On March 24, Canada’s newly appointed Prime Minister Mark Carney referred to as a snap election for April 28. If the financial file of his Liberal Social gathering, which has been in workplace since Justin Trudeau’s victory in 2015, is a significant factor in voters’ choices, bookies could be providing you with fairly lengthy odds on them.

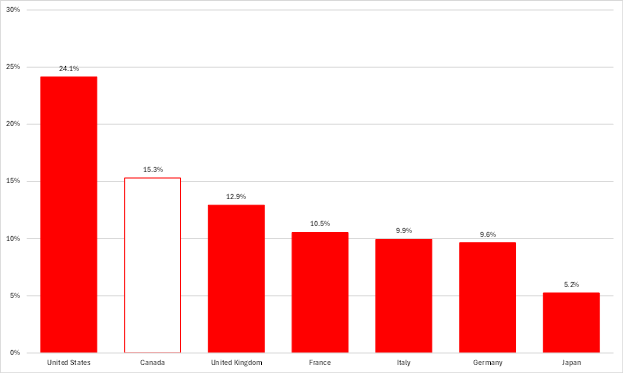

Gross Home Product (GDP) per capita is a key metric of financial efficiency which tells us how a lot per individual is offered to be consumed, invested, or put to another use. Beneath the Liberals, Canada’s efficiency relative to its G7 friends has been depressing. As Determine 1 exhibits, between 2014 and 2023, Canadian GDP per capita grew by simply 1.9 % in actual phrases, the worst efficiency within the G7 and fewer than a 3rd the expansion in Germany, the next-worst performing nation. Certainly, Canadian GDP per capita was decrease in 2023 than it was in 2018.

Determine 1: Actual per capita GDP development, 2014 to 2023 (PPP, fixed 2021 worldwide $)

Supply: World Financial institution World Improvement Indicators

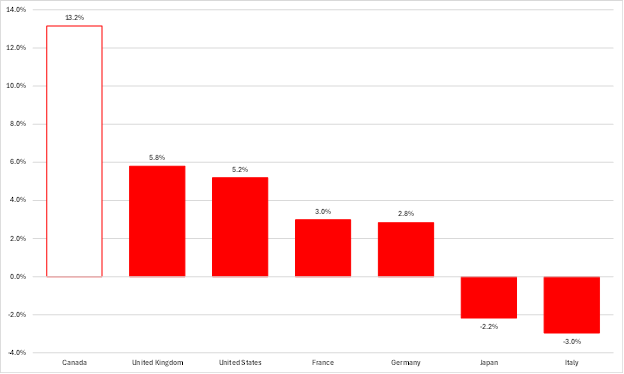

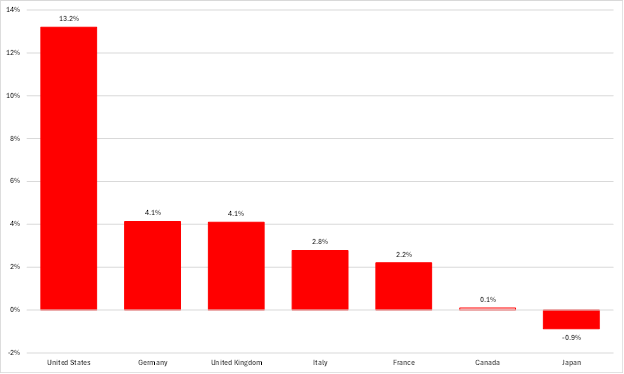

What accounts for this dismal efficiency? GDP per capita is calculated by merely dividing whole GDP by the inhabitants. Canada’s file on whole GDP development is comparatively sturdy. Between 2014 and 2023, the Canadian economic system grew by 15.3 % in actual phrases, second solely to the USA among the many G7 nations, as Determine 2 exhibits. However whereas the numerator in our equation – GDP – has grown quickly, so has the denominator, inhabitants. Between 2014 and 2023, Canada’s inhabitants grew by 13.2 %, the quickest charge within the G7 and greater than double that of the second-placed United Kingdom, as Determine 3 exhibits.

