How can greater transparency in financial services help improve underwriting, lower risks, and create more opportunities for banks and small businesses alike?

We caught up with Matthew Parker, founder and CEO of ModernTax, to discuss how bringing more transparency to areas of finance like taxation can help credit providers make better decisions.

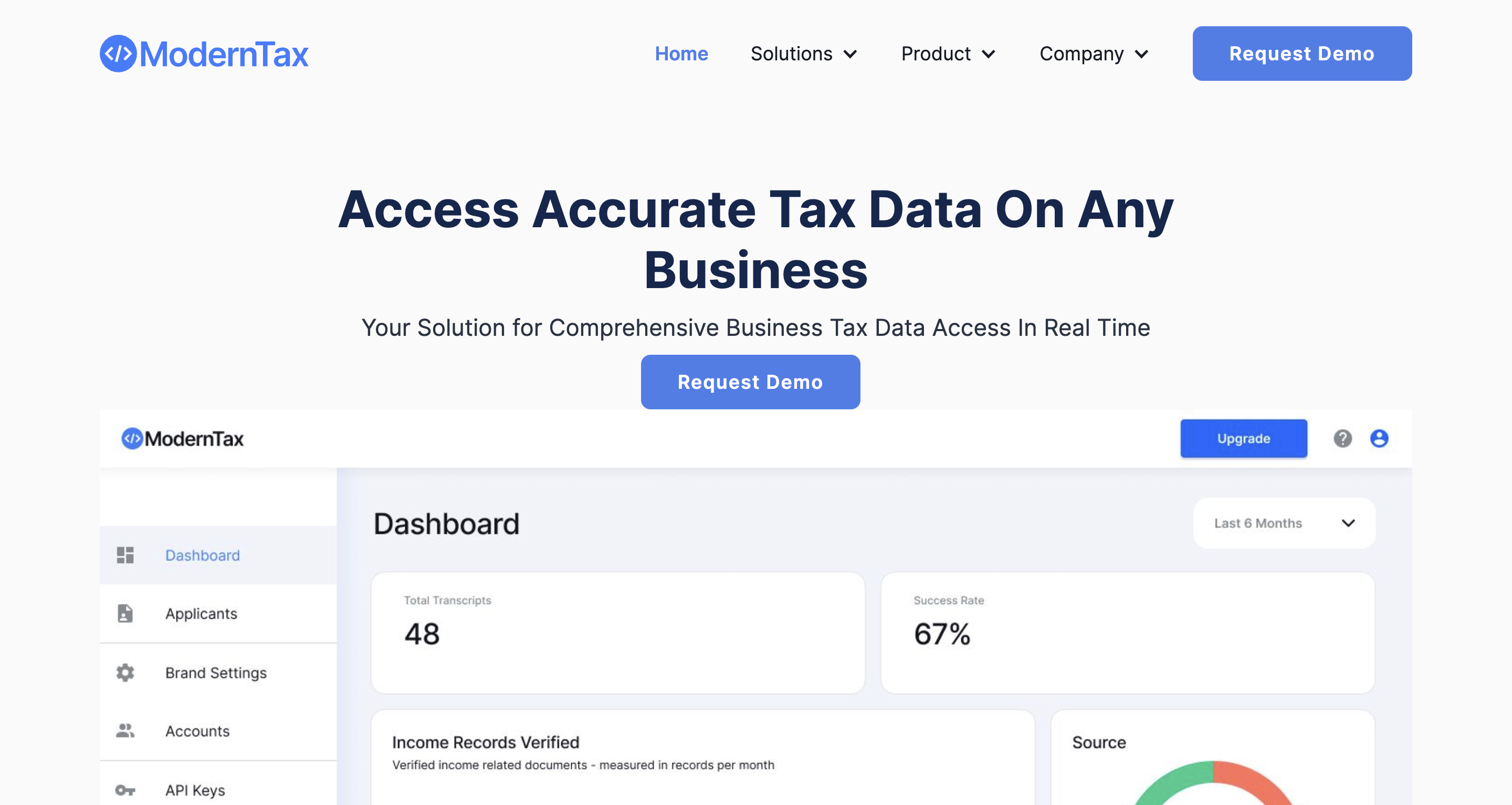

Founded in 2021 and headquartered in San Francisco, California, ModernTax made its Finovate debut earlier this year at FinovateSpring. At the conference, the company demoed its Business Verification Platform and Verifier API, a secure solution that enables fintechs and banks to verify tax records, business standing and KYC data.

Last month, ModernTax launched its Live Contributory Network for on-demand tax verification. The solution connects licensed tax professionals with ModernTax customers to provide on-demand, secure, and reliable tax verification services.

To start off, what is it about taxes that interests you? Of all the areas of finance, what’s special about taxes?

Matthew Parker: My first job out of college was in social services, specifically working in child support. My responsibilities included calculating the combined income of two people with misaligned incentives. This experience opened my eyes to how broken the world of tax, income, and finance can be at the ground level.

