After years of digital innovation, many monetary apps nonetheless drown customers in knowledge—and miss what actually issues: how folks really feel about their cash. At UXDA, we see a radically totally different path: by making use of neuroscience and neuromarketing, we’ve

discovered that tapping into customers’ emotional motivations can remodel their total monetary journey. It’s not nearly options and transactions—it’s about constructing belief, encouraging good habits and turning cash administration into one thing folks really

be ok with.

Digital banking has undergone vital transformation over the previous decade, but many customers nonetheless expertise stress and confusion when managing their funds on-line. At UXDA, we consider design has the facility to alleviate these ache factors and

spark real human connection. How can we use neuromarketing to use neuroscience insights concerning the mind into making monetary merchandise each environment friendly and emotionally rewarding.

Analysis in shopper neuroscience by Kenning and Hubert (2008) signifies that unconscious, emotional elements strongly affect our selections. In finance, these elements are magnified by everybody’s unconscious fears about cash, threat and loss.

Leveraging neuromarketing ideas permits digital banking and Fintech platforms to faucet into customers’ pure motivations, creating partaking, trust-building experiences that construct significant monetary well-being.

Why Neuroscience Issues in Finance

Managing cash is usually seen as a purely logical job based mostly on numbers, charges and calculations. Nevertheless, as Nobel laureate Daniel Kahneman demonstrated, feelings are inseparable from decision-making in finance. This connection is particularly eye-opening

within the realm of digital banking and Fintech product interfaces, the place introducing components of empathy and optimistic reinforcement can appear counterintuitive. In digital banking, small optimistic experiences—like celebrating a $5 financial savings—can have a surprisingly

massive affect. These “small wins” create momentum, serving to customers construct wholesome monetary habits over time.

The issue is that customers unconsciously develop on a regular basis monetary behaviors and decision-making patterns that may collide with cognitive biases, like loss aversion and psychological accounting. They’ve ingrained methods of enthusiastic about and dealing with

cash that may restrict monetary development or result in suboptimal selections. A “neuroscientific method” acknowledges these biases and works with them.

In lots of circumstances, these habits run headlong into loss aversion (Kahneman & Tversky, 1979) and psychological accounting (Thaler, 1985), biases that lead customers to really feel outsized ache over small losses and compartmentalize cash in ways in which may not maximize

their monetary well being. As a substitute of attempting to eradicate these biases, a neuroscientific method harnesses them for good—gently guiding customers towards higher selections by well-timed nudges and simplified selections.

