfins offend the aesthetic sensibilities of the rulers) and to compel the auto corporations to provide the equal in buggies as a substitute. Underneath such a strict routine, the customers could be, in a way, compelled to buy buggies as a result of no vehicles could be permitted. Nonetheless, on this case, the statistician would absolutely be purblind if he blithely and easily recorded the buggies as being simply as “productive” because the earlier vehicles. To name them equally productive could be a mockery; in reality, given believable situations, the “nationwide product” totals may not even present a statistical decline, after they had truly fallen drastically.

And but the extremely touted “public sector” is in even worse straits than the buggies of our hypothetical instance. For a lot of the assets consumed by the maw of presidency haven’t even been seen, a lot much less used, by the customers, who had been at the very least allowed to trip of their buggies. Within the personal sector, a agency’s productiveness is gauged by how a lot the customers voluntarily spend on its product. However within the public sector, the federal government’s “productiveness” is measured — mirabile dictu — by how a lot it spends! Early of their building of national-product statistics, the statisticians had been confronted with the truth that the federal government, distinctive amongst people and companies, couldn’t have its actions gauged by the voluntary funds of the general public — as a result of there have been little or none of such funds. Assuming, with none proof, that authorities should be as productive as the rest, they then settled upon its expenditures as a gauge of its productiveness. On this means, not solely are authorities expenditures simply as helpful as personal, however all the federal government have to do in an effort to improve its “productiveness” is so as to add a big chunk to its forms. Rent extra bureaucrats, and see the productiveness of the general public sector rise! Right here, certainly, is a simple and blissful type of social magic for our bemused residents.

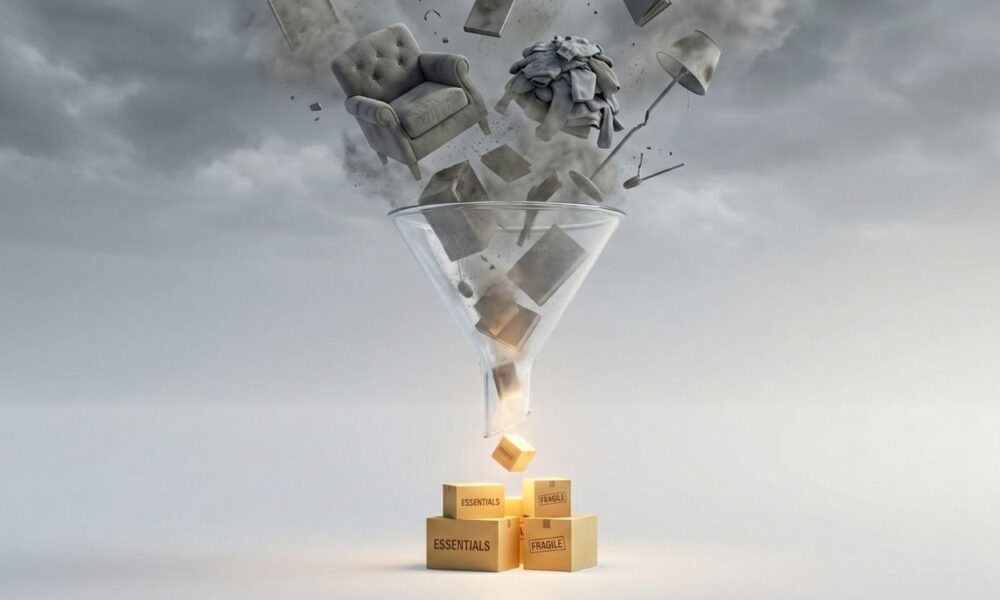

The reality is precisely the reverse of the frequent assumptions. Removed from including cozily to the personal sector, the general public sector can solely feed off the personal sector; it essentially lives parasitically upon the personal financial system. However which means the productive assets of society — removed from satisfying the needs of customers — at the moment are directed, by compulsion, away from these needs and wishes. The customers are intentionally thwarted, and the assets of the financial system diverted from them to these actions desired by the parasitic forms and politicians. In lots of instances, the personal customers get hold of nothing in any respect, besides maybe propaganda beamed to them at their very own expense. In different instances, the customers obtain one thing far down on their checklist of priorities — just like the buggies of our instance. In both case, it turns into evident that the “public sector” is definitely antiproductive: that it subtracts from, somewhat than provides to, the personal sector of the financial system. For the general public sector lives by steady assault on the very criterion that’s used to gauge productiveness: the voluntary purchases of customers.

