sukumolnunt/iStock via Getty Images

PIMCO Dynamic Income Opportunities Fund (NYSE:PDO), traded on the NYSE exchange, is one of the largest closed-end funds, or CEFs, that PIMCO manages in terms of total assets under management. We have a number of income-oriented investors in our investing group, and were asked about our thoughts on this fund. The investigation into the fund, its makeup, its NAV, its dismal performance, sky-high managing fees (expense ratio), and pending catalysts, leads us to the conclusion that on future weakness, we believe the fund is finally a buy.

The primary reason for this assertion is that we expect NAV appreciation beginning later this year when interest rates are cut. This comes with one key caveat. Rate cuts alone do not guarantee NAV appreciation. The circumstances will matter. If interest rates are slashed because we have fallen into recession, the increased risk of defaults on debt could outweigh any benefit of lower treasury yields, causing the fund’s value to actually decline. We view the more likely scenario as rate cuts in an environment where inflation continues to fall and settle out while the economy experiences a bit of a slowdown without much of a recession, if any. In this case, the fund’s holdings will likely appreciate in value. Let us discuss.

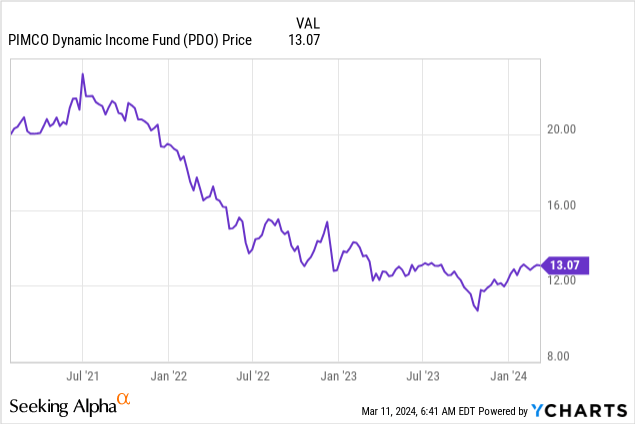

For the many investors who have bought into this fund, its huge draw, like many other PIMCO funds, is the significant yield, and monthly cash flow generated from holding this closed-end fund. However, performance has been dismal. That said, the fund started to pick up in November, rallying with the market, but more notably interest rates that calmed down. Of course, rates perked back up in early 2024, and that added some pressure, but the price has stabilized in the $12-$13 range largely speaking.

It is true that many who bought in during 2021 or 2022 are underwater here. Of course it really depends too on how the dividends are used. Some are reinvesting looking for compounding, in which case if our thesis holds, those paper losses are likely to turn into gains. And depending on cost basis, if you have been pocketing the dividend, it’s possible you have collected enough to be even.

