Desk of Contents

Government Abstract

Step one in efficacious welfare reform is knowing the size and scope of the challenges concerned with every program. The implementation of the Affected person Safety and Reasonably priced Care Act (ACA) in 2014 and the modifications to eligibility necessities and profit limits because of the COVID-19 pandemic have dramatically modified the welfare program panorama within the final decade, doubtlessly rendering a substantial amount of prior analysis outdated. This paper gives an in depth description of the character of those modifications by using the methodology of Tanner, Moore, and Hartman (1995) and Tanner and Hughes (2013) of their respective Cato Research of the identical title: “The Work Versus Welfare Commerce-Off.”

Whereas this paper additionally attracts on more moderen analyses, each papers predate the ACA implementation and the COVID-19 pandemic, so they supply a very good reference level. Along with the welfare applications examined within the 2013 paper, this paper consists of three further applications: The Little one Care and Growth Fund, the Lifeline Program for Low-Earnings Customers, and the Reasonably priced Connectivity Program. The overall conclusion is that the growth of every of those applications makes welfare reform extra pressing than ever as a result of these applications entice tens of millions in poverty and place an infinite pressure on taxpayers.

Key Factors

- The overall worth of all welfare advantages examined on this paper pay greater than each a beginning wage and median revenue in all 50 states.

- Recipients of Short-term Help for Needy Households (TANF) are the most definitely to obtain two or extra welfare advantages. The TANF Bundle (TANF, SNAP, Housing, Medicaid, LIHEAP, the EITC, Lifeline, and the ACP) pays greater than the beginning wage in 48 states plus Washington, DC.

- The most typical welfare advantages bundle is Medicaid Supplemental Diet Help Program (SNAP), and the Earned Earnings Tax Credit score (EITC). The bundle of Medicaid, SNAP and the EITC doesn’t pay greater than the beginning wage in any state or DC.

- Finally, welfare reform should be paired with regulatory reform and tax reform. Regulatory reforms assist take away obstacles to getting People again to work and tax reforms assist working People hold extra of what they earn, lowering the necessity for welfare applications.

Welfare and its Results on Authorities and Work

Welfare, also called public advantages, are types of help from the federal government directed in the direction of low-income residents and households.1 Some non-citizens (akin to refugees) are legally eligible for applications akin to TANF, SNAP, and Medicaid.2 Whereas undocumented residents should not eligible for welfare advantages, there’s concern of noncitizens accessing these advantages by way of technique of id fraud or misrepresentation of residency. Proof for that is combined at finest. Whereas the comfort of eligibility necessities in the course of the COVID-19 pandemic did lead to a rise in fraudulent funds, information relating to fraudulent funds should not disaggregated to specify the immigration standing of these caught and convicted of fraud.3 Welfare might be direct transfers from the federal government (akin to money help underneath the Short-term Help for Needy Households) or in-kind advantages (akin to healthcare protection underneath Medicaid). These applications are typically “means-tested applications,” the place a person or household should fall under a sure revenue threshold to qualify for advantages. These means-tested applications present items and providers that people and households wrestle to buy on their very own (i.e. meals, housing, healthcare protection, and childcare).4

You will need to think about each the seen and unseen results of welfare spending. Even when we assume that these applications are reaching focused demographics, they arrive at a serious price. First is the associated fee to taxpayers. The CBO estimates that Earnings Safety Applications (akin to TANF and SNAP), in addition to Medicaid and the Kids’s Well being Insurance coverage Program (CHIP) price $1.05 trillion (65 p.c of the $1.6 trillion federal finances deficit and 16 p.c of the $6.5 trillion in annual federal spending).5 That’s simply over $8,000 per family or $6,850 per taxpayer.6 Along with these direct prices, welfare applications negatively impression financial progress. Economists clarify why an individual would select welfare over work when it comes to revenue and substitution results. The revenue impact reveals that as revenue will increase, people are likely to demand leisure over labor. The identical holds true when utilized to welfare transfers. As people select to not work or lower their labor to keep up welfare advantages, output decreases, lowering financial progress. Then again, the substitution impact (one’s willingness to surrender welfare in trade for work) reveals how welfare punishes work. Some economists argue that people who select to go away welfare lose extra worth in advantages than they acquire from elevated revenue, creating an incentive to not work.7

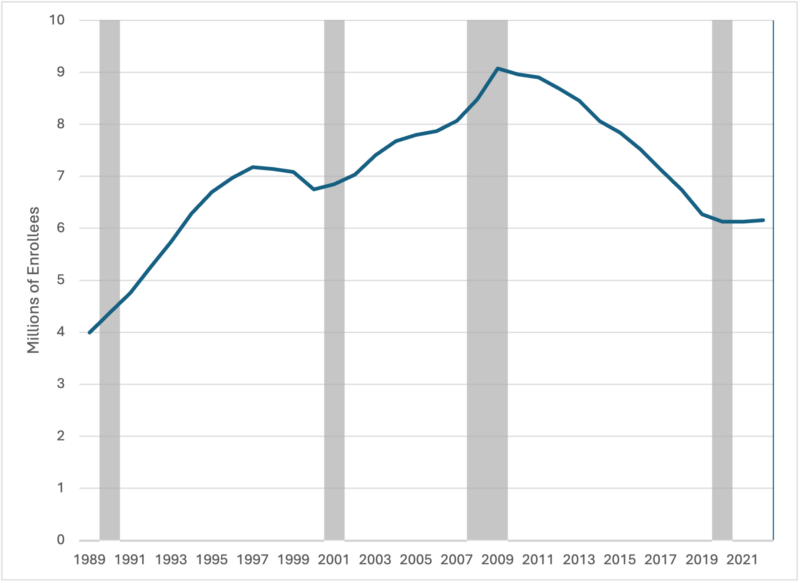

Observe: Shaded areas point out intervals of recession.

Supply: U.S. Bureau of Labor Statistics, Labor Power Participation Price [CIVPART], retrieved from FRED, Federal Reserve Financial institution of St. Louis; https://fred.stlouisfed.org/collection/CIVPART, June 7, 2024.

As Determine 1 reveals, the Civilian Labor Power Participation charge for People aged 25-54 has steadily declined for the reason that early 2000s and simply returned to pre-pandemic ranges in February 2023. Tanner (2022) additionally notes that the character of in-kind advantages additionally “infantilizes the poor,” as a result of, “generally, the funds are made on to suppliers. The individual being helped by no means even sees the cash.”8

Cowen (2002) additionally notes two different teams damage by welfare spending: the longer term poor and immigrants.9 As summarized by Henderson (2018), as financial output is lowered, the annual progress charge of the US economic system decreases, leading to better future poverty.10 As well as, as welfare spending is funded by revenue taxes and the federal authorities issuing debt, capital is diverted away from the personal sector to fund public spending, leaving much less accessible for financial progress. Cowen and Henderson additionally be aware that poor foreigners are damage by home pressures to restrict immigration to cut back immigrant entry to welfare. With out the welfare system a rise in immigration might doubtlessly enhance the incomes of overseas poor shifting to the US.11

Welfare additionally generates waste. Glock (2024) examines the online results of taxes and transfers on US households. With welfare applications offering advantages to low-, middle-, and high-income households (particularly within the wake of welfare growth in the course of the COVID-19 pandemic), Glock finds that in instances the place welfare beneficiaries are incomes revenue and paying taxes, they obtain a worth of advantages not less than equal to the quantity of taxes they paid.12 Finally, this creates waste by requiring bureaucracies to handle the tax collections and transfers, and limits choices for households by requiring them to adjust to tax and profit guidelines as an alternative of conserving the money they earn.13

These applications broadly operate primarily based on the interplay between federal and state insurance policies, though every program is barely completely different (the variations of the applications mentioned on this paper are addressed within the subsequent part). Usually, the federal authorities gives funding to welfare applications and units minimal necessities for spending, whereas the states have the ability to manage these applications, permitting the states some flexibility as to how this system capabilities inside a specific state.14 The result’s that welfare advantages differ from state to state. Watson and Goodman (2024) discovered, nonetheless, that the states that spent the least quantity of state funds on welfare acquired extra federal {dollars} than the states that spent their very own cash, “which largely offset disparities in state-directed profit generosity.”15

This paper will look at eleven welfare applications and the whole financial worth of advantages offered to a hypothetical household with a single father or mother and two dependent youngsters in all 50 states and the District of Columbia. The idea for the evaluation comes from Tanner, Moore, and Hartman (1995) in addition to Tanner and Hughes (2013).16, 17 These papers examined a number of mixtures of welfare applications and in contrast these applications to minimal wage in addition to a beginning wage. This comparability offered a transparent image of the incentives People face when selecting to work or obtain welfare.

The Classes of Welfare Included on this Research

This paper examines the next welfare applications:

- Medicaid

- Short-term Help for Needy Households (TANF)

- The Earned Earnings Tax Credit score (EITC)

- The Little one Care & Growth Fund (CCDF)

- Housing Alternative Voucher Program (Part 8)

- Low-Earnings House Vitality Help Program (LIHEAP)

- Supplemental Diet Help Program (SNAP)

- Particular Supplemental Diet Program for Girls, Infants, and Kids (WIC)

- The Emergency Meals Help Program (TEFAP)

- The Lifeline Program for Low-Earnings Customers

- The Reasonably priced Connectivity Program (ACP)

This part will briefly describe the classes of welfare included in every research, in addition to their respective modifications and participation charges over time. As famous by Tanner and Hughes (2013), the federal authorities supplied 126 applications to low-income households.18 Of these 126 applications, 72 have been direct money transfers or in-kind for people and households transfers, whereas the rest have been thought-about “neighborhood funding applications.”19

As of the newest Census information accessible, the US Census Bureau discovered that 99.1 million folks (30 p.c of the US inhabitants) participated in not less than one welfare program (though they didn’t cowl all welfare applications).20 Amongst households, the Census Survey of Earnings and Program Participation (SIPP) finds that 75.3 million households (56 p.c) have been enrolled in “any profit/program,” whereas 21.5 million households (16 p.c) have been enrolled in three or extra applications.21 Merely tallying the whole variety of members in every program, nonetheless, wouldn’t present an correct estimate of the whole variety of People accessing welfare, as a result of many members are enrolled in a number of applications. A 2023 research from the US Authorities’s Workplace of Human Providers Coverage discovered that 54 p.c of welfare recipients in 2019 participated in a number of applications.22 A companion research discovered that in 2019 TANF and Little one Care and Growth Fund (CCDF) recipients have been the most definitely to obtain a number of advantages.23

This research additionally depends on the College of Kentucky Middle for Poverty Analysis, in addition to particular program participation information up by way of 2022. These datasets, sadly, don’t present info relating to what number of recipients take part in a number of applications. As Rector and Menon (2018) be aware, “The true financial price of welfare is essentially unknown, as a result of the spending is fragmented into myriad applications.”24

The failure to offer clear info highlights each the constraints of this research and a critical concern for policymakers and taxpayers. With out an correct rely of who’s receiving welfare, policymakers will be unable to correctly reform welfare spending nor enact reforms that assist recipients trapped in a cycle of dependence. If one considers a extra cynical standpoint, policymakers might not need to know these particulars as a result of their very own job safety relies upon upon sustaining the established order.

Medicaid

Medicaid, Title IX of the Social Safety Act, is a joint federal-state program that funds well being care to the poor. Conventional Medicaid eligibility is restricted to low-income youngsters, pregnant girls, dad and mom of dependent youngsters, the aged, and other people with disabilities.25 On this program, states are assured federal matching {dollars} and not using a cap for certified providers, primarily based on a system that matches not less than 50 p.c of state spending. This matching charge will increase as state per-capita revenue decreases. Trying forward at FY 2025, the federal matching for state funds is predicted to vary from 50 p.c to almost 75 p.c.26

Below the Affected person Safety and Reasonably priced Care Act (ACA), states had the choice to increase Medicaid to non-elderly adults with revenue as much as 133 p.c of the Federal Poverty Stage.27 When states have been initially allowed to increase Medicaid beginning January 1, 2014, the federal authorities promised to cowl 100% of Medicaid Growth as an incentive for states to increase Medicaid.28 With this promise of a “free lunch,” many states rushed to increase Medicaid, and Medicaid enrollment elevated.

