In a big improvement for the mortgage broking sector, Melbourne-based dealer Sadish Visvalingam has efficiently refinanced greater than $20 million in loans by utilising an Synthetic Intelligence-powered digital assistant constructed by fintech startup Effi Applied sciences. This achievement demonstrates AI’s potential in mortgage operations and highlights how technological innovation can improve neighborhood outcomes.

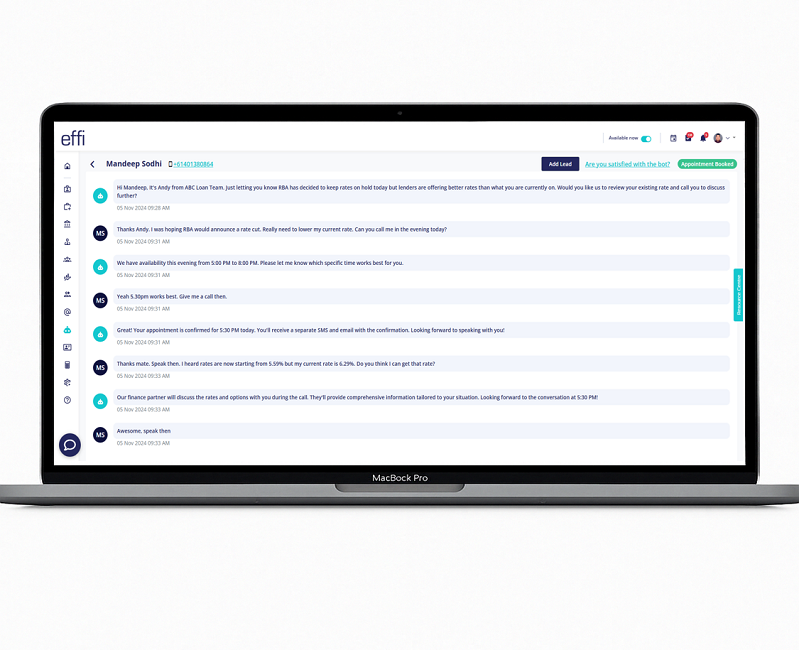

The AI assistant, embedded inside Effi’s broker-centric CRM, autonomously reached out to each present purchasers and leads acquired from area people occasions by way of SMS. It performed clever, conversational interactions and scheduled appointments immediately into Sadish’s calendar — eliminating the necessity for handbook intervention.

“This can be a transformative development,” stated Sadish. “The AI device enabled us to interact extra households with larger effectivity, serving to them safe improved rates of interest and in the end scale back their monetary burden. It’s expertise with a tangible human profit.”

Effi has additionally launched a Voice Agent able to dealing with steadily requested questions, managing post-settlement consumer follow-ups, and executing routine outreach duties. Although nonetheless in its pilot part, the voice bot is displaying early indicators of promise. “We imagine this device will proceed to evolve quickly,” Sadish added. “What it may possibly do now could be spectacular — and it’s solely going to get higher. It has the potential to redefine how brokers handle consumer relationships.”

To share the advantages of AI integration with friends, Sadish co-hosted a sold-out AI Implementation for Brokers workshop in Melbourne. The coaching session offered sensible training on making use of AI instruments to streamline workflow, enhance compliance, and ship stronger consumer engagement throughout the board.

“AI shouldn’t be right here to interchange brokers,” stated Sadish. “It’s right here to boost what we do — giving us extra time to attach with our purchasers, perceive their wants, and supply strategic, long-term steering.”

To additional help trade adoption, Sadish additionally launched BrokerVsAI, a centered initiative to simplify AI onboarding for brokers in search of to modernize their operations.

With mortgage brokers now accounting for 76% of the Australian house mortgage market, this evolution represents greater than a pattern — it’s a shift towards smarter, extra client-focused broking practices. Visionaries like Sadish Visvalingam are proving that the way forward for mortgage broking isn’t just digital — it’s clever, empathetic, and community-driven.