With international cues driving the dynamics of the home markets, buyers want to make sure that they don’t miss out on the diversification, whereas preserving the allocation inside cheap ranges. ‘Mom Market’ is anticipated to see some volatility due to the noisy Trump administration, in accordance with Kalpen Parekh, chief govt officer of DSP Mutual Fund.

“Most market members want to Trump. We are able to count on noisy administration for a few years, as narratives of de-globalisation are already rising. We’ve got been beneficiaries of worldwide markets, however the language that US is talking is certain to create extra volatility,” he mentioned.

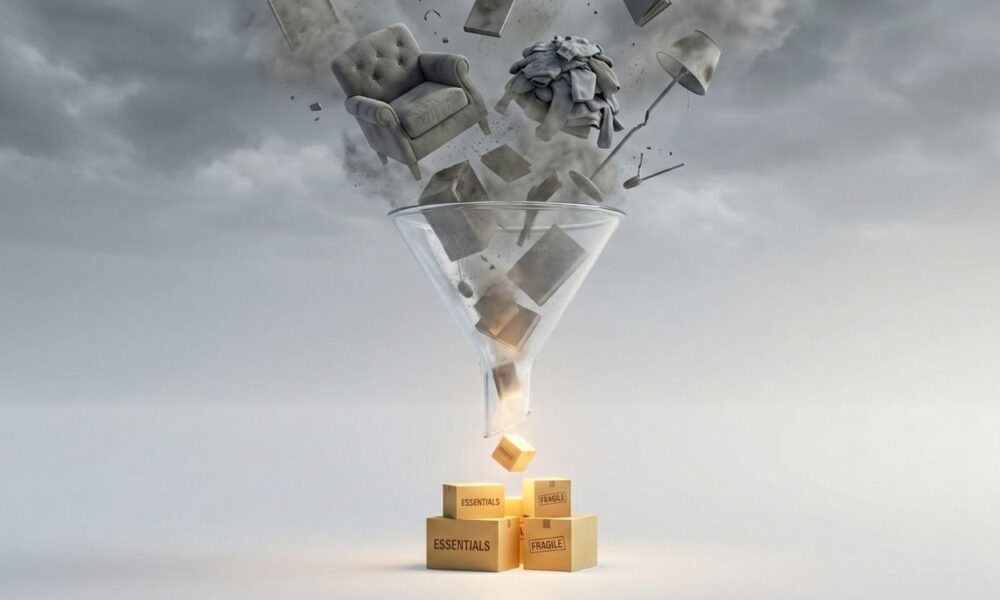

The volatility will not be restricted to sure markets, commodities or foreign money, however is to be anticipated throughout these asset lessons. Now, buyers might want to discover methods to navigate the volatility and accommodate these actions through diversification.

“Multi-asset funds will purchase Indian equities, international markets and commodities. The fund rebalancing can have tax profit as effectively when in comparison with doing it your self. A well-managed balanced benefit fund is my bias however you would equally do it your self,” mentioned Parekh.

This mentioned, he highlights the necessity to stay via stormy climate generally and even conditions the place multi-asset funds underperform.