Among the largest will increase got here from the newly certified able-bodied adults with out dependents. To complicate issues additional, Schmidt, et al (2021) discovered that Medicaid Growth resulted a rise in enrollment for TANF, SNAP, and the EITC.29 As of June 2024, 40 states and Washington, DC30 have expanded Medicaid.31 In the course of the COVID-19 pandemic, the federal authorities positioned a requirement within the CARES Act for states to maintain Medicaid recipients constantly enrolled in trade for federal funds.32 Medicaid started “unwinding” from these pandemic provisions on April 1, 2023. In most states, Medicaid pays greater than the common single insurance coverage premium. One of the simplest ways to enhance Medicaid is to repeal the expansions created by the ACA and be certain that this program focuses on the poor.33 That is proven in Desk 1.

| Jurisdiction | Medicaid Profit Spending Per Full-12 months Equal Enrollee (FYE) | Common Annual Single Premium per Enrolled Worker for Employer-Based mostly Well being Insurance coverage (Worker and Employer Contribution) |

| Alabama | $6,848.05 | $6,769.00 |

| Alaska | $9,083.22 | $8,624.00 |

| Arizona | $8,921.21 | $7,214.00 |

| Arkansas | $7,849.95 | $6,861.00 |

| California | $8,810.95 | $7,547.00 |

| Colorado | $7,629.05 | $7,031.00 |

| Connecticut | $9,249.15 | $8,237.00 |

| Delaware | $9,877.08 | $8,168.00 |

| District of Columbia | $12,871.12 | $8,650.00 |

| Florida | $6,124.24 | $7,551.00 |

| Georgia | $5,830.17 | $7,367.00 |

| Hawaii | $7,246.82 | $7,367.00 |

| Idaho | $7,827.38 | $7,292.00 |

| Illinois | $8,731.45 | $7,547.00 |

| Indiana | $9,389.60 | $7,601.00 |

| Iowa | $8,489.98 | $7,433.00 |

| Kansas | $10,096.23 | $6,885.00 |

| Kentucky | $9,341.50 | $6,990.00 |

| Louisiana | $7,657.44 | $7,422.00 |

| Maine | $10,771.50 | $7,993.00 |

| Maryland | $9,554.73 | $7,978.00 |

| Massachusetts | $11,879.30 | $8,054.00 |

| Michigan | $7,558.35 | $7,276.00 |

| Minnesota | $12,366.61 | $7,526.00 |

| Mississippi | $8,043.59 | $6,726.00 |

| Missouri | $9,888.68 | $7,737.00 |

| Montana | $8,432.28 | $7,759.00 |

| Nebraska | $10,653.85 | $7,601.00 |

| Nevada | $6,141.03 | $6,848.00 |

| New Hampshire | $10,383.05 | $8,053.00 |

| New Jersey | $10,200.78 | $8,183.00 |

| New Mexico | $8,331.67 | $7,794.00 |

| New York | $10,884.16 | $8,936.00 |

| North Carolina | $8,880.73 | $7,753.00 |

| North Dakota | $12,535.35 | $7,841.00 |

| Ohio | $9,508.21 | $7,743.00 |

| Oklahoma | $6,985.62 | $6,713.00 |

| Oregon | $10,968.75 | $7,091.00 |

| Pennsylvania | $12,101.94 | $8,098.00 |

| Rhode Island | $9,263.54 | $8,215.00 |

| South Carolina | $6,150.43 | $7,252.00 |

| South Dakota | $8,823.99 | $7,640.00 |

| Tennessee | $6,933.45 | $7,182.00 |

| Texas | $8,379.29 | $7,351.00 |

| Utah | $9,062.77 | $6,746.00 |

| Vermont | $8,312.50 | $8,417.00 |

| Virginia | $10,163.97 | $7,676.00 |

| Washington | $11,271.91 | $7,170.00 |

| West Virginia | $8,246.74 | $8,065.00 |

| Wisconsin | $8,179.34 | $7,673.00 |

| Wyoming | $8,995.54 | $7,982.00 |

Sources: MACStats, Exhibit 22: Medicaid Profit Spending Per Full-12 months Equal (FYE) Enrollee by State and Eligibility Group, December 2023, Accessed March 5, 2024, https://www.macpac.gov/publication/medicaid-benefit-spending-per-full-year-equivalent-fye-enrollee-by-state-and-eligibility-group/; Kaiser Household Basis, Common Annual Single Premium per Enrolled Worker For Employer-Based mostly Well being Insurance coverage, 2022, Accessed March 5, 2024, https://www.kff.org/different/state-indicator/single-coverage/?currentTimeframe=0&sortModel=%7Bpercent22colIdpercent22:%22Locationpercent22,%22sortpercent22:%22ascpercent22percent7D

Short-term Help for Needy Households (TANF)

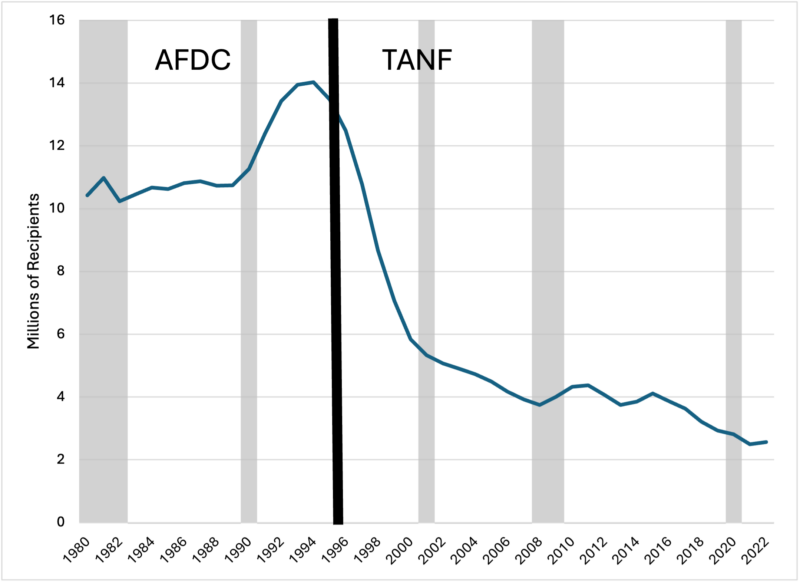

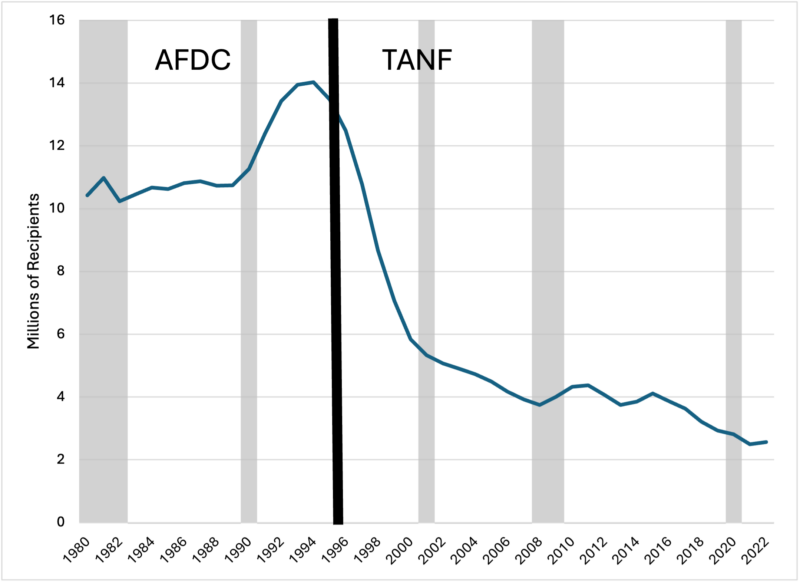

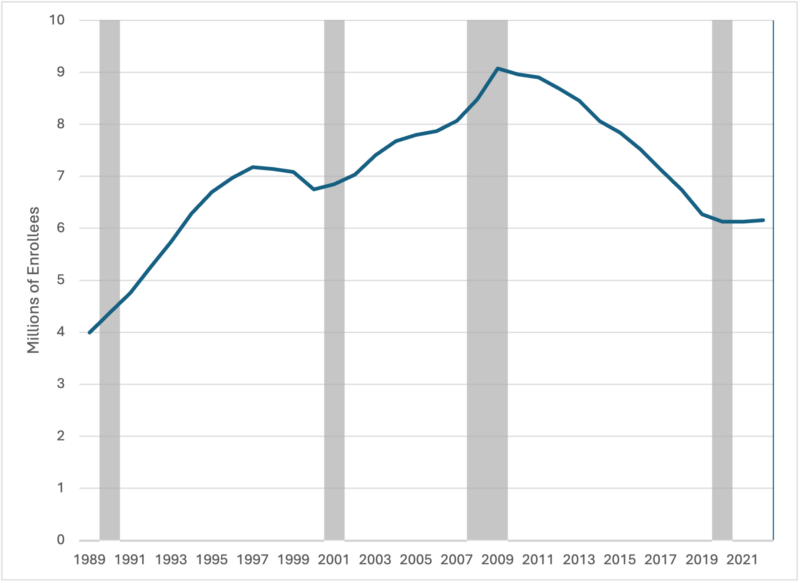

The Short-term Help for Needy Households (TANF) is the first money profit program for the poor. TANF was created in 1996 in the course of the 1996 welfare reforms because the successor to Assist to Households with Dependent Kids (AFDC). TANF, like Medicaid, is funded within the type of federal block grants to the states and state funds. With the welfare reforms of 1996, TANF enrollment noticed main decline attributable to extra stringent eligibility necessities and closing dates. Determine 2 under reveals the development in complete members from 1980-2022.

Since 2013, TANF has undergone a number of modifications. Initially, the main focus remained on employment and strict work necessities, with states enhancing providers to fulfill federal participation charges.34 As of FY 2022, solely 35 p.c of TANF recipients have been employed and solely 16 states required a job search upon software.36, 37

Desk 2 reveals the utmost month-to-month and annual TANF advantages, together with their hourly equivalents in comparison with the state minimal wage. Observe that whereas TANF advantages pay lower than state minimal wages, TANF members have been additionally the most definitely to obtain a number of advantages, with 87 p.c of recipients taking part in two or extra applications.38 Additionally it is essential to notice that lower than 1 / 4 of TANF funding (each federal and state) goes towards “fundamental help” (direct money transfers).39 Whereas this fundamental help makes up the only largest class (23 p.c), the following two largest quantities of TANF funds go towards “Early Care and Training” (22.7 p.c) and “Program Administration” (10.4 p.c). The remaining 44.3 p.c goes towards myriad different applications.40

Observe: Shaded areas point out intervals of recession.

Supply: College of Kentucky Middle for Poverty Analysis. 2024. “UKCPR Nationwide Welfare Information, 1980-2022.” URL: http://ukcpr.org/sources/national-welfare-data (accessed June 1, 2024)

| Jurisdiction | Month-to-month TANF Profit | Annual Advantages | Hourly Equal | Minimal Wage |