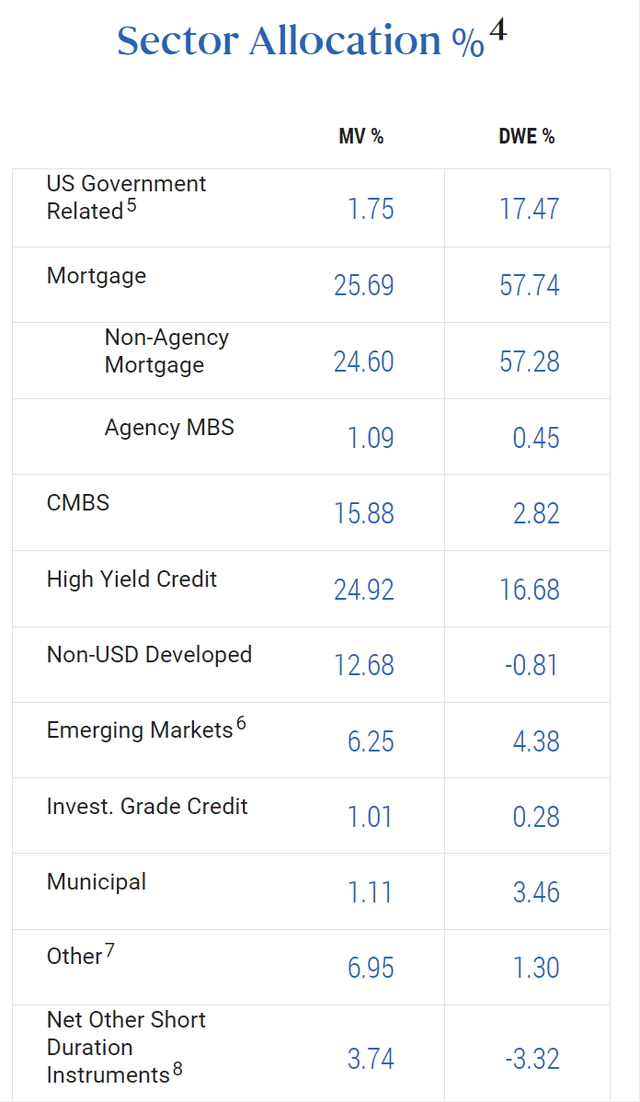

So let’s talk a little about the fund’s holdings and structure. For those familiar with PDO, this is a bit of review, but for our many followers who may be finding this CEF for the first time, it is important to have an understanding of what you are buying exposure to. PDO has numerous holdings and is a diversified portfolio of credit instruments. A large portion of the assets are in mortgage-backed securities, which are primarily residential in nature. PIMCO also uses a dynamic asset allocation strategy across multiple fixed-income sectors. There is flexibility and the investments made are impacted by changing market conditions, management’s valuation assessments, trends in the economic outlook, movements in the credit market trends and more.

There is also a focus on emerging markets, but the United States makes up more than three-quarters of the geographic exposure. Further, PIMCO has sought to look for special situations in distressed assets. So, if rates are cut because of an economy that has fallen off the map, this approach can lead to losses from defaults. Something to keep in mind on the risk front.

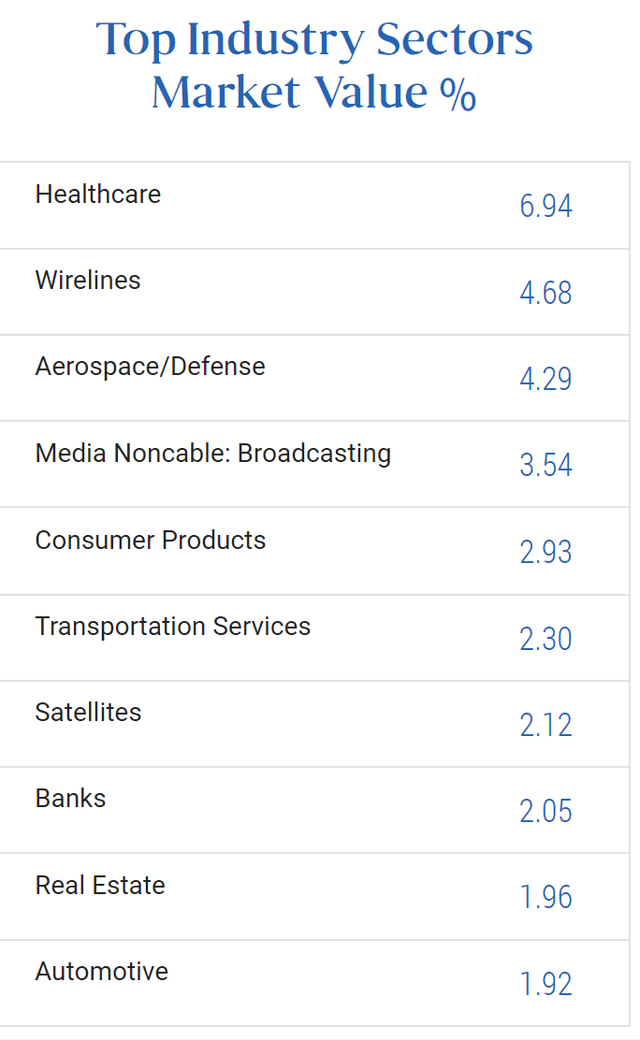

Health care and wireline investments make up 10% of the sector exposure.

PIMCO Portfolio Composition

In terms of where investments are made, as you can see mortgage-backed securities comprise 25% of the allocation, as does high-yield debt. There is commercial mortgage-backed security risk here as well. The commercial space has been one of concern and continues to be something the market monitors.