Determine 2: Actual GDP development, 2014 to 2023 (PPP, fixed 2021 worldwide $)

Supply: World Financial institution World Improvement Indicators

Determine 3: Inhabitants development, 2014 to 2023

Supply: World Financial institution World Improvement Indicators

On condition that the expansion charge of GDP is simply the sum of the expansion charge of GDP per capita and the expansion charge of the inhabitants, we will calculate that inhabitants development accounted for 84.9 % of the common annual development of Canada’s whole GDP between 2014 and 2023, the very best share among the many G7 nations and 42.3 proportion factors greater than the nation with the second greatest share, the UK. A decade of Liberal authorities in Canada has seen spectacular development of whole GDP because of inhabitants development – 88.1 % of which between the fourth quarter of 2014 and the fourth quarter of 2024 got here from immigration – however, in financial phrases, the common Canuck isn’t significantly better off.

Canada’s productiveness downside

It is because, as Paul Krugman wrote: “Productiveness isn’t every little thing, however in the long term it’s nearly every little thing. A rustic’s means to enhance its lifestyle over time relies upon nearly fully on its means to boost its output per employee.” And Canada’s file on elevating output per employee is poor. As Determine 4 exhibits, GDP per individual employed elevated, in actual phrases, by simply 0.1 % between 2014 and 2023, a charge higher than solely Japan among the many G7 nations. This isn’t new. Amongst its G7 friends, Canadian GDP per individual employed ranks fifth in each single yr from 1990 onwards.

Determine 4: Actual per employee GDP development, 2014 to 2023 (fixed 2021 PPP $)

Supply: World Financial institution World Improvement Indicators

What accounts for this stagnation? A latest report by RBC, Canada’s greatest financial institution, gives some solutions.

Rules and crimson tape are an issue. RBC notes that “Canadian companies make investments considerably lower than within the US—about half as a lot per employee in combination.” Whereas “a part of the slowing in funding has been from a pullback in funding within the Canadian oil and gasoline sector,” it explains that “companies have additionally invested a considerably smaller share of GDP within the manufacturing sector in Canada than within the US over the past decade.” “The problem doesn’t seem like an absence of accessible funding,” it continues, however “an inefficient mission approvals backdrop [which] is making investing in Canada comparatively costly.” RBC notes that, “In 2020, Canada ranked 188th out of 208 economies tracked by the World Financial institution on the variety of days companies spent coping with development permits for brand new tasks. That’s 3 times longer than time spent within the US.”

Rules and crimson tape additionally retard commerce domestically. “A patchwork of regulatory and administrative guidelines throughout completely different municipalities and provinces…restricts commerce inside Canada,” the report notes. Certainly, “The Worldwide Financial Fund has estimated that inside commerce boundaries…price the equal of a 20-percent common tariff between provinces. By comparability, the efficient tariff charge collected on worldwide imports from overseas in Canada is lower than one %.”

Buying and selling throughout worldwide borders can be comparatively onerous. Whereas “Precise tariff charges on worldwide commerce in Canada are low…Canada ranks poorly (51st globally) within the ease of buying and selling throughout borders largely because of excessive administrative prices related to importing and exporting,” RBC writes.

Taxes are an issue too. “Canadian company tax charges are nonetheless corresponding to different superior economies,” RBC notes, “However bearing in mind the tax on firm dividends on the private earnings tax degree, the full tax on distributed earnings from Canadian corporations is the very best within the G7, based on the OECD.”

Canadian financial development has additionally been tilted towards sectors which have seen gradual productiveness development. Within the case of providers this can be unavoidable, however, RBC write, “Development is without doubt one of the industries that has struggled probably the most to spice up productiveness over time” and “Funding in residential buildings accounts for twice the share of GDP in Canada (6 %) than within the US (3 %)…Consequently, development accounts for about twice the share of whole hours labored in Canada (8 %) because it does within the US (4 %).”

Lastly, “A big and rising public sector is much less productive,” RBC be aware. “Canada’s massive public sector training and healthcare industries are a lot much less productive than within the US by 70 % and 50 %, respectively. and accounting (sic) for a fifth of the full economic system productiveness hole regardless of solely accounting for 14 % of the economic system.”

Who will get to repair it?

Till early March, the Liberals regarded sure to pay a heavy worth for Canada’s poor financial efficiency, amongst different issues, with polls exhibiting Pierre Poilievre’s Conservatives with comfy leads. Then, fortunes all of a sudden flipped and each ballot since Carney’s election name has proven the Liberals within the lead. Typical knowledge holds that the Canadians are rallying around the flag in response to President Trump’s bellicose statements, and standard knowledge could also be proper. It’s exhausting to see something in Mark Carney which might generate such a turnaround.

Canada shouldn’t be doomed to be an financial laggard. It’s effectively positioned geographically and blessed with ample pure assets. However its subsequent authorities, whoever heads it, could have its work lower out to reverse many years of financial underperformance.