| Alabama | $215.00 | $2,580.00 | $1.24 | $7.25 |

| Alaska | $923.00 | $11,076.00 | $5.33 | $11.73 |

| Arizona | $278.00 | $3,336.00 | $1.60 | $14.35 |

| Arkansas | $204.00 | $2,448.00 | $1.18 | $11.00 |

| California | $980.00 | $11,760.00 | $5.65 | $16.00 |

| Delaware | $338.00 | $4,056.00 | $1.95 | $13.25 |

| District of Columbia | $665.00 | $7,980.00 | $3.84 | $17.50 |

| Florida | $303.00 | $3,636.00 | $1.75 | $12.00 |

| Georgia | $280.00 | $3,360.00 | $1.62 | $7.25 |

| Hawaii | $610.00 | $7,320.00 | $3.52 | $14.00 |

| Idaho | $309.00 | $3,708.00 | $1.78 | $7.25 |

| Indiana | $288.00 | $3,456.00 | $1.66 | $7.25 |

| Iowa | $426.00 | $5,112.00 | $2.46 | $7.25 |

| Kansas | $429.00 | $5,148.00 | $2.48 | $7.25 |

| Kentucky | $262.00 | $3,144.00 | $1.51 | $7.25 |

| Louisiana | $484.00 | $5,808.00 | $2.79 | $7.25 |

| Maine | $628.00 | $7,536.00 | $3.62 | $14.15 |

| Maryland | $862.00 | $10,344.00 | $4.97 | $15.00 |

| Massachusetts | $752.00 | $9,024.00 | $4.34 | $15.00 |

| Michigan | $492.00 | $5,904.00 | $2.84 | $10.33 |

| Minnesota | $641.00 | $7,692.00 | $3.70 | $10.85 |

| Mississippi | $260.00 | $3,120.00 | $1.50 | $7.25 |

| Nebraska | $485.00 | $5,820.00 | $2.80 | $12.00 |

| Nevada | $386.00 | $4,632.00 | $2.23 | $11.25 |

| New Hampshire | $1,151.00 | $13,812.00 | $6.64 | $7.25 |

| New Jersey | $559.00 | $6,708.00 | $3.23 | $15.13 |

| New Mexico | $447.00 | $5,364.00 | $2.58 | $12.00 |

| New York | $789.00 | $9,468.00 | $4.55 | $15.00 |

| North Carolina | $272.00 | $3,264.00 | $1.57 | $7.25 |

| North Dakota | $486.00 | $5,832.00 | $2.80 | $7.25 |

| Ohio | $542.00 | $6,504.00 | $3.13 | $10.45 |

| Oklahoma | $292.00 | $3,504.00 | $1.68 | $7.25 |

| Oregon | $506.00 | $6,072.00 | $2.92 | $14.20 |

| Pennsylvania | $403.00 | $4,836.00 | $2.33 | $7.25 |

| Rhode Island | $721.00 | $8,652.00 | $4.16 | $14.00 |

| South Carolina | $308.00 | $3,696.00 | $1.78 | $7.25 |

| South Dakota | $630.00 | $7,560.00 | $3.63 | $11.20 |

| Tennessee | $387.00 | $4,644.00 | $2.23 | $7.25 |

| Texas | $312.00 | $3,744.00 | $1.80 | $7.25 |

| Vermont | $811.00 | $9,732.00 | $4.68 | $13.67 |

| Virginia | $587.00 | $7,044.00 | $3.39 | $12.00 |

| Washington | $654.00 | $7,848.00 | $3.77 | $16.28 |

| West Virginia | $542.00 | $6,504.00 | $3.13 | $8.75 |

| Wisconsin | $630.50 | $7,566.00 | $3.64 | $7.25 |

| Wyoming | $781.00 | $9,372.00 | $4.51 | $7.25 |

Sources: City Institute Welfare Guidelines Database, funded by HHS/ACF and Creator’s calculations.

Earned Earnings Tax Credit score (EITC)41

The Earned Earnings Tax Credit score (EITC) is a refundable tax credit score designed to learn low-to-moderate-income working people and households, notably these with youngsters. Established in 1975, the EITC goals to cut back the tax burden on these teams, complement their wages, and incentivize employment.42

Eligibility for the EITC is dependent upon a number of components, together with revenue stage, submitting standing, and the variety of qualifying youngsters.43 The credit score will increase with earned revenue till it reaches a most worth, then step by step phases out as revenue continues to rise. For the 2023 tax yr, the utmost credit score ranges from $600 for people with out youngsters to over $7,000 for these with three or extra qualifying youngsters.One vital benefit of the EITC is its refundability, that means that eligible recipients can obtain a refund even when the credit score exceeds their complete tax legal responsibility.44 Tanner (2022) notes that the EITC has been extra profitable than different applications at preventing poverty.45

The EITC has additionally been related to a number of constructive outcomes, akin to lowering poverty, notably amongst youngsters, and inspiring workforce participation.46 The EITC’s complexity, nonetheless, can result in a excessive error charge (each fraud and improper calculation).47 Desk 3 reveals the Federal EITC Parameters as of 2024. As Desk 3 reveals, it imposes a penalty on marriage. A married couple with two youngsters would exhaust advantages at $62,688, whereas a single father or mother would achieve this at just below $7,000 much less. Tanner (2022) notes, “Thus, the only father or mother can proceed to obtain advantages at larger revenue ranges relative to the poverty stage than married {couples} can—and the credit score is extra beneficiant since the advantages are being distributed among the many three folks, reasonably than 4.”48 Macartney and Ghertner (2023) additionally discover that 42 p.c of EITC recipients are enrolled in two or extra welfare applications, the most typical applications being Medicaid (49 p.c of EITC recipients in a number of welfare applications) and SNAP (36 p.c of EITC recipients in a number of welfare applications).

| Submitting Standing | Column1 | No Kids | One Little one | Two Kids | Three or Extra Kids |

| Single or Head of Family | Earnings at Max Credit score | $8,260 | $12,390 | $17,400 | $17,400 |

| Most Credit score | $632 | $4,213 | $6,960 | $7,830 | |

| Phaseout Begins | $10,330 | $22,720 | $22,720 | $22,720 | |

| Phaseout Ends (Credit score Equals Zero) | $18,591 | $49,084 | $55,768 | $59,899 | |

| Married Submitting Collectively | Earnings at Max Credit score | $8,260 | $12,390 | $17,400 | $17,400 |

| Most Credit score | $632 | $4,213 | $6,960 | $7,830 | |

| Phaseout Begins | $17,250 | $29,640 | $29,640 | $29,640 | |

| Phaseout Ends (Credit score Equals Zero) | $25,511 | $56,004 | $62,688 | $66,819 |

Sources: Tax Basis and Inner Income Service “Income Process 2023-34”

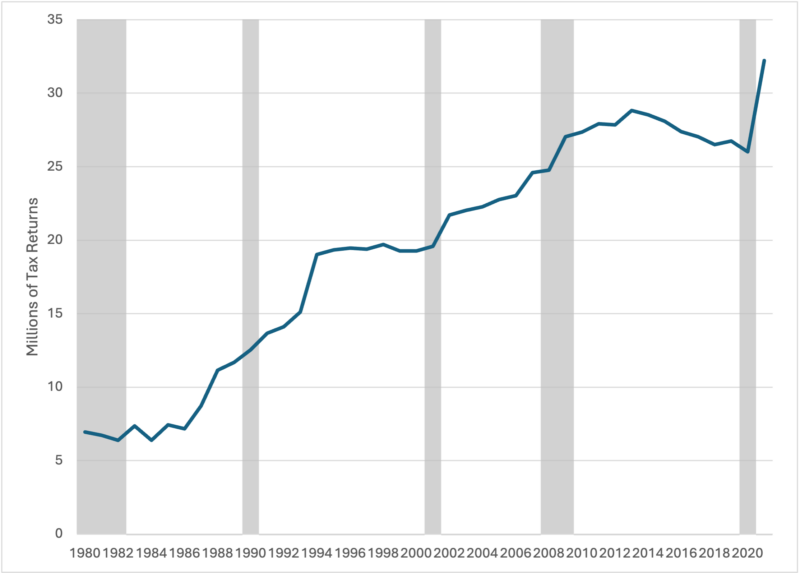

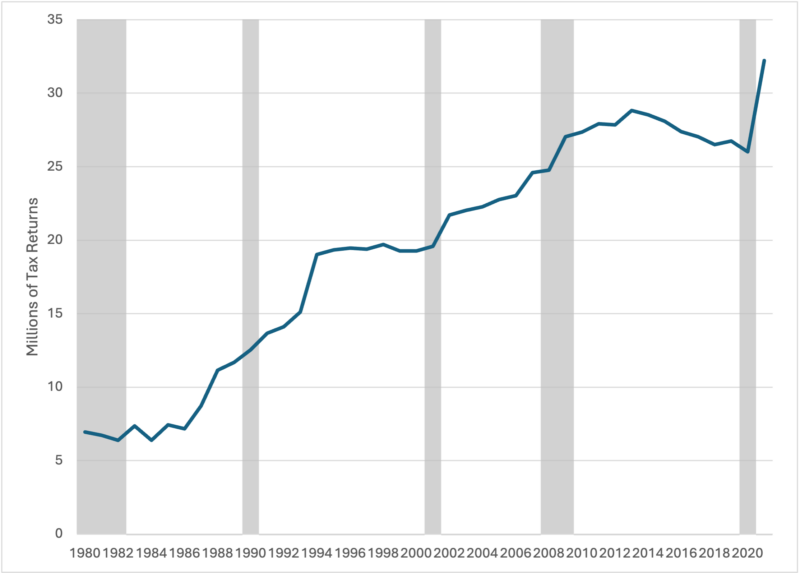

As of tax yr 2021, over 32 million revenue tax returns acquired the EITC, with a median credit score of $2,039.49 Determine 3 reveals the variety of revenue tax returns receiving the EITC since 1980. Observe the sharp will increase with the expansions in 1990, 1993, 2001, 2009, and 2021.

Observe: Shaded areas point out intervals of recession.

Supply: Inner Income Service, Statistics of Earnings Division, Desk 2.5: Returns with Earned Earnings Credit score and Desk A: Chosen Earnings and Tax Gadgets for Chosen Years (in Present and Fixed {Dollars}). January 2024.

Along with the federal EITC, 27 states and DC additionally provide an Earned Earnings Tax Credit score. Desk 4 (recreated from the IRS) lists the states that supply an EITC together with their descriptions in addition to whether or not the state EITC is refundable (even when one doesn’t owe tax, she or he continues to be eligible for a refund).

| State or Native Authorities | Share of Federal Credit score | Is Credit score Refundable? |

| California | 45% | Sure |

| Colorado | 10% | Sure |

| Connecticut | 23% | Sure |

| Delaware | 20% | No |

| District of Columbia | 40% | Sure |

| Hawaii | 20% | No |

| Illinois | 18% | Sure |

| Indiana | 9% | Sure |

| Iowa | 15% | Sure |

| Kansas | 17% | Sure |

| Louisiana | 3.5% | Sure |

| Maine | 5% | Sure |

| Maryland | 50% | Sure |

| Massachusetts | 30% | Sure |

| Michigan | 6% | Sure |

| Minnesota | Ranges from 25%-45% of federal | Sure |

| Montana | 3% | Sure |

| Nebraska | 10% | Sure |

| New Jersey | 39% | Sure |

| New Mexico | 10% | Sure |

| New York | 30% | Sure |

| New York Metropolis | 5% | Sure |

| Ohio | 30% | No |

| Oklahoma | 5% | Sure |

| Oregon | 9% (12% if qualifying youngster underneath age 3) |

Sure |

| Rhode Island | 15% | Sure |

| South Carolina | 41.67% | No |

| Vermont | 36% | Sure |

| Virginia | 20% | No |

| Wisconsin | One youngster — 4% | Sure |

| Two Kids — 11% | ||

| Three Kids — 34% |

Sources: Inner Income Service “State and Native Governments with Earned Earnings Tax Credit score”

Little one Care and Growth Fund

The Little one Care and Growth Fund (CCDF), established in 1990 underneath the Little one Care and Growth Block Grant (CCDBG) Act, is a federal block grant to states to subsidize childcare prices for low-income households and is run by the US Division of Well being and Human Providers (HHS).50

The CCDF has developed over time. The 2014 reauthorization of the CCDBG Act introduced vital modifications, together with necessities for enhanced well being and security requirements (together with transparency on compliance with dad and mom), in addition to elevated supplier coaching, inevitably creating regulatory obstacles for these seeking to present childcare. Mixed with the 2014 reauthorization’s elevated entry to early childhood education schemes, demand for these applications inevitably exceeded the provision of suppliers.51 Many dad and mom nonetheless wrestle right now to seek out desired childcare due to the scarcity.52

In the course of the COVID-19 pandemic, the CCDF noticed unprecedented modifications and expansions to handle the disaster’s impression on the childcare sector. Congress appropriated over $52 billion in supplemental funding by way of numerous reduction acts, together with the CARES Act, the Coronavirus Response and Aid Supplemental Appropriations Act, and the American Rescue Plan Act (ARPA). These funds have been essential in stopping the collapse of the childcare system, which confronted extreme challenges attributable to widespread closures and lowered enrollment.