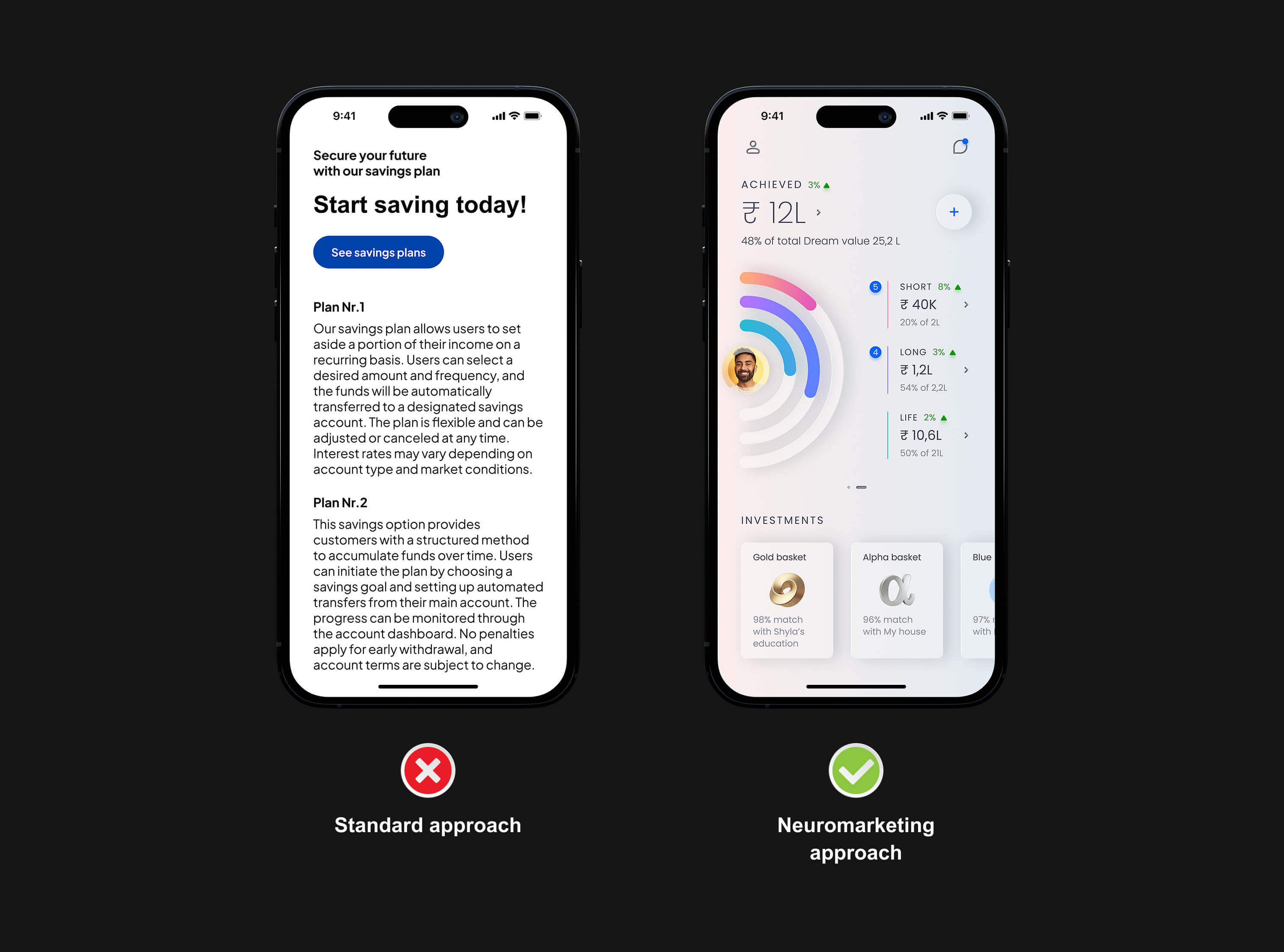

It is usually counterintuitive to assume that much less info would possibly really profit customers. Monetary establishments usually consider in providing as a lot knowledge as attainable—detailed charts, intensive product catalogs and dense legalese—assuming it empowers

prospects. In follow, it really does the alternative. When issues get too sophisticated, folks tune out. Analysis of Kenning and Hubert has proven that simplifying selections and offering clear, guided experiences really builds belief and satisfaction. Clear,

easy interfaces are far more practical than an overload of particulars. Neuroscience exhibits us that simplicity and readability in digital interfaces might be much more persuasive and reassuring than an avalanche of info.

Conventional monetary providers usually concentrate on rates of interest, charges or product comparisons, however they miss the emotional facet of cash administration. That is the place neuroscience bridges the hole. By understanding how the mind’s reward system works—significantly

the position of dopamine in shaping habits—we are able to design monetary merchandise that present fast, optimistic reinforcement for good cash habits.

Emotional Model Connection

One other stunning perception is the position of emotional bonds in constructing long-term loyalty and belief (Plassmann, Ramsøy & Milosavljevic, 2012). Whereas finance is usually seen as chilly and purely transactional, individuals are extra more likely to have interaction with digital

monetary platforms when there’s an emotional factor concerned. For instance, as an alternative of merely presenting numbers, we are able to incorporate storytelling into the person expertise, reworking every monetary motion into a private aim—resembling saving for a trip

or a toddler’s training—making the expertise extra relatable and motivating.

This method aligns with Damasio’s (1994) declare that feelings are integral to rational thought. When customers see their monetary objectives—like saving for a visit or paying off debt—apps immediately really feel extra useful and fewer aggravating.

Dopamine design challenges the belief that monetary providers, experiences and interfaces have to be strictly formal, emotionally impartial and dry. Every time a person meets a milestone—regardless of how small—monetary app interfaces might present micro-celebrations,

resembling fast animations or congratulatory messages. Although it could appear trivial, these bursts of suggestions launch dopamine within the mind, reinforcing optimistic behaviors.

Extending this additional, gamification options—like progress bars and streaks—faucet into the mind’s inherent need for completion and reward. Berns, McClure, Pagnoni and Montague (2001) noticed how even predictable rewards can maintain engagement

over time, significantly when layered into an interactive journey. By systematically making use of these mechanisms, digital banking interfaces can remodel mundane duties—resembling saving spare change—into satisfying, repeatable actions. One instance is the Qapital

app, which received customers’ loyalty by turning saving right into a enjoyable, interactive expertise by goal-setting, automation and reward-based options.