We could gauge the fiscal influence of presidency on the personal sector by subtracting authorities expenditures from the nationwide product. For presidency funds to its personal forms are hardly additions to manufacturing; and authorities absorption of financial assets takes them out of the productive sphere. This gauge, in fact, is barely fiscal; it doesn’t start to measure the antiproductive influence of varied authorities rules, which cripple manufacturing and change in different methods than absorbing assets. It additionally doesn’t eliminate quite a few different fallacies of the nationwide product statistics. However at the very least it removes such frequent myths as the concept that the productive output of the American financial system elevated throughout World Battle II. Subtract the federal government deficit as a substitute of add it, and we see that the true productiveness of the financial system declined, as we might rationally anticipate throughout a conflict.

In one other of his astute feedback, Joseph Schumpeter wrote, regarding anticapitalist intellectuals, “capitalism stands its trial earlier than judges who’ve the sentence of demise of their pockets. They’ll move it, regardless of the protection they could hear; the one success a victorious protection can probably produce is a change within the indictment.” The indictment has actually been altering. Within the Thirties, we heard that authorities should develop as a result of capitalism had caused mass poverty. Now, below the aegis of John Kenneth Galbraith, we hear that capitalism has sinned as a result of the lots are too prosperous. The place as soon as poverty was suffered by “one-third of a nation,” we should now bewail the “hunger” of the general public sector.

By what requirements does Dr. Galbraith conclude that the personal sector is just too bloated and the general public sector too anemic, and due to this fact that authorities should train additional coercion to rectify its personal malnutrition? Actually, his normal is just not historic. In 1902, for instance, web nationwide product of the USA was $22.1 billion; authorities expenditure (federal, state, and native) totaled $1.66 billion, or 7.1 % of the overall product. In 1957, then again, web nationwide product was $402.6 billion, and authorities expenditures totaled $125.5 billion, or 31.2 % of the overall product. Authorities’s fiscal depredation on the personal product has due to this fact multiplied from 4 to five-fold over the current century. That is hardly “hunger” of the general public sector. And but, Galbraith contends that the general public sector is being more and more starved, relative to its standing within the nonaffluent nineteenth century!

What requirements, then, does Galbraith provide us to find when the general public sector will lastly be at its optimum? The reply is nothing however private whim:

There might be query as to what’s the check of stability — at what level could we conclude that stability has been achieved within the satisfaction of personal and public wants. The reply is that no check may be utilized, for none exists.… The current imbalance is obvious.… This being so, the course during which we transfer to appropriate issues is completely plain.

To Galbraith, the imbalance of in the present day is “clear.” Clear why? As a result of he seems to be round him and sees deplorable situations wherever authorities operates. Faculties are overcrowded, city visitors is congested and the streets littered, rivers are polluted; he may need added that crime is more and more rampant and the courts of justice clogged. All of those are areas of presidency operation and possession. The one supposed resolution for these obvious defects is to siphon more cash into the federal government until.

However how is it that solely authorities businesses clamor for more cash and denounce the residents for reluctance to produce extra? Why will we by no means have the private-enterprise equivalents of visitors jams (which happen on authorities streets), mismanaged faculties, water shortages, and so forth? The reason being that non-public companies purchase the cash that they deserve from two sources: voluntary fee for the companies by customers, and voluntary funding by traders in expectation of shopper demand. If there’s an elevated demand for a privately owned good, customers pay extra for the product, and traders make investments extra in its provide, thus “clearing the market” to everybody’s satisfaction. If there’s an elevated demand for a publicly owned good (water, streets, subway, and so forth), all we hear is annoyance on the shopper for wasting your assets, coupled with annoyance on the taxpayer for balking at the next tax load. Non-public enterprise makes it its enterprise to courtroom the patron and to fulfill his most pressing calls for; authorities businesses denounce the patron as a hard consumer of their assets. Solely a authorities, for instance, would look fondly upon the prohibition of personal vehicles as a “resolution” for the issue of congested streets. Authorities’s quite a few “free” companies, furthermore, create everlasting extra demand over provide and due to this fact everlasting “shortages” of the product. Authorities, briefly, buying its income by coerced confiscation somewhat than by voluntary funding and consumption, is just not and can’t be run like a enterprise. Its inherent gross inefficiencies, the impossibility for it to clear the market, will insure its being a mare’s nest of hassle on the financial scene.

In former instances, the inherent mismanagement of presidency was typically thought of a great argument for maintaining as many issues as potential out of presidency arms. In spite of everything, when one has invested in a dropping proposition, one tries to chorus from pouring good cash after unhealthy. And but, Dr. Galbraith would have us redouble our dedication to pour the taxpayer’s hard-earned cash down the rathole of the “public sector,” and makes use of the very defects of presidency operation as his main argument!