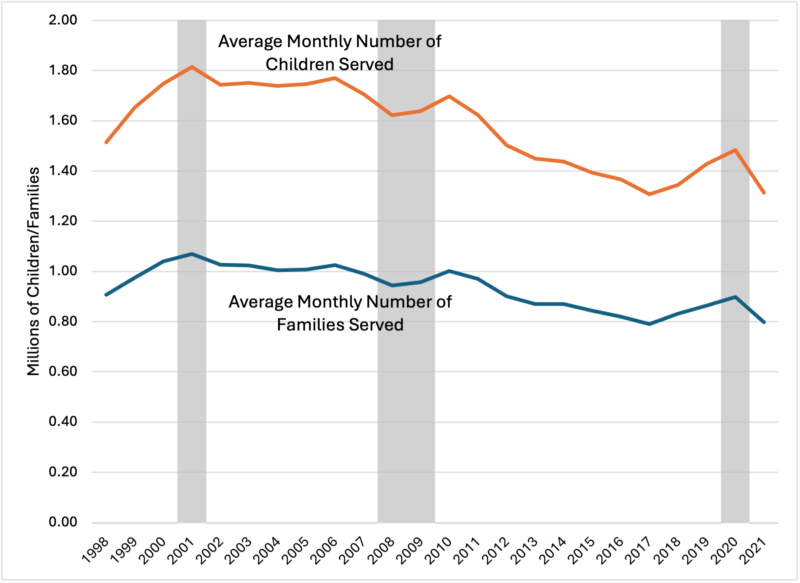

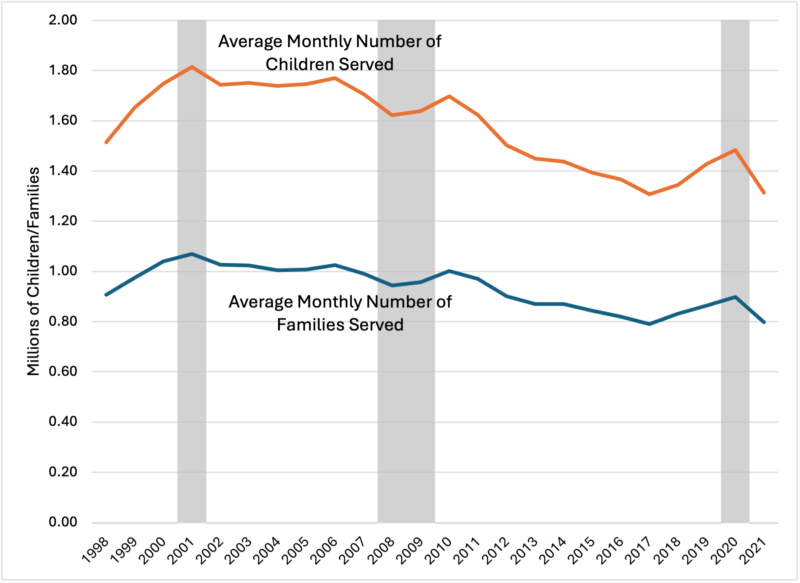

States utilized the supplemental funding to make a number of key changes together with increasing eligibility for childcare subsidies, waiving household co-payments, and rising reimbursement charges to suppliers. The Little one Care Stabilization program, funded by way of ARPA, additionally offered grants to cowl operational prices akin to wages, hire, and provides. Michigan, Nevada, and New Mexico additionally used the funds to extend compensation for childcare employees by way of larger wages, hiring and retention bonuses, and expanded advantages. Determine 4 reveals the common variety of youngsters and households enrolled from 1998-2021.

Observe: Shaded areas point out intervals of recession.

Supply: US Administration for Kids & Households, Workplace of Little one Care, Program Information and Statistics.

Desk 5 reveals the whole spending on all enrollees and the spending per household by state.

| Jurisdiction | Whole Spending | Spending per Household |

| Alabama | $224,721,469.00 | $11,643.60 |

| Alaska | $32,183,511.00 | $18,931.48 |

| Arizona | $301,739,612.00 | $15,797.89 |

| Arkansas | $144,929,008.00 | $8,837.13 |

| California | $1,483,390,130.00 | $16,019.33 |

| Colorado | $182,657,300.00 | $20,072.23 |

| Connecticut | $140,278,688.00 | $19,483.15 |

| Delaware | $42,623,720.00 | $14,697.83 |

| District of Columbia | $27,708,387.00 | $39,583.41 |

| Florida | $781,179,271.00 | $11,590.20 |

| Georgia | $518,767,129.00 | $19,356.98 |

| Hawaii | $54,498,716.00 | $17,030.85 |

| Idaho | $72,417,696.00 | $19,572.35 |

| Illinois | $521,297,983.00 | $14,520.84 |

| Indiana | $300,083,417.00 | $21,132.64 |

| Iowa | $126,523,907.00 | $15,062.37 |

| Kansas | $123,338,114.00 | $19,893.24 |

| Kentucky | $218,784,200.00 | $24,582.49 |

| Louisiana | $220,038,371.00 | $17,889.30 |

| Maine | $39,726,583.00 | $14,188.07 |

| Maryland | $233,658,867.00 | $22,685.33 |

| Massachusetts | $277,769,333.00 | $17,360.58 |

| Michigan | $383,370,136.00 | $30,426.20 |

| Minnesota | $226,711,728.00 | $23,864.39 |

| Mississippi | $136,595,744.00 | $10,348.16 |

| Missouri | $266,417,358.00 | $17,188.22 |

| Montana | $37,153,804.00 | $21,855.18 |

| Nebraska | $89,073,649.00 | $23,440.43 |

| Nevada | $109,859,173.00 | $31,388.34 |

| New Hampshire | $41,857,935.00 | $16,099.21 |

| New Jersey | $332,783,392.00 | $20,416.16 |

| New Mexico | $101,284,305.00 | $16,603.98 |

| New York | $828,164,984.00 | $24,574.63 |

| North Carolina | $471,298,032.00 | $16,892.40 |

| North Dakota | $29,348,707.00 | $19,565.80 |

| Ohio | $530,532,703.00 | $29,474.04 |

| Oklahoma | $209,792,226.00 | $11,852.67 |

| Oregon | $150,709,574.00 | $20,094.61 |

| Pennsylvania | $510,356,429.00 | $12,570.36 |

| Rhode Island | $42,184,194.00 | $26,365.12 |

| South Carolina | $216,519,453.00 | $23,793.35 |

| South Dakota | $38,189,582.00 | $18,185.52 |

| Tennessee | $359,710,683.00 | $8,365.36 |

| Texas | $1,405,868,263.00 | $20,112.56 |

| Utah | $163,052,924.00 | $25,477.02 |

| Vermont | $22,228,664.00 | $11,114.33 |

| Virginia | $319,442,293.00 | $33,275.24 |

| Washington | $305,829,505.00 | $21,690.04 |

| West Virginia | $79,427,382.00 | $9,928.42 |

| Wisconsin | $223,063,493.00 | $24,784.83 |

| Wyoming | $21,565,850.00 | $14,377.23 |

Supply: US Administration for Kids & Households, Workplace of Little one Care, Program Information and Statistics. FY2024 CCDF Funding Allocations (Based mostly on Appropriations)

Housing Help

Housing help is out there by way of numerous applications, together with public housing, Housing Help Funds (generally generally known as “Part 8”), and different hire subsidies. The quantity of help varies not solely by state but in addition inside states, with larger quantities accessible in city areas the place rents and housing costs are larger. Simply as Tanner and Hughes (2013), this paper makes use of common help stage in every state, reasonably than the excessive (city) or low (non-urban) ranges.56 These quantities are recreated in Desk 6.

| Jurisdiction | 2024 State Common Housing Annual Funds |

| Alabama | $12,429.21 |

| Alaska | $18,213.92 |

| Arizona | $17,206.24 |

| Arkansas | $11,285.95 |

| California | $24,321.93 |

| Colorado | $18,865.80 |

| Connecticut | $21,212.09 |

| Delaware | $18,860.80 |

| District of Columbia | $26,829.60 |

| Florida | $17,776.19 |

| Georgia | $14,494.99 |

| Hawaii | $27,324.00 |

| Idaho | $14,005.96 |

| Illinois | $12,118.45 |

| Indiana | $12,665.35 |

| Iowa | $11,475.08 |

| Kansas | $11,721.23 |

| Kentucky | $12,034.24 |

| Louisiana | $13,035.68 |

| Maine | $14,301.71 |

| Maryland | $21,095.90 |

| Massachusetts | $25,099.77 |

| Michigan | $12,743.48 |

| Minnesota | $13,718.68 |

| Mississippi | $12,253.81 |

| Missouri | $11,434.92 |

| Montana | $12,498.90 |

| Nebraska | $11,170.30 |

| Nevada | $17,308.52 |

| New Hampshire | $18,072.61 |

| New Jersey | $23,746.97 |

| New Mexico | $13,038.98 |

| New York | $17,611.86 |

| North Carolina | $14,240.57 |

| North Dakota | $12,230.35 |

| Ohio | $12,022.64 |

| Oklahoma | $11,983.70 |

| Oregon | $17,450.40 |

| Pennsylvania | $13,688.78 |

| Rhode Island | $22,148.68 |

| South Carolina | $14,165.22 |

| South Dakota | $12,456.84 |

| Tennessee | $13,417.62 |

| Texas | $14,206.62 |

| Utah | $14,773.82 |

| Vermont | $16,800.08 |

| Virginia | $16,860.67 |

| Washington | $18,788.00 |

| West Virginia | $11,761.13 |

| Wisconsin | $12,597.67 |

| Wyoming | $13,790.82 |

Sources: U.S. Division of Housing and City Growth (HUD) Workplace of Coverage Growth and Analysis “Dataset: Honest Market Rents (40th Percentile Rents)

Since 2013, a number of states lowered housing advantages for recipients of different welfare applications. This discount is partly attributable to decreased federal housing funds, and partly attributable to state coverage selections requiring recipients of advantages akin to TANF to make use of their money advantages for housing bills.57 Moreover, latest coverage modifications have centered on rising the provision of reasonably priced housing by way of public-private partnerships and increasing housing vouchers to extra low-income households, although the general impression varies considerably by area.58

Low-Earnings House Vitality Help Program (LIHEAP)

The Low-Earnings House Vitality Help Program (LIHEAP) was established to cut back the burden of vitality bills on weak populations, LIHEAP allocates funds to states, territories, and tribal organizations, which then distribute these funds to eligible households.59 This system notably targets households with aged members, people with disabilities, and households with younger youngsters, to make sure they obtain vital help.60

Eligibility for LIHEAP is decided primarily based on revenue standards, with states having the pliability to set thresholds at or under 150 p.c of the federal poverty tips or 60 p.c of the state median revenue, whichever is larger.61 States might also select to set decrease revenue limits, however households with incomes under 110 p.c of the federal poverty tips can’t be excluded from eligibility. Moreover, households receiving advantages from different federal applications akin to TANF, Supplemental Safety Earnings (SSI), and the Supplemental Diet Help Program (SNAP) might also qualify for LIHEAP help.62

Extra funding has been offered by way of numerous COVID-19 reduction packages, considerably rising the LIHEAP spending. States have acquired extra flexibility in utilizing these funds, together with the power to supply larger profit ranges and increase eligibility standards. Enhanced disaster help measures have been carried out to stop utility shut-offs and assist households handle personal debt accumulation ensuing from job losses and financial instability.63 Advantages as of FY 2022 are proven in Desk 7. Participation information have been unavailable.

| Jurisdiction | Common Annual Vitality Advantages (Heating and Cooling) |

| Alabama | $805.00 |

| Alaska | $1,350.00 |

| Arizona | $1,437.00 |

| Arkansas | $496.00 |

| California | $880.00 |

| Colorado | $465.00 |

| Connecticut | $997.00 |

| Delaware | $1,451.00 |

| District of Columbia | $1,174.00 |

| Florida | $1,327.00 |

| Georgia | $965.00 |

| Hawaii | $2,398.00 |

| Idaho | $357.00 |

| Illinois | $940.00 |

| Indiana | $536.00 |

| Iowa | $792.00 |

| Kansas | $664.00 |

| Kentucky | $472.00 |

| Louisiana | $1,079.00 |

| Maine | $755.00 |

| Maryland | $851.00 |

| Massachusetts | $1,344.00 |

| Michigan | $9.00 |

| Minnesota | $1,105.00 |

| Mississippi | $1,830.00 |

| Missouri | $843.00 |

| Montana | $689.00 |

| Nebraska | $872.00 |

| Nevada | $573.00 |

| New Hampshire | $1,342.00 |

| New Jersey | $571.00 |

| New Mexico | $524.00 |

| New York | $1,239.00 |

| North Carolina | $335.00 |

| North Dakota | $1,171.00 |

| Ohio | $312.00 |

| Oklahoma | $691.00 |

| Oregon | $788.00 |

| Pennsylvania | $610.00 |

| Rhode Island | $1,318.00 |

| South Carolina | $1,526.00 |

| South Dakota | $687.00 |

| Tennessee | $1,449.00 |

| Texas | $2,200.00 |

| Utah | $1,056.00 |

| Vermont | $572.00 |

| Virginia | $1,358.00 |

| Washington | $453.00 |

| West Virginia | $479.00 |

| Wisconsin | $432.00 |

| Wyoming | $593.00 |

Sources: U.S. Division of Well being & Human Providers Administration for Kids and Households, Workplace of Group Providers LIHEAP Efficiency Measurement Web site.