Neuromarketing for Easy and Pleasant Consumer Expertise

Neuromarketing applies insights from neuroscience to form design and communication methods that faucet into emotional drivers, habits and rewards. Whereas it has gained traction in e-commerce and shopper apps, its affect in monetary providers

is now accelerating. Cash selections are inherently emotional; individuals are pushed not solely by logical threat assessments but in addition by psychological elements like concern of loss, impulse rewards and behavior loops. By tapping into these motivators, digital banking and

Fintech platforms can turn out to be extra partaking and fewer intimidating.

Utilizing UXDA’s strategic UX framework, we flip mind science into easy design selections that construct belief and make digital monetary providers really feel clearer, friendlier and extra human. For instance, by using nudge idea (Thaler & Sunstein,

2008), we are able to information customers towards higher selections with out being manipulative. Overloading customers with an excessive amount of knowledge, like charts, graphs and jargon, can break belief and make decision-making more durable. At UXDA, we use strategic UX to simplify issues by changing

complexity with intuitive visuals, clear language and straightforward step-by-step flows. Easy design adjustments, resembling curating product choices and lowering muddle, empower customers and assist them keep away from feeling overwhelmed.

The truth is, generally much less actually is extra. Through the use of minimalistic dashboards or progress trackers, resembling “You are 70% towards your debt-free aim,” we assist cut back nervousness and preserve customers engaged. Clear, goal-driven suggestions offers customers confidence and

a way of route, which makes them extra more likely to return.

Lengthy-term monetary success depends upon constructing constant habits—like saving, managing debt and making knowledgeable spending selections. Neuroscientific analysis exhibits that small behavior loops, bolstered by optimistic suggestions, transition sporadic interactions

into established routines (Berridge, 2007), insights usually leveraged in neuromarketing methods. At UXDA, we embed these loops into digital journeys, from well timed prompts about upcoming payments to personalised recommendations on lowering pointless bills.

The aim isn’t to govern however to empower. As customers see actual progress—whether or not it’s lowering their spending or contributing to financial savings—they construct confidence, deepening their relationship with the platform. Over time, these small actions flip into

lasting habits, reworking the banking app right into a trusted monetary companion.

UXDA’s Dopamine Banking: Making use of Neuromarketing to Finance

UXDA applies neuromarketing ideas to humanize the way in which folks work together with monetary providers by our invented idea, Dopamine Banking. It makes use of a dopamine design to make banking not solely extra environment friendly and user-friendly but in addition extra

rewarding and emotionally resonant.

Beneath is an outline based mostly on utilizing dopamine design as part of neuromarketing, together with how UXDA’s Dopamine Banking leverages these ideas in monetary providers:

1. Emphasize Constructive Reinforcement

What It Is:

Constructive reinforcement focuses on rewarding desired behaviors in order that they turn out to be habit-forming. Neurologically, these small rewards set off dopamine launch, creating a way of accomplishment and pleasure.

Easy methods to Apply in Monetary UX:

- Micro-Celebrations: Add celebratory animations or messages after customers meet financial savings or budgeting objectives.

- Immediate Suggestions: Present fast affirmation (e.g., a “Success!” pop-up) to bolster actions like invoice funds or micro-savings.

Scientific Foundation:

Berridge (2007) describes how dopamine drives “incentive salience,” which means that optimistic suggestions will increase the chance of repeating the habits.

2. Use Gamification to Drive Engagement

What It Is:

Gamification includes including sport components—factors, badges, streaks—to non-gaming environments. It exploits our innate need for achievement and recognition, triggering motivational reward pathways.

Easy methods to Apply in Monetary UX:

- Progress Bars and Milestones: Present customers their progress towards incomes rewards or cashback (e.g., “You’ve earned $20 cashback this month! Preserve going to unlock extra”), encouraging them to place in additional effort to degree up.

- Challenges and Streaks: Introduce each day or weekly objectives (e.g., “Save $5 every day”) that reward consistency.

Scientific Foundation:

Berns et al. (2001) discovered that predictable rewards and aim monitoring set off dopamine launch, which helps maintain ongoing engagement.

