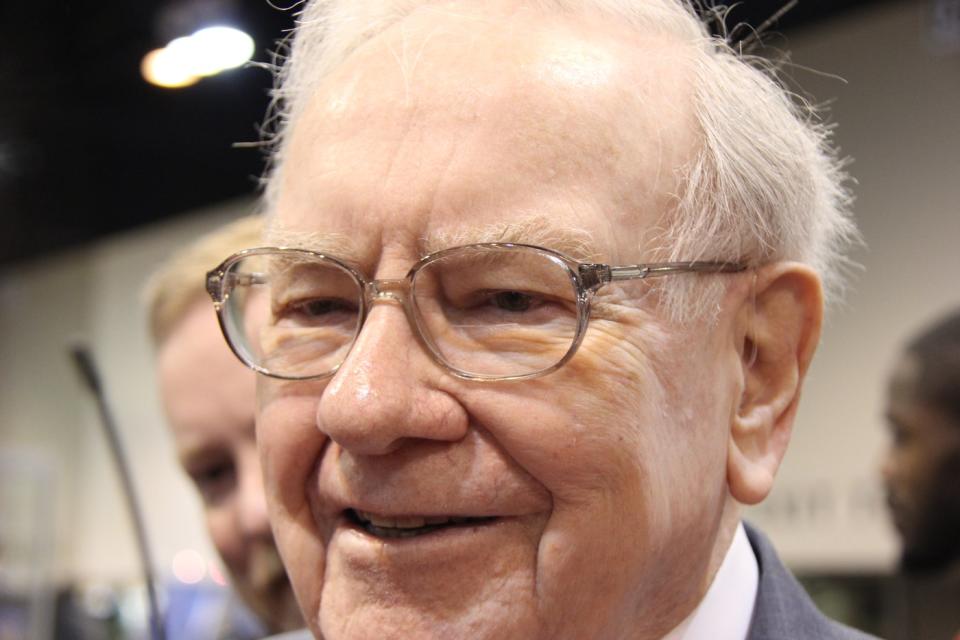

Coca-Cola (NYSE: KO) shouldn’t be the most important place in Warren Buffett’s portfolio, but it surely is among the billionaire’s favorites — and one which probably will stay there at present ranges.

Buffett began shopping for shares of the world’s greatest nonalcoholic beverage maker in 1987 and continued including to the place for a interval of seven years. These 400 million shares have not budged since. In reality, he has even described his holding on to Coca-Cola as “a Rip Van Winkle slumber.”

Buffett, recognized to drink a number of cans of Coke a day, clearly loves the product, and he additionally loves the truth that others really feel the identical method, too. This model power gives the corporate a moat, or aggressive benefit, a key factor Buffett appears for in an organization. On prime of this, the beverage large has grown earnings over time and rewards buyers with dividends.

For these causes, Coca-Cola is probably going right here to remain in its place within the Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) portfolio. But it surely may not be the one inventory to win Buffett’s everlasting loyalty. In reality, a inventory that he simply diminished his place in might truly be part of Coke as one in all Berkshire Hathaway’s “without end” holdings. My prediction is that this inventory will grow to be Buffett’s subsequent Coca-Cola …

Buffett not too long ago offered some shares of this inventory

So, which inventory am I speaking about? Effectively, it is one other firm that is a family title, although it operates within the expertise trade moderately than the beverage sector: Apple (NASDAQ: AAPL).

However wait a minute, you may be saying, Buffett offered a few of his shares within the iPhone maker throughout the second quarter. Is not {that a} dangerous signal?

Not essentially. On the Berkshire Hathaway annual assembly in Could, Buffett signaled that his Apple gross sales are linked to locking within the present 21% capital beneficial properties tax fee, and never attributable to a lack of religion within the firm. He expects the tax fee to go up, contemplating the present measurement of the federal deficit. Even counting the sale of 49% of his Apple place, Buffett mentioned it’s “extraordinarily probably” that on the finish of the 12 months, it is going to be Berkshire’s largest common-stock holding.

The current sale in Apple brings the holding right down to 400 million shares. Sound acquainted? That is the identical variety of shares Berkshire holds in Coca-Cola. This, after all, is an fascinating element to level out, however I am not basing my prediction on it. I’ve a stronger argument for why Buffett might view Apple as his subsequent Coca-Cola.

A “good CEO”

And this has to do along with his confidence in the best way the corporate is run and its stable earnings file. In Buffett’s 2021 shareholder letter, he referred to Tim Prepare dinner as Apple’s “good CEO” and praised his choice to repurchase Apple shares. Share buybacks enhance the possession of present holders with out them paying a dime.

These repurchases helped Berkshire enhance its holding from 5.2% of Apple in 2018, when it accomplished its purchases of the inventory, to five.4% by 2020. Berkshire began shopping for Apple shares again in 2016.

Prepare dinner’s experience additionally has guided Apple alongside the trail of double-digit earnings progress over the previous 5 years. And, like Coca-Cola, Apple has a major moat, with customers of the iPhone flocking to the corporate every time a brand new model is launched. Final 12 months, for the primary time ever, Apple gained the highest seven spots on the record of the top-selling smartphones that is compiled by Counterpoint, a expertise market analysis agency.

An “enduring moat”

“A really nice enterprise will need to have an everlasting ‘moat’ that protects glorious returns on invested capital,” Buffett wrote in his 2007 letter to shareholders, emphasizing the significance of this when selecting investments.

Lastly, yet one more factor about Apple might assist it grow to be the “second Coca-Cola” within the Berkshire Hathaway portfolio: the corporate’s dedication to dividends. Berkshire Hathaway has averaged about $775 million yearly in Apple dividends since 2018.

Expertise firms aren’t recognized to pay out super dividends since they make investments rather a lot again into progress, so Apple’s dividend is not the most important on the block. However the firm has steadily paid one since 2012. And at $1 per share yearly, for a dividend yield of 0.4%, it is a sexy a part of the whole package deal.

All of this prompts me to foretell that, like Coca-Cola, Apple will probably be a everlasting fixture within the Berkshire Hathaway portfolio. And due to its sturdy earnings observe file, sturdy moat, and dividend coverage, this tech inventory makes an ideal addition to any portfolio needing the incredible mixture of progress and security.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Apple wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $729,857!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 9, 2024

Adria Cimino has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple and Berkshire Hathaway. The Motley Idiot has a disclosure coverage.

Prediction: This Inventory Will Change into Warren Buffett’s Subsequent Coca-Cola was initially printed by The Motley Idiot