Supplemental Diet Help Program (SNAP)

The Supplemental Diet Help Program (SNAP) gives monetary help to low-income households for buying meals. Previously generally known as “meals stamps,” this system was renamed in 2008 when paper vouchers have been changed by digital debit playing cards.64 SNAP is absolutely funded by the federal authorities, and advantages are constant throughout the nation, with some exceptions.65 Advantages are designed in order that eligible households don’t spend greater than 30 p.c of their internet revenue on a meals package deal that meets the Agriculture Division’s “Thrifty Meals Plan,” adjusted for family measurement and inflation.66

Eligibility for Short-term Help for Needy Households (TANF) robotically qualifies a household for SNAP in all 50 states. As a result of TANF money advantages differ broadly by state, nonetheless, the quantity acquired in SNAP advantages additionally varies by state. Decrease TANF advantages lead to larger SNAP advantages. Excluding Alaska and Hawaii, states with low TANF advantages (akin to Texas, Arkansas, and Tennessee) present the best SNAP advantages. Conversely, states with excessive TANF advantages, akin to New Hampshire, Vermont, and California, present the bottom SNAP advantages.67

For the reason that onset of the COVID-19 pandemic, a number of vital modifications have been made to SNAP to handle the elevated demand for meals help, together with a 15 p.c enhance in SNAP advantages from January 2021 by way of September 2021.68

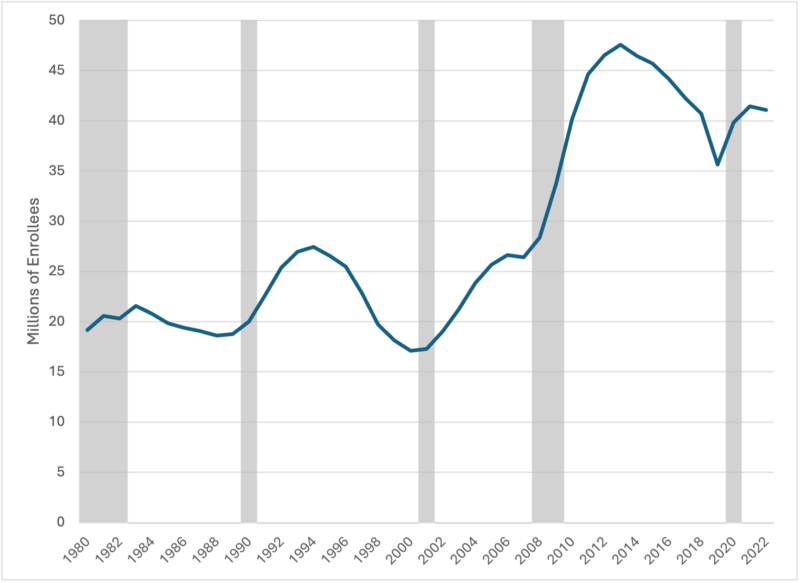

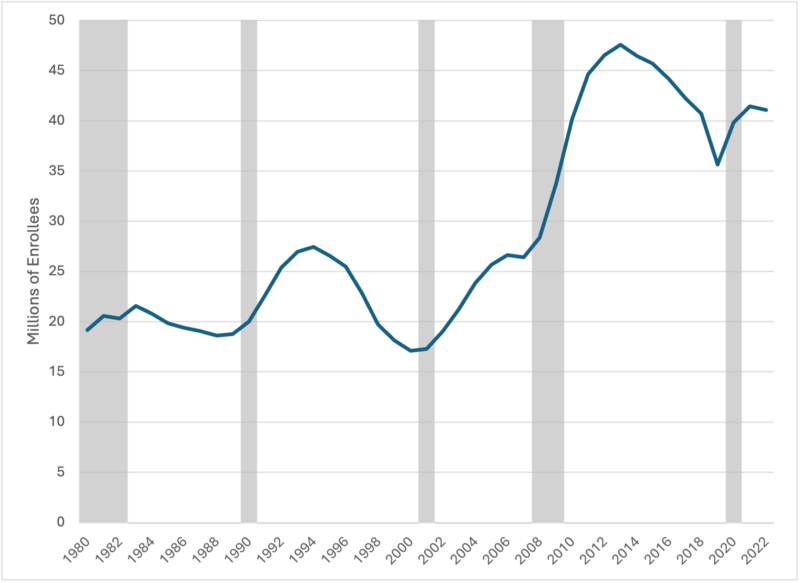

Moreover, the American Rescue Plan Act of 2021 offered additional funding to boost SNAP advantages and lengthen the Pandemic Digital Profit Switch (P-EBT) program, which helps households with youngsters who would have acquired free or reduced-price meals if faculties have been open.69 Many states additionally quickly waived sure eligibility necessities to make sure extra households might entry help in the course of the disaster.70 SNAP advantages have been completely raised beginning in October 2021. Predictably, this led to a rise in SNAP participation, proven in Determine 5. SNAP Whole Prices per individual and family are proven in Desk 8.

Observe: Shaded areas point out intervals of recession.

Supply: College of Kentucky Middle for Poverty Analysis. 2024. “UKCPR Nationwide

| Jurisdiction | Per Family Price | Per Individual Price |

| Alabama | $435.96 | $219.90 |

| Alaska | $795.42 | $375.79 |

| Arizona | $361.48 | $174.67 |

| Arkansas | $358.20 | $181.99 |

| California | $401.06 | $229.80 |

| Colorado | $404.93 | $213.89 |

| Connecticut | $381.69 | $221.79 |

| Delaware | $410.42 | $203.71 |

| District of Columbia | $378.21 | $228.15 |

| Florida | $435.96 | $219.90 |

| Georgia | $353.71 | $175.05 |

| Hawaii | $814.32 | $444.96 |

| Idaho | $335.86 | $167.56 |

| Illinois | $413.02 | $223.18 |

| Indiana | $382.00 | $181.23 |

| Iowa | $323.55 | $161.56 |

| Kansas | $444.47 | $222.42 |

| Kentucky | $367.13 | $168.59 |

| Louisiana | $443.95 | $218.85 |

| Maine | $361.08 | $209.52 |

| Maryland | $387.06 | $210.11 |

| Massachusetts | $391.83 | $237.59 |

| Michigan | $395.21 | $210.33 |

| Minnesota | $510.00 | $260.67 |

| Mississippi | $350.26 | $177.30 |

| Missouri | $383.53 | $190.26 |

| Montana | $322.16 | $165.18 |

| Nebraska | $338.15 | $167.19 |

| Nevada | $371.04 | $195.31 |

| New Hampshire | $389.95 | $209.10 |

| New Jersey | $413.85 | $213.44 |

| New Mexico | $425.47 | $220.95 |

| New York | $412.98 | $239.53 |

| North Carolina | $414.47 | $211.23 |

| North Dakota | $357.22 | $181.36 |

| Ohio | $404.90 | $208.51 |

| Oklahoma | $413.99 | $210.47 |

| Oregon | $362.12 | $208.18 |

| Pennsylvania | $382.18 | $203.41 |

| Rhode Island | $375.96 | $230.74 |

| South Carolina | $423.33 | $207.73 |

| South Dakota | $395.58 | $191.99 |

| Tennessee | $390.08 | $199.40 |

| Texas | $477.44 | $215.42 |

| Utah | $411.65 | $205.34 |

| Vermont | $394.40 | $231.19 |

| Virginia | $418.58 | $215.37 |

| Washington | $370.68 | $212.24 |

| West Virginia | $381.49 | $204.97 |

| Wisconsin | $383.13 | $200.65 |

| Wyoming | $390.20 | $188.13 |

Supply: United States Division of Agriculture, Supplemental Diet Help Program (SNAP). Accessed June 2024.

Particular Supplemental Diet Program for Girls, Infants, and Kids (WIC)

The Particular Supplemental Diet Program for Girls, Infants, and Kids (WIC) is a federal help program administered by the USDA’s Meals and Diet Service (FNS). It gives supplemental meals, well being care referrals, and vitamin schooling to low-income pregnant, breastfeeding, and postpartum girls, in addition to infants and kids as much as age 5 who’re discovered to be at dietary danger.71

WIC funding primarily comes from federal sources, with annual appropriations figuring out the funding ranges. Though the appropriations committees usually guarantee ample funds to cowl all eligible members, some states additionally complement federal funds with their very own sources.72 The funding course of consists of system grants to states, allotted primarily based on standards such because the earlier yr’s operational ranges and changes for inflation. WIC additionally features a contingency fund to deal with surprising shortfalls or will increase in participation.73

This system’s advantages embrace vouchers for particular meals objects akin to toddler system, fruits, greens, complete grains, and dairy merchandise.74 Since 2017, a number of vital updates have been made to the Particular Supplemental Diet Program for Girls, Infants, and Kids (WIC) to boost its dietary choices and align with modern dietary tips.75

One of many main updates got here from the US Division of Agriculture’s Meals and Diet Service (FNS) in 2024. These updates aimed to offer WIC members with a broader number of meals that meet the newest dietary science and assist wholesome dietary patterns. The revisions included rising the variability and variety of vegetables and fruit, increasing whole- Moreover, canned fish and beans are actually included in additional meals packages, and there’s elevated flexibility within the quantity of toddler system offered to partially breastfed infants.76, 77

Given these updates, spending on WIC has dramatically elevated. The FY 2023 “Meals and Diet Help Panorama” Annual Report by the USDA discovered that spending on food-assistance applications (together with SNAP and WIC) decreased in FY 2023 however remained larger than spending in years earlier than 2020. WIC spending in 2020 totaled $6.6 billion, reflecting a rise in program participation and meals price will increase. Spending decreased in FY 2023 largely attributable to decrease spending on Pandemic Digital Profit Switch (P-EBT).79 WIC members are proven in Determine 6.

Observe: Shaded areas point out intervals of recession.

Supply: College of Kentucky Middle for Poverty Analysis. 2024. “UKCPR Nationwide Welfare Information, 1980-2022.” URL: http://ukcpr.org/sources/national-welfare-data (accessed June 1, 2024)

Analysis has additionally proven that the WIC program has a big impression on the toddler system market. Oliveira, eta al. discovered that “A lot of the enhance in market share is the direct impact of recipients buying the brand new WIC model, however spillover results additionally enhance gross sales of the model to non-WIC prospects.”80 The WIC advantages by state are proven in Desk 9.

| Jurisdiction | Common Month-to-month Advantages per Recipient | Annual Profit | Advantages for a Household with 2 Kids |

| Alabama | $53.36 | $640.27 | $1,280.54 |

| Alaska | $69.34 | $832.06 | $1,664.12 |

| Arizona | $49.01 | $588.13 | $1,176.27 |

| Arkansas | $52.55 | $630.55 | $1,261.10 |

| California | $64.07 | $768.84 | $1,537.68 |

| Colorado | $52.13 | $625.58 | $1,251.17 |

| Connecticut | $58.58 | $703.00 | $1,406.00 |

| Delaware | $39.37 | $472.40 | $944.80 |

| District of Columbia | $39.57 | $474.88 | $949.75 |

| Florida | $61.93 | $743.10 | $1,486.20 |

| Georgia | $51.79 | $621.46 | $1,242.92 |

| Hawaii | $67.93 | $815.17 | $1,630.35 |

| Idaho | $47.60 | $571.14 | $1,142.28 |

| Illinois | $58.44 | $701.28 | $1,402.56 |

| Indiana | $48.03 | $576.35 | $1,152.70 |

| Iowa | $53.80 | $645.62 | $1,291.24 |

| Kansas | $49.83 | $597.98 | $1,195.96 |

| Kentucky | $51.15 | $613.74 | $1,227.49 |

| Louisiana | $50.92 | $610.98 | $1,221.97 |

| Maine | $51.01 | $612.06 | $1,224.13 |

| Maryland | $53.99 | $647.86 | $1,295.73 |

| Massachusetts | $54.82 | $657.79 | $1,315.59 |

| Michigan | $49.83 | $597.92 | $1,195.84 |

| Minnesota | $54.31 | $651.71 | $1,303.41 |

| Mississippi | $48.32 | $579.88 | $1,159.75 |

| Missouri | $43.51 | $522.15 | $1,044.31 |

| Montana | $50.37 | $604.39 | $1,208.78 |

| Nebraska | $46.95 | $563.43 | $1,126.86 |

| Nevada | $50.84 | $610.06 | $1,220.13 |

| New Hampshire | $44.63 | $535.51 | $1,071.01 |

| New Jersey | $76.32 | $915.88 | $1,831.75 |

| New Mexico | $51.97 | $623.62 | $1,247.24 |

| New York | $73.25 | $879.01 | $1,758.02 |

| North Carolina | $47.91 | $574.92 | $1,149.84 |

| North Dakota | $56.90 | $682.80 | $1,365.60 |

| Ohio | $55.63 | $667.56 | $1,335.12 |

| Oklahoma | $44.19 | $530.26 | $1,060.52 |

| Oregon | $47.83 | $573.99 | $1,147.98 |

| Pennsylvania | $57.44 | $689.25 | $1,378.50 |

| Rhode Island | $51.67 | $620.08 | $1,240.16 |

| South Carolina | $49.65 | $595.85 | $1,191.70 |

| South Dakota | $47.37 | $568.48 | $1,136.97 |

| Tennessee | $44.74 | $536.84 | $1,073.68 |

| Texas | $46.01 | $552.14 | $1,104.28 |

| Utah | $58.90 | $706.77 | $1,413.54 |

| Vermont | $48.85 | $586.18 | $1,172.37 |

| Virginia | $46.64 | $559.72 | $1,119.45 |

| Washington | $48.15 | $577.81 | $1,155.62 |

| West Virginia | $44.78 | $537.42 | $1,074.84 |

| Wisconsin | $38.58 | $462.95 | $925.89 |

| Wyoming | $50.75 | $609.00 | $1,218.00 |

Sources: U.S. Division of Agriculture, Particular Supplemental Diet Program for Girls, Infants, and Kids (WIC)