3. Personalize Experiences with Information-Pushed Insights

What It Is:

Personalization tailors the person expertise based mostly on particular person knowledge—spending habits, financial savings objectives—making the service extra related and compelling.

Easy methods to Apply in Monetary UX:

- Adaptive Dashboards: Present real-time spending patterns, customized budgeting ideas and goal-setting reminders that replicate every person’s distinctive monetary habits.

- Contextual Notifications: Supply well timed nudges (e.g., “Payday simply arrived—wish to put aside $50 for financial savings?”).

Scientific Foundation:

Kenning and Hubert (2008) observe that personalization will increase emotional engagement, belief and person satisfaction.

4. Cut back Anxiousness Via Emotional Framing

What It Is:

Cash issues usually spark stress or confusion. Emotional framing makes use of reassuring language and visuals to make monetary duties really feel much less intimidating and extra approachable.

Easy methods to Apply in Monetary UX:

- Pleasant, Conversational Tone: Swap out formal jargon for relatable copy and guided tutorials. As a substitute of “Please full the required verification course of,” use “Let’s get you verified! Just some fast steps.”

- Visible Storytelling: Rework uncooked numbers into significant journeys (e.g., “Your path to proudly owning a house”) that resonate emotionally.

Scientific Foundation:

Damasio (1994) highlights that feelings play a key position in decision-making, and by lowering monetary nervousness, person belief and engagement might be considerably improved.

5. Leverage Loss Aversion and Psychological Accounting

What It Is:

- Loss Aversion (Kahneman & Tversky, 1979): Folks dislike dropping greater than they like gaining the same quantity.

- Psychological Accounting (Thaler, 1985): People categorize cash into “accounts” (e.g., lease, leisure) and deal with every class in another way.

Easy methods to Apply in Monetary UX:

- “Financial savings First” Technique: Encourage computerized transfers into financial savings upon paycheck arrival, framing it as “defending your future.”

- Categorized Budgets: Current spending summaries by class (e.g., groceries, eating out) to align with how customers naturally compartmentalize funds.

Scientific Foundation:

Kahneman & Tversky (1979) and Thaler (1985) level out that these cognitive biases might be harnessed to encourage financially accountable selections.

6. Simplify Advanced Selections with Alternative Structure

What It Is:

Alternative structure dictates how choices are introduced to information higher selections. When too many selections exist, customers could expertise determination fatigue or paralysis.

Easy methods to Apply in Monetary UX:

- Restricted, Curated Choices: When suggesting bank cards or funding portfolios, current a couple of well-explained alternate options.

- Sensible Defaults: Preselect probably the most useful (or hottest) possibility for customers preferring a fast, low-effort determination.

Scientific Foundation:

Kenning & Hubert (2008) display that minimizing cognitive load and simplifying decision-making processes considerably enhances person satisfaction and belief.

7. Encourage Behavior Formation with Constant Engagement

What It Is:

Behavior formation includes common cues, actions and rewards that turn out to be computerized over time. Monetary apps can leverage behavior loops to embed optimistic cash administration behaviors.

Easy methods to Apply in Monetary UX:

- Recurring Financial savings Plans: Automate transfers to financial savings accounts, making constant saving a default habits.

- Common Test-ins: Ship mild reminders (e.g., “Evaluate your spending every Sunday”) to maintain customers aware of their funds.

Scientific Foundation:

Berridge (2007) emphasizes that when behaviors are persistently paired with fast rewards, they reinforce neural pathways within the mind, making these habits stronger so they may endure over time.

8. Strengthen Emotional Model Connection

What It Is:

An emotional model connection goes past purposeful advantages to create a deeper relationship between the shopper and the monetary service. This fosters loyalty, belief and a way of belonging.

Easy methods to Apply in Monetary UX:

- Model Storytelling: Weave an interesting model narrative all through the person journey, displaying prospects how the establishment’s values align with their private objectives (e.g., sustainability, group help).

- Significant Touchpoints: Use pleasant, personalised messages at key moments (e.g., congratulating customers on their birthdays or celebrating financial savings milestones) to create a heat, human connection.

Scientific Foundation:

Plassmann, Ramsøy & Milosavljevic (2012) point out that sturdy model cues can activate reward pathways, reinforcing emotional attachment.

9. Incorporate Dopamine Design

What It Is:

Dopamine design capitalizes on how the mind’s reward system releases dopamine in anticipation of optimistic outcomes. By designing interfaces that supply well timed, significant rewards, monetary apps can enhance person motivation and engagement.