A few years later, I worked in consulting, helping banks understand what went wrong with the mortgage crisis. I then stumbled into my first entrepreneurial endeavor: a franchise tax preparation company. Over three years, I grew from one office to five and learned the ins and outs of the tax preparation business.

In 2017, I caught the technology bug and bought a one-way flight to San Francisco with the goal of starting a tax startup that utilized all of the tax data I had been accessing through my tax preparation business as alternative data to underwrite loans.

Six years later, I am building ModernTax to make use of this data to help underwrite, decrease risk, and create a more transparent financial ecosystem for U.S.-based small businesses.

Can you elaborate on that?

Parker: One thing that has consistently bothered me is the black box of tax information that lives outside of our bank feeds and accounting feeds. There is an entire business that helps accountants export accounting data into tax software (they are a customer), but that is a niche market.

The real problem we are solving is financial transparency. Many businesses that provide financial services are locked out of access to critical financial records, and 99% of U.S. businesses are not required to report any financials. This results in a massive transparency gap. Tax records are one way to fill this gap, with 15 million unique entities and 160 million individual tax returns filed annually in the U.S. alone.

How does ModernTax solve this problem better than other companies, or other solutions?

Parker: ModernTax aims to solve the problem of financial transparency by providing tax information on all U.S. small businesses, which can level the playing field and create a more transparent financial ecosystem. The commercial credit market in the U.S. alone is worth $8.8 trillion annually, and the average company in this industry generates approximately $7 billion in yearly revenue.

By utilizing tax records, which are filed by 15 million unique entities and 160 million individuals annually in the U.S. alone, ModernTax’s strategy revolves around transparency and eliminates the need for countless hours of back-and-forth communication and manual data entry to collect this information, saving commercial providers time and money, and making it easier to evaluate businesses.

What is your primary market? What has the response to your technology been like?

Parker: We primarily sell to commercial credit providers such as banks, online lenders, and other data providers that assist companies in underwriting, fraud prevention, and verifying financial documents for their customers.

We have received positive responses from data providers such as D&B, Experian, and Transunion, as well as from our first paying partner, Enigma Technologies. Moreover, ModernTax has been well-received by direct carrier insurance companies for both underwriting and claims processing on income-related products.

Are there any deployments or features of your technology that are especially noteworthy?

Parker: In the past month, we have added 14 new features. One notable observation is the need for a robust platform that allows our contributors to efficiently provide us with data. Unfortunately, the IRS does not provide adequate tools to help companies maintain transparency in their reporting. We are constantly learning from our contributors on how we can build tools to address this issue.

ModernTax is headquartered in San Francisco and was founded in 2021. What is it like to be a young startup in San Francisco today?

Parker: Personally, it feels surreal to me. I moved to San Francisco in 2017, lived through the pandemic, and experienced the boom of 2021 and the correction of 2022. Nevertheless, San Francisco is resilient. Although there are political and socioeconomic problems that come with being a high-stakes, high- reward city, founders can arrive here with nothing and become paper billionaires and liquid millionaires faster than anywhere else in the world.

This creates a tale of two cities. To be a young startup, you have a ton of resources right in your backyard, but you also realize how competitive it is. There was a new billion-dollar company born every day for a certain amount of time and now, with AI, we are seeing history repeat itself. It’s important to keep your momentum but also not get too distracted.

We also wanted to talk with you as a Black founder and entrepreneur. What advice would you give to other potential founders-of-color?

Parker: Starting a company is hard, full stop. I even joke with my wife that I don’t mind telling my 18-month-old son “no” a lot because it’s just the nature of life in general. As a black founder, I have experienced both ups and downs. George Floyd’s murder created a domino effect of predominantly white people at large institutions feeling guilty, which led to a lot of initiatives that were half-baked and more PR moves than anything. That sentiment wore off pretty quickly, especially as markets turned for the worst in 2022.

If you built your brand “how hard it is to be a black founder”, you are likely bitter right now because we learned that the market didn’t care about you being black or about what happened with George Floyd. We are now seeing pushback with the rollback of affirmative action, the lawsuit impacting Fearless Fund, and I think more challenges will come. So, I would say focus on your business, focus on your customers, and build products. If you play the victim in a game that is already hard, you decrease your chances of winning.

You demoed your technology at FinovateSpring earlier this year. What was that experience like for you and your team?

Parker: This demo helped us think about how our product helps financial institutions and we were able to demonstrate the capabilities that companies can experience by getting access to this information in real-time.

What are your goals for ModernTax? What can we expect from the company over the balance of 2023 and into next year?

Parker: ModernTax aims to provide near-instant access to verified tax and financial information through a network of licensed tax agents to create a more transparent verification process for their customers. Over the balance of 2023 and into next year, the company plans to add eight new customers, launch new features for its contributor portal and business user features, and attend various business development events and in-person client meetings.

Photo by Nataliya Vaitkevich