The Emergency Meals Help Program (TEFAP)

The Emergency Meals Help Program (TEFAP) provides meals to low-income people, providing assist each on to households for residence consumption and not directly by way of businesses that distribute ready meals. Eligibility standards for residence consumption are decided by every state, with most states utilizing an revenue threshold or contemplating candidates who take part in different means-tested applications akin to SNAP.81

Like different welfare applications, TEFAP spending elevated in the course of the pandemic.82 These further funds allowed TEFAP to buy extra meals and increase its distribution networks. Furthermore, TEFAP launched flexibility in its operations to accommodate social distancing and different public well being tips. This included the implementation of drive-through meals distribution occasions and residential supply providers to attenuate bodily contact and scale back the danger of virus transmission.83

Whereas TEFAP participation information should not accessible, TEFAP provides estimated weekly and month-to-month meals prices lined primarily based on the age and intercourse of recipients. These quantities are proven in Desk 10.

This paper estimates the price of meals for a household with a mom aged 20-50 years ($242.20) with two youngsters aged 6-8 years previous ($199.40 every) for a month-to-month price estimated at $641 and an annual price estimated at $7,692.

| Group | Age | Weekly Price | Month-to-month Price |

| Little one | 1 yr | $25.20 | $109.20 |

| 2-3 years | $37.90 | $164.40 | |

| 4-5 years | $41.30 | $179.00 | |

| 6-8 years | $46.00 | $199.40 | |

| 11th of September years | $53.20 | $230.70 | |

| Male | 12-13 years | $56.90 | $246.70 |

| 14-19 years | $71.80 | $311.10 | |

| 20-50 years | $70.10 | $303.60 | |

| 51-70 years | $61.80 | $267.90 | |

| 71+ years | $58.90 | $255.40 | |

| Feminine | 12-13 years | $49.20 | $213.20 |

| 14-19 years | $57.10 | $247.20 | |

| 20-50 years | $55.90 | $242.30 | |

| 51-70 years | $51.90 | $225.10 | |

| 71+ years | $57.20 | $248.00 |

Sources: U.S. Division of Agriculture, USDA Meals Plans: Month-to-month Price of Meals Reviews

Lifeline Program for Low-Earnings Customers and the Reasonably priced Connectivity Program (ACP)

The Lifeline Program was established to offer cellphone and web service to low-income households. Anybody already enrolled in Medicaid, SNAP, Rental Help (in addition to different applications not included on this paper) is robotically eligible.84 If the applicant’s family revenue is at or under 135 p.c of the poverty, she or he can also be eligible for lifeline. This system provides a service low cost of $9.25 per 30 days for cellphone and/or web service.

Carried out in the course of the COVID-19 pandemic, the Reasonably priced Connectivity Program (ACP) aimed to offer subsidies for broadband entry to low-income households. Each Lifeline and ACP are grouped collectively as a result of if a recipient was enrolled in Lifeline, she or he was robotically certified for the ACP.85 This program supplied $30 per 30 days for qualifying households.86 Winfree (2024) notes that this system has inadvertently led to larger prices for low-speed web plans.87 Moreover, broadband suppliers have adjusted their pricing methods to seize extra of the subsidy offered to low-income households, thus rising the general price burden on these customers.88 Winfree (2024) prompt phasing out the ACP to stop additional market distortions and rising prices.89

As of the date of enrollment freeze on February 8, 2024, there have been just below 23 million households (roughly 17.5 p.c of all households within the US) enrolled within the ACP.90 These enrolled households acquired ACP protection till the top of this system on June 1, 2024. The FCC notes, nonetheless, that “The ACP has ended for now,” implying that it will likely be introduced again sooner or later.91

Whole Welfare Advantages Throughout the States

Desk 11 reveals these quantities utilizing all of the applications included on this research, which leads to a a lot bigger enhance within the complete worth of welfare profit packages. As with Desk 11, the 1995 quantity is adjusted to 2023 {dollars} whereas the 2013 and 2024 quantities are adjusted for regional value parities (RPPs) by state. Adjusting for RPPs permit for comparisons of buying energy throughout the states and DC. These figures symbolize the quantity of advantages a household consisting of a single father or mother and two dependent youngsters can obtain yearly. As a caveat, whereas it’s possible for a recipient to be enrolled in a number of welfare advantages applications, it’s unlikely for a recipient to be enrolled in all applications mentioned on this paper. Different welfare program mixtures are examined within the subsequent part.

| Jurisdiction | 1995 | 2013 | 2024 | Improve Since 1995 | Improve Since 2013 |

| Alabama | $25,677.12 | $30,470.59 | $48,150.19 | $22,473.07 | $17,679.60 |

| Alaska | $63,601.31 | $34,509.80 | $72,831.32 | $9,230.02 | $38,321.52 |

| Arizona | $27,849.67 | $20,026.14 | $60,779.98 | $32,930.31 | $40,753.84 |

| Arkansas | $26,073.20 | $15,986.93 | $44,942.71 | $18,869.51 | $28,955.78 |

| California | $47,602.61 | $48,575.16 | $76,529.52 | $28,926.90 | $27,954.35 |

| Colorado | $41,281.05 | $19,281.05 | $68,173.45 | $26,892.40 | $48,892.40 |

| Connecticut | $58,465.36 | $58,000.00 | $74,781.21 | $16,315.85 | $16,781.21 |

| Delaware | $42,466.67 | $38,196.08 | $62,972.36 | $20,505.70 | $24,776.28 |

| District of Columbia | $57,477.12 | $66,431.37 | $102,296.24 | $44,819.11 | $35,864.86 |

| Florida | $35,949.02 | $16,470.59 | $54,746.07 | $18,797.05 | $38,275.48 |

| Georgia | $34,368.63 | $18,379.08 | $58,707.58 | $24,338.95 | $40,328.50 |

| Hawaii | $71,896.73 | $79,202.61 | $75,687.55 | $3,790.82 | -$3,515.06 |

| Idaho | $35,552.94 | $14,575.16 | $59,764.03 | $24,211.09 | $45,188.87 |

| Illinois | $38,318.95 | $17,751.63 | $57,269.79 | $18,950.84 | $39,518.16 |

| Indiana | $37,528.10 | $29,934.64 | $62,678.31 | $25,150.20 | $32,743.67 |

| Iowa | $37,528.10 | $18,562.09 | $55,782.36 | $18,254.26 | $37,220.27 |

| Kansas | $34,763.40 | $34,627.45 | $61,910.89 | $27,147.49 | $27,283.44 |

| Kentucky | $33,183.01 | $17,450.98 | $63,360.70 | $30,177.69 | $45,909.72 |

| Louisiana | $33,577.78 | $29,084.97 | $58,947.74 | $25,369.96 | $29,862.77 |

| Maine | $42,664.05 | $18,196.08 | $62,082.31 | $19,418.26 | $43,886.23 |

| Maryland | $45,033.99 | $49,882.35 | $79,020.53 | $33,986.55 | $29,138.18 |

| Massachusetts | $60,243.14 | $66,065.36 | $78,846.84 | $18,603.70 | $12,781.48 |

| Michigan | $38,911.11 | $34,549.02 | $70,922.06 | $32,010.94 | $36,373.04 |

| Minnesota | $41,083.66 | $38,366.01 | $72,853.95 | $31,770.29 | $34,487.94 |

| Mississippi | $22,715.03 | $15,464.05 | $50,308.72 | $27,593.69 | $34,844.67 |

| Missouri | $29,430.07 | $29,803.92 | $55,995.02 | $26,564.95 | $26,191.10 |

| Montana | $32,196.08 | $35,202.61 | $63,848.70 | $31,652.62 | $28,646.08 |

| Nebraska | $31,405.23 | $18,849.67 | $66,415.11 | $35,009.88 | $47,565.43 |

| Nevada | $39,899.35 | $38,980.39 | $79,034.10 | $39,134.76 | $40,053.71 |

| New Hampshire | $45,033.99 | $51,960.78 | $73,738.72 | $28,704.73 | $21,777.93 |

| New Jersey | $52,342.48 | $56,797.39 | $76,381.61 | $24,039.13 | $19,584.23 |

| New Mexico | $36,738.56 | $36,470.59 | $57,919.88 | $21,181.32 | $21,449.29 |

| New York | $53,922.88 | $57,124.18 | $78,784.65 | $24,861.78 | $21,660.47 |

| North Carolina | $33,183.01 | $33,673.20 | $57,394.06 | $24,211.06 | $23,720.86 |

| North Dakota | $34,763.40 | $37,686.27 | $65,374.23 | $30,610.83 | $27,687.95 |

| Ohio | $34,368.63 | $34,248.37 | $71,585.16 | $37,216.53 | $37,336.79 |

| Oklahoma | $34,960.78 | $29,385.62 | $48,601.90 | $13,641.11 | $19,216.28 |

| Oregon | $37,924.18 | $44,836.60 | $69,494.65 | $31,570.47 | $24,658.05 |

| Pennsylvania | $38,911.11 | $37,477.12 | $58,351.37 | $19,440.26 | $20,874.25 |

| Rhode Island | $51,552.94 | $56,640.52 | $81,558.92 | $30,005.98 | $24,918.40 |

| South Carolina | $31,998.69 | $28,640.52 | $63,561.41 | $31,562.72 | $34,920.89 |

| South Dakota | $34,171.24 | $34,784.31 | $61,721.04 | $27,549.80 | $26,936.73 |

| Tennessee | $27,060.13 | $15,843.14 | $49,340.63 | $22,280.50 | $33,497.50 |

| Texas | $30,023.53 | $16,405.23 | $62,030.58 | $32,007.05 | $45,625.35 |

| Utah | $39,305.88 | $18,235.29 | $70,437.58 | $31,131.70 | $52,202.29 |

| Vermont | $41,281.05 | $55,359.48 | $60,631.23 | $19,350.18 | $5,271.75 |

| Virginia | $45,627.45 | $19,437.91 | $82,633.43 | $37,005.98 | $63,195.52 |

| Washington | $40,886.27 | $37,699.35 | $75,161.84 | $34,275.56 | $37,462.49 |

| West Virginia | $30,023.53 | $32,549.02 | $55,991.99 | $25,968.46 | $23,442.97 |

| Wisconsin | $38,318.95 | $19,464.05 | $66,956.23 | $28,637.27 | $47,492.17 |

| Wyoming | $37,726.80 | $42,640.52 | $61,174.96 | $23,448.17 | $18,534.44 |

Notes: The quantity this hypothetical household of three would obtain from the EITC on this situation relies on the utmost quantity of revenue this household might earn whereas nonetheless remaining absolutely eligible for TANF for the utmost time of 25 months.. Virginia earned revenue relies upon the TANF eligibility by way of the VIEW program. VIEW recipients are topic to a 24-month restrict on TANF advantages adopted by a 24-month interval of ineligibility. If a recipient participates in VIEW after his or her interval of ineligibility is over, she or he might earn $1,830 and stay eligible. The quantity proven within the desk applies to recipients who acquired an extension or exemption to the time restrict.

Sources: U.S. Division of Well being and Human Providers, U.S. Division of Agriculture, Middle for Medicare and Medicaid Providers, U.S. Division of Housing and City Growth, Welfare Guidelines Database, Tax Basis, Tanner, Moore, and Hartman (1995), Tanner and Hughes (2013), and Creator’s calculations. Regional value parities (RPPs) by state and metro space from the U.S. Bureau of Financial Evaluation (BEA)

How Does Welfare Pay In comparison with Work?