PIMCO portfolio composition

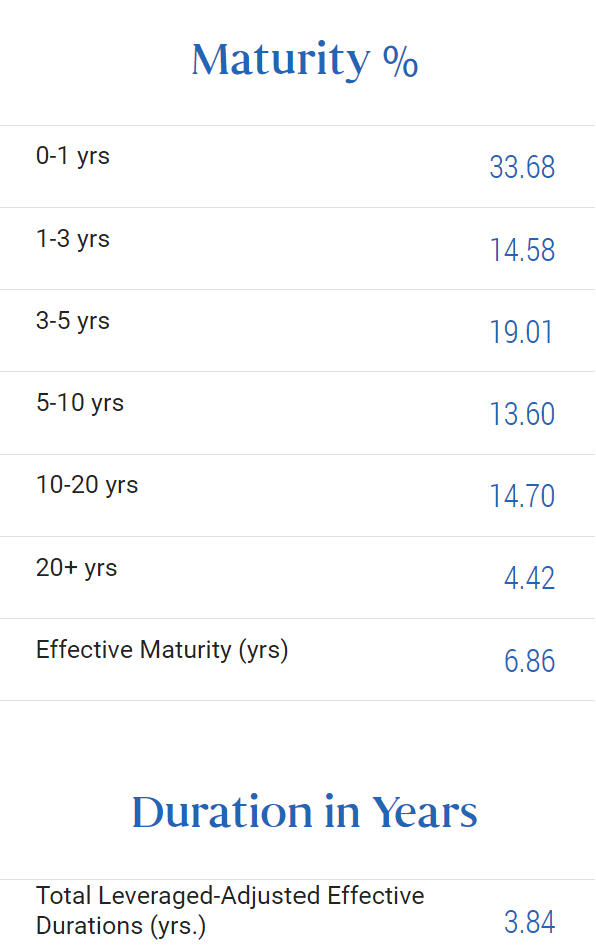

A note here is worth explaining, the two categories MV and DWE. MV is market value of the portfolio. The DWE duration weighted exposure. The shorter the duration, the less the exposure should be impacted by movement in rates. The overall maturity on the whole portfolio is 3.84%.

PIMCO portfolio composition

As you can see, one-third of the portfolio has a maturity of less than one year. However, nearly 20% is also ten years plus. What we like about the fund is that with one-third of the portfolio having such a short maturity, it does allow management to quickly make changes based on shifting trends in the market. Still, that flexibility was not enough to offset the hit to holdings that took place from 2021-2023. That said, we see things improving going forward. Rate hikes are over. Cuts are the precipice. In our opinion, it is not a matter of ‘if’ the funds NAV will improve, but when, barring a significant recession.

There is another nuance to be aware of here as well. While it is still almost a decade away, this fund is a limited-term fund. What this means is that the fund is going to be dissolved. You can read more about this in the detailed prospectus from February. PIMCO intends to terminate this fund as of “the first business day following the twelfth anniversary of the effective date of the Fund’s initial registration statement, which the Fund currently expects to occur on or about January 27, 2033.” This can be avoided if there is a tender offer at NAV to make this a permanent fund, but investors should be prepared for dissolution.

Like other PIMCO funds, the distribution coverage is lacking. This creates a rift and debate between dividends and the impact of return of capital classifications. While that is a broader discussion beyond the scope of this introduction to PDO, it is worth pointing out. That said, compared to other funds we have looked at from PIMCO, the coverage is among the highest ranks.

The other wrinkle with this fund is the stretched management fee/expense ratio to run the fund. On the one hand, you are paying up for a team to do all of this work. On the other, you not only are paying a management fee but also have hefty fees to acquire the leverage (i.e. interest expense). Right now it is 5.75% adding all of these up. Why does this matter? All things being equal to a fund that does similar work but has lower feeds, PIMCO would need to outperform to the point of covering the difference in the expense ratios/management fees to see similar returns.

So why do we rate PDO a buy? Well first, we want to be clear that we think you should wait for a blip on the market to send the price you would pay closer to NAV. NAV is $12.51 right now. Ideally, you buy at a discount. It is possible NAV will grow into the premium, which is currently about 5% here, but patience is required. When you are investing for income, the price you pay is so paramount. While cash flow is king, you still want to avoid principal erosion on paper. There is no guarantee the investment will recover.

In the case of PIMCO Dynamic Income Opportunities Fund, we do see rate cuts coming H2 2024, something we have predicted for over a year. As of now, consensus is June. The cuts are likely to be done because inflation is under far better control, and as of now, the economy is holding up. We see this as a catalyst for PDO’s NAV, and on this basis, we think you buy, with our aforementioned caveats in mind.