Having reported one other quarter of double-digit income development for its disaster bond and insurance-linked securities (ILS) associated actions, Greg Case the CEO of broking large Aon additionally highlighted parametric danger switch as one other space he sees exercise ranges as distinctive in.

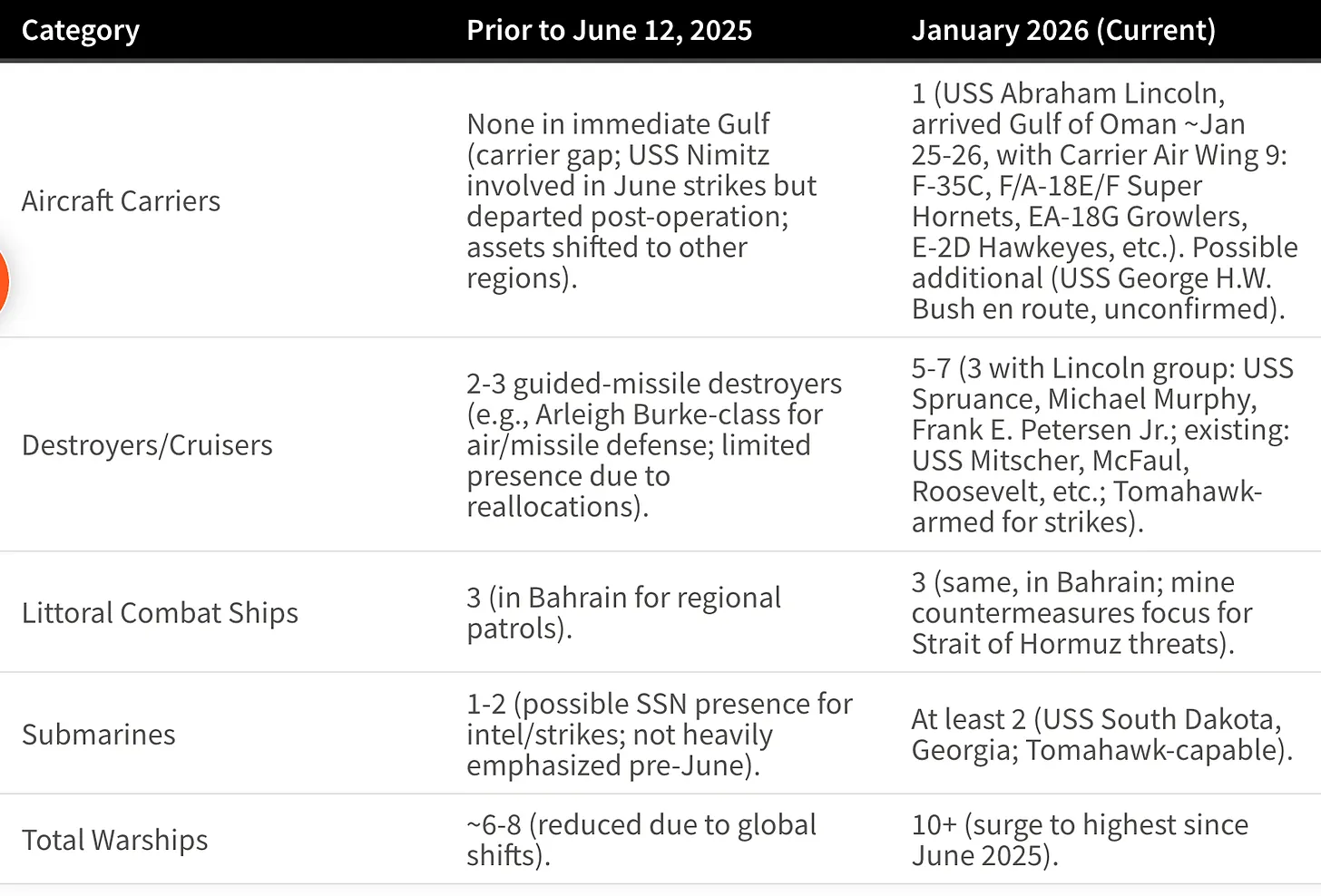

Reporting its first-quarter outcomes at present, Aon disclosed 4% natural income development in its Reinsurance Options enterprise, however inside that was continued enlargement of its disaster bond and ILS actions.

“Reinsurance with 4% natural income development was pushed by development in treaty placements and double-digit development in each facultative placements and insurance-linked securities,” Aon CFO Edmund Reese defined throughout a first-quarter earnings name simply now.

Including that, “This development was partially offset by the influence of a multi-year extension with a big shopper at increased limits and adjusted fee.

“Waiting for the second quarter, we anticipate softer market situations with April 1 property charges in each the US and Japan down 5% to twenty%.

“Importantly, we anticipate full-year natural income development in-line with our mid-single digit or larger goal, as we see a robust second-half pushed by increased limits at July 1 renewals, continued development in our worldwide facultative placements and power in our technique and expertise group.”

CEO Case additionally advised demand for reinsurance restrict is predicted to rise on the mid-year renewals, reflecting expectations from others out there right now.

Greg Case mentioned the natural income metric for the reinsurance division at Aon through the name as effectively.

“Take into consideration what’s occurring in reinsurance proper now for us, we’re constructing our core momentum and actually that is what we do at a phase stage with our purchasers, however actually differentiating on analytics. What we’ve invested in Aon Enterprise Providers and with Threat Capital has been actually, for us, significant, actually tour-de-force.

“We’re successful greater than ever earlier than on this context, on the reinsurance and the business danger aspect, and this Threat Capital assemble can also be significant,” Case mentioned.

Persevering with to elucidate that, “You realize, the extent of cat bond and parametric work we’re doing is phenomenal and pushed by Threat Capital and the strategic expertise group additionally reinforcing and driving development.

“So, the 4% which you recognize, it’s treaty placements, it’s double-digit development in facultative, one other double digit development in insurance-linked securities. So internet internet, it’s robust development total.”

Case additionally mentioned the choice danger switch and parametric segments of the dealer’s providing, seeing it as an space that’s rising.

“One of many issues that was attention-grabbing is different danger switch continues to be extremely prevalent, and the work we’re doing with reinsurance within the business danger enviornment on different danger switch is substantial,” Case defined.

Later he highlighted a latest parametric danger switch win for Aon, saying, “We simply did a large, I feel the most important parametric on a extreme convective storm that’s ever been completed for an enormous metal firm and it actually was within the face of, you recognize, this new set of dangers which can be on the horizon and the way they will take care of that. So for us, we’re tailoring options in opposition to this.”

Aon, by means of its Aon Securities unit, has been a number one dealer and funding financial institution within the disaster bond house for a few years and continues to develop this enterprise because the ILS market expands.

Now, with use of parametric triggers increasing throughout insurance coverage and reinsurance, the dealer can also be discovering this danger switch product one other space of incremental income development.

Learn extra on Aon’s Q1 2025 outcomes over at our sister publication Reinsurance Information.