Tanner and Hughes (2013) discovered that “Welfare at the moment pays greater than a minimum-wage job in 35 states, even after accounting for the Earned Earnings Tax Credit score, and in 13 states, it pays greater than $15 per hour.”92 The outcomes right here present that welfare at the moment pays greater than a minimal wage job in all 50 states. You will need to be aware right here that the federal minimal wage has not modified since July 2009, making its inflation-adjusted worth decrease over time whereas welfare advantages are adjusted for inflation.93 This holds true when proscribing the applications to these used within the 2013 paper, in addition to in all applications included on this paper. These outcomes additionally account for the Earned Earnings Tax Credit score and Little one Tax Credit score.

Desk 12 compares complete welfare profit packages in every state to the tenth percentile revenue (a proxy for a beginning wage) for every state.

In all 50 states, welfare pays greater than the tenth percentile annual revenue, each earlier than and after taxes.94

| Jurisdiction | Whole Welfare Advantages | Pretax Wage Equal (tenth Percentile) | Payroll Tax | Federal Earnings Tax (Minus Credit) | State Earnings Tax (Minus Credit) | Whole Tax Legal responsibility | After-Tax Earnings |

| Alabama | $48,150.19 | $21,580 | $1,826.06 | -$8,603.40 | $1,903.50 | -$4,873.85 | $26,453.85 |

| Alaska | $72,831.32 | $29,540 | $2,861.10 | -$5,974.20 | $0.00 | -$3,113.10 | $32,653.10 |

| Arizona | $60,779.98 | $29,220 | $2,347.79 | -$6,075.60 | $567.25 | -$3,160.57 | $32,380.57 |

| Arkansas | $44,942.71 | $24,520 | $1,734.26 | -$7,629.60 | $1,976.92 | -$3,918.43 | $28,438.43 |

| California | $76,529.52 | $31,520 | $2,688.21 | -$5,315.60 | $4,818.78 | $2,191.39 | $29,328.61 |

| Colorado | $68,173.45 | $30,520 | $2,727.23 | -$5,645.60 | -$1,423.48 | -$4,341.86 | $34,861.86 |

| Connecticut | $74,781.21 | $29,550 | $2,844.27 | -$5,963.00 | $3,331.10 | $212.37 | $29,337.63 |

| Delaware | $62,972.36 | $26,630 | $2,490.08 | -$6,934.40 | $3,087.85 | -$1,356.48 | $27,986.48 |

| District of Columbia | $102,296.24 | $35,790 | $5,227.25 | -$3,908.20 | $10,522.00 | $11,841.05 | $23,948.96 |

| Florida | $54,746.07 | $25,070 | $2,005.83 | -$7,447.60 | $0.00 | -$5,441.77 | $30,511.77 |

| Georgia | $58,707.58 | $22,830 | $2,164.19 | -$8,190.40 | $1,695.86 | -$4,330.35 | $27,160.35 |

| Hawaii | $75,687.55 | $27,850 | $2,597.94 | -$6,525.00 | $8,592.44 | $4,665.38 | $23,184.62 |

| Idaho | $59,764.03 | $23,530 | $1,947.69 | -$7,959.40 | $1,066.68 | -$4,945.03 | $28,475.03 |

| Illinois | $57,269.79 | $28,370 | $2,515.32 | -$6,356.60 | $1,029.26 | -$2,812.02 | $31,182.02 |

| Indiana | $62,678.31 | $24,810 | $2,103.75 | -$7,531.80 | $623.55 | -$4,804.50 | $29,614.50 |

| Iowa | $55,782.36 | $24,970 | $2,275.88 | -$7,480.60 | $3,307.05 | -$1,897.68 | $26,867.68 |

| Kansas | $61,910.89 | $23,360 | $2,086.16 | -$8,010.80 | $3,104.24 | -$2,820.41 | $26,180.41 |

| Kentucky | $63,360.70 | $22,980 | $1,956.87 | -$8,141.40 | $1,480.80 | -$4,703.73 | $27,683.73 |

| Louisiana | $58,947.74 | $20,680 | $1,864.31 | -$8,714.40 | $1,265.00 | -$5,585.10 | $26,265.10 |

| Maine | $62,082.31 | $29,600 | $2,357.73 | -$5,946.00 | $1,764.75 | -$1,823.52 | $31,423.52 |

| Maryland | $79,020.53 | $28,950 | $2,816.73 | -$6,161.00 | -$1,450.93 | -$4,795.20 | $33,745.20 |

| Massachusetts | $78,846.84 | $33,140 | $3,354.53 | -$4,784.20 | $2,562.50 | $1,132.83 | $32,007.18 |

| Michigan | $70,922.06 | $27,050 | $2,363.85 | -$6,789.00 | $300.85 | -$4,124.30 | $31,174.30 |

| Minnesota | $72,853.95 | $29,020 | $2,613.24 | -$6,141.60 | $4,020.00 | $491.64 | $28,528.37 |

| Mississippi | $50,308.72 | $20,460 | $1,644.75 | -$8,740.80 | $1,588.60 | -$5,507.45 | $25,967.45 |

| Missouri | $55,995.02 | $25,750 | $2,119.82 | -$7,219.00 | $2,558.53 | -$2,540.66 | $28,290.66 |

| Montana | $63,848.70 | $24,540 | $2,112.17 | -$7,627.20 | $1,931.99 | -$3,583.05 | $28,123.05 |

| Nebraska | $66,415.11 | $25,770 | $2,256.75 | -$7,216.60 | $4,201.64 | -$758.21 | $26,528.21 |

| Nevada | $79,034.10 | $23,090 | $2,005.07 | -$8,106.20 | $0.00 | -$6,101.14 | $29,191.14 |

| New Hampshire | $73,738.72 | $28,360 | $2,548.98 | -$6,357.80 | $0.00 | -$3,808.82 | $32,168.82 |

| New Jersey | $76,381.61 | $29,090 | $2,790.72 | -$6,123.20 | $2,072.67 | -$1,259.81 | $30,349.81 |

| New Mexico | $57,919.88 | $24,330 | $1,935.45 | -$7,694.40 | -$14.05 | -$5,773.00 | $30,103.00 |

| New York | $78,784.65 | $31,200 | $2,897.06 | -$5,417.00 | $2,060.60 | -$459.35 | $31,659.35 |

| North Carolina | $57,394.06 | $22,960 | $2,081.57 | -$8,143.80 | $1,307.70 | -$4,754.54 | $27,714.54 |

| North Dakota | $65,374.23 | $28,250 | $2,509.97 | -$6,392.00 | $639.80 | -$3,242.24 | $31,492.24 |

| Ohio | $71,585.16 | $24,650 | $2,306.48 | -$7,132.00 | -$750.88 | -$5,576.40 | $30,226.40 |

| Oklahoma | $48,601.90 | $21,930 | $1,874.25 | -$8,488.40 | $1,317.00 | -$5,297.15 | $27,227.15 |

| Oregon | $69,494.65 | $30,340 | $2,537.51 | -$5,710.20 | $4,076.96 | $904.27 | $29,435.73 |

| Pennsylvania | $58,351.37 | $25,140 | $2,386.04 | -$7,429.20 | $1,405.75 | -$3,637.41 | $28,777.41 |

| Rhode Island | $81,558.92 | $28,330 | $2,659.14 | -$6,372.40 | $398.58 | -$3,314.69 | $31,644.69 |

| South Carolina | $63,561.41 | $22,320 | $1,856.66 | -$8,356.60 | -$6,183.07 | -$12,683.02 | $35,003.02 |

| South Dakota | $61,721.04 | $26,310 | $1,933.16 | -$7,035.80 | $0.00 | -$5,102.65 | $31,412.65 |

| Tennessee | $49,340.63 | $23,180 | $1,937.75 | -$8,074.40 | $0.00 | -$6,136.66 | $29,316.66 |

| Texas | $62,030.58 | $22,710 | $2,207.79 | -$8,225.80 | $0.00 | -$6,018.01 | $28,728.01 |

| Utah | $70,437.58 | $26,200 | $2,285.06 | -$7,070.00 | $706.12 | -$4,078.82 | $30,278.82 |

| Vermont | $60,631.23 | $29,540 | $2,503.08 | -$5,974.20 | -$3,159.18 | -$6,630.30 | $36,170.30 |

| Virginia | $82,633.43 | $26,280 | $2,577.29 | -$7,050.40 | $1,205.68 | -$3,267.44 | $29,547.44 |

| Washington | $75,161.84 | $34,310 | $3,191.58 | -$4,390.80 | -$900.00 | -$2,099.22 | $36,409.22 |

| West Virginia | $55,991.99 | $21,940 | $1,772.51 | -$8,487.20 | $2,360.56 | -$4,354.14 | $26,294.14 |

| Wisconsin | $66,956.23 | $26,240 | $2,375.33 | -$7,065.20 | $2,753.07 | -$1,936.81 | $28,176.81 |

| Wyoming | $61,174.96 | $24,780 | $2,360.03 | -$7,545.40 | $0.00 | -$5,185.38 | $29,965.38 |

Sources: U.S. Division of Well being and Human Providers, U.S. Division of Agriculture, Middle for Medicare and Medicaid Providers, U.S. Division of Housing and City Growth, Federal Communications Fee, Creator’s calculations.

| Rank | Jurisdiction | Whole Welfare Advantages | Pretax Wage Equal (fiftieth Percentile) | Share of Median Earnings |

| 1 | Arkansas | $44,942.71 | $37,270.00 | 120.59% |

| 2 | Illinois | $57,269.79 | $47,480.00 | 120.62% |

| 3 | District of Columbia | $102,296.24 | $82,930.00 | 123.35% |

| 4 | Tennessee | $49,340.63 | $39,930.00 | 123.57% |

| 5 | Oklahoma | $48,601.90 | $39,100.00 | 124.30% |

| 6 | Alabama | $48,150.19 | $38,470.00 | 125.16% |

| 7 | Iowa | $55,782.36 | $44,350.00 | 125.78% |

| 8 | Pennsylvania | $58,351.37 | $45,790.00 | 127.43% |

| 9 | Vermont | $60,631.23 | $47,320.00 | 128.13% |

| 10 | Missouri | $55,995.02 | $42,310.00 | 132.34% |

| 11 | Washington | $75,161.84 | $56,320.00 | 133.45% |

| 12 | Delaware | $62,972.36 | $47,150.00 | 133.56% |

| 13 | Florida | $54,746.07 | $40,820.00 | 134.12% |

| 14 | Arizona | $60,779.98 | $45,290.00 | 134.20% |

| 15 | Wyoming | $61,174.96 | $45,450.00 | 134.60% |

| 16 | Massachusetts | $78,846.84 | $58,450.00 | 134.90% |

| 17 | Colorado | $68,173.45 | $50,250.00 | 135.67% |

| 18 | Maine | $62,082.31 | $45,420.00 | 136.68% |

| 19 | Georgia | $58,707.58 | $42,890.00 | 136.88% |

| 20 | North Carolina | $57,394.06 | $41,810.00 | 137.27% |

| 21 | North Dakota | $65,374.23 | $47,410.00 | 137.89% |

| 22 | Mississippi | $50,308.72 | $36,100.00 | 139.36% |

| 23 | Alaska | $72,831.32 | $52,000.00 | 140.06% |

| 24 | Texas | $62,030.58 | $43,460.00 | 142.73% |

| 25 | Connecticut | $74,781.21 | $51,780.00 | 144.42% |

| 26 | New Mexico | $57,919.88 | $39,900.00 | 145.16% |

| 27 | Oregon | $69,494.65 | $47,770.00 | 145.48% |

| 28 | Wisconsin | $66,956.23 | $45,650.00 | 146.67% |

| 29 | Kansas | $61,910.89 | $41,870.00 | 147.86% |

| 30 | West Virginia | $55,991.99 | $37,770.00 | 148.24% |

| 31 | Indiana | $62,678.31 | $42,100.00 | 148.88% |

| 32 | Idaho | $59,764.03 | $40,060.00 | 149.19% |

| 33 | Minnesota | $72,853.95 | $48,760.00 | 149.41% |

| 34 | New Jersey | $76,381.61 | $51,080.00 | 149.53% |

| 35 | New York | $78,784.65 | $52,470.00 | 150.15% |

| 36 | Nebraska | $66,415.11 | $44,100.00 | 150.60% |

| 37 | Montana | $63,848.70 | $42,210.00 | 151.26% |

| 38 | Louisiana | $58,947.74 | $38,970.00 | 151.26% |

| 39 | Maryland | $79,020.53 | $51,420.00 | 153.68% |

| 40 | California | $76,529.52 | $49,740.00 | 153.86% |

| 41 | New Hampshire | $73,738.72 | $47,920.00 | 153.88% |

| 42 | South Dakota | $61,721.04 | $39,870.00 | 154.81% |

| 43 | Hawaii | $75,687.55 | $48,560.00 | 155.86% |

| 44 | Michigan | $70,922.06 | $45,500.00 | 155.87% |

| 45 | Kentucky | $63,360.70 | $40,180.00 | 157.69% |

| 46 | Utah | $70,437.58 | $44,470.00 | 158.39% |

| 47 | Ohio | $71,585.16 | $44,750.00 | 159.97% |

| 48 | South Carolina | $63,561.41 | $38,870.00 | 163.52% |

| 49 | Rhode Island | $81,558.92 | $49,360.00 | 165.23% |

| 50 | Virginia | $82,633.43 | $48,290.00 | 171.12% |

| 51 | Nevada | $79,034.10 | $40,810.00 | 193.66% |

Sources: U.S. Division of Well being and Human Providers, U.S. Division of Agriculture, Middle for Medicare and Medicaid Providers, U.S. Division of Housing and City Growth, Federal Communications Fee, Creator’s calculations.