Professor Galbraith has two supporting arrows in his bow. First, he states that, as individuals’s dwelling requirements rise, the added items should not value as a lot to them as the sooner ones. That is normal data; however Galbraith in some way deduces from this decline that individuals’s personal needs at the moment are value nothing to them. But when that’s the case, then why ought to authorities “companies,” which have expanded at a a lot quicker charge, nonetheless be value a lot as to require an additional shift of assets to the general public sector? His closing argument is that non-public needs are all artificially induced by enterprise promoting, which robotically “creates” the needs that it supposedly serves. Briefly, individuals, in response to Galbraith, would, if not to mention, be content material with nonaffluent, presumably subsistence-level dwelling; promoting is the villain that spoils this primitive idyll.

Except for the philosophical downside of how A can “create” B’s needs and wishes with out B’s having to position his personal stamp of approval upon them, we’re confronted right here with a curious view of the financial system. Is all the things above subsistence “synthetic”? By what normal? Furthermore, why on this planet ought to a enterprise undergo the additional hassle and expense of inducing a change in shopper needs, when it will possibly revenue by serving the patron’s current, uncreated needs? The very “advertising and marketing revolution” that enterprise is now present process, its elevated and virtually frantic focus on “market analysis,” demonstrates the reverse of Galbraith’s view. For if, by promoting, enterprise manufacturing robotically creates its personal shopper demand, there could be no want no matter for market analysis — and no fear about chapter both. In reality, removed from the patron in an prosperous society being extra of a “slave” to the enterprise agency, the reality is exactly the alternative: for as dwelling requirements rise above subsistence, the patron will get extra explicit and picky about what he buys. The businessman should pay even better courtroom to the patron than he did earlier than: therefore the livid makes an attempt of market analysis to search out out what the customers need to purchase.

There’s an space of our society, nevertheless, the place Galbraith’s strictures on promoting could virtually be stated to use — however it’s in an space that he curiously by no means mentions. That is the big quantity of promoting and propaganda by authorities. That is promoting that beams to the citizen the virtues of a product that, in contrast to enterprise promoting, he by no means has an opportunity to check. If Cereal Firm X prints an image of a reasonably woman declaiming that “Cereal X is yummy,” the patron, even when doltish sufficient to take this severely, has an opportunity to check that proposition personally. Quickly his personal style determines whether or not he’ll purchase or not. But when a authorities company advertises its personal virtues over the mass media, the citizen has no direct check to allow him to simply accept or reject the claims. If any needs are synthetic, they’re these generated by authorities propaganda. Moreover, enterprise promoting is, at the very least, paid for by traders, and its success is determined by the voluntary acceptance of the product by the customers. Authorities promoting is paid for via taxes extracted from the residents, and therefore can go on, 12 months after 12 months, with out examine. The hapless citizen is cajoled into applauding the deserves of the very individuals who, by coercion, are forcing him to pay for the propaganda. That is actually including insult to harm.

If Professor Galbraith and his followers are poor guides for coping with the general public sector, what normal does our evaluation provide as a substitute? The reply is the previous Jeffersonian one: “that authorities is greatest which governs least.” Any discount of the general public sector, any shift of actions from the general public to the personal sphere, is a web ethical and financial acquire.

Most economists have two primary arguments on behalf of the general public sector, which we could solely think about very briefly right here. One is the issue of “exterior advantages.” A and B usually profit, it’s held, if they’ll pressure C into doing one thing. A lot may be stated in criticism of this doctrine; however suffice it to say right here that any argument proclaiming the appropriate and goodness of, say, three neighbors, who yearn to type a string quartet, forcing a fourth neighbor at bayonet level to be taught and play the viola, is hardly deserving of sober remark. The second argument is extra substantial; stripped of technical jargon, it states that some important companies merely can’t be equipped by the personal sphere, and that due to this fact authorities provide of those companies is important. And but, each single one of many companies equipped by authorities has been, previously, efficiently furnished by personal enterprise. The tasteless assertion that non-public residents can’t probably provide these items is rarely bolstered, within the works of those economists, by any proof no matter. How is it, for instance, that economists, so usually given to pragmatic or utilitarian options, don’t name for social “experiments” on this course? Why should political experiments all the time be within the course of extra authorities? Why not give the free market a county or perhaps a state or two, and see what it will possibly accomplish?

This text is excerpted from Financial Controversies, chapter 21, “The Fallacy of the ‘Public Sector’” (2011). It initially appeared within the New Individualist Overview (Summer season, 1961): 3–7.