Easy methods to Apply in Monetary UX:

- Small Wins and Suggestions: Rejoice each small monetary victory (even micro-savings of $1–2) with mild animations or cheerful sounds.

- Progressive Challenges: Constantly replace challenges and objectives to keep up novelty, thereby sustaining the dopaminergic “reward anticipation.”

Scientific Foundation:

Berridge (2007) highlights the hyperlink between dopamine launch and the motivation to repeat rewarding actions, essential for forming persistent behaviors.

10. Nudge Monetary Well being

What It Is:

Nudging (Thaler & Sunstein, 2008) includes subtly guiding folks towards higher selections with out proscribing their freedom. In finance, nudges can enhance total monetary well being by encouraging customers to avoid wasting extra, spend responsibly or plan for the longer term.

Easy methods to Apply in Monetary UX:

- Computerized Enrollment: Default customers into increased financial savings or retirement contribution charges, whereas nonetheless permitting opt-outs.

- Well timed Prompts: Ship notifications at decision-critical moments (e.g., a nudge to speculate a bonus quite than spend it) to capitalize on recent capital inflow.

Scientific Foundation:

Thaler & Sunstein (2008) display that when designed ethically, nudges can information people towards useful behaviors with out compromising their autonomy.

Moral Transparency in Neuromarketing

A typical false impression about neuromarketing is that it is manipulative, however we consider that business has to take a unique method. Transparency is vital. We must always use insights from neuroscience to make experiences higher for customers, to not trick

them. Each little nudge, celebration or game-like function must be clear, so customers all the time know what is going on on and why it issues to them.

As Plassmann et al. (2012) level out, this clear method is essential within the monetary sector, the place belief is the whole lot. By respecting privateness, offering clear opt-out choices and avoiding hidden charges or deceptive ways, Fintech platforms

ought to use neuromarketing to construct belief as an alternative of breaking it. This creates a relationship during which customers really feel supported and guided, not manipulated. To realize this, it’s essential to maintain the next ideas in thoughts:

- Knowledgeable Consent: Be clear about knowledge assortment and utilization.

- Keep away from Manipulation: Design to empower customers to make higher monetary selections, to not exploit vulnerabilities.

- Information Privateness and Safety: Defend delicate monetary info with sturdy safeguards.

- Respect Autonomy: Guarantee nudges and dopamine-triggering components are aligned with customers’ finest pursuits.

Conclusion

Adopting a neuromarketing method in digital banking and Fintech challenges many long-held assumptions—that finance must be purely rational, that customers want extra knowledge quite than much less and that feelings don’t have any place in “critical” monetary selections.

Nevertheless, analysis (Damasio, 1994; Kahneman & Tversky, 1979) persistently exhibits that human habits is pushed by a mixture of cognitive biases, emotional responses and routine patterns—not simply logic and motive. Ignoring this human facet can restrict the effectiveness

of even probably the most superior monetary instruments.

By integrating emotional storytelling, dopamine-driven micro-rewards and nudge idea right into a user-centered technique, UXDA’s strategic UX redefines how folks expertise monetary merchandise. The actual energy lies in leveraging these counterintuitive

insights—from celebrating even the smallest financial savings habits to simplifying selections—to empower customers in constructing lasting monetary well-being. When employed ethically and transparently, neuromarketing doesn’t trick customers; it meets them the place they’re, serving to

them discover confidence and pleasure in an space sometimes related to stress and uncertainty. Listed below are the important thing neuromarketing methods you’ll be able to combine into monetary UX design:

- Reward System: Set off dopamine launch with fast optimistic suggestions and achievements.

- Emotional Resonance: Use storytelling, pleasant design and visible cues to scale back nervousness and construct belief.

- Personalization: Tailor insights to person habits, fostering deeper engagement and loyalty.

- Cognitive Biases: Make use of ideas like loss aversion and psychological accounting to encourage accountable monetary selections.

- Alternative Structure: Simplify person selections with clear, restricted choices and useful defaults.

- Consistency and Behavior Formation: Reinforce optimistic behaviors by common reminders and automatic duties.

Via these methods, corporations can create person experiences that not solely meet prospects’ purposeful wants but in addition resonate emotionally—in the end resulting in higher satisfaction, belief and long-term loyalty.