In all 50 states, complete welfare advantages pay greater than the state median revenue. If a household does obtain all the advantages measured on this paper (albeit doing so is extremely uncommon) welfare recipients have a large incentive to not work. You will need to be aware, nonetheless, that whereas Desk 13 portrays uncommon situations during which a household could be receiving all advantages measured on this research, most welfare recipients are enrolled in a number of applications. This part will even look at a number of different situations of welfare profit distribution. That distribution relies on the most definitely mixtures of advantages decided by the Workplace of the Assistant Secretary for Planning and Analysis (ASPE).

The primary bundle reveals that of a TANF recipient, who’s most definitely to obtain two or extra applications (together with eligibility for the EITC). Additionally it is essential to notice that, with a TANF recipient extraordinarily more likely to obtain SNAP and Medicaid, the likelihood of receiving housing help and vitality help will increase. As well as, receiving these applications robotically enrolls the recipient for cellphone and web help (each Lifeline and the ACP). The better quantity between complete welfare advantages and a post-tax beginning wage (tenth percentile revenue) is in daring and italics.

| Jurisdiction | TANF | SNAP | Housing | Medicaid | LIHEAP | EITC* | State EITC | Lifeline and ACP | Whole | Beginning Wage |

| Alabama | $2,580.00 | $4,337.79 | $12,429.21 | $6,848.05 | $805.00 | $130.00 | $0.00 | $174.00 | $27,304.05 | $26,453.85 |

| Alaska | $11,076.00 | $4,286.59 | $18,213.92 | $9,083.22 | $1,350.00 | $930.00 | $0.00 | $174.00 | $45,113.73 | $32,653.10 |

| Arizona | $3,336.00 | $4,679.38 | $17,206.24 | $8,921.21 | $1,437.00 | $230.00 | $0.00 | $174.00 | $35,983.83 | $32,380.57 |

| Arkansas | $2,448.00 | $4,538.57 | $11,285.95 | $7,849.95 | $496.00 | $270.00 | $0.00 | $174.00 | $27,062.47 | $28,438.43 |

| California | $11,760.00 | $4,973.63 | $24,321.93 | $8,810.95 | $880.00 | $950.00 | $427.50 | $174.00 | $52,298.01 | $29,328.61 |

| Colorado | $6,708.00 | $4,956.20 | $18,865.80 | $7,629.05 | $465.00 | $510.00 | $127.50 | $174.00 | $39,435.55 | $34,861.86 |

| Connecticut | $9,252.00 | $4,955.81 | $21,212.09 | $9,249.15 | $997.00 | $770.00 | $177.10 | $174.00 | $46,787.15 | $29,337.63 |

| Delaware | $4,056.00 | $4,858.85 | $18,860.80 | $9,877.08 | $1,451.00 | $590.00 | $26.55 | $174.00 | $39,894.28 | $27,986.48 |

| District of Columbia | $7,980.00 | $4,682.35 | $26,829.60 | $12,871.12 | $1,174.00 | $870.00 | $609.00 | $174.00 | $55,190.07 | $23,948.96 |

| Florida | $3,636.00 | $4,580.24 | $17,776.19 | $6,124.24 | $1,327.00 | $330.00 | $0.00 | $174.00 | $33,947.67 | $30,511.77 |

| Georgia | $3,360.00 | $5,231.52 | $14,494.99 | $5,830.17 | $965.00 | $270.00 | $0.00 | $174.00 | $30,325.68 | $27,160.35 |

| Hawaii | $7,320.00 | $4,511.54 | $27,324.00 | $7,246.82 | $2,398.00 | $570.00 | $114.00 | $174.00 | $49,658.36 | $23,184.62 |

| Idaho | $3,708.00 | $4,925.05 | $14,005.96 | $7,827.38 | $357.00 | $390.00 | $0.00 | $174.00 | $31,387.40 | $28,475.03 |

| Illinois | $6,588.00 | $4,742.50 | $12,118.45 | $8,731.45 | $940.00 | $870.00 | $174.00 | $174.00 | $34,338.40 | $31,182.02 |

| Indiana | $3,456.00 | $6,120.02 | $12,665.35 | $9,389.60 | $536.00 | $810.00 | $81.00 | $174.00 | $33,231.97 | $29,614.50 |

| Iowa | $5,112.00 | $5,333.69 | $11,475.08 | $8,489.98 | $792.00 | $510.00 | $76.50 | $174.00 | $31,963.25 | $26,867.68 |

| Kansas | $5,148.00 | $4,966.22 | $11,721.23 | $10,096.23 | $664.00 | $470.00 | $79.90 | $174.00 | $33,319.58 | $26,180.41 |

| Kentucky | $3,144.00 | $4,332.98 | $12,034.24 | $9,341.50 | $472.00 | $250.00 | $0.00 | $174.00 | $29,748.72 | $27,683.73 |

| Louisiana | $5,808.00 | $4,030.36 | $13,035.68 | $7,657.44 | $1,079.00 | $250.00 | $12.50 | $174.00 | $32,046.97 | $26,265.10 |

| Maine | $7,536.00 | $5,079.90 | $14,301.71 | $10,771.50 | $755.00 | $650.00 | $78.00 | $174.00 | $39,346.12 | $31,423.52 |

| Maryland | $10,344.00 | $4,967.85 | $21,095.90 | $9,554.73 | $851.00 | $490.00 | $137.20 | $174.00 | $47,614.68 | $33,745.20 |

| Massachusetts | $9,024.00 | $4,597.59 | $25,099.77 | $11,879.30 | $1,344.00 | $690.00 | $207.00 | $174.00 | $53,015.67 | $32,007.18 |

| Michigan | $5,904.00 | $4,859.19 | $12,743.48 | $7,558.35 | $9.00 | $470.00 | $141.00 | $174.00 | $31,859.02 | $31,174.30 |

| Minnesota | $7,692.00 | $4,577.86 | $13,718.68 | $12,366.61 | $1,105.00 | $1,070.00 | $267.50 | $174.00 | $40,971.65 | $28,528.37 |

| Mississippi | $3,120.00 | $5,327.40 | $12,253.81 | $8,043.59 | $1,830.00 | $190.00 | $0.00 | $174.00 | $30,938.80 | $25,967.45 |

| Missouri | $3,504.00 | $3,865.89 | $11,434.92 | $9,888.68 | $843.00 | $150.00 | $15.00 | $174.00 | $29,875.49 | $28,290.66 |

| Montana | $7,056.00 | $3,882.56 | $12,498.90 | $8,432.28 | $689.00 | $330.00 | $9.90 | $174.00 | $33,072.64 | $28,123.05 |

| Nebraska | $5,820.00 | $5,105.67 | $11,170.30 | $10,653.85 | $872.00 | $710.00 | $71.00 | $174.00 | $34,576.81 | $26,528.21 |

| Nevada | $4,632.00 | $9,545.09 | $17,308.52 | $6,141.03 | $573.00 | $190.00 | $0.00 | $174.00 | $38,563.64 | $29,191.14 |

| New Hampshire | $13,812.00 | $4,732.84 | $18,072.61 | $10,383.05 | $1,342.00 | $930.00 | $0.00 | $174.00 | $49,446.50 | $32,168.82 |

| New Jersey | $6,708.00 | $4,680.95 | $23,746.97 | $10,200.78 | $571.00 | $450.00 | $180.00 | $174.00 | $46,711.70 | $30,349.81 |

| New Mexico | $5,364.00 | $4,584.00 | $13,038.98 | $8,331.67 | $524.00 | $410.00 | $102.50 | $174.00 | $32,529.15 | $30,103.00 |

| New York | $9,468.00 | $5,022.99 | $17,611.86 | $10,884.16 | $1,239.00 | $590.00 | $177.00 | $174.00 | $45,167.00 | $31,659.35 |

| North Carolina | $3,264.00 | $4,405.52 | $14,240.57 | $8,880.73 | $335.00 | $270.00 | $0.00 | $174.00 | $31,569.82 | $27,714.54 |

| North Dakota | $5,832.00 | $4,448.12 | $12,230.35 | $12,535.35 | $1,171.00 | $270.00 | $0.00 | $174.00 | $36,660.82 | $31,492.24 |

| Ohio | $6,504.00 | $4,203.16 | $12,022.64 | $9,508.21 | $312.00 | $530.00 | $159.00 | $174.00 | $33,413.00 | $30,226.40 |

| Oklahoma | $3,504.00 | $4,298.39 | $11,983.70 | $6,985.62 | $691.00 | $330.00 | $16.50 | $174.00 | $27,983.21 | $27,227.15 |

| Oregon | $6,072.00 | $4,746.91 | $17,450.40 | $10,968.75 | $788.00 | $410.00 | $36.90 | $174.00 | $40,646.96 | $29,435.73 |

| Pennsylvania | $4,836.00 | $4,939.81 | $13,688.78 | $12,101.94 | $610.00 | $490.00 | $0.00 | $174.00 | $36,840.52 | $28,777.41 |

| Rhode Island | $8,652.00 | $4,345.42 | $22,148.68 | $9,263.54 | $1,318.00 | $690.00 | $103.50 | $174.00 | $46,695.14 | $31,644.69 |

| South Carolina | $3,696.00 | $4,812.72 | $14,165.22 | $6,150.43 | $1,526.00 | $410.00 | $170.85 | $174.00 | $31,105.21 | $35,003.02 |

| South Dakota | $7,560.00 | $4,644.73 | $12,456.84 | $8,823.99 | $687.00 | $350.00 | $0.00 | $174.00 | $34,696.56 | $31,412.65 |

| Tennessee | $4,644.00 | $5,231.52 | $13,417.62 | $6,933.45 | $1,449.00 | $710.00 | $0.00 | $174.00 | $32,559.59 | $29,316.66 |

| Texas | $3,744.00 | $4,057.82 | $14,206.62 | $8,379.29 | $2,200.00 | $130.00 | $0.00 | $174.00 | $32,891.73 | $28,728.01 |

| Utah | $5,976.00 | $4,452.44 | $14,773.82 | $9,062.77 | $1,056.00 | $430.00 | $0.00 | $174.00 | $35,925.03 | $30,278.82 |

| Vermont | $9,732.00 | $4,701.95 | $16,800.08 | $8,312.50 | $572.00 | $530.00 | $190.80 | $174.00 | $41,013.33 | $36,170.30 |

| Virginia | $7,044.00 | $4,586.10 | $16,860.67 | $10,163.97 | $1,358.00 | $730.00 | $146.00 | $174.00 | $41,062.74 | $29,547.44 |

| Washington | $7,848.00 | $5,729.27 | $18,788.00 | $11,271.91 | $453.00 | $530.00 | $0.00 | $174.00 | $44,794.18 | $36,409.22 |

| West Virginia | $6,504.00 | $9,771.86 | $11,761.13 | $8,246.74 | $479.00 | $370.00 | $0.00 | $174.00 | $37,306.73 | $26,294.14 |

| Wisconsin | $7,566.00 | $4,244.50 | $12,597.67 | $8,179.34 | $432.00 | $0.00 | $0.00 | $174.00 | $33,193.50 | $28,176.81 |

| Wyoming | $9,372.00 | $4,602.37 | $13,790.82 | $8,995.54 | $593.00 | $550.00 | $0.00 | $174.00 | $38,077.73 | $